Proof You Should Ignore The Fear-Driven Investing Headlines

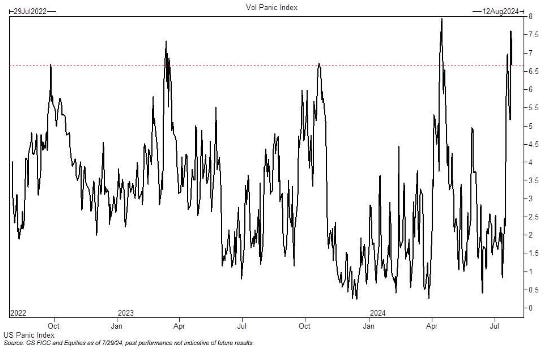

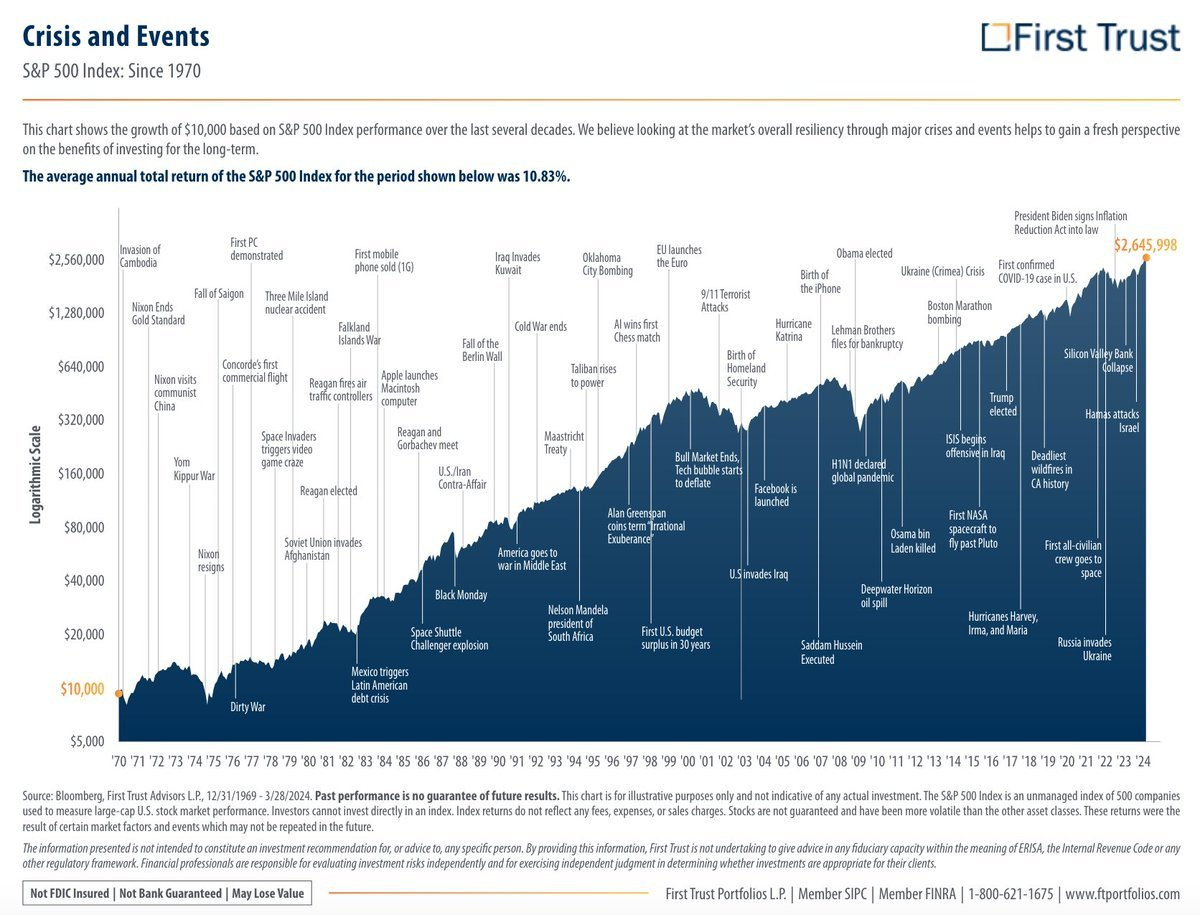

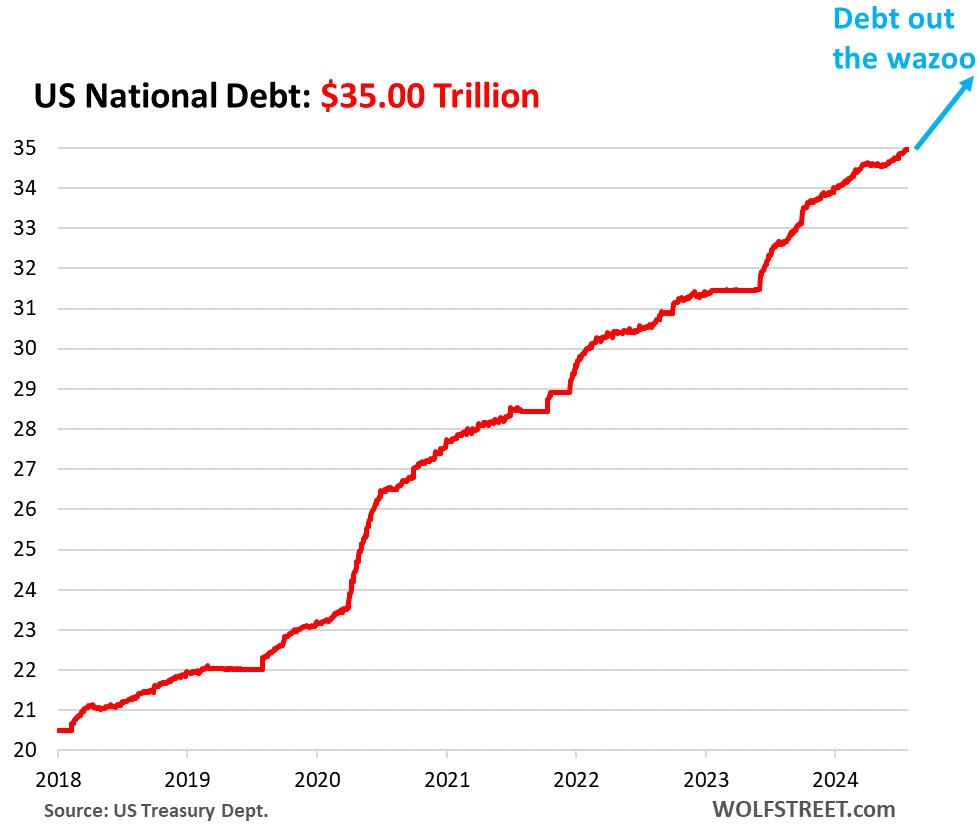

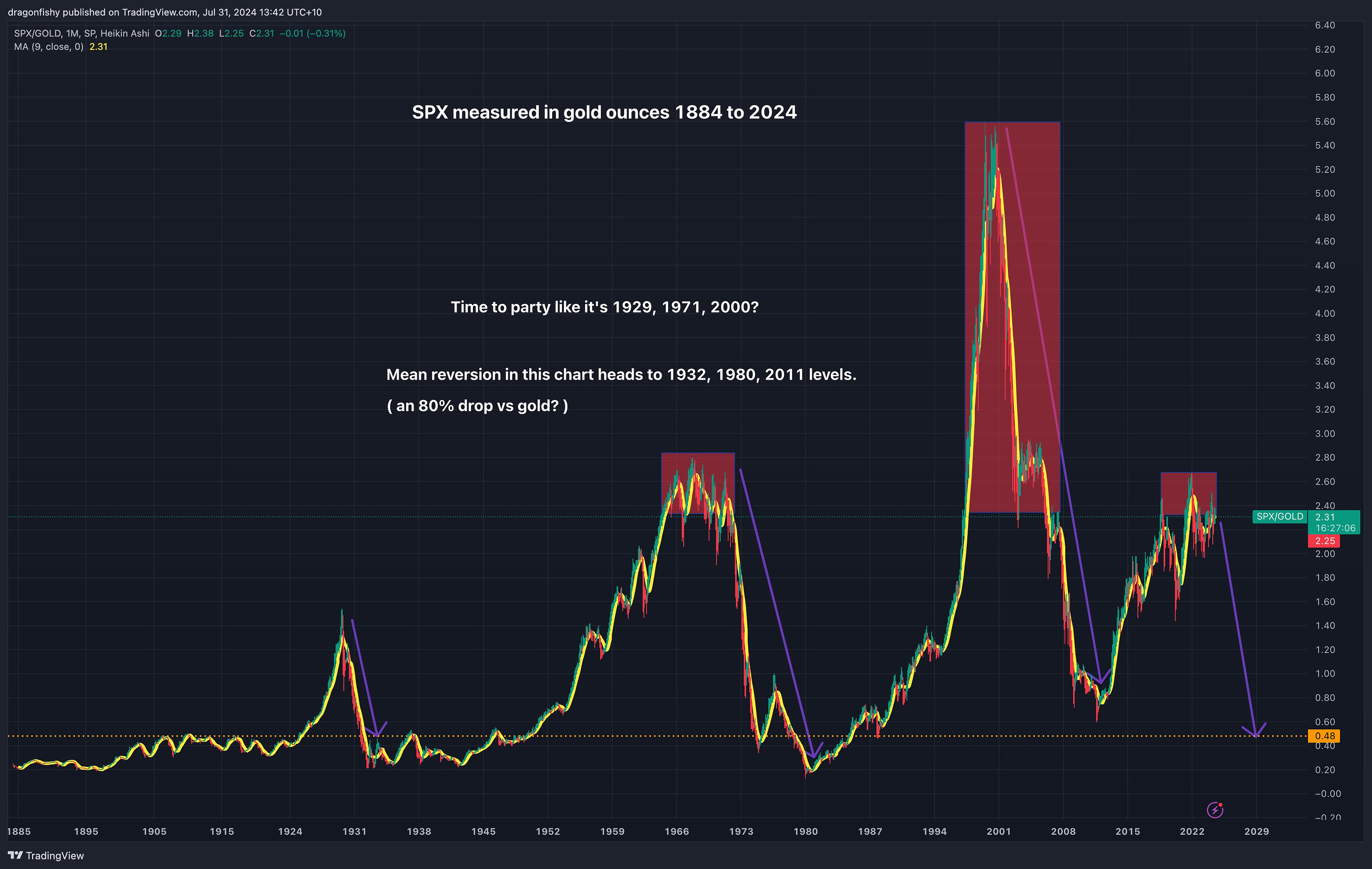

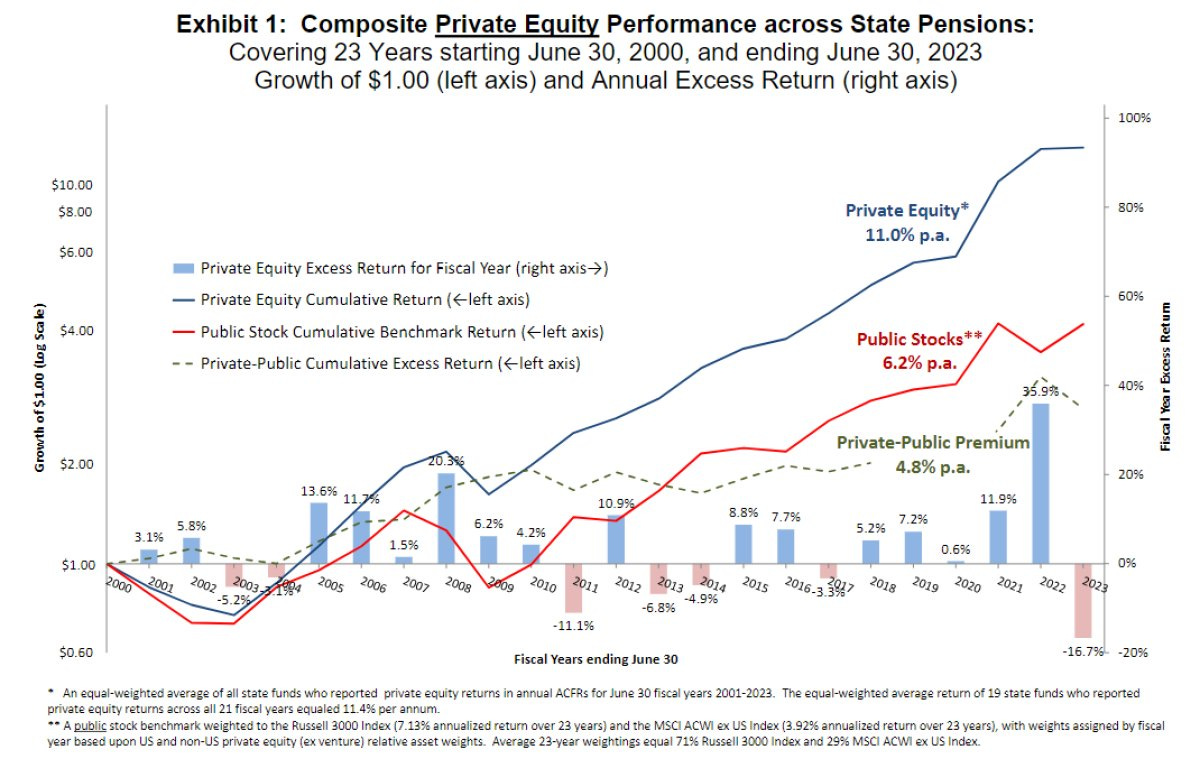

To investors, The market is trying to figure out the future, which means some people are getting spooked going into today’s July interest rate decision. The Goldman Sachs Panic Index is the highest it has been in two years. But should you actually be worried about this? It depends on your time horizon. If you are investing for next week or next month, you better pay very close attention to the short-term gyrations of the stock market. But if you are investing for the long-term, which is probably measured in 5+ year timeframes, then most of what you read in the news will be noise. The fear index doesn’t matter. Today’s interest rate decision doesn’t matter. Neither does September’s decision. Who wins the election in November won’t matter either. The S&P 500 has an average annual total return over the last 50+ years of more than 10%. Regardless of the details people worried about on a daily basis, the stock market is structurally engineered to go up over decades. This should give patient investors the confidence to continue being patient. To understand why the stock market will continue going up, we must understand how fast the US debt has been growing — the national debt has grown nearly 50% since January 2020. There is no path for us to pay the debt back. Leadership must devalue the dollar to monetize the debt, which means all assets priced in US dollars will continue to appreciate in dollar terms. For example, the S&P 500 is essentially