Earnings+More - Tarnished

And his coat is torn and frayed, it's seen much better days. Hard Rock Bet is all about fun and innovation. With a top ranked sportsbook & casino product, unique access to US states, and a globally recognized brand, join our team to help shape the online experiences that millions love. We’re currently seeking:

Losing its shineA supposedly fun thing I'll never do again: DraftKings’ decision to call a halt to its planned player surcharge at least had the benefit of being swift. Having initially floated the plan with its Q2 earnings announcement on August 1, it was pulled just 13 days later.

Timeline to a climbdown

Aftershocks: The team at Wells Fargo expressed surprise at “how quickly DraftKings pivoted” but they argued the ramifications might last a lot longer.

Regulatory backlash: The customer reaction might not be the only fire left to fight. EKG suggested the potential backlash might extend to state regulators, who “would not have looked kindly on any attempts to skirt paying taxes.”

Is this a test? It was, in fact, the latest misstep in what Wells Frago characterized as a “tough” past two or three months.

Relief rally: In the short term, the decision to call a halt was welcomed positively by investors. Helped by the wider market bounce towards the end of the week, DraftKings’s shares were up 12.5% in the days following the reversal. Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem. +MoreBetfred US CEO Kresimir Spajic has told EGR that a market exit is “on the table.” Recall, the company has already pulled the plug in Maryland, Ohio and Colorado. Fanatics has launched in Louisiana, its 22nd sports-betting state, via a market access deal with Penn. Betway has been announced as the new official betting partner for the EPL’s Nottingham Forest. This follows on from the deal announced ahead of the new season with Manchester City. Meanwhile, Luckia is the new official betting partner for LaLiga in Spain and Mexico. The agreement includes the rights of LaLiga EA Sports and LaLiga Hypermotion. Stats Perform and the English Football League (EFL) have announced an exclusive multi-year partnership for official international live streaming video rights for licensed sports-betting operators. FuboTV has gained a preliminary injunction to halt the launch of Venu, the sports streaming service from Fox, Warner Bros. Discovery and Disney (ESPN). Fubo filed the complaint on antitrust grounds. The legal issues have likely pushed the launch until 2025. On socialThe week aheadThe big beast of the gaming affiliate world, Better Collective, reports its numbers late on Wednesday with the call the next morning. The team at Redeye last week trimmed its Q2 revenue and EBITDA estimates to €97m and €29m respectively.

Bet365’s UEFA dealName on the cup: The Stoke-based sportsbook is set to be officially announced as a sponsor of the UEFA Champions League, the first time a gambling operator has been associated with Europe’s premier club competition. Spot the ball: Eagle-eyed football supporters may have noticed a new name gracing the perimeter board advertising at Wednesday’s UEFA Super Cup final in Warsaw when bet365 flashed up in rotation during Real Madrid’s 2-0 defeat of Atalanta.

Pick that one out of the net: The deal is estimated to be worth around £50m a year and will run for three seasons from the start of this campaign. Alongside sponsorship features such as perimeter boards and stadium branding, bet365 will also run a new pick six game. Second string: Earnings+More has also confirmed that Betano is to be announced as a sponsor of the UEFA Europa League and the UEFA Conference League after Bwin declined to exercise an option to extend its three-year sponsorship.

