Analysis: Comparison of Buy and Sell Orders after the Ethereum Spot ETF Listing and Its Long-term Impact

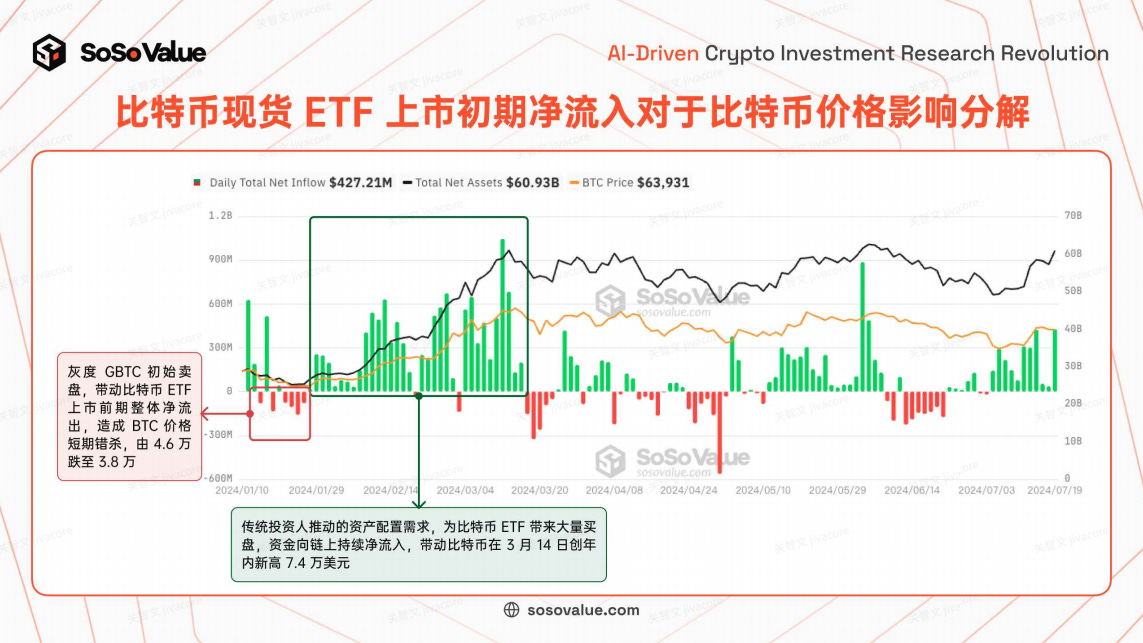

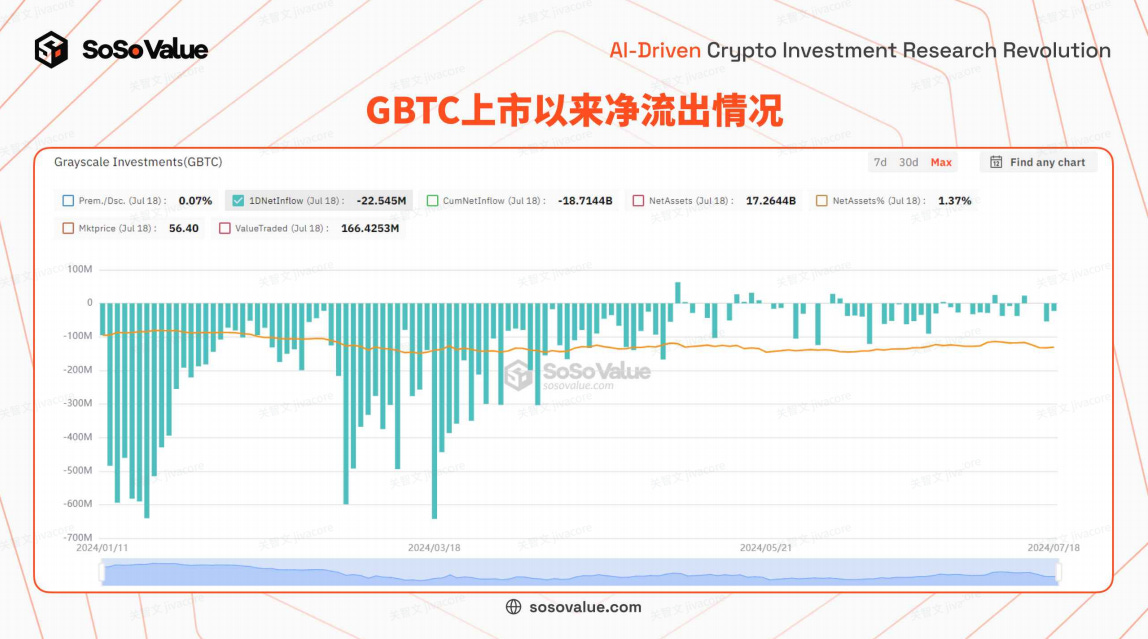

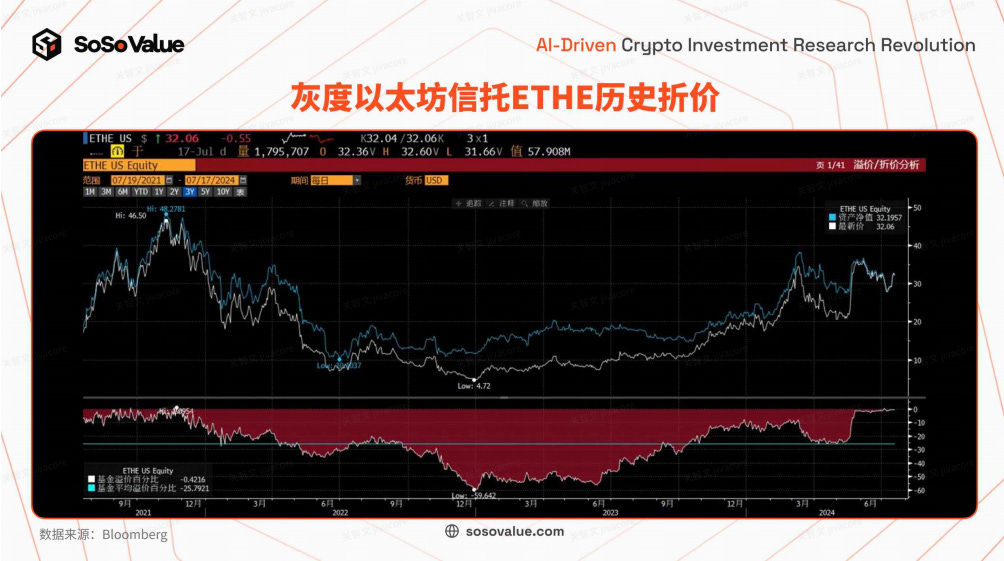

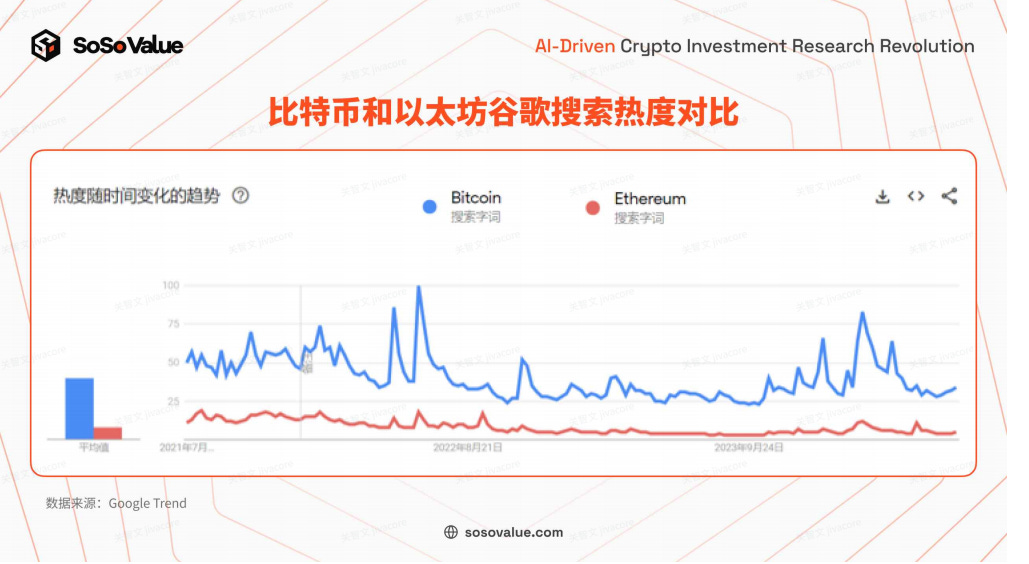

By SoSoValue On July 23, 2024, the U.S. Ethereum Spot ETF officially began trading, exactly 10 years after Ethereum’s first Initial Coin Offering (ICO) on July 22, 2014. Whether this significant date was chosen intentionally or coincidentally, this event holds epic significance for the sustainable development of the entire crypto world. It marks an important step for POS public chains entering the mainstream financial world, which will inevitably attract more builders to join the Ethereum ecosystem. Additionally, it paves the way for other crypto infrastructure like Solana to enter the mainstream, holding substantive significance for the popularization of blockchain ecosystems. On the other hand, since the Ethereum ETF is not allowed to stake from a regulatory perspective, investors holding ETFs will miss out on the 3%-5% staking yield (risk-free rate in the Ethereum world) compared to directly holding Ethereum tokens. Furthermore, the public’s understanding of Ethereum is relatively lower than that of Bitcoin, which might lead to a lesser short-term impact on Ethereum’s price compared to the impact on BTC price following the Bitcoin Spot ETF approval. The listing of the Ethereum Spot ETF is more likely to enhance the relative stability of Ethereum’s price and reduce volatility. The following analysis will discuss the short-term impact on the buying and selling forces of Ethereum tokens post the Ethereum Spot ETF listing, and the long-term impact on the crypto ecosystem. I. Short-term Analysis: Buy and Sell Forces Weaker than Bitcoin ETF, Expected Impact of Ethereum ETF to be Smaller According to SoSoValue’s continuous tracking of the Bitcoin Spot ETF, the largest factor impacting the price is the daily net inflow, i.e., the actual new buying/selling volume brought to the crypto world by cash creations/redemptions of the Bitcoin Spot ETF (see Figure 1). This influences supply and demand, determining the price. According to the S-1 filing, the U.S. Ethereum Spot ETF has the same creation/redemption mechanism as the Bitcoin Spot ETF, both supporting only cash creations/redemptions. Therefore, daily net inflow will also be the most critical observation indicator for the Ethereum Spot ETF. However, there are two main differences: ● Sell Orders: Due to the significant management fee difference (over 10 times) between the Grayscale Ethereum Trust (stock code ETHE) and its competitors, the "migration effect" sell orders are still present. The