Inflation May Have Been Much Higher Than We Thought

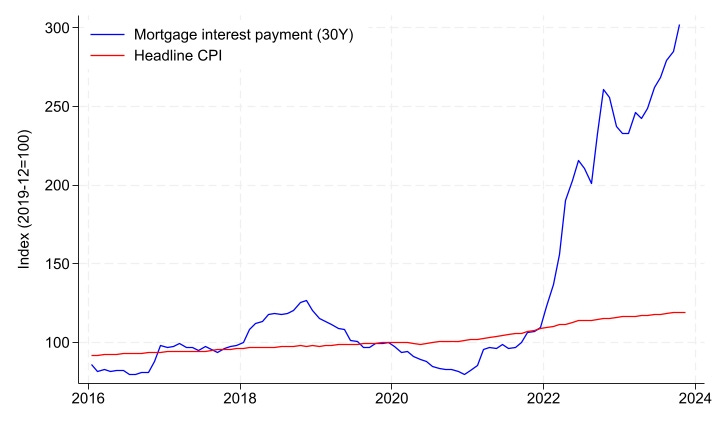

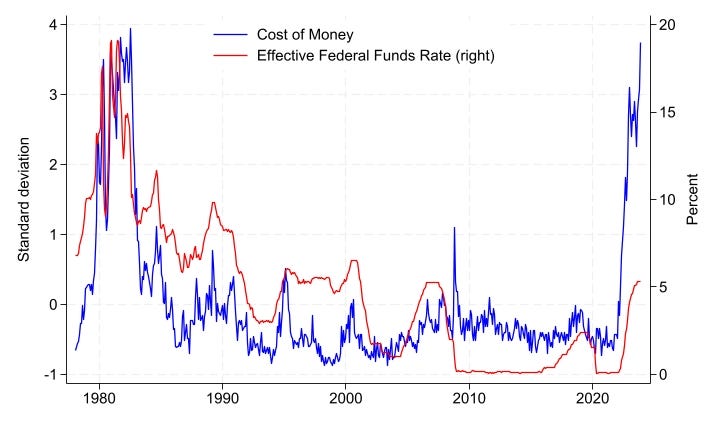

To investors, Former Secretary of the Treasury Larry Summers put together a Twitter thread back in February which was widely ignored. In his comments, Summers makes an argument that increasing interest rates drastically accelerated the true inflation rate experienced by an average citizen. He specifically calls out this increased inflation was missed by the current CPI measurement. For example, Summers argues the following:

Summers goes on to show that citizens are very worried about the increasing borrowing costs.

