The Generalist - How to Win a Competitive Deal

How to Win a Competitive DealYou need more than sharp elbows. A tactical guide to winning your spot on the cap table.Friends, Venture capitalists, much like vampires, must be invited in. Though every private market financier wishes they could simply select the startups of their choosing (a sampler plate of SpaceX and Stripe, with a dab of Canva for flavor), they must enter only upon the permission of a founder. Another way to put this: Even if you are the best picker in the world, capable of spotting the pearl gleaming from a mound of bitumen, you will deliver zero returns if you can’t convince an entrepreneur to let you invest. The less you know about venture capital, the easier that sounds. Venture capitalists offer money. How difficult can it be to sell money? As the Irish dramatist Sean O’Casey put it, “Money doesn’t make you happy, but it does quiet the nerves.” What founder isn’t in the market for a gently tranquilizing bankroll? It is not so simple. Over the past two decades, venture capital has swollen from a small holding to a factory farm, a phenomenon so frequently observed it is almost passé to mention. Once the province of a handful of patrician Silicon Valley partnerships, the United States is now home to nearly 2,500 firms competing with hundreds of others around the globe. The result is that money, at least from venture capitalists, isn’t worth what it used to be. What was once a buyer’s market definitively tilted toward the sellers. Though the detonation of the 2021-2022 bubble has seen the scales waver, at tech’s top end, financiers still brawl for the best deals. For all of venture’s outward friendliness, it remains a zero-sum game. There are only so many extraordinary companies founded each year and only so much money each can and will take. If your counterparts at rival firms greet you with a smile, it may be to show you their teeth. Faced with formidable competition, how can you ensure you win allocation to the startups you want to invest in? What techniques should you deploy to transform yourself from “nice-to-have” to “must-make-room-for?” This edition of the Investors Guide series offers answers. We’ve interviewed some of the world’s best investors and asked them to share how they outcompete their peers and gain access to legendary companies. This group includes multiple Midas winners and the backers of grand slams like Figma, Discord, DoorDash, Faire, Nubank, Abnormal Security, Coda, Cockroach Labs, and many more. If you’re just joining us, our 10-part Investors Guide series is a detailed exploration of the strategies and tactics of exceptional investors – delivered right to your inbox. Here are our previous two editions: We’ll publish seven more editions over the coming weeks and months – plus one bonus edition. For $22/month, you’ll unlock access to the full series and much more. Here are three reasons you should join today:

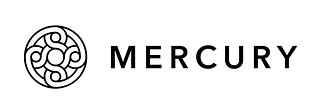

Brought to you by MercuryIf Jony Ive built a banking* experience… I think it would look a lot like Mercury. The Generalist has been a Mercury customer for years, and I’m constantly awed by the platform’s beauty, thoughtfulness, and power. It’s become a core part of how we run our business and is probably the only banking product I find a genuine pleasure to use. Mercury’s banking experience isn’t just loved by The Generalist. 200K other startups trust it to simplify their finances and power essential workflows, like paying bills or sending invoices. By using Mercury, customers save time, get granular visibility into their finances, and have finer-toothed control over money movement. Apply in minutes today at mercury.com to simplify your finances and perform at your best. *Mercury is a financial technology company, not a bank. Banking services provided by Choice Financial Group and Evolve Bank & Trust®; Members FDIC. How to Win a Competitive DealStrap on your helmet and get out the eye grease: it’s time to compete. For venture capitalists, this part of the investing process – the time between discovering a desirable, competitive deal and making the investment is the arena. It’s the province of sharp elbows, late-night phone calls, speed reading data rooms, and dueling term sheets. If handled well, this can be the making of the firm. With a small number of intelligent, farseeing decisions, you may find yourself the equity holder of a legendary business and the partner to a historic entrepreneur. But if managed poorly, you may find yourself sitting on an overheated pile of buzzy logos, not real businesses. Based on the strategies of the exceptional investors we’ve interviewed, and our own research, we’ve devised a five step playbook to help you run a tight process, make shrewd decisions, and win allocation. 1. Sharpen the sword

