Earnings+More - Luxury tax

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we're seeking leaders who are driven to challenge the status quo:

Paying for the privilegeTurn left or turn back: DraftKings has added a subscription service to its offering in the high tax state of New York, where in return for a monthly fee of $20 players can receive “stepped up” odds boosts on all parlays. Are you not entertained? DraftKings said in a statement to Sportico that the new service was “designed to offer our customers an enhanced fan experience, creating more excitement and value to our extensive parlay offering.”

Under the terms of the subscription service, players who place parlay bets where the individual legs are -500 or narrower receive tiered returns, with profits for two-leg parlays increased by 10%, moving up to double the profit for parlays with 11 legs or more.

If at first you don’t succeed: Recall, DraftKings attempted to introduce a player surcharge for high tax jurisdictions last summer, but following “customer feedback” – and a comment from Flutter that it had no intention of following the move – the plan was quickly buried.

Ways to skin a cat: In the midst of the run of customer-friendly sports results in October, Robins said during another investor conference that the maximization of hold was only one lever at the company’s disposal to generate profits.

One industry commentator suggested to E+M that DraftKings was trying to build a better mousetrap “but probably it’s still a mousetrap.”

How’s this landed, boss? The reaction on social media was, well, mixed. And very mixed. And even more mixed. In no way related: Separately, in a note last week analysts at JP Morgan lowered their DraftKings’ Q4 revenue target, down to just under $1.4bn from $1.5bn, due to the customer-friendly sporting results in October.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem. +MoreCodere Online is being threatened with a class action lawsuit from disgruntled shareholders alleging securities fraud following its December 27 admission that its auditor Marcum had resigned citing an “inability to complete certain audit procedures.”

DraftKings and its former executive Michael Hermalyn, who moved to Fanatics, reached a settlement last month regarding the lawsuit over the ex-employee’s non-compete clause.