flat since the early 1970s when it is priced in gold ounces, rather than US dollars. That signals majority of the stock market growth is likely from currency debasement instead of intrinsic value growth. So what are some of the non-consensus conclusions that I make from this data? First, investors with a long-time horizon should just keep dollar cost averaging into the stock market. Nick Maggiulli literally wrote an entire book called Just Keep Buying that describes this in detail. Second, the illiquidity of private equity may not be worth the perceived outperformance. You can see in this chart below that private equity investors claim a premium performance over “public stocks.” But if we use the 11% annual return for private equity since 2000, there is nearly no difference when compared to the 10.83% annual return of the S&P 500 over the last 50 years. This will likely surprise many investors who have been aggressively pouring capital into the private markets (note: I’ve done this too!) Now there is one caveat worth calling out on this analysis — the best public market investors have done much better than 10.8% annually and the best private market investors capture more than 11%. As with most things in life, the best in an industry do substantially better than the average, but it is hard for investors to know whether they are investing with the best or merely going to get the average market return. I hope this data and analysis makes you think more critically about where you put your money, along with how to internalize the fear-driven headlines you may read day-to-day. As Warren Buffett so eloquently said, “never bet against America.” Up and to the right over the long-term. We are so fortunate. Hope you all have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Founder & CEO, Professional Capital Management Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by clicking here. Hany Rashwan is the Founder & CEO of 21Shares, they have over $7 billion in assets and they are all focused on crypto. In this conversation, we talk about everything they have learned, ETFs, institutional vs retail, what is going on around the world in terms of regulation, politics, and what the United States can learn about those regions to decide what comes next for us. Listen on iTunes: Click here Listen on Spotify: Click here Hany Rashwan on When Countries Will Buy Bitcoin Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. Invite your friends and earn rewardsIf you enjoy The Pomp Letter, share it with your friends and earn rewards when they subscribe. |

Older messages

My Takeaways From The Bitcoin Conference Speakers

Monday, July 29, 2024

Listen now (5 mins) | Today's letter is brought to you by Domain Money! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Presidential Bitcoin Conference Begins

Thursday, July 25, 2024

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Podcast app setup

Thursday, July 25, 2024

Open this on your phone and click the button below: Add to podcast app

Podcast app setup

Wednesday, July 24, 2024

Open this on your phone and click the button below: Add to podcast app

Ether ETFs Launch Today - Everything You Need To Know

Tuesday, July 23, 2024

To investors, The Ether ETFs will begin trading today. These are the second set of crypto ETFs that have been approved by the SEC for trading. The approval of an asset other than bitcoin is a milestone

You Might Also Like

Chokepoints in the AI boom

