Detailed Analysis of Elixir: Can Decentralized Market Makers Use Synthetic Dollar Assets as the "Unified Measure" …

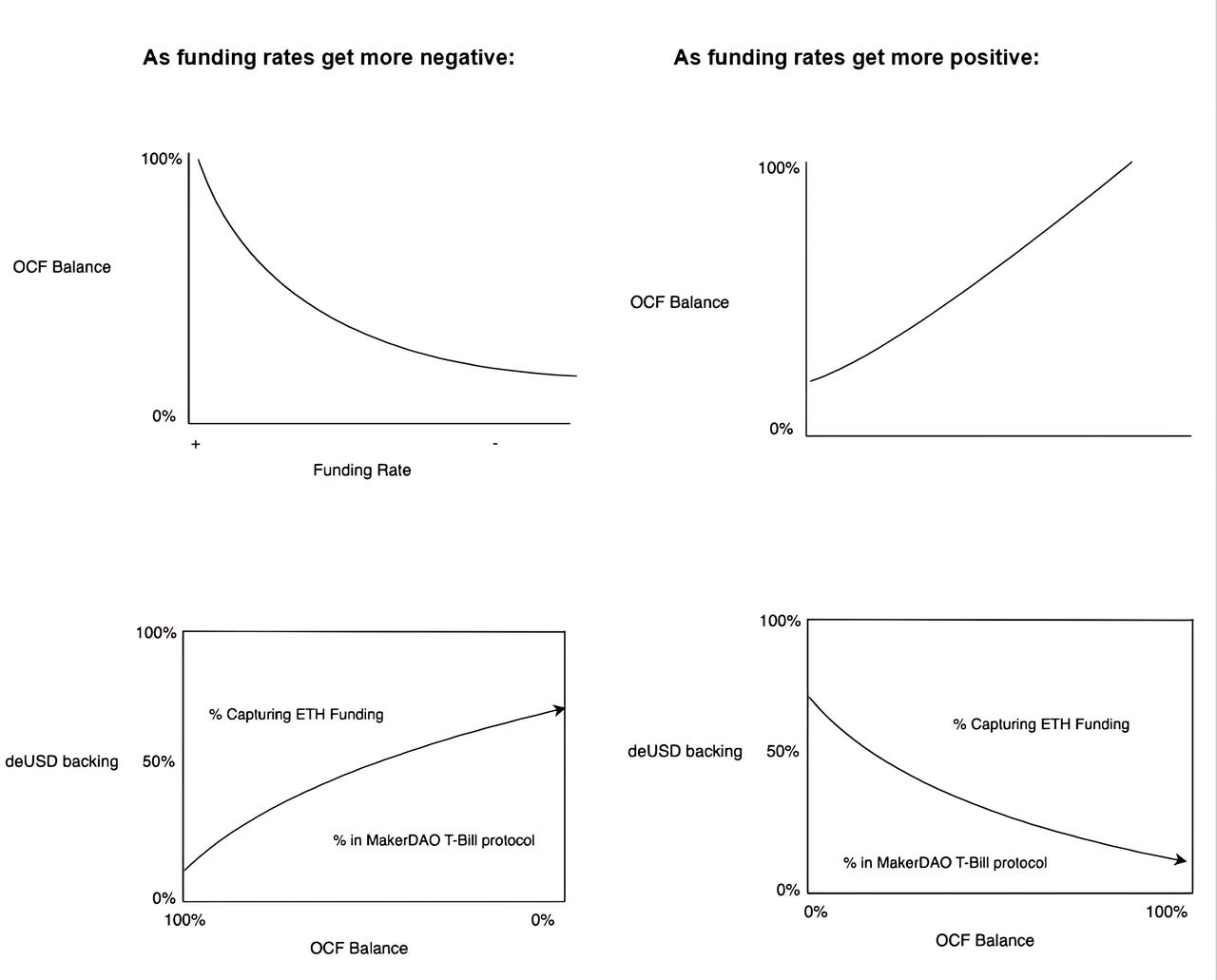

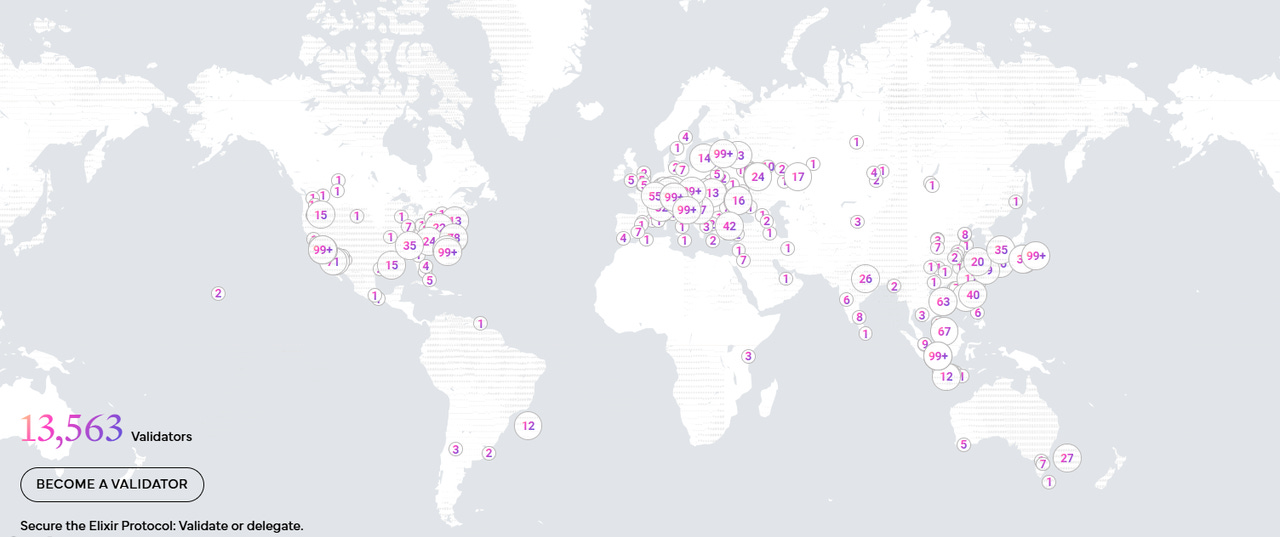

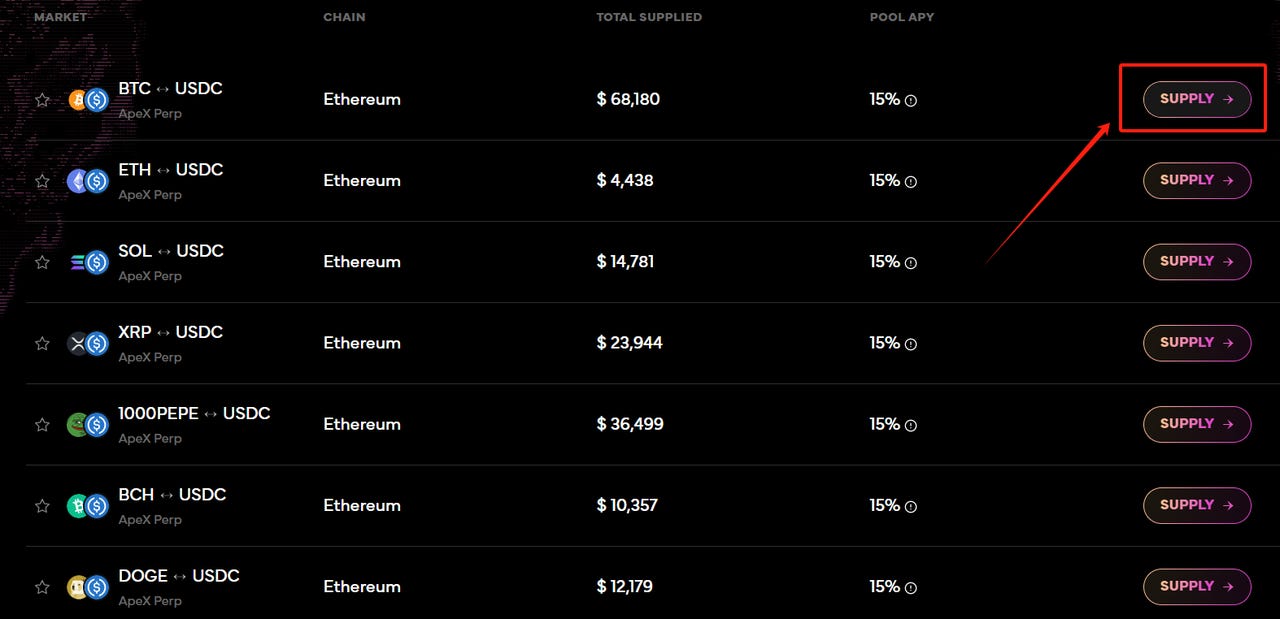

Author: TechFlow This article is sponsored by Elixir This article explores the innovative mechanisms and technology of Elixir, its collaboration with multiple DeFi protocols to address existing liquidity issues, and the mechanisms, advantages, and future of Elixir's decentralized dollar (deUSD). Since its launch, the Elixir protocol has attracted nearly $200 million in deposits and processed over 261 million transactions. Team Background and Funding Founder: Philip Forte ● Former partner at BlockVenture ● Advisor to Solana, Moonbeam, Flow Network, Magic Partner: Cole Petersen ● DeFi author for Forbes ● Investor in 3AC, Neuralink, and 20 other startups CTO: Chris Gilbert ● Former Chief Engineer at Tokensoft and IDEXX COO: Tim Wang ● Led crypto venture investments at Hudson River Trading ● Over 10 years of traditional finance experience, including investment banking at J.P. Morgan, private equity at Lightyear Capital, and venture capital at Eniac Ventures ● Angel investor in over 30 crypto projects In March 2024, Elixir announced an $8 million funding round led by Maelstrom Capital and Mysten Labs, with participation from GSR, Amber Group, and other institutions and individuals. Including two previously disclosed rounds, the total funding amount reached $17.6 million. Elixir's Collaboration Network Currently, Elixir has integrated with more than 30 leading DEXs, including Vertex, RabbitX, Bluefin, Apex, and Orderly. Through Elixir, users can provide liquidity to order book DEX trading pairs. LP providers can earn diversified staking rewards through Elixir LP incentives or partnership agreements. To date, Elixir has supplied over $1.25 billion in funding capacity to various order book exchanges, and it provides nearly or more than 50% of the liquidity for popular decentralized order book exchanges such as Bluefin, Rabbitx, Orderly Network, and Vertex. In the future, Elixir plans to integrate with a series of well-known DeFi protocols, including Pancakeswap, Paradex, and Synfutures. Technical Advantages Off-Chain System First, exchange data sources are responsible for obtaining market data from various exchanges. These data sources hold read-only credentials for the exchanges and subscribe to an update stream to receive real-time market data. This data is then broadcasted to data aggregators. Data aggregators collect data from multiple exchange data sources and combine it into a deterministic data framework. The aggregators then encrypt and sign the data to ensure its integrity and immutability. Finally, the signed data is broadcasted to validators and auditing nodes. The validator network operates through a Delegated Proof of Stake (DPoS) mechanism. Validators are responsible for verifying the correctness of the data, requiring 66% consensus to confirm data validity. End users delegate their