market is prepared for the outflows similar to those experienced with GBTC. Unlike Bitcoin, during the conversion of the Grayscale Ethereum Trust to an ETF, 10% of the net assets were split to establish a low-fee Grayscale Ethereum Mini Trust (stock code ETH), which may slightly reduce the sell orders. ● Buy Orders: Due to regulatory restrictions on staking, holding the Ethereum ETF will result in 3%-5% less staking yield compared to directly holding Ethereum tokens. Moreover, the general public’s understanding of Ethereum is lower than that of Bitcoin, and if optimistic about crypto, they will still prefer the Bitcoin ETF with a clear scarcity of 21 million units for their portfolio. Figure 1: Decomposition of the impact of initial net outflows from the Ethereum Spot ETF on Bitcoin prices 1. Sell Orders: $9.2 Billion in Grayscale ETHE with Over 10x Management Fee Difference Will Still Cause Early Migration Sell Orders, but Less Impactful than GBTC Outflows Looking back at the significant net outflows caused by the early days of the Grayscale Bitcoin ETF (GBTC), two main reasons were: significantly higher management fees compared to competitors, leading to a migration effect where investors redeemed from the 1.5% fee GBTC to buy other ETFs with around 0.2% management fees; and the profit-taking by arbitrage traders who bought discounted GBTC and shorted BTC in the open market. From January 11 to May 2, GBTC experienced sustained large-scale net outflows, reducing its Bitcoin holdings by 53%. Figure 2: Net outflows of GBTC since listing Unlike the direct conversion of GBTC, Grayscale split 10% of the net assets of the Ethereum Trust to establish a low-fee Ethereum Mini Trust (stock code ETH), slightly alleviating the migration outflow pressure caused by high fees. According to the S-1 filing, Grayscale Ethereum Trust (stock code: ETHE) will transfer about 10% of Ethereum to the Mini Trust ETH as initial funding; thereafter, both Grayscale Ethereum ETFs will operate independently. For current ETHE investors, on July 23, each share of ETHE will automatically allocate 1 share of the Ethereum Mini Trust ETH, and the net asset value of ETHE will be adjusted to 90% of its previous value. Considering the management fee rate of ETHE is 2.5% and the Mini Trust ETH is 0.15% (waived for the first 6 months up to $2 billion), 10% of the assets will automatically be allocated to the low-fee ETF for existing ETHE investors. Referring to GBTC’s final migration ratio of around 50%, it is expected that the launch of the Ethereum Mini Trust ETH, with its early-bird fee discount, will alleviate the short-term outflow pressure of Grayscale ETHE. Moreover, since ETHE’s discount has already narrowed significantly, the