2. Question your motivations

3. Move fast, add value

4. Connect and close

5. Learn from your losses

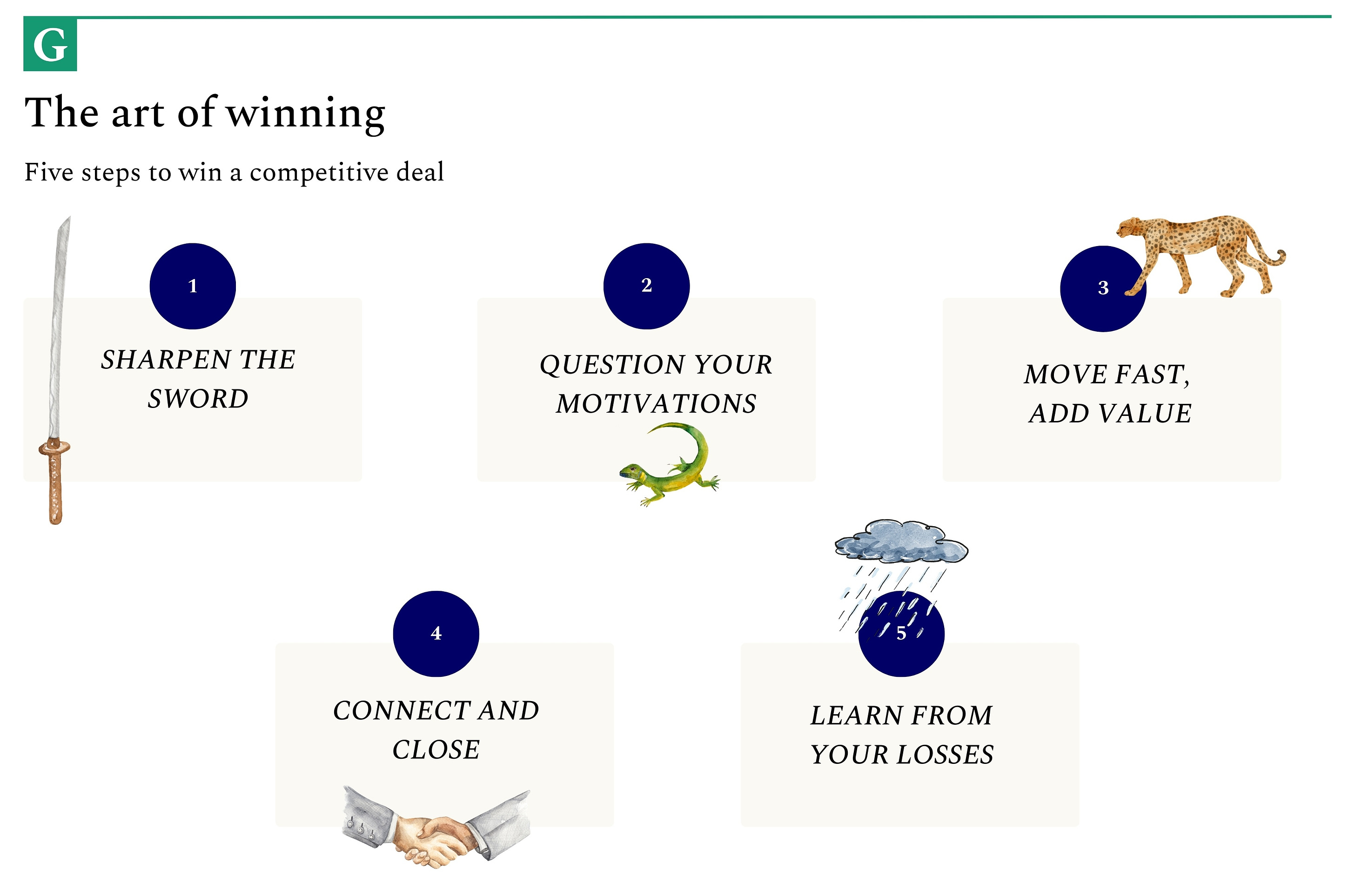

Thank you to Rebecca Kaden (USV), Saam Motamedi (Greylock), Sarah Guo (Conviction), Saar Gur (CRV), Alex Taussig (Lightspeed), Danny Rimer (Index), Hernan Kazah (Kaszek), and Kanyi Maqubela (Kindred) for sharing your wisdom. Step 1: Sharpen the swordThe work to win an investment starts long before a missive pops up in your Twitter DMs. To give yourself a fighting chance of getting access to a hot round, consider these three preparatory steps:

Develop your networksUnless you expect to be the first investor to discover every competitive deal (an impossible task), you’ll need to build a network that sends you opportunities with enough time to act on them. Building a reputation and network that delivers on that front is a prerequisite for competing for the most sought-after deals. It’s also an ongoing task. Sarah Guo argues that more than 80% of winning a deal happens in advance of the round: Conviction

If you’re just starting, it’s worth reflecting on the networks you’re already a part of that you can lean into. For example, if you attended an elite college with a history of producing strong founders, that’s a great starting point. So, too, is time spent working at a company with a high talent density. You never know which former roommate or co-worker could become the founder of a trendy startup. Saar Gur of CRV explains just how influential those past bonds can be: CRV

One academic study published in the Journal of Corporate Finance has observed a version of this phenomenon in private equity. Namely, PE investors tend to source and win more deals when the target CEO attended the same university as them. All of which is to say that you might have a great starting point, even if you haven’t fully realized it. Attending a prestigious institution or holding a swanky job may be helpful, but it is far from necessary. Plenty of Silicon Valley’s denizens have constructed sprawling, influential relationships without such ties. Sarah Guo shares her advice for bootstrapping a network: Conviction

For more information about building a network, check out the first two editions of the Investors Guide: Earn trust with promising foundersBuilding a reputation and network is the work of a lifetime. A more direct tactic is proactively building relationships with promising and future founders. Doing so allows you to build trust outside of a deal window over a much longer timeline. Lightspeed’s Alex Taussig tends to get to know founders for over a year before investing: Lightspeed

