Bitcoin industry insiders aren’t worried about the price correction

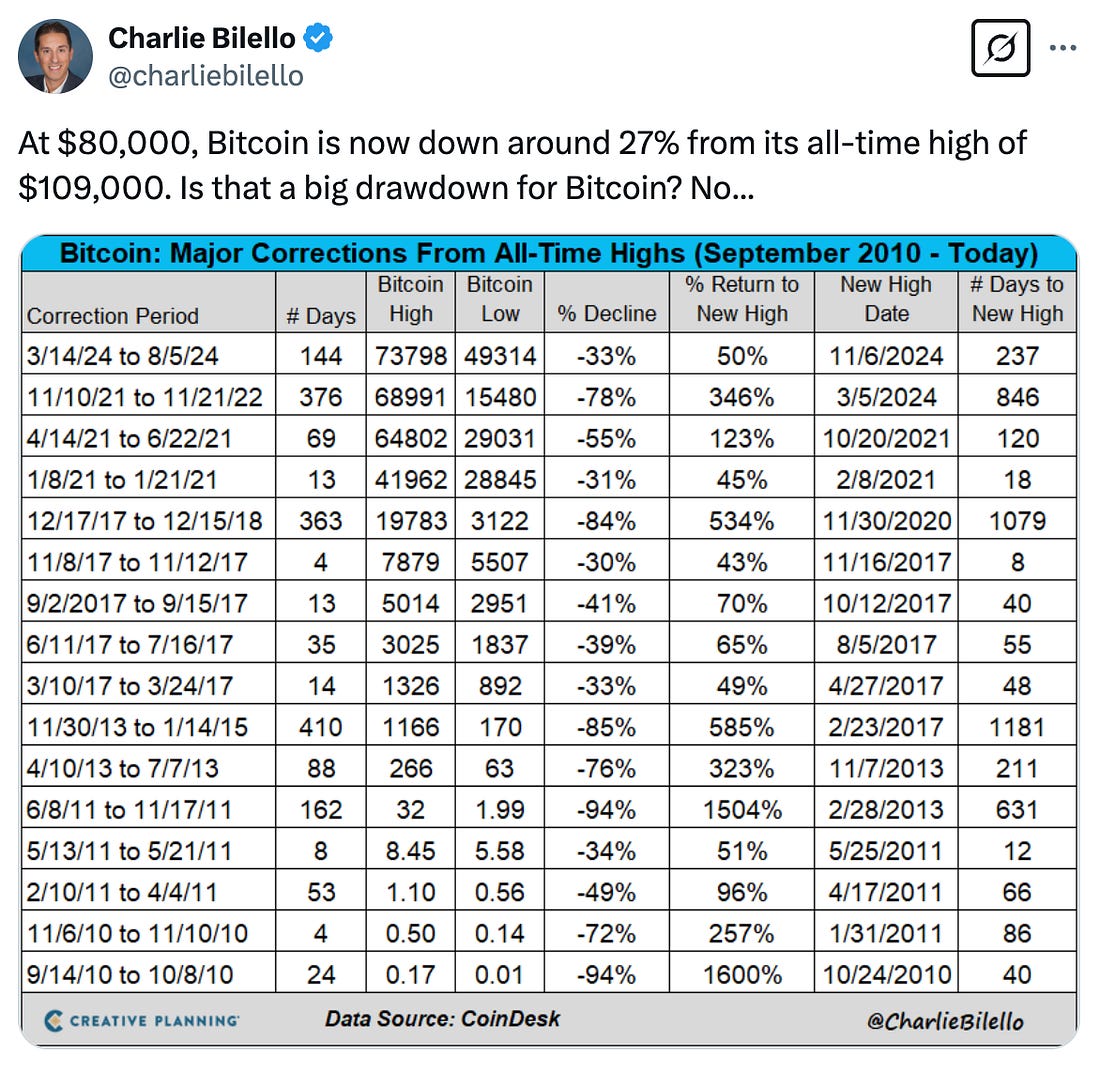

Today’s letter features a guest post from Phil Rosen, the co-founder of Opening Bell Daily, an independent financial media company. He wrote about his observations from attending the Bitcoin Investor Week conference in New York City. Bitcoin is falling but industry insiders don’t care. The cryptocurrency is down 16% over the last five days. Early Friday it dipped below $80,000 for the first time since the week of the November election, and it’s down more than 27% from its all-time high of $109,000. At Bitcoin Investor Week, I’ve spent the last few days surrounded by people who you’d think would be most rattled — miners, fund managers, crypto evangelists — and yet the recent price correction has barely registered. When I’ve brought it up myself, attendees’ responses have been the same: shrugs, laughs, and a sense of the inevitable. “Nothing bad about buying bitcoin at a discount,” one independent investor told me. Another guest, a Big Tech product manager who plows most of his paychecks into bitcoin and MicroStrategy, said he has increased his dollar-cost-averages into bitcoin from $20 a day to $50 over the last two weeks. Recent headlines have pointed to the asset’s decline as evidence of misplaced optimism or exuberance. That doesn’t reflect at all the mood here. Price action — what most of the media focuses on — is noise to those playing the long game. My guess is that it isn’t a stretch to say that this conference brought together one of the highest-conviction groups of bitcoiners in the world. As Charlie Bilello pointed out on X, the recent pullback is nothing new historically. The difference now is that the tailwinds today look more promising than any other year prior — none of which featured a crypto-friendly White House, lighter regulatory touch, and institutional adoption. AI versus bitcoin miningThe most interesting conversations I had this week centered on how the rise of artificial intelligence could disrupt bitcoin miners. Several mining executives told me that AI’s increasing energy requirements could reshape bitcoin’s decentralization. Data centers and AI training models have been devouring energy at an extreme pace while taking up more and more space in the general zeitgeist. Smaller and medium-sized bitcoin miners — which already compete for scarce energy resources with larger competitors — could get priced out, according to those in the industry I spoke with. Smaller mining operations could vanish, leaving only the largest, most well-capitalized miners in their place. Should mining become more centralized, bitcoin itself becomes more controlled and, potentially, more vulnerable. To be clear, no one positioned this scenario as existential. Yet the AI boom and tech companies’ massive capital commitment to it will make the energy question more relevant in the years to come. So the rise of AI, I learned this week, is an energy story masquerading as a technology story. And bitcoin is caught in the middle. Should the broader computing arms race accelerate (I think it will), the bitcoin miners working to secure the network could be unintentional casualties, resulting in fewer hands on the steering wheel. And for the asset that popularized the word “decentralized,” that’s a far more daunting prospect than a 27% price correction. Phil Rosen is the co-founder of Opening Bell Daily, an independent financial media company. Sign up for the free newsletter he writes every morning to 190,000 investors. How Bitcoin Hits $1,000,000 Adam Back is the Co-Founder & CEO of Blocksteam, and has been involved with bitcoin since the very early days. In this conversation we discuss what is going on with bitcoin, how institutional adoption is going, the potential bitcoin strategic reserve, Satoshi, and much more. Enjoy! Podcast Sponsors