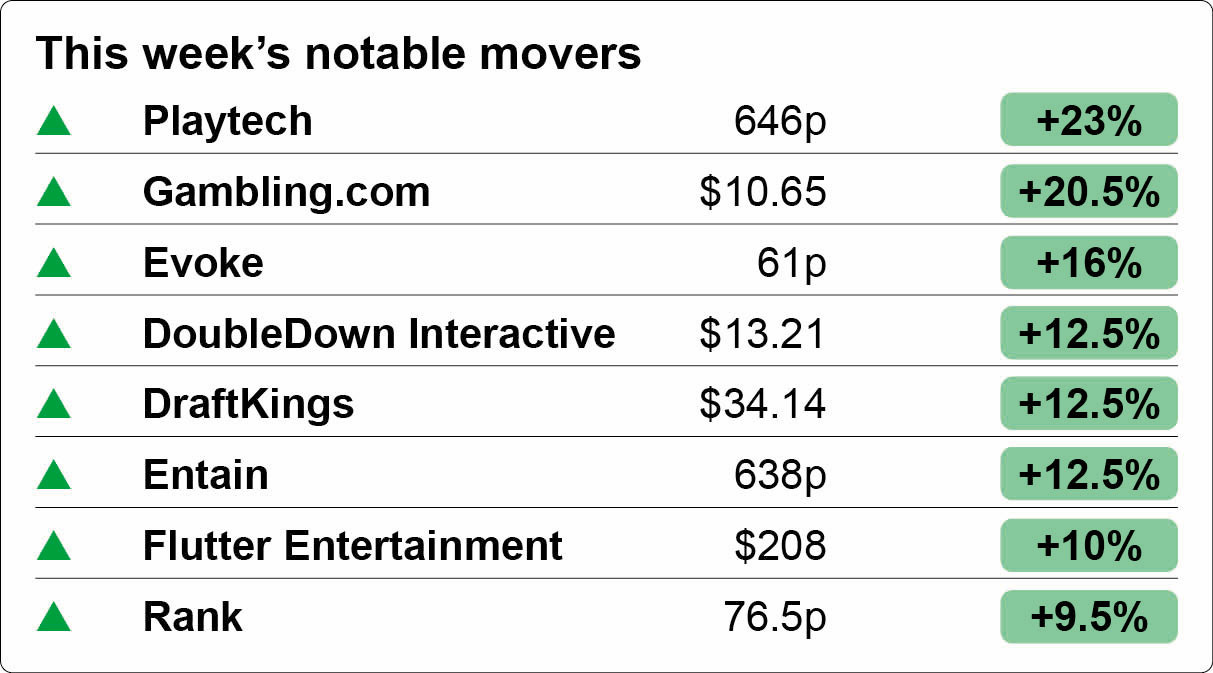

The shares weekBouncebackability: Memories of the yen carry trade crash are already long gone as the sector rode the coattails of a wider market surge late last week, with green arrows seen almost across the board on Friday.

Rocket from the crypt: Confirmation that Playtech was in exclusive talks with Flutter over a buyout of Snai – with a rumored price tag that might exceed Playtech’s market cap – understandably put a rocket under the share price, which soared 23% this week. Flutter rose 10%.

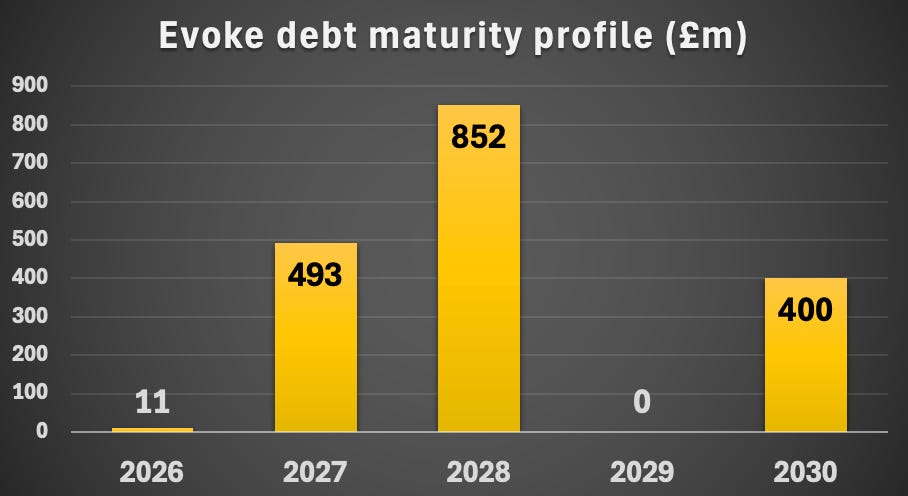

Target practice: Gambling.com pleased its investors with a better-than-expected performance in Q2 and was rewarded with a 20%+ leap last week. The analysts at Jefferies said the beat and raise gives onlookers confidence in the company’s long-term target of $100m in adj. EBITDA. Algosport are regarded as one of the ‘best-kept secrets’ in the gambling industry, currently supporting hundreds of Tier 1 and challenger operators with our proprietary Algosport Blackbox – a powerful engine capable of supercharging your sportsbook. We are best known for our next generation Bet Builder/Same Game Multiples product that offers the widest range of sports with unrivalled coverage, markets and features, both pre-match and in-play. To understand how we could help create more revenue get in touch at www.algosport.co.uk By the numbers – Evoke debtPile driver: Staying with Evoke, the worst is over as far as it being overwhelmed by its debt pile but, as last week’s earnings presentation made clear, the company is still hemmed in by its £1.76bn of borrowings.

💷 Evoke’s wall of worry Austerity chic: Notably, Wilkins said one of his “key learnings” in his first six months in the job is the company still has “loads to go on the cost side,” with a “wide range” of manual processes, duplication and inefficiencies to be eliminated.