profit-taking pressure from discount arbitrage positions is expected to be less than that of GBTC. The discount of Grayscale ETHE once reached 60% at the end of 2022, exceeded 20% in April-May 2024, but has narrowed to 1%-2% since late May and to within 1% by July. Meanwhile, GBTC’s discount rate remained at 6.5% two days before its conversion to an ETF (January 9). Therefore, the motivation for ETHE arbitrage traders to take profits has greatly reduced. Figure 3: Comparison of Ethereum Spot ETF fees Figure 4: Historical discount of Grayscale Ethereum Trust ETHE 2. Buy Orders from the Stock Market: Public Consensus on Ethereum Is Far Less Than Bitcoin, Asset Allocation Motivation Weaker Than BTC Spot ETF For the general public, Bitcoin's logic is simple and easy to understand, with a consensus: digital gold in the digital world, clear scarcity with a total supply of 21 million, fitting well into their existing investment framework. In contrast, Ethereum, as the largest basic public chain, has a relatively complex mining mechanism and its development is influenced by various forces in the ecosystem. Most importantly, as an investment target, its supply quantity involves dynamic calculations, making it difficult for ordinary investors to intuitively understand. Essentially, Ethereum’s supply is theoretically unlimited, with the latest POS mechanism driving supply through block rewards from staking, and decreasing supply through gas fee burning from network activity, forming a dynamic supply-demand balance. The current supply is about 120 million, with a recent annual inflation rate of 0.6%-0.8%. From a fundamental perspective, as a public chain facing competition from others like Solana and Ton, the general public does not have strong faith in its competitive endgame. Public data also shows a significant difference in interest between Ethereum ETF and Bitcoin ETF. Comparing Google search trends, Ethereum's interest is only about one-fifth of Bitcoin's (see Figure 5). Observing the seed funding for the Ethereum ETF issuance (typically from fund managers/underwriters), Fidelity's seed funding for its Ethereum ETF (stock code FETH) is only a quarter of its Bitcoin ETF (stock code FBTC), with similar gaps for other issuers like VanEck and Invesco (see Figure 6). Figure 5: Comparison of Google search trends for Bitcoin and Ethereum Figure 6: Comparison of seed funding for Ethereum ETF and Bitcoin ETF from the same issuer 3. Buy Orders from Within the Crypto Circle: Lack of Basic Staking Yield on ETH Chain, Essentially No Demand Crypto investors also contributed to part of the buying volume of the Bitcoin Spot ETF, mainly for proof of real-world assets. By holding Bitcoin ETFs and paying an annual fee of 