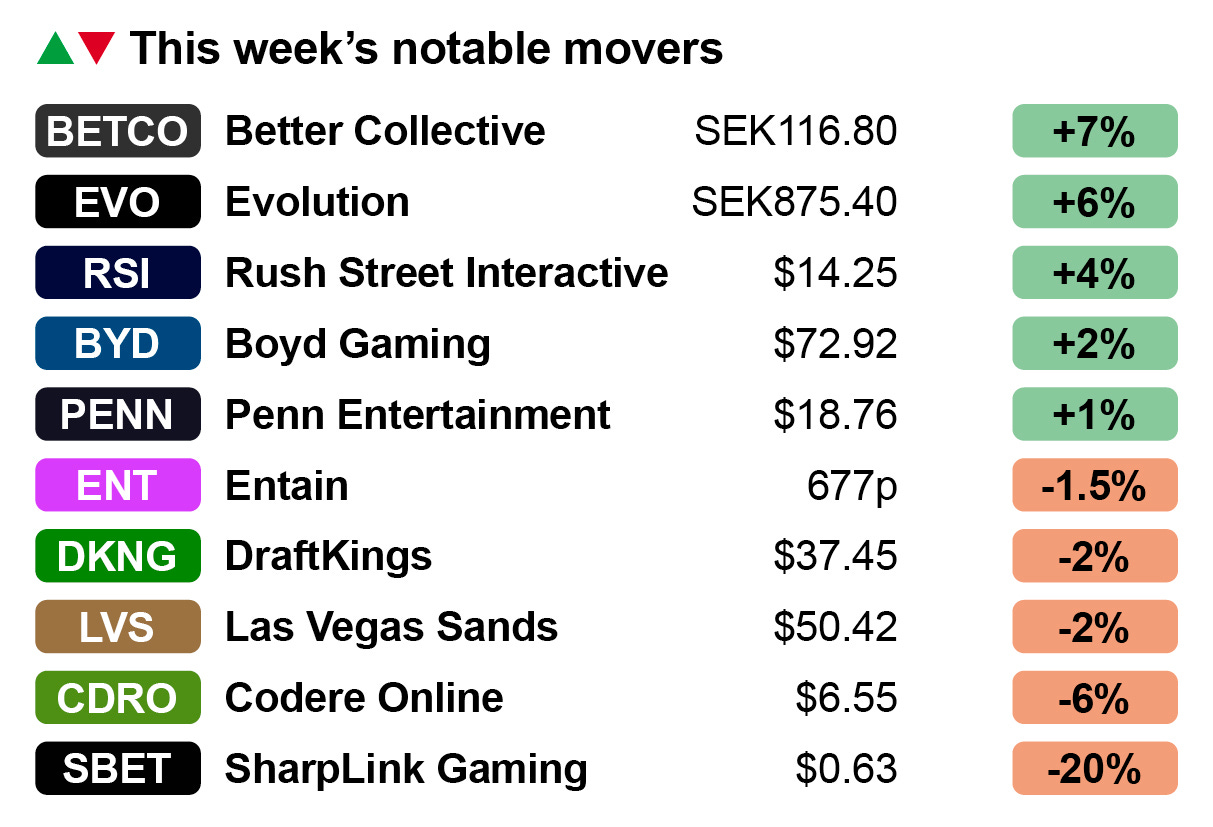

No longer in exile on Main Street: The RSN Diamond Sports has emerged from its Chapter 11 bankruptcy proceedings under the new name Main Street Sports. It will now operate 16 regional sports networks as the FanDuel Sports Network under the terms of the previously announced naming rights agreement. Markets watchNew year, new you: Change is coming to the land-based casino gaming sector, according to a New Year’s note from the analysts at Jefferies, who have upgraded Boyd Gaming and Las Vegas Sands.

Macau remains as tricky to read as ever this year. Las Vegas Sands was down 2% despite being identified by Jefferies as likely to benefit from the improved macro condition and the strength of the mass segment consumer.

Stay of execution: The analysts said both Caesars Entertainment and MGM Resorts were “too inexpensive to ignore” given their respective multiples of 6.8x and 6.2x, but they indicated they would need to see evidence of better execution in digital to get involved. Among the gainers this week, Evolution, up 6%, managed to claw back some ground following the bruising market reaction to the news that the UK Gambling Commission was reviewing the company’s license. See last Thursday’s Compliance+More.

Analyst takes – LiveScoreVirgin records: The success LiveScore is enjoying with Virgin Bet – helping to drive UK revenues up 39% to £139m while group revenues increased 38% to £179m – suggests Bally’s scored an “own goal” when it failed to take the business as part of the Gamesys acquisition, suggested the analysts at Regulus.

Hangin’ tough: LiveScore “proves" the UK is a big enough market to “test a model and gain significant revenue” but not big enough to secure profitability without a ~5% share, a level that is “extremely tough to deliver in a competitive market.”

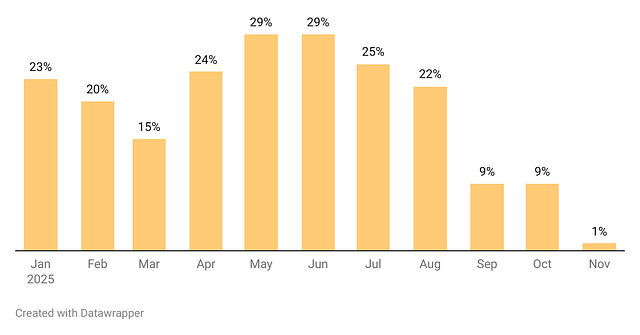

Does your Bet Builder supplier or in-house Same Game Multi solution support 13 sports, including all of the main global betting sports, plus local variants and even eSports? Does your product allow your end-users to place both Pre-Match and In:Play Bet Builders across multiple sports? Can you offer cashout across all Bet Builder transactions? Does your solution use your own odds rather than another opinion of the market? If the answer to any of these is ‘no’ then come and find out why over 170 operators are using the Algosport Bet Builder solution today. Algosport will be at ICE in Barcelona in January, so to book a no-nonsense conversation about improving your product or increasing your revenue, please drop us a line at ICE2025@algosport.co.uk or visit www.algosport.co.uk By the numbers – promo pullbackPanda eyes: The yin and yang of the lower hold in October was a reduction in promotional intensity in the following month, according to the data from the states that report promo level activity and examined by the analysts at Deutsche Bank.