state to the validators, and those holding the most stakes receive the largest rewards and participate in the consensus. The validator network ensures the decentralization and security of the system. The relay infrastructure uses secure enclave technology (and will use multi-party computation (MPC) infrastructure in the long term) to handle keys associated with exchanges. Relay nodes check if the encrypted order proposals have achieved 2/3 consensus, then use the keys to sign these orders and send the signed orders to the exchanges. The relay infrastructure acts as a bridge between the off-chain and on-chain systems, ensuring all transactions are verified and signed. On-Chain System Audit nodes receive data frameworks and order proposals from data aggregators and relay nodes. Audit nodes execute policies to verify the correctness of order proposals. If malicious proposals are detected, audit nodes call on-chain functions in the controller for appropriate action. Audit nodes ensure the accuracy of data and transactions. The controller is a smart contract responsible for managing stake, rewards, and penalties. In case of disputes, the controller checks the 2/3 consensus among active validators and penalizes malicious validators. The controller executes on-chain operations through smart contracts to ensure fairness and security in the system. Elixir's network architecture combines off-chain and on-chain systems to ensure efficient data processing and secure transaction validation. The validator network achieves decentralization and consensus through the DPoS mechanism, the relay infrastructure guarantees data and transaction integrity and immutability, and audit nodes and the controller provide additional security and fairness enforcement. This multi-layered architectural design allows Elixir to offer efficient, secure, and reliable services in a decentralized environment. At the same time, Elixir uses advanced algorithmic market-making techniques to manage and optimize liquidity supply. The main strategies include a variant of the infinite Avellaneda-Stoikov algorithm, which determines the quoting time through a random walk approach. This creates an experience for traders that is almost akin to that of a CEX, while also providing the best LP experience for liquidity providers. To prevent market manipulation and gamification behavior, Elixir introduces random components into its algorithms and uses SGX secure enclaves to generate random numbers. These random numbers are synchronized among validators through verifiable random functions. By combining a unique network architecture with algorithmic liquidity management, Elixir offers an innovative liquidity supply model. This model ensures both the efficiency and security of capital flows, while acting as a bridge between different DeFi projects, enhancing interoperability and liquidity. Recently, Elixir announced plans to launch a collateralized synthetic asset, decentralized dollar (deUSD), aiming to further improve the liquidity status of its partners and increase the returns for