Sunday, December 22, 2024

Plua: Why 2025 looks like a brighter year for VC, key signals for allocators and more Read online | Don't want to receive these emails? Manage your subscription. Log in The Weekend Pitch December

Brain Food: The Right Grip

Sunday, December 22, 2024

FS | BRAIN FOOD December 22 2024 | #608 | read on fs.blog | Free Version Welcome to Brain Food, a weekly newsletter full of timeless ideas and insights you can use. Before we dive in, a last-minute

🤖 Google Search “AI Mode” Dropping Soon

Sunday, December 22, 2024

The Weekend Update... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 12 spicy takes

Sunday, December 22, 2024

Prediction markets, phone addiction, ESOP plans and other such things. 🎄

Recruiting Brainfood - Issue 428

Sunday, December 22, 2024

Merry Christmas everybody - it's the Brainfood Christmas Special, so we bear gifts and reflections from the world of TA / HR on the year 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Simple hack to get 4x more shares

Sunday, December 22, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

I built an online tool site in 5 minutes

Sunday, December 22, 2024

AI tools are getting even more incredible

How to Describe a Hallucination

Saturday, December 21, 2024

If hallucinations defy the grasp of words, how should we try to describe them?

+28,000% Engagement with Pinterest?

Saturday, December 21, 2024

Exploding impressions and engagement

The importance of pillar pages for SEO

Saturday, December 21, 2024

88% of SEOs believe topical authority is very important to their SEO strategy, according to a Surfer SEO study. One of the most effective ways to strengthen your topical authority is by creating pillar