The hold disruption in October and the pullback in promos also played into the handle figure for November. As can be seen, across Deutsche Bank’s focal states, handle was up a mere 1% in November even while GGR rose a whopping 66%.

November iCasinoGoing out on a high: Total iCasino GGR in November was up 29% YoY to $766m, which the team at Jefferies pointed out was 2% higher than the previous record level set in the prior month. As the team noted, that came without the benefit of incremental recycled customer winnings as would have been the case in October.

The squeeze: In terms of market share across all states, FanDuel claimed top spot with just over 25% share, followed by DraftKings on 23.5% and BetMGM on a little over 20%.

Ohio: The November sports-betting data shows GGR was up 72% to $117m on handle that was up 10% to $1.02bn. Leading the market was FanDuel on 39%, with DraftKings second on 32%.

In Kentucky in November, OSB GGR rose 66% to $35.2m, with DraftKings on top with 42%, followed by FanDuel on 37%. Notably, bet365 claimed third spot with 8%. Online gaming revenue in Portugal hit a record high in Q3, up 24% to €266m. iCasino contributed €175m of the total while sports betting was worth €91m. Join 100s of operators automating their trading with OpticOdds. Real-time data. Proven trading tools. Built by experts. Unlock complimentary access until year-end at www.opticodds.com. Earnings calendar

We simplify game development by doing the heavy lifting, so you can focus on creativity. Whether you’re an emerging studio or an established one looking to relieve development pressure, we ’ve got you covered.

An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

Out of left field

Friday, January 3, 2025

Crypto.com's further threat to OSB status quo ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Last chance saloon

Friday, December 20, 2024

Can Hollywood save Penn's online business? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Jam today

Thursday, December 19, 2024

Gambling.com buys OddsJam for up to $160m ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Beefed up

Thursday, December 19, 2024

Flutter could be worth more than $100bn in four years, say analysts ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

In ascendancy

Thursday, December 19, 2024

Consumers shifting spending to digital gaming, say analysts ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Free download: 5 ways to improve your proposals

Thursday, February 27, 2025

A free resource for you ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

From living in a car to $1.4M in 5 months

Thursday, February 27, 2025

I love that you're part of my network. Let's make 2025 epic!! I appreciate you :) Today's hack From living in a car to $1.4M in 5 months Taro Fukuyama and 2 of his friends from Tokyo

I'm launching a meme coin live RIGHT NOW

Thursday, February 27, 2025

(All for charity dw) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Vibe shift

Thursday, February 27, 2025

Billions added to values as investors warm to sector earnings ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Midnight Society Bows Out While ChronoForge Aims for a Bigger Stage 😮

Thursday, February 27, 2025

PlayToEarn Newsletter #260 - Your weekly web3 gaming news

WTF is open-source marketing mix modeling?

Thursday, February 27, 2025

Marketers should be wary of open-source programs promoted by purveyors with a walled garden history. February 17, 2025 PRESENTED BY WTF is open-source marketing mix modeling? Marketers should be wary

👀 What Content Is AI Citing?

Thursday, February 27, 2025

Another parasite SEO gift for you 🧙✨🎩 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The 2021 GTM Playbook Is Mostly Dead

Thursday, February 27, 2025

But What's The AI Era Replacement? To view this email as a web page, click here saastr daily newsletter The 2021 GTM Playbook Is Mostly Dead. But What's The AI Era Replacement? By Jason Lemkin

'Do Your Job: The Art of Winning' with Bill Belichick

Thursday, February 27, 2025

In his upcoming book “The Art of Winning,” set to be released in May, Coach Bill Belichick shares several key secrets to his extraordinary success on the field.

Good Questions

Thursday, February 27, 2025

About Google's Performance Max.