Quantitative Easing Made Market Bears Irrelevant

Today’s Letter is Brought To You By Range!Looking for a tax strategy to offset those BTC gains? Range has you covered -- they have rebuilt wealth management from the ground up, offering investors like you a modern all-in-one comprehensive suite of financial services. With Range, you get everything in one place—investments, taxes, estate, real estate, equity, and cash flow. No more piecemealing your way to generational wealth while hunting for the right connections to manage all aspects of your money. The traditional industry has you convinced that you have to pay ridiculously high fees to get sophisticated wealth management. Let them know you’re done. You’ve found Range. The search is over. To investors, Optimism has infiltrated the market and it is changing the flow of capital. Adam Kobeissi writes:

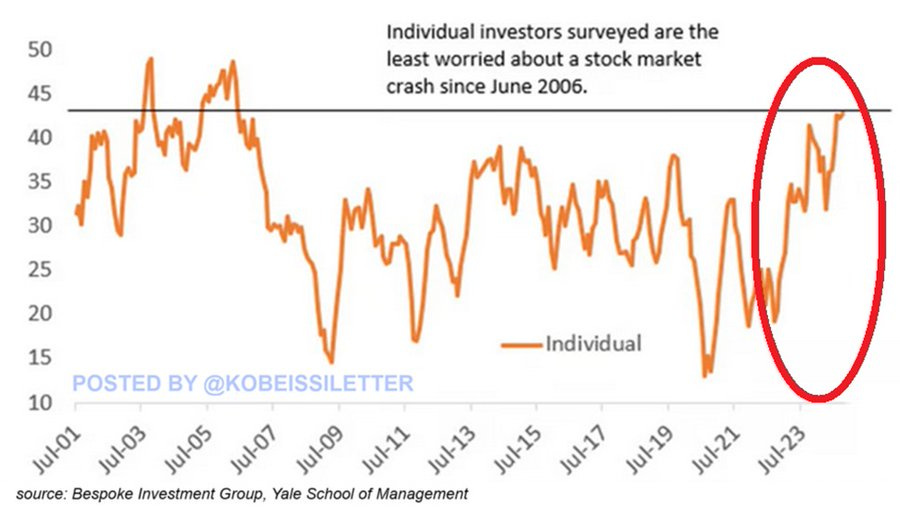

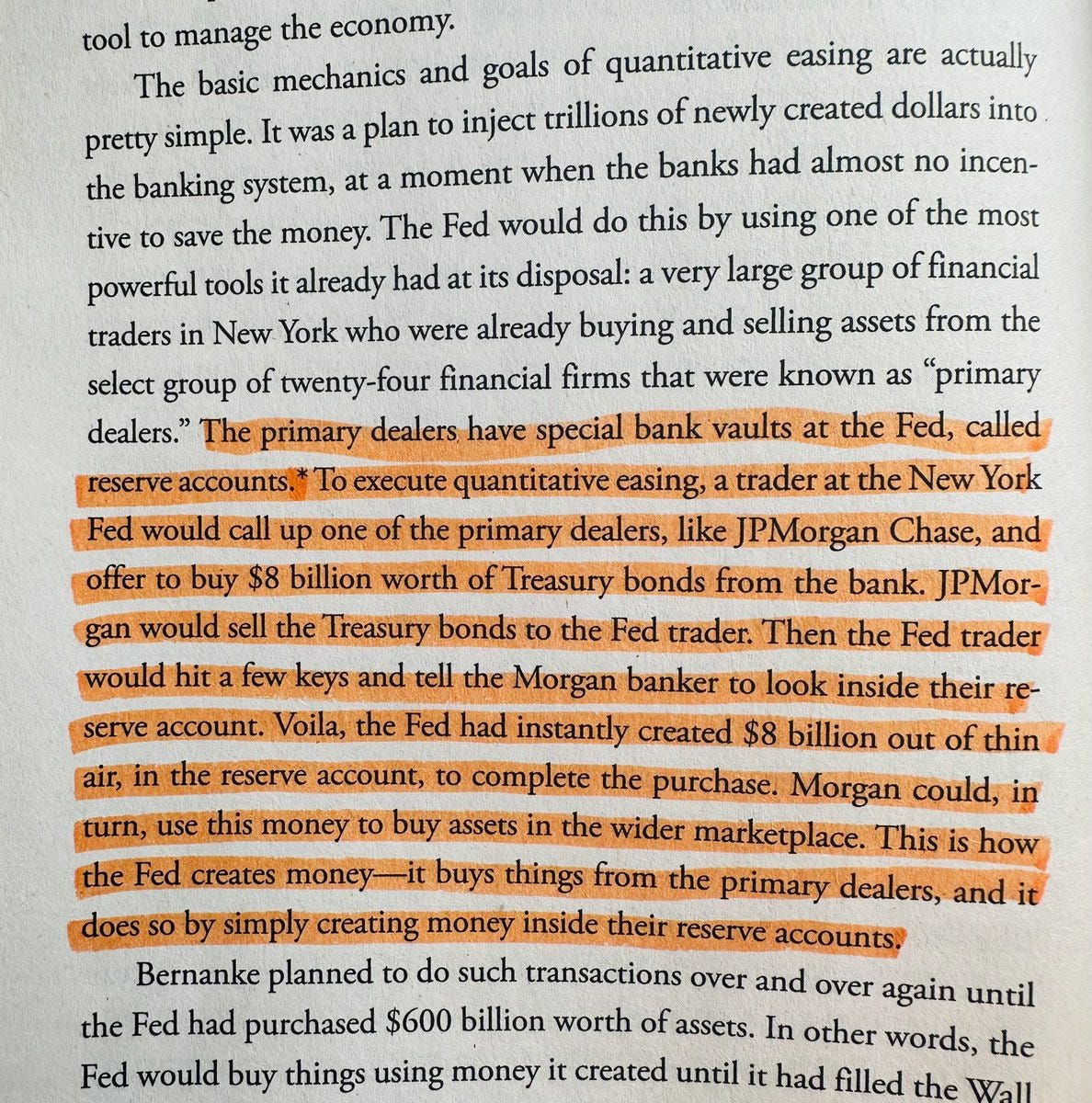

Here is the crazy part about optimism — optimists are usually right over the long run. I believe this is becoming increasingly true in financial markets because the Federal Reserve broke the market about 16 years ago. We have never recovered, nor do I think we will ever recover. I read a book over the weekend called The Lords of Easy Money written by Christopher Leonard. It details the last few decades at the Federal Reserve with a specific focus on the rise of quantitative easing and the unseen ramifications on markets and financial assets. A big takeaway from the book was a key error that economists, investors, and market commentators made in the last decade and a half — everyone was obsessed with measuring price inflation due to QE, but not enough people were worried about asset inflation from the same root cause. There are two ways to look at asset inflation. One aspect is that asset prices shouldn’t be able to grow up-and-to-the-right forever, so if quantitative easing is creating that scenario then we should expect the asset bubble to pop. The second aspect contradicts the first point and argues that asset bubbles can’t pop if the central bank is always willing to suppress interest rates and print more money when asset prices start to fall. I fall in the second camp. There is a very strong argument that we will never see another 18+ month bear market in the US economy as long as the US dollar exists as a fiat currency. That may sound like a bold statement, but let me explain. Central banks have perfected the quantitative easing playbook. They can cut interest rates and print money at an incredible speed now. During the 2020 pandemic, interest rates were cut to 0% with emergency rate cuts and we saw trillions of dollars created out of thin air. Asset prices had “crashed,” but they quickly recovered and hit new all-time highs months later. This is the new normal. This is the world of asset prices growing forever. This is the world of optimism. I know the new world is confusing to people who have grown up in an economy before the invention of QE, but we now have nearly two decades of data that proves we are in a new regime. As Christopher Leonard points out in his book, money has become fake numbers on a screen that get created out of thin air and handed to the select primary dealers. If you give someone a money printer, they