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

From the Desk of Anthony Pompliano

Thursday, February 27, 2025

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Can The US Eliminate Federal Income Tax?

Thursday, February 27, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

American Consumers Are In Financial Pain

Thursday, February 27, 2025

Listen now (3 mins) | READER NOTE: I have spent the last few years mostly managing balance sheet capital. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Mar-a-Lago Accord

Thursday, February 27, 2025

Listen now (4 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Citadel Wants Crypto Regardless Of What Happens In The Market

Thursday, February 27, 2025

Listen now (5 mins) | Today's letter is brought to you by Osprey Funds! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Amazon Reveals It Had 20.93 Billion Searches in December - CrewReview

Friday, February 28, 2025

You're an Amazon whiz... but maybe not an email whiz. Omnisend makes setting up email for your brand as easy as click, drag, and drop. Make email marketing easy. Hey Reader, Believe it or not,

How AI Search Handles Citations, Google’s Latest Lawsuit + 2 Weird Niche Sites

Friday, February 28, 2025

It's Friday and that means one thing... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Social care strategy, ads scaling tips, background carousels, and more

Friday, February 28, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... presented by social-media-marketing-world-logo The weekend is almost here, Reader! Before you unplug, here's one last round

OpenAI’s underestimated us!

Friday, February 28, 2025

Altman admits they ran out of GPUs—what now?

Influence Weekly #378 - YouTube Star MrBeast Is Raising Money at a $5 Billion Valuation

Friday, February 28, 2025

GTA Developer Explores Partnerships With Metaverse Creators To Transform Popular Game Into UGC Creative Hub

Weekly Dose of Optimism #133

Friday, February 28, 2025

Pancreatic Cancer Vaccine, Restoring Hearing, Loyal, Atlas, Apple, Coinbase, Lunar Landers ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

VC valuations feel the pressure

Friday, February 28, 2025

AI prompts record VC funding; Kindred Ventures' Steve Jang on AI wearables; Stripe hits $91.5B valuation Read online | Don't want to receive these emails? Manage your subscription. Log in The

Standing on the other side of goodbye

Friday, February 28, 2025

Little moments that make me question: have I moved away or come home? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

A New EBITDA Adjustment to Drive Business Selling Price (a short video)

Friday, February 28, 2025

THE EXIT STRATEGIST A New EBITDA Adjustment to Drive Business Selling Price (a short video) Click Here to Watch Our Short Video The Key to driving strategic value in the sale of a technology company is