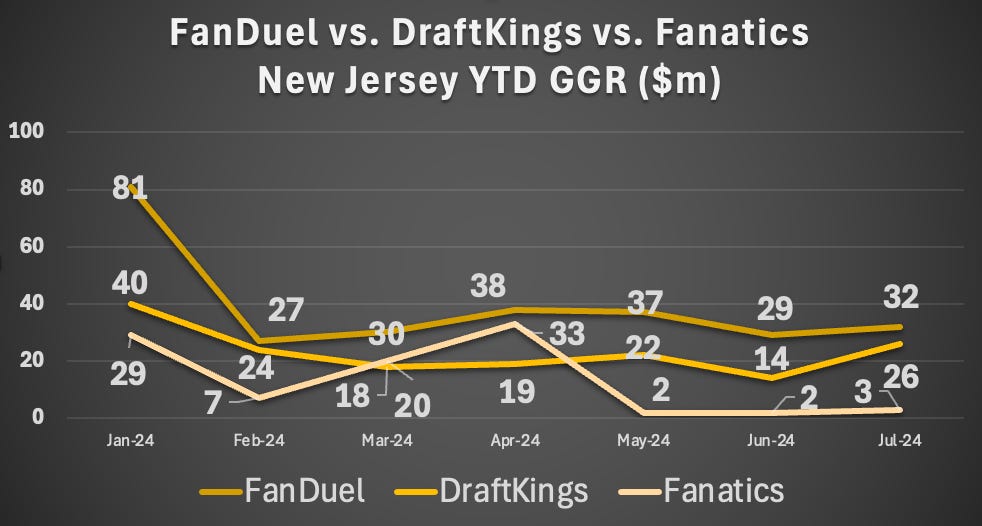

New Jersey JulyVIP MIA: The latest data from Jew Jersey confirmed that Fanatics’ (presumably) VIP-led bounce earlier this year is well and truly over. Recall, it dramatically took second spot from DraftKings in March and April with $20m and $30m of GGR respectively.

Sports-betting GGR in July was up 31% YoY to $80m. FanDuel, meanwhile, continued to lead with 41% GGR share, followed by DarftKings on 33%, BetMGM (8%) and Caesars (4%). ESPN Bet maintained a minimal footprint with 3% share.

New York: OSB GGR in July was up 33% to $140m on handle that rose 31% to $1.2bn. FanDuel led on 42%, followed by DraftKings (34%), Caesars (8%) and Fanatics (6%). Maryland: Sports-betting GGR jumped 89% to $41.7m in July, with FanDuel grabbing more than half of total revenue on 51%, followed by DraftKings on 29% and BetMGM on 8.5%. Handle rose 35% to $333m. Indiana: B&M gaming saw GGR come in at $206m, down 3% YoY. Sports-betting GGR rose 25% to $29m. Belgium: Total GGR for 2023 was up 17% to €1.7bn despite the restrictions on gambling ads that came into effect mid-year. iCasino revenues rose 20% to €455m while B&M casinos rose 14% to €140m. OSB GGR rose 13% to €238m with retail setting up 2% to €152m. Join 100s of operators automating their trading with OpticOdds. Real-time data. Proven trading tools. Built by experts. Meet us at SBC Lisbon & G2E Vegas. Join top operators at www.opticodds.com. Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

Read all about it

Monday, August 12, 2024

Penn CEO dismisses paper talk but talks rumors persist ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Wannabe

Friday, August 9, 2024

ESPN Bet can be America's sportsbook, says Penn ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trainspotting

Thursday, August 8, 2024

New Entain CEO 'jumping on board a moving train' ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The unraveling

Tuesday, August 6, 2024

DraftKings could lose more than it gains from surcharge, says analysis ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Charged atmosphere

Monday, August 5, 2024

DraftKings' customer surcharge plan dominates its Q2 earnings call ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Marketing Weekly #211

Sunday, December 22, 2024

Marketing a Virtual Patient: The Quest to Eliminate Medical Error • What if You Could Reduce Returned Products With Just Some Lines of Text? • How to Manage an Omnipresent Social Media Strategy • 3

Salesforce Now Hiring 2,000 Sales Execs To Sell AI

Sunday, December 22, 2024

And the top SaaStr news of the week To view this email as a web page, click here Salesforce: Actually We're Going to Hire 2000 Sales Execs Now To … Sell AI So it was just the other day Salesforce

Sunday Thinking ― 12.22.24

Sunday, December 22, 2024

"When someone shows you who they are, believe them the first time."

Chokepoints in the AI boom

Sunday, December 22, 2024

Plua: Why 2025 looks like a brighter year for VC, key signals for allocators and more Read online | Don't want to receive these emails? Manage your subscription. Log in The Weekend Pitch December

Brain Food: The Right Grip

Sunday, December 22, 2024

FS | BRAIN FOOD December 22 2024 | #608 | read on fs.blog | Free Version Welcome to Brain Food, a weekly newsletter full of timeless ideas and insights you can use. Before we dive in, a last-minute

🤖 Google Search “AI Mode” Dropping Soon

Sunday, December 22, 2024

The Weekend Update... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 12 spicy takes

Sunday, December 22, 2024

Prediction markets, phone addiction, ESOP plans and other such things. 🎄

Recruiting Brainfood - Issue 428

Sunday, December 22, 2024

Merry Christmas everybody - it's the Brainfood Christmas Special, so we bear gifts and reflections from the world of TA / HR on the year 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Simple hack to get 4x more shares

Sunday, December 22, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

I built an online tool site in 5 minutes

Sunday, December 22, 2024

AI tools are getting even more incredible