liquidity contributors. Synthetic Asset deUSD As DeFi becomes a crucial hub of on-chain prosperity, the importance of synthetic assets is also becoming more evident. In the on-chain world, synthetic assets directly peg the value of other assets, saving users from numerous intermediate steps in transactions, as well as the fees and wear-and-tear from multiple asset exchanges. As a good use case for crypto users to avoid slippage, synthetic assets have deeply rooted themselves in the crypto world, with their market value continuously growing and becoming widely recognized within the crypto ecosystem. Various on-chain protocols also consider synthetic assets an important part of their liquidity sources. Recognizing the bright spot of synthetic assets in DeFi liquidity management, Elixir is about to launch a fully collateralized synthetic dollar, deUSD. Price Stabilization Mechanism Currently, deUSD is collateralized with stETH, with plans to support more diverse collateral assets in the future. The deUSD design mechanism employs delta-neutral strategies and dynamic adjustment of asset composition to mitigate the risk of collateral asset price fluctuations. How Does the Delta-Neutral Strategy Work? Firstly, anyone can mint deUSD by collateralizing stETH. Each collateralized stETH is used to short an equivalent amount of ETH in the market. The short position can also capture positive funding rates, bringing additional income to deUSD. When the funding rate is negative, deUSD dynamically adjusts its asset composition based on the balance of the Open Collateral Fund (OCF), which supports the value of deUSD, to maintain price stability. Here’s how it works: ● In a negative funding rate environment, borrowing behavior in the market increases, causing the OCF balance to gradually decrease. ● As the OCF decreases, the asset composition ratio of deUSD is gradually adjusted, reducing the proportion of long-term base yield and increasing the proportion of sDAI/other yield-stable assets. ● For example, when the OCF reaches a high watermark of 100%, deUSD's asset composition ratio is "80% long-term strategy portfolio + 20% sDAI/other yield-stable assets." ● When the OCF reaches a high watermark of 75%, deUSD's asset composition dynamically adjusts to "70% long-term strategy portfolio + 30% sDAI/other yield-stable assets." The Elixir validator network comprises over 13,000 independent nodes distributed globally, with each node participating in transaction validation and the consensus mechanism. This decentralized validator network eliminates any single point of control, ensuring the protocol is free from any form of centralized intervention and maintaining the transparency and security of the protocol. Supported by the Elixir validator network, users can mint and redeem deUSD by interacting directly with smart contracts, without any centralized approval process. This ensures that the minting rights are entirely in the hands of the users, maintaining complete decentralization throughout the process. Current number of Elixir validator nodes worldwide