The Pomp Letter - Should The Fed Cut Interest Rates?

To investors, Carlyle Group’s David Rubenstein told CNBC’s Andrew Ross Sorkin yesterday he believes the Fed will hold off on cutting interest rates until after the Presidential election in November. Rubenstein’s logic is as follows:

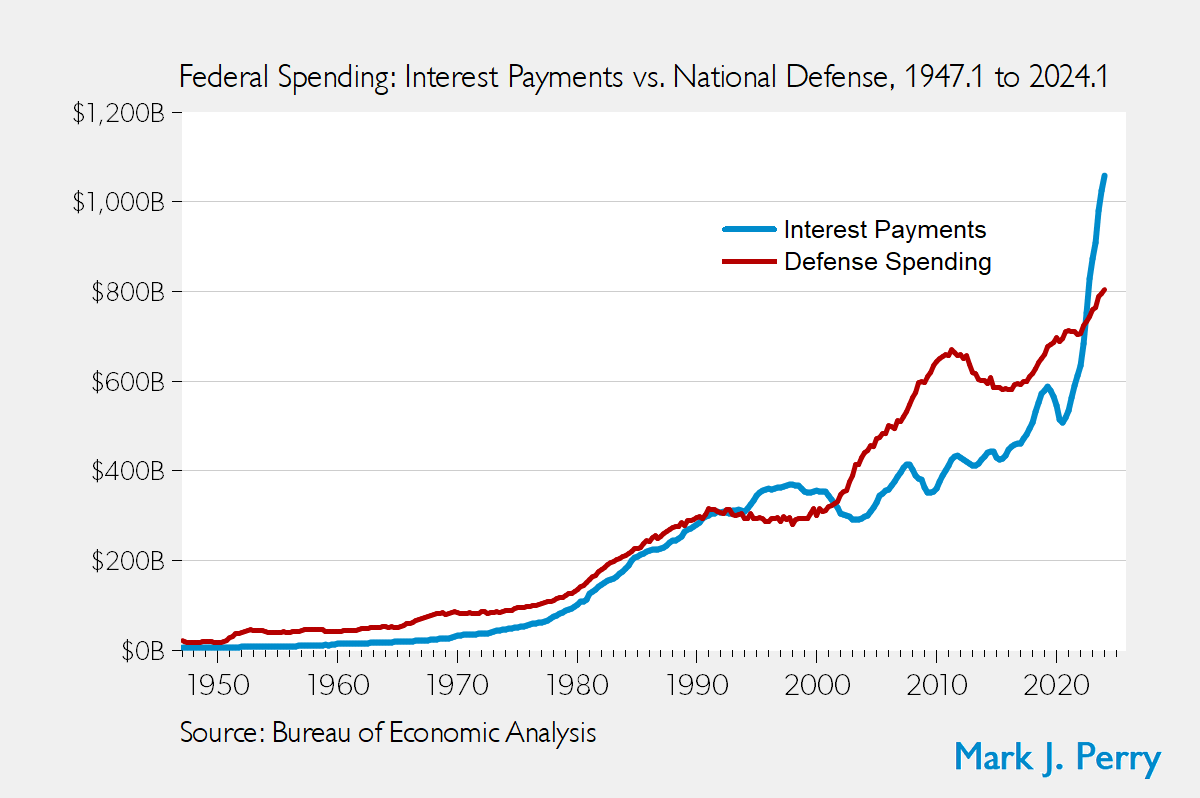

While the Fed staying out of politics sounds like a good idea, there is a much bigger problem already underway — the Fed’s refusal to cut interest rates has created a significant expense for the US government. Annualized interest payments on the national debt are now more than $200 billion more than total defense spending, according to economics professor Mark J Perry. So what is the argument for the Fed to cut interest rates now? Jim Parrott of Parrott Ryan Advisors and Mark Zandi, chief economist of Moody’s Analytics, wrote an op-ed in the Washington Post earlier this month where they laid out the following argument:

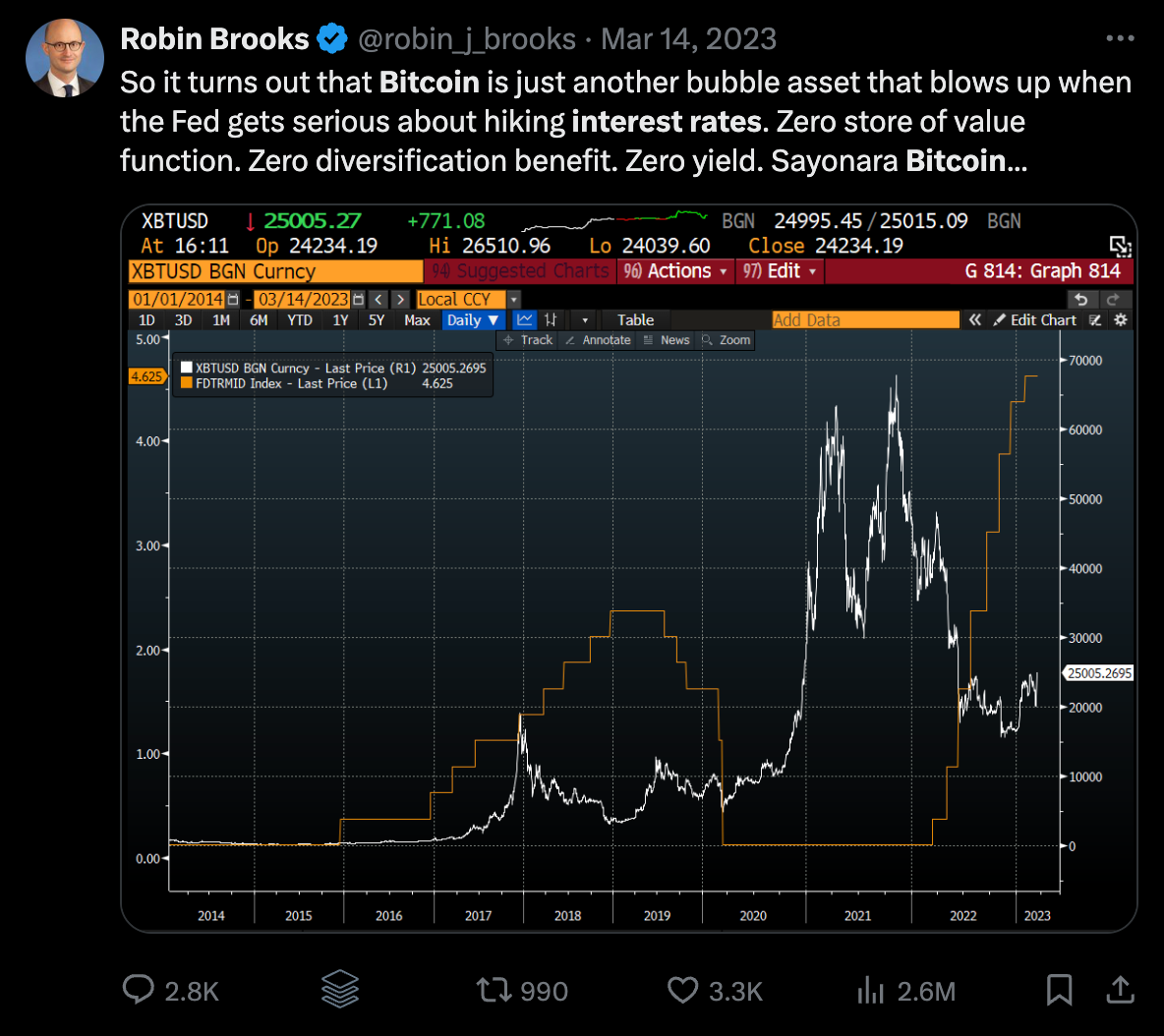

This brings me to the negative impact on banks if the Fed doesn’t cut interest rates. According to Red Pill Rick (yes, that is his Twitter handle), the banks are already in serious trouble with the unrealized losses on securities they currently hold. The Fed told everyone for two years that interest rates would stay artificially low for years to come. They obviously went against that guidance in 2022 until today. By cutting interest rates, they could potentially soften the blow for these banks and prevent future bank failures. Lastly, interest rates were blamed as the culprit for bitcoin’s falling price throughout 2022 and 2023. Take Robin Brooks, a Senior Fellow at the Brookings Institute, as a prime example. Here is his tweet from March 14, 2023 when interest rates were sub-5%. Since this tweet, interest rates continued to go up, yet bitcoin has more than doubled in price over approximately 15 months. I guess it becomes difficult to argue that bitcoin is “just another bubble asset that blows up when the Fed gets serious about hiking interest rates” when the asset returns to all-time highs despite the higher interest rates. But don’t get confused — bitcoin would benefit greatly if the Fed was to cut interest rates. So would many financial assets. This would make investors happy, but potentially could lead to more inflationary pressure across the economy. As I have long argued, the Fed is in a tough position. They are not merely managing monetary policy, but rather have to take politics and financial markets into account as well. They are trying to use backwards looking data to make decisions today based on what they predict will happen in the future. It is an impossible job. Lose-lose. That won’t stop people from speculating on what the central bankers will do next though. Hope you all have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Phil Rosen, the Co-Founder of Opening Bell Daily, interviews Anthony Pompliano. Topics include stablecoins, US debt, interest rates, and geopolitics. Listen on iTunes: Click here Listen on Spotify: Click here My CNBC Appearance Yesterday - Why Bitcoin’s Price Is Falling Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Podcast app setup

Monday, June 24, 2024

Open this on your phone and click the button below: Add to podcast app

Podcast app setup

Monday, June 24, 2024

Open this on your phone and click the button below: Add to podcast app

Inflation May Have Been Much Higher Than We Thought

Monday, June 24, 2024

Listen now (3 mins) | To investors, Former Secretary of the Treasury Larry Summers put together a Twitter thread back in February which was widely ignored. In his comments, Summers makes an argument