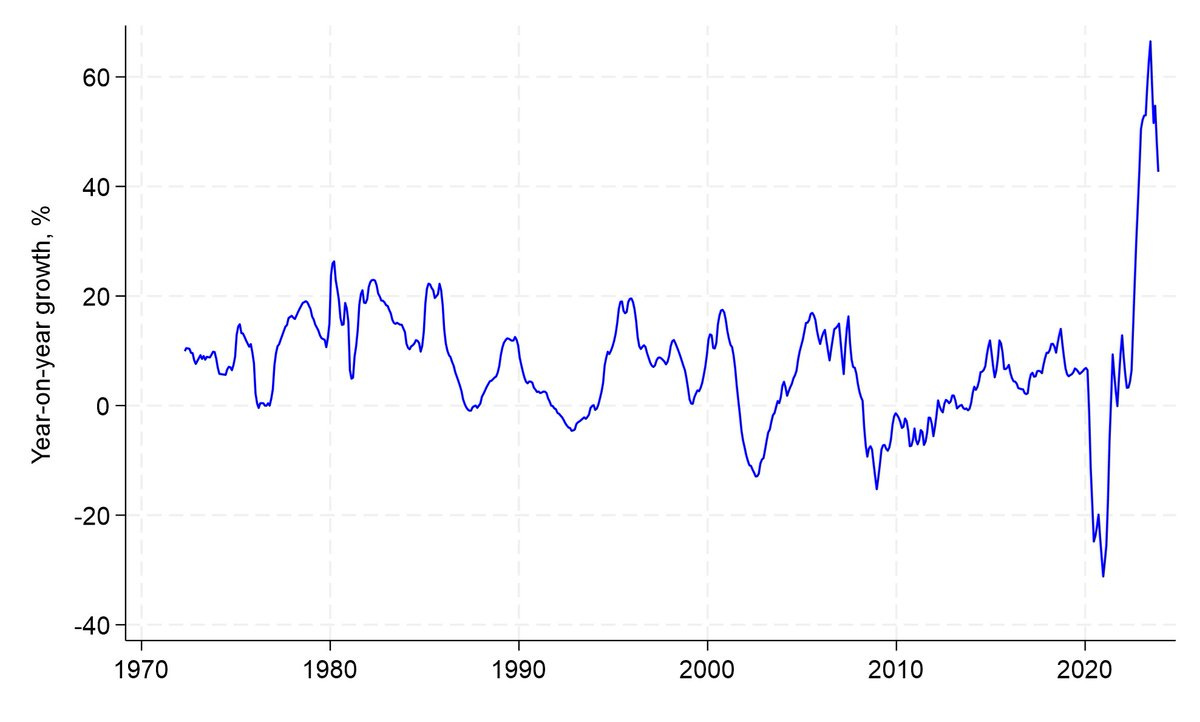

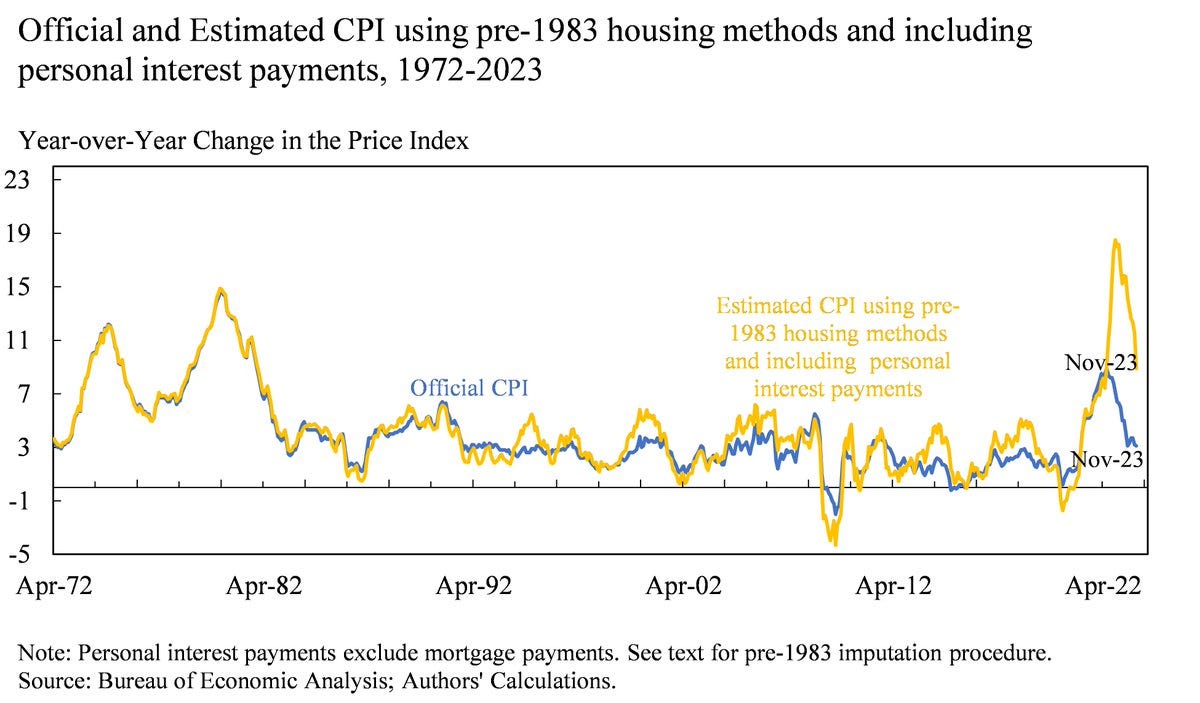

The former Secretary of the Treasury was not looking to simply complain though. He and his colleagues created a new methodology to calculate CPI in an attempt to get closer to the truth about what has been going on.

This brings us to the main point that Summers wanted to make — inflation was substantially higher than what the official metric showed in the last few years.