deUSD abstracts products and exchanges across different blockchains into a single yield asset, reducing the complexity of operations between different blockchains and exchanges for deUSD holders. This simplification allows for easier asset management and converts more institutions and individuals into potential liquidity providers. deUSD functions like a universal ticket within the Elixir partner ecosystem, enabling users to participate in staking interactions across multiple platforms and even multiple chains, thereby meeting multi-chain needs through Elixir. Compared to volatile assets like ETH, deUSD, with its price stabilization mechanism, is likely more appealing to decentralized exchanges. This stability not only benefits the platforms themselves but also reflects their responsibility toward their users. Several partners have already accepted deUSD as collateral, and in the future, deUSD is expected to become the main liquidity asset for order book decentralized exchanges within the ecosystem. Additionally, Elixir's long-term plan is to extend this staking mechanism to centralized exchanges that accept deUSD as collateral. This would allow users to leverage deUSD not only in decentralized exchanges but also in certain centralized exchanges for trading and lending operations, thereby offering more returns and opportunities. How to Participate In March of this year, Elixir launched the Apothecary event, incentivizing users to contribute to Elixir's liquidity network by awarding points (Elixir of Immortality). Users can participate in Apothecary by completing their personal information, providing liquidity, and more. For details, refer to the Apothecary introduction page. Providing Liquidity: 1. Go to Elixir's liquidity page: https://t.co/k80BHNj3e4 2. Connect your wallet 3. Click on the currency pair and provide liquidity deUSD Staking Rewards (Coming Soon) Upon the official launch of the mainnet, users can freely choose to withdraw the ETH staked in the protocol or directly mint the staked ETH into deUSD. The ETH not withdrawn from the contract will automatically be minted into an equivalent amount of deUSD. Elixir has also allocated substantial staking rewards for deUSD, increasing Apothecary’s point rewards from 20 million to 50 million. deUSD stakers will receive triple the points, and users providing liquidity for the deUSD/USDC pair on Curve will receive five times the points. The deUSD Farming event, lasting eight weeks, will start when deUSD officially launches. Learn More: ● Elixir Official Website: [https://www.elixir.xyz/](https://www.elixir.xyz/) ● Elixir Official Twitter: [https://x.com/elixir](https://x.com/elixir) ● Elixir Telegram Official Group: [https://t.me/elixir_network](https://t.me/elixir_network) ● Elixir Official Documentation: [https://docs.elixir.xyz/](https://docs.elixir.xyz/) ● Apothecary Event: [https://www.elixir.xyz/apothecary](https://www.elixir.xyz/apothecary) Sponsored by Elixir Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Parallel Solution: How Movement Channel Ethereum's Technology