The Stock Market Can Tell Us Things About Crypto

Friday, June 21, 2024

Listen now (3 mins) | To investors, The crypto market is separate and distinct from the stock market in many ways. The assets in this new industry trade 24/7/365, are available to anyone with an

Podcast app setup

Thursday, June 20, 2024

Open this on your phone and click the button below: Add to podcast app

You Might Also Like

The Profile: The CEOs attending psychedelic retreats & the crypto founders getting ‘debanked’

Sunday, December 22, 2024

This edition of The Profile features crypto entrepreneurs, 'psychedelic' CEOs, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🤔A lingering suspicion...

Sunday, December 22, 2024

Plus, what stands in most marketers' way... hey-Jul-17-2024-03-58-50-7396-PM Here at Masters in Marketing, Caroline, Laura, and I have interviewed some very bright minds from some very bold brands.

Marketing Weekly #211

Sunday, December 22, 2024

Marketing a Virtual Patient: The Quest to Eliminate Medical Error • What if You Could Reduce Returned Products With Just Some Lines of Text? • How to Manage an Omnipresent Social Media Strategy • 3

Salesforce Now Hiring 2,000 Sales Execs To Sell AI

Sunday, December 22, 2024

And the top SaaStr news of the week To view this email as a web page, click here Salesforce: Actually We're Going to Hire 2000 Sales Execs Now To … Sell AI So it was just the other day Salesforce

Sunday Thinking ― 12.22.24

Sunday, December 22, 2024

"When someone shows you who they are, believe them the first time."

Chokepoints in the AI boom

Sunday, December 22, 2024

Plua: Why 2025 looks like a brighter year for VC, key signals for allocators and more Read online | Don't want to receive these emails? Manage your subscription. Log in The Weekend Pitch December

Brain Food: The Right Grip

Sunday, December 22, 2024

FS | BRAIN FOOD December 22 2024 | #608 | read on fs.blog | Free Version Welcome to Brain Food, a weekly newsletter full of timeless ideas and insights you can use. Before we dive in, a last-minute

🤖 Google Search “AI Mode” Dropping Soon

Sunday, December 22, 2024

The Weekend Update... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 12 spicy takes

Sunday, December 22, 2024

Prediction markets, phone addiction, ESOP plans and other such things. 🎄

Recruiting Brainfood - Issue 428

Sunday, December 22, 2024

Merry Christmas everybody - it's the Brainfood Christmas Special, so we bear gifts and reflections from the world of TA / HR on the year 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