Earnings+More - Wannabe

Get your act together we could be just fine. Hard Rock Bet is all about fun and innovation. With a top ranked sportsbook & casino product, unique access to US states, and a globally recognized brand, join our team to help shape the online experiences that millions love. We’re currently seeking:

American dreamStar-spangled: Penn Entertainment sees closing the gap with the market leaders on parlays as a percentage of handle as central to its hopes of leveraging the ESPN name and cementing ESPN Bet as a major player in the US OSB landscape. Be the best: CEO Jay Snowden noted FanDuel has been “in a class of its own” when it comes to parlay hold percentages, but said ESPN Bet would be “significantly better” at the start of the football season than previously.

Lean on me: That effort starts in earnest with the new football season and the upcoming launch in New York, where both Snowden and CFO Felicia Hendrix were keen to stress the extent to which ESPN Bet would be leaning on the connection to the existing ESPN consumer base.

I like to watch: Responding to a question regarding DraftKings’ customer surcharge plans, Snowden said the move was “unexpected” but “definitely interesting.”

By the numbers: In Q2, Penn saw revenue fall less than 1% to $1.66bn while adj. EBITDA fell by 23% to $367m. B&M gaming was a mixed bag, with growth in the Northeast, West and Midwest segments managing to more than offset the 3%+ fall in the South.

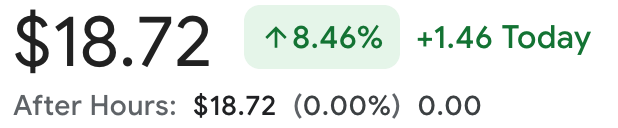

Schtum: On the subject of potential M&A, Snowden batted away an analyst query over financial media reports – “and even some of the gaming trade rags” – surrounding rumored approaches, remaining tight-lipped silent except to say the company doesn’t comment on speculation. ✒️ Penn is mightier, up over 8% on Thursday Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem. +MoreEndeavor has put OpenBet and IMG Arena up for sale as the company moves towards it being swallowed up by major shareholder and private equity house Silver Lake. Endeavor bought OpenBet from Light & Wonder for a knock-down $800m in Oct22, adding it to its existing IMG Arena business.

Genius Sports has announced the launch of GeniusIQ, a next-generation data and artificial intelligence platform for sports. Read acrossSimply predictable: In The Token Word, Nigel Eccles, ex-founder at FanDuel and now founder and CEO at BetHog and blockchain-based betting exchange BetDEX, had a word of warning for in-the-news prediction market provider Polymarket.

Thais that bind: Meanwhile, the news of Thailand announcing the skeleton details of its regulatory regime for casinos was the top story this week in Compliance+More. +More careersThe big move: IGT has announced the appointment of Nick Khin as president of global gaming having previously served as IGT COO and VP of gaming since 2015. Khin is based in Las Vegas and will report directly to CEO Vince Sandusky.

Hard timesThreat level: Investors are generally quick to factor in a hard landing recession for gaming stocks and, according to the analysts at Bank of America, recent price movements suggest there is a 60% chance of such a downturn.

I think I’m cracking up: BoA made the point that there are some evident “fundamental cracks” among low-end travel and leisure providers. Within the gaming sector, stocks at risk should these cracks widen include Penn, Caesars and MGM Resorts.

Light & Wonder earnings reactionNothing’s gonna change my love for you: The team at Deutsche Bank suggested there was enough contained within LNW’s Q2 earnings for both bulls and bears to chew on, with the numbers unlikely to change views on either side.

On the call, CEO Matt Wilson made note of the recent private equity buying activity in the gaming supply space and the DB team suggested LNW might yet be “active” on the M&A front.

Algosport are regarded as one of the ‘best-kept secrets’ in the gambling industry, currently supporting hundreds of Tier 1 and challenger operators with our proprietary Algosport Blackbox – a powerful engine capable of supercharging your sportsbook. We are best known for our next generation Bet Builder/Same Game Multiples product that offers the widest range of sports with unrivalled coverage, markets and features, both pre-match and in-play. To understand how we could help create more revenue get in touch at www.algosport.co.uk Seeking inspirationHalf and half: Interactive was the star of the show for Inspired, showing 40% YoY revenue growth to $9.4m, while gaming was up 1% to $27.1m and leisure rose 3% to $27.4m, all helping to offset a 23% decline in virtual sports to $11.7m. Group adj. EBITDA fell 6% to $25.5m.