Over time, you’ll get to see how these founders perform. Even if their first business doesn’t succeed, they may go on to start another company with greater potential. In those cases, knowing their abilities gives you an advantage over other investors, allowing you to act faster. Saar Gur explains how that played out with Ring, the smart doorbell eventually acquired by Amazon for approximately $1 billion: CRV

Even if you miss a deal initially, there may be an opportunity to build a relationship in preparation for future rounds. For example, Alex Taussig built a productive long-term relationship with Faire’s Max Rhodes. It helped him win the right to invest. Lightspeed

Not all of the relationships you build will lead to an investment. Indeed, if you want a genuine friendship with someone, it’s best not to think in such transactional terms, as Alex Taussig explains: Lightspeed

Build specialized knowledgeWhen a deal drops, you need to be ready to race. One final tip to make sure you don’t start cold? Build valuable specialized knowledge. If you can turn yourself into an expert – or at least a good sparring partner – in a particular area, you’ll be a much more attractive option for founders. Greylock’s Saam Motamedi has done this by becoming an AI specialist: Greylock

Generalists needn’t fear. Even if you don’t want to limit yourself to a certain sector, you can still develop theses and accumulate relevant knowledge. The goal is simply to give yourself an informational advantage over your peers, and make yourself a more compelling partner to founders. Writing is a particularly useful way of achieving these ends. It forces you to articulate your thinking, encourages feedback, and attracts founders. Even if it doesn’t pay off in the near term, it may come in handy down the line. Rebecca Kaden of USV discusses the value of writing and shares a recent example: USV

If words don’t come easily to you, there are other ways of developing a track record of your thinking and establishing credibility. Saar Gur highlights how having research calls can accelerate your conviction and deliver an advantage: CRV

Step 2: Question your motivationsAn email pops up in your Superhuman account. It’s your friend at a collaborative VC introducing you to the CEO of a startup. The team comes from Anduril, OpenAI, and Stripe. They’re building at the intersection of AI and American infrastructure but with SaaS margins. They have term sheets from Founders Fund, Khosla, Sequoia, and USV. Whoever they pick, they’re leaving some allocation open for other aligned investors... Subscribe to The Generalist to unlock the rest.Become a paying subscriber of The Generalist to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

Bryan Everlasting: An Interview with the Tech Executive Spending Millions on Immortality

Thursday, June 20, 2024

Inside the mind of the former tech executive working to become immortal. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How to Find a Unicorn

Tuesday, June 11, 2024

A tactical guide to sourcing legendary investments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Vinod Khosla: A Case Study of Unreasonable Tenacity (and Frozen Pizza)

Monday, June 3, 2024

If you want to build a legendary company, sometimes, you simply cannot take no for an answer. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How to Raise Your First Fund

Tuesday, May 21, 2024

A tactical playbook to kickstart your investing journey and set you up for success. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Modern Meditations: Tyler Cowen

Friday, May 17, 2024

The renowned economist shares his thoughts on AI teddy bears, nuclear risk, and darkly plausible futures. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Making Wayves

Tuesday, March 4, 2025

+ Girls just wanna have funding; e-bike turf war View in browser Powered by ViennaUP Author-Martin by Martin Coulter Good morning there, Since 2021, VC firm Future Planet Capital (FPC) has secured more

Animal Shine And Doctor Stein 🐇

Monday, March 3, 2025

And another non-unique app͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

upcoming analyst-led events

Monday, March 3, 2025

the future of the customer journey, tech M&A predictions, and the industrial AI arms race. CB-Insights-Logo-light copy Upcoming analyst-led webinars Highlights: The future of the customer journey,

last call...

Monday, March 3, 2025

are you ready? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 Dimmable window technology

Monday, March 3, 2025

Miru is creating windows that uniformly tint—usable in cars, homes, and more.

Lopsided AI Revenues

Monday, March 3, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Lopsided AI Revenues Which is the best business in AI at the

📂 NEW: 140 SaaS Marketing Ideas eBook 📕

Monday, March 3, 2025

Most SaaS marketing follows the same playbook. The same channels. The same tactics. The same results. But the biggest wins? They come from smart risks, creative experiments, and ideas you

17 Silicon Valley Startups Raised $633Million - Week of March 3, 2025

Monday, March 3, 2025

🌴 Upfront Summit 2025 Recap 💰 Why Is Warren Buffett Hoarding $300B in Cash 💰 US Crypto Strategic Reserve ⚡ Blackstone / QTS AI Power Strains 🇨🇳 Wan 2.1 - Sora of China ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⛔ STOP paying suppliers upfront - even if they offer a cheaper price in return!

Monday, March 3, 2025

You're not really saving money if all your cash is stuck in inventory. Hey Friend , A lot of ecommerce founders think paying upfront for inventory at a lower price is a smart move. Not always!

13 Content & Media Deals 💰

Monday, March 3, 2025

Follow the money in media ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