0.2%-0.25%, they can prove ownership of assets in the traditional financial market, facilitating economic activities in the public world and leveraging various financial operations, such as mortgage lending and constructing structured products. This is attractive to some high-net-worth crypto investors. Since Bitcoin follows the POW (Proof of Work) mining mechanism without a stable POS staking yield, the cost of holding Bitcoin ETFs and directly holding Bitcoin does not differ much. However, for the Ethereum Spot ETF, due to regulatory restrictions on staking, holding ETFs results in 3%-5% less risk-free annual yield compared to directly holding Ethereum. Ethereum uses the POS (Proof of Stake) mechanism, where validator nodes stake Ethereum to validate transactions and maintain the network, earning block rewards. This staking yield is considered the risk-free base yield of the Ethereum ecosystem. Recently, the staking yield has stabilized above 3%. Therefore, holding Ethereum ETFs for portfolio purposes will result in at least 3% less annual yield than directly holding Ethereum. Hence, the buy orders from high-net-worth individuals within the crypto circle for Ethereum Spot ETFs can be ignored. Figure 7: Staking yield since Ethereum transitioned to POS mechanism II. Long-term Analysis: Ethereum ETF Paves the Way for Other Crypto Assets to Enter the Mainstream World As the largest public chain currently, the approval of the Ethereum Spot ETF is a significant step for public chains entering the mainstream financial world. Reviewing the SEC’s criteria for approving crypto ETFs, Ethereum meets requirements in anti-manipulation, liquidity, and price transparency, paving the way for more compliant crypto assets to enter the public investment world through spot ETFs in the future. ● Anti-manipulation: Ethereum nodes are sufficiently decentralized, and ETF assets are not staked. With over 4,000 nodes, single-node control over the network is prevented. Additionally, not allowing staking for the Ethereum Spot ETF avoids excessive control of the network by a few entities. In the financial market, Ethereum’s basic trading infrastructure is relatively mature, especially with its rich futures products on the Chicago Mercantile Exchange (CME), providing investors with more hedging options and price predictability, reducing market manipulation risks. ● Liquidity & Price Transparency: Ethereum’s market cap is about $420 billion, ranking it in the top 20 by market cap in the U.S. stock market. With a 24-hour trading volume of $18 billion and listings on nearly 200 exchanges, it ensures ample liquidity and fair, transparent pricing. Comparatively, Solana also meets these indicators to some extent (see Figure 8). VanEck