are going to print money. And if the Fed is printing money, then asset prices are going higher and higher. This may lead some of you to ask “what if the Fed stops printing money?” The analysis would change, but the important part of the story is the United States can no longer afford to stop printing money. We are addicted to cheap, plentiful capital. This is why I believe it is nearly impossible for us to see an 18+ month bear market. If the Fed sees asset prices falling aggressively, they will step in quickly and intensely. The market doesn’t respond to the Fed, the Fed responds to the market. There is one part of Leonard’s book where he outlines a perfect example of this — Ben Bernanke’s Fed wanted to conduct QE at a smaller scale and slower rate than the market expected, but Bernanke had to fulfill the market’s expectations because he and his colleagues worried about asset prices falling if they diverged from expectations. So why am I calling this out? The optimism I pointed to at the top of today’s letter is incredibly important for one reason — the Fed is essentially required to intervene in the market and push asset prices higher. Market participants are expecting it, so the Fed has to do it. The market is the captain now. This development means you have a choice to make as an investor. You can believe everyone has gone crazy and a multi-year bear market is right around the corner, or you can recognize the Fed broke financial markets and they will stimulate the economy at any sign of trouble until they hyper-inflate away the dollar (which will take much longer than most people think!). I am an optimist and I am a student of history. You only have to go back to the Global Financial Crisis to realize the rules of the game changed. Time in the market is more important than timing the market. Bears sound smart, but bulls make money. Hope you have a great start to your week. I’ll talk to everyone tomorrow. -Anthony Pompliano Founder & CEO, Professional Capital Management How To Make Millions With Small Business Codie Sanchez is the founder of Contrarian Thinking, and the author of a brand new book called “Main Street Millionaire: How to Make Extraordinary Wealth Buying Ordinary Businesses.” In this conversation, we discuss the process to find, buy, and scale small businesses, the amount of wealth that can be generated, how you can do it, and why it is so important for you to own upside in whatever you do. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

The Regulatory Landscape Is Changing At Intersection of Public Markets and Crypto

Tuesday, December 3, 2024

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is The Bitcoin Bull Market Almost Over?

Monday, December 2, 2024

Today's Letter is Brought To You By Range! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Why Is Bitcoin's Price Dropping Right Now?

Tuesday, November 26, 2024

Listen now (3 mins) | Today's Letter is Brought To You By Range! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Microstrategy of X is coming — Here Is An Interesting One

Monday, November 25, 2024

Listen now (6 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Crypto-Related Public Companies Are Still Undervalued

Friday, November 22, 2024

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