Calculating inflation is nearly impossible to do because every person experiences the phenomenon differently. We live in different areas. We buy different goods and services. The uniqueness of the problem makes deriving a single, accurate answer even harder. But one thing is clear — everything has been getting more expensive. Larry Summers’ calculation has inflation peaking at 18%. The Bureau of Labor Statistics had inflation peaking just over 9%. That is a wide gap. Regardless of an exact number, it should be clear that interest payments and other interest rate-related costs should be factored into what people are living through right now. The headline CPI number may have come down, but these interest payments have no relief in sight. Don’t expect good decisions to come out of the Federal Reserve as long as they are asked to evaluate bad data. Hope you all have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Annelise Osborne is the author of a brand new book, “From Hoodies to Suits: Innovating Digital Assets for Traditional Finance.” She also is the Chief Business Officer at Kadena. In this conversation, we talk about a brand new trend where Wall Street is starting to interface with the hoodies, what the suits are interested in, where they are putting their money, what the hoodies are doing, banks vs. bitcoin, and more. Listen on iTunes: Click here Listen on Spotify: Click here Why Wall Street Is All-In On Bitcoin & Crypto Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

The Stock Market Can Tell Us Things About Crypto

Friday, June 21, 2024

Listen now (3 mins) | To investors, The crypto market is separate and distinct from the stock market in many ways. The assets in this new industry trade 24/7/365, are available to anyone with an

Podcast app setup

Thursday, June 20, 2024

Open this on your phone and click the button below: Add to podcast app

Regulators Say Ethereum Is Not A Security

Wednesday, June 19, 2024

Listen now (3 mins) | To investors, A popular bitcoin maximalist talking point for years has been “bitcoin is the only crypto commodity and the rest of the tokens are unregistered securities.” How do I

Are Retail Investors Beating Institutions To The Bitcoin Spot ETFs?

Tuesday, June 18, 2024

Listen now (4 mins) | To investors, A few people have been asking me why bitcoin spot ETF inflows have been occurring, but the price of bitcoin is not drastically increasing. This is a good question,

Stablecoins & Artificial Intelligence Want To Save The US From Crisis

Monday, June 17, 2024

Listen now (4 mins) | To investors, The Wall Street Journal published an op-ed over the weekend from former House speaker Paul Ryan titled Crypto Could Stave Off A US Debt Crisis. In the article, Ryan

You Might Also Like

Hack retention like unicorns do

Monday, December 23, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

The Profile: The CEOs attending psychedelic retreats & the crypto founders getting ‘debanked’

Sunday, December 22, 2024

This edition of The Profile features crypto entrepreneurs, 'psychedelic' CEOs, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🤔A lingering suspicion...

Sunday, December 22, 2024

Plus, what stands in most marketers' way... hey-Jul-17-2024-03-58-50-7396-PM Here at Masters in Marketing, Caroline, Laura, and I have interviewed some very bright minds from some very bold brands.

Marketing Weekly #211

Sunday, December 22, 2024

Marketing a Virtual Patient: The Quest to Eliminate Medical Error • What if You Could Reduce Returned Products With Just Some Lines of Text? • How to Manage an Omnipresent Social Media Strategy • 3

Salesforce Now Hiring 2,000 Sales Execs To Sell AI

Sunday, December 22, 2024

And the top SaaStr news of the week To view this email as a web page, click here Salesforce: Actually We're Going to Hire 2000 Sales Execs Now To … Sell AI So it was just the other day Salesforce

Sunday Thinking ― 12.22.24

Sunday, December 22, 2024

"When someone shows you who they are, believe them the first time."

Chokepoints in the AI boom

Sunday, December 22, 2024

Plua: Why 2025 looks like a brighter year for VC, key signals for allocators and more Read online | Don't want to receive these emails? Manage your subscription. Log in The Weekend Pitch December

Brain Food: The Right Grip

Sunday, December 22, 2024

FS | BRAIN FOOD December 22 2024 | #608 | read on fs.blog | Free Version Welcome to Brain Food, a weekly newsletter full of timeless ideas and insights you can use. Before we dive in, a last-minute

🤖 Google Search “AI Mode” Dropping Soon

Sunday, December 22, 2024

The Weekend Update... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 12 spicy takes

Sunday, December 22, 2024

Prediction markets, phone addiction, ESOP plans and other such things. 🎄