and 21Shares have successively submitted applications for Solana Spot ETFs. With the continuous enrichment of traditional financial market tools such as crypto futures, we can expect more crypto asset ETFs to be approved, further capturing the mindset of traditional investors, accelerating development. Figure 8: Core data comparison of representative Layer 1 public chains In summary, due to the weaker buying and selling forces of the Ethereum Spot ETF compared to the Bitcoin ETF, and the market’s preparation for the outflows from Grayscale ETHE, along with the fact that it has been six months since the Bitcoin Spot ETF was listed, the positive effects of the Ethereum Spot ETF approval have largely been reflected in the current Ethereum price. Thus, the short-term impact on Ethereum’s price is expected to be smaller than the previous impact of the Bitcoin Spot ETF listing on Bitcoin, with possibly smaller fluctuations. If there are further mispricing opportunities due to Grayscale outflows at the initial listing, it could be a good setup opportunity. Investors can follow the U.S. Ethereum Spot ETF board specially launched by SoSoValue (https://sosovalue.com/assets/etf/us-eth-spot). In the long run, the crypto ecosystem and the mainstream world are moving from independent development towards integration, with a significant cognitive adjustment period in between. The cognitive differences between new and old participants in the crypto ecosystem may be the core factor affecting crypto price fluctuations and creating investment opportunities in the next 1-2 years. Historically, the integration process of emerging assets into the mainstream world has always been characterized by significant volatility, continuously creating investment opportunities worth anticipating. The approval of the Ethereum ETF further opens the door for crypto ecosystem applications to enter mainstream asset allocation. We can foresee other infrastructures like Solana with large user bases and ecosystems gradually integrating into the mainstream world. As the crypto world enters the mainstream, the reverse process of the mainstream world entering the crypto world is also quietly continuing. Mainstream financial assets, mainly U.S. Treasury bonds, are also gradually entering the crypto world through RWA (Real World Assets) tokens, achieving efficient global financial asset circulation. If the approval of the Bitcoin ETF knocked on the door of the new world integrating crypto and traditional finance, then the approval of the Ethereum ETF is the first step through the door. Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Predictions from Various Parties on the Short- to Medium-Term Price Impact of the Launch of Ethereum Spot ETFs