That joke isn’t funny anymore: Executive chair Lorne Weil noted the Inspired share price is “laughably undervalued” but said management was “not really worrying” about any take-private moves.

Earnings in briefGolden Entertainment: Valuation concerns were expressed on the call as CEO Blake Sartini made the point that as it stands, on “conservative math”, the value of Golden’s real estate in Las Vegas exceeds the value of the company.

Century Casinos: Net revenue rose 7% YoY to $146m but adj. EBITDA fell by 6% to $27.4m, with the decline largely attributable to construction disruption across several properties and Polish casino closures. Mohegan: Q3 revenue rose 21% to $504m, helped by a significant 67% YoY rise in international revenues to $135m following the opening of the Inspire resort in South Korea. Digital revenues also more than doubled to $41.8m. Bragg Gaming: Revenue was near enough static at $24.9m while adj. EBITDA dropped by 24% YoY to $3.6m, a decline Bragg blamed on changing product mix. CEO Matevž Mazij said the company’s strategic review was “still ongoing against a backdrop of increased M&A activity.” Full House earnings reactionGlass half full: The somewhat slower start for Full House’s Chamonix property and the continuing overhang of a legal issue for the Waukegan, Illinois casino meant the share price hit the skids this week, down nearly 13% as of early trading yesterday.

Purse strings: Lee said Full House is pushing out the start of construction of the permanent $325m American Place, Waukegan casino until this time next year.

Join 100s of operators automating their trading with OpticOdds. Real-time data. Proven trading tools. Built by experts. Meet us at SBC Lisbon & G2E Vegas. Join top operators at www.opticodds.com. Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

Trainspotting

Thursday, August 8, 2024

New Entain CEO 'jumping on board a moving train' ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The unraveling

Tuesday, August 6, 2024

DraftKings could lose more than it gains from surcharge, says analysis ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Charged atmosphere

Monday, August 5, 2024

DraftKings' customer surcharge plan dominates its Q2 earnings call ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

😬 This is… nuts?

Friday, August 2, 2024

DraftKings to impose player surcharge in high-tax states ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Take me to the Rivers

Thursday, August 1, 2024

Rush Street impresses investors with beat and raise ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Marketing Weekly #211

Sunday, December 22, 2024

Marketing a Virtual Patient: The Quest to Eliminate Medical Error • What if You Could Reduce Returned Products With Just Some Lines of Text? • How to Manage an Omnipresent Social Media Strategy • 3

Salesforce Now Hiring 2,000 Sales Execs To Sell AI

Sunday, December 22, 2024

And the top SaaStr news of the week To view this email as a web page, click here Salesforce: Actually We're Going to Hire 2000 Sales Execs Now To … Sell AI So it was just the other day Salesforce

Sunday Thinking ― 12.22.24

Sunday, December 22, 2024

"When someone shows you who they are, believe them the first time."

Chokepoints in the AI boom

Sunday, December 22, 2024

Plua: Why 2025 looks like a brighter year for VC, key signals for allocators and more Read online | Don't want to receive these emails? Manage your subscription. Log in The Weekend Pitch December

Brain Food: The Right Grip

Sunday, December 22, 2024

FS | BRAIN FOOD December 22 2024 | #608 | read on fs.blog | Free Version Welcome to Brain Food, a weekly newsletter full of timeless ideas and insights you can use. Before we dive in, a last-minute

🤖 Google Search “AI Mode” Dropping Soon

Sunday, December 22, 2024

The Weekend Update... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 12 spicy takes

Sunday, December 22, 2024

Prediction markets, phone addiction, ESOP plans and other such things. 🎄

Recruiting Brainfood - Issue 428

Sunday, December 22, 2024

Merry Christmas everybody - it's the Brainfood Christmas Special, so we bear gifts and reflections from the world of TA / HR on the year 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Simple hack to get 4x more shares

Sunday, December 22, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

I built an online tool site in 5 minutes

Sunday, December 22, 2024

AI tools are getting even more incredible