Wednesday, July 31, 2024

In this episode, we discuss parallel execution technology and the development of Movement Chain with its co-founder, Rushi. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with Layer3 Co-founder: Innovative Reward System How to View Airdrop Hunters and Differences between Eas…

Tuesday, July 30, 2024

In this episode, we talked with Brandon Kumar, co-founder of Layer3, to discuss the innovative ways Layer3 connects users with blockchain protocols. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

In-depth Analysis of Compound's Governance Attack: A Whale Seizes an Established DeFi Protocol Again

Tuesday, July 30, 2024

Abstract: I came across an interesting piece of information about Compound being subjected to a governance attack. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with Berachain co-founder: How to develop from an NFT community to L1 and create a positive flywheel eff…

Monday, July 29, 2024

In this episode, we talk with Smokey, the co-founder of Berachain, about the unique aspects and transformative potential of Berachain within the blockchain ecosystem. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (July 22 to July 28)

Sunday, July 28, 2024

Johnny Ng Kit-chong: Bitcoin Could Be Considered for Strategic Financial Reserves in the Future. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

USDT/USDC Prepaid Card’s Popularity Is Soaring – FinTax Reminds You to Be Aware of Related Risks

Thursday, February 27, 2025

In recent years, with the rapid development of the cryptocurrency market and digital payment technologies, several exchanges and wallet service providers have launched their own USDT/USDC prepaid card

SEC replaces Crypto Assets Unit with Cyber and Emerging Technologies Unit

Thursday, February 27, 2025

Laura D'Allaird leads the SEC's new unit to combat AI-driven fraud and bolster cybersecurity compliance. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

NFT & Gaming - 🦁 Loaded Lions will launch its LION token on 27 Feb; Yuga Labs sold its IP rights of the Meebits N…

Thursday, February 27, 2025

Loaded Lions will launch its LION token on 27 Feb on the Cronos EVM chain. Yuga Labs sold its IP rights of the Meebits NFT collection. Doodles plans to launch a new token, DOOD, on Solana. ͏ ͏ ͏ ͏ ͏ ͏

WuBlockchain Weekly: Hong Kong Recognizes BTC and ETH for Investment Immigration, SEC Discusses Staking, Argentina…

Thursday, February 27, 2025

According to the statistics of SoSovalue, as of Thursday, twenty state-level administrative regions across the United States have initiated relevant legislative procedures. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin surges to $99K as Coinbase defeats Gensler’s SEC lawsuit pending Commission approval

Thursday, February 27, 2025

Coinbase's settlement with SEC sets precedent in crypto regulation, sparking debate and potential legislative clarification. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: USDe Faces Largest Single-Day Redemption, SEC Concludes Investigation into OpenSea, and Bi…

Thursday, February 27, 2025

Since the implementation of the new priority fee allocation mechanism on February 12th, Solana's annualized inflation rate has increased by 30.5%. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ByBit suffers $1.5 billion Ethereum heist in cold wallet breach

Thursday, February 27, 2025

The sophisticated attack exploited ByBit's Ethereum cold wallet, but all other systems are reportedly unaffected. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

MORE EGGS IN FEWER BASKETS

Thursday, February 27, 2025

CRYPTODAY 141 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 17 to Feb 23)

Thursday, February 27, 2025

Recently, the Jiangsu Higher People's Court released a typical foreign-related case. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin price steadies as large holders curb profit-taking in February

Thursday, February 27, 2025

The flattening of profits among major Bitcoin holders means less pressure on Bitcoin's price. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