Wednesday, July 24, 2024

Editor: WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with Core Blockchain Rich: Leveraging Bitcoin Security to Drive Smart Contracts

Tuesday, July 23, 2024

This article is sponsored by Core. Self-introduction My passion for crypto began in 2013 when the concept of Bitcoin as a non-sovereign store of value, or digital gold, blew me away. Then, around the

Elixir: Is Order-book Style the Future of PERP DEXs?

Monday, July 22, 2024

By @lasertheend Elixir is a modular DPoS Network built to power liquidity across order-book exchanges and enables users to deploy liquidity to pairs and exchanges to build trustless features to enhance

Asia's weekly TOP10 crypto news (July 15 to July 21)

Sunday, July 21, 2024

1. Hong Kong Regulatory News This Week 1.1 On July 23, HKEX to Launch Asia's First Inverse Bitcoin Product link Wu Blockchain exclusively reports that on July 23, the Hong Kong Stock Exchange will

Weekly Project Updates: Worldcoin Extends Token Unlock Period, Scroll TVL Surpasses $1 Billion, Binance Launches A…

Saturday, July 20, 2024

1. Worldcoin: TFH Investors and Team Members' WLD Tokens Unlock Period Extended to 5 Years link According to the latest Worldcoin white paper, the unlock schedule for approximately 80% of TFH

You Might Also Like

FBI confirms North Korea-backed Lazarus hackers stole $1.5 billion from Bybit

Thursday, February 27, 2025

FBI tracks Ethereum laundering spree by North Korean hackers amid rising threat of cyber warfare in the crypto world. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with MicroStrategy Founder Michael Saylor: The Company Holding the Most Bitcoin in the World

Thursday, February 27, 2025

In this interview, Colin from WuBlockchain had an in-depth discussion with MicroStrategy founder Michael Saylor about the company's ongoing Bitcoin acquisition strategy, the growing adoption of

Abu Dhabi Invests $436.9M In Bitcoin ETF

Thursday, February 27, 2025

February 17th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Abu Dhabi Invests $436.9M In Bitcoin ETF Changpeng Zhao Sparks Meme Coin Rumours Coinbase Finally Lists POPCAT & PENGU

📈 BTC’s realised price (average acquisition price) reached an all-time high of $43,000; State of Wisconsin Invest…

Thursday, February 27, 2025

BTC's realised price reached an all-time high of $43000; Abu Dhabi's Mubadala Investment disclosed its BTC ETF holdings; South Korea to allow universities and charities to sell crypto donations

HashKey Exchange's Interpretation of the Hong Kong SFC Virtual Asset Roadmap

Thursday, February 27, 2025

We are pleased to see the Hong Kong government release the forward-looking and pragmatic “ASPI-Re” roadmap for advancing the virtual asset industry. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Argentina’s stock market plummets amid President Javier Milei’s LIBRA memecoin scandal

Thursday, February 27, 2025

Argentina's economic landscape shaken as Milei's LIBRA endorsement turns into multi-billion dollar fiasco. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Heated AMA Debate: 0G Team Responds to Allegations of CFX Soft Rug, Overvaluation, and Token Commitment Concerns

Thursday, February 27, 2025

This AMA primarily focused on the relationship between Conflux and 0G Labs, discussing 0G Labs' high valuation, fundraising structure, technical direction, and community concerns over transparency.

Pectra: Ethereum’s Next Major Upgrade

Thursday, February 27, 2025

Breaking down key changes included in Ethereum's Pectra hard-fork ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Solana falls to lowest price since November 2024 losing 43% since January

Thursday, February 27, 2025

Volatility reigns as Solana's price retreat tests its resilience against past support levels. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Five Projects with Real-World Revenue Scenarios Utiling Token Empowerment

Thursday, February 27, 2025

Memecoin once captured significant attention and investment with its unique culture, humorous image, and community-driven characteristics. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