Fakepixels - All Compute Must Flow

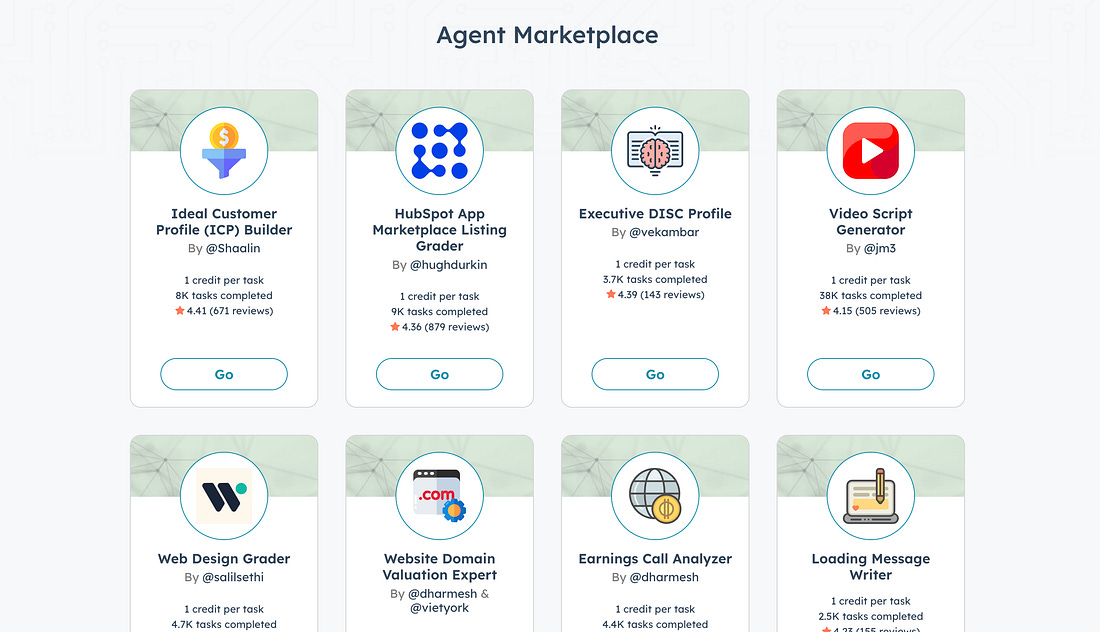

The future of AI innovation faces a quiet but critical constraint. As major players secure GPU resources through exclusive contracts, promising emerging experiments struggle to access the compute they need. This growing concentration of essential infrastructure threatens to narrow the field of AI development to a select few. In crypto, there’s a saying: “Value must flow.” Inspired by this principle, we must ask: What would it take for compute to flow freely? How can we build fluid GPU marketplaces ensuring resources immediately and fairly reach their highest-value uses? Blockchain systems already solved a similar challenge: dynamically allocating limited processing power amid fluctuating demand. AI markets can leverage this insight, creating a true market infrastructure currently missing in the compute ecosystem. Why now? Compute spending is projected to surpass global oil expenditure within five years. Yet unlike oil markets, AI compute lacks mature market infrastructure, trapping resources in rigid contracts, unavailable precisely when needed. To be clear, large labs like OpenAI, Anthropic, and Meta naturally prioritize exclusive GPU access for internal workloads, but this exclusivity often leaves resources idle. Meanwhile, vast GPU power lies outside these labs in data centers and local machines worldwide. A fluid marketplace incentivizes both large labs and distributed GPU providers to monetize idle resources, unlocking supply from the long tail. A dynamic marketplace for GPU resources would better serve smaller AI companies than the current system of rigid contracts and allocations. Building on Steve Ruiz's “sign in with AI” concept and blockchain prioritization methods, we could create a flexible system that more efficiently matches compute supply with demand. “It’s oxygen.”Steve Ruiz envisions a future where hundreds of specialized AI applications emerge to serve diverse needs. Instead, the GPU market's structure throttles this potential at its source. Data from a16z's Oxygen program reveals a stark reality: startups that managed to secure GPU access show 3-4x faster development cycles than those forced to wait. Young companies face an impossible choice: spend millions upfront on compute, or waste precious engineering resources building complex tracking systems. A recent case exemplifies the problem. As Anjney Midha explains, "Last summer, we had a portfolio company who had a signed contract for delivery of a set amount of GPUs, and at the last minute was told they would need to wait another three months. It turns out a bigger customer had come in and offered 3x more than the startup had agreed to pay." The implications for startups are severe: "The reality of market forces is that, as long as there are bigger customers who get better treatment because they're buying in bulk, there will always be a need for us to help our companies be treated that way." "Computing power isn't just a resource for us—it's oxygen," confided one founder, who requested anonymity due to ongoing negotiations with providers. "Without day-one access, we might as well not exist." Inspirations from EthereumTo truly enable compute to flow, we need two complementary layers: a decentralized marketplace and a dynamic allocation system. The marketplace allows GPU providers and AI developers to freely discover and transact, unlocking trapped capacity and expanding access. The allocation layer, inspired by blockchain fee markets, dynamically directs resources to their highest-value use in real-time. Blockchain platforms like Ethereum have tackled a similar challenge: distributing scarce compute resources fairly. Consider these parallels for AI markets:

Blockchain-inspired dynamic pricing offers transparent, granular, real-time resource allocation beyond static cloud models, in real-time matching supply with fluctuating demand. To maintain equitable access, complementary measures—such as reserved capacities for nonprofits, students, and creators—can support resource-constrained participants. While existing cloud providers like AWS or Azure implicitly price urgency (spot vs. reserved instances), these systems are relatively static and lack real-time, transparent responsiveness. Blockchain-inspired priority markets offer a more granular, dynamic mechanism—continuously adjusting allocations in real-time, directly matching supply to fluctuating demand. Beyond urgency, AI workloads often vary in memory requirements, hardware specialization, and reliability needs. A multi-dimensional pricing model can further refine allocations by allowing developers to pay specifically for their required resources while enabling providers to allocate capacity efficiently and accurately. A concrete example in film-making

Imagine you're an independent filmmaker who just landed funding from A24 and urgently needs GPUs to render complex animations for an upcoming film festival. Today's rigid GPU scheduling forces your high-stakes tasks into a queue behind bulk workloads from large studios, causing frustrating delays. A dynamic priority marketplace solves this instantly, with your task automatically signaling its urgency through a priority fee, ensuring timely GPU allocation exactly when needed. To ensure fairness, especially for resource-constrained creators, the platform can provide subsidies or reserved capacity for artists, students, or nonprofits, balancing equity and efficiency. This design thoughtfully blends simplicity, fairness, and real-time responsiveness, providing timely access precisely when creators need it. From commodity to market infrastructureThe current GPU market faces a classic innovator's dilemma. Incumbents like NVIDIA profit from artificial scarcity and rigid, long-term contracts, while cloud providers optimize for predictable workloads rather than dynamic user needs. This rigidity creates a window for disruption:

Historically, early attempts at creating "compute futures markets" fell short, simply due to limited demand scale. Aaron Brown notes, "semiconductors in 1989 were a quarter of today's AI demand." But now, with AI’s explosive growth, a priority-based GPU marketplace is finally viable, enabling sophisticated financial instruments: spot markets for immediate compute, futures for predictable demand, and credit for resource borrowing during spikes. First movers who implement these flexible allocation mechanisms will become essential infrastructure providers for the AI economy. Just as oil futures transformed energy markets, compute futures today offer AI developers financial tools that match and amplify their technical ambitions, an opportunity incumbents may be too slow to capture, leaving room for emerging startups. What would it take to make this real?Equally critical is establishing a clear, verifiable standard for GPU resources, ensuring buyers know exactly what they're purchasing. Just as commodity markets validate oil quality, GPU markets can use standardized benchmarks or independent certifications to verify that purchased compute meets promised specifications. This trust in resource authenticity and quality will underpin the reliability of the entire marketplace. The market would evolve naturally from high-value, time-sensitive applications like financial markets, where the value of priority is most evident. As more providers integrate and developers build on the protocol, we'd see the emergence of sophisticated financial instruments—futures, options, and compute-backed lending. Each phase increases efficiency and flexibility for emerging AI applications. The challenge for such a system to work is immense. Bootstrapping a new market protocol requires coordinating countless stakeholders, each with their own incentives and constraints. But if computing truly becomes the backbone of our economy, building this infrastructure may be among the most consequential work of our generation. Addressing common objectionsThere are a couple of common objections to the idea. “Does blockchain-inspired prioritization truly suit AI’s complexity?” The goal isn't to copy blockchain methods directly, but to learn from their strengths in transparent, real-time allocation. Practical solutions may combine blockchain-inspired insights with more traditional market and institutional frameworks, balancing complexity and efficiency. "AI workloads require stability—not volatile markets." AI tasks are longer-running and more complex than blockchain transactions, often demanding predictable access. A practical hybrid approach would let providers like AWS or Azure offer stable, reserved GPU capacity for predictable workloads alongside dynamic, priority-based queues for urgent tasks, balancing stability with real-time flexibility. "Won’t wealthy incumbents dominate anyway?" Priority fees might favor well-funded players. Mitigations like dedicated resource pools or compute grants for smaller entities and research initiatives can preserve fairness and diversity. "Falling costs will solve this" Hardware improvements like Blackwell (2.5x H100 performance) actually increase the need for flexible allocation. As Midha notes, "companies with H100 commitments are nervous" about being locked into older tech. Meanwhile, inference demands remain unpredictable, making fixed contracts inefficient. Unleashing the long tail of AI creativityChris Paik's observation that "all value creation occurs through the reduction of friction" points to something far larger than compute allocation. The outlined priority mechanism could revolutionize how we distribute and value any scarce digital resource. Think the emerging market for AI agents. Today, specialized AI assistants sit idle while others are overwhelmed with requests. A priority-based allocation system could create fluid markets for agent attention, automatically routing tasks to the most suitable agents based on urgency and expertise. The applications extend to content discovery and relevance ranking. Rather than relying on static algorithms, priority signals could create dynamic marketplaces for attention. Most intriguingly, priority-based mechanisms could enhance price discovery beyond traditional market approaches. While existing priority mechanisms (such as auctions or spot markets) assume rational participants and stable information, dynamic priority fees uniquely embrace the realities of rapidly shifting urgency, imperfect information, and volatile demand. They allow “markets to breathe," continuously adjusting allocations to match real-time human (and agent) needs and conditions. The future diversity of AI innovation hinges on how fairly we distribute compute resources today. Ensuring compute flows isn't merely a technical challenge, it's about creating conditions for a diverse playground for experimentation. And that’s the message: all compute must flow. I first wrote about “digital-native commodities” in 2023 and the idea has evolved with the work I did at Station and Base. This thought exercise is just the beginning of a broader conversation about how we allocate the resources powering our shared future. While I’ve outlined one possible approach centered on priority mechanisms, there are many other innovative solutions to consider. Here are some open questions I’m still exploring:

These questions—and many others—will be topics I continue to investigate. If any of these resonate, or if you have insights to share, feel free to reply to this letter or drop me a note. Special thanks to Robert Miller for the edits and review. Further readings

Fakepixels is free today. But if you enjoyed this post, you can tell Fakepixels that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

How to build an agent

Thursday, February 27, 2025

It began as a routine exercise: two days spent crafting consciousness in a JSON file. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[FKPXLS] The New Frontier of Belonging

Thursday, April 22, 2021

Even as migrants, we can feel local to many homes.

[FKPXLS] The Illusions of Free-to-Play

Saturday, February 20, 2021

From freemium products to open-source projects to marketplaces to UGC platforms, free-to-play games are already everywhere.

[FKPXLS] Brave New Decade

Friday, January 1, 2021

The Brave New Decade will be about finally having the courage to confront ourselves as flawed humans as we are, and finding ourselves in one another.

[FKPXLS] SPECIAL VOLUME: Embedded Education

Friday, December 4, 2020

Learning no longer lives on an individual platform. Rather, learning happens everywhere. We're entering a new age of “Embedded Education”.

You Might Also Like

180 / Make your everyday browsing ridiculously beautiful

Monday, March 3, 2025

Product Disrupt Logo Product Disrupt Half-Monthly Feb 2025 • Part 2 View in browser Welcome to Issue 180 Last year I teamed up with two of my close friends on a side project we're all obsessed with

Accessibility Weekly #438: When to Use Lists

Monday, March 3, 2025

March 3, 2025 • Issue #438 View this issue online or browse the full issue archive. Featured: When to use lists for better accessibility "When creating HTML content, using lists appropriately is

High touch recruiting

Sunday, March 2, 2025

Issue 235: Long-lasting candidate experiences ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🐺 Is a trade show is your right next step?

Friday, February 28, 2025

Q&A with Shoppe Objects' founders ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AD100 Designers on Battling Burnout

Thursday, February 27, 2025

View in your browser | Update your preferences ADPro Get Your Groove Back Most days, working in the design field is creatively fulfilling. But occasionally, in the throes of tight project timelines,

Accessibility Weekly #436: Evaluating Overlay-adjacent Accessibility Products

Thursday, February 27, 2025

February 17, 2025 • Issue #436 View this issue online or browse the full issue archive. Featured: Evaluating overlay-adjacent accessibility products "There's a category of third party products

#495: Accessibility and Inclusive UX

Thursday, February 27, 2025

Accessible fonts, inclusive design patterns, accessibility annotations and how to design for people with ADHD. Issue #495 • Feb 18, 2025 • View in the browser 💨 Smashing Newsletter Bok Smashing Friends

AD Editors Share Their Favorite March Issue Moments

Thursday, February 27, 2025

View in your browser | Update your preferences ADPro Behind the Scenes of Creatives at Home The March issue of AD, dedicated to creatives at home, is here. In her editor's letter, global editorial

🐺 Did you know about this?

Thursday, February 27, 2025

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

![[SDFX] - Studio Grade New Comfy UI - (Free + Opensource) [SDFX] - Studio Grade New Comfy UI - (Free + Opensource)](https://substackcdn.com/image/fetch/w_1100,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fec53ba12-2e43-4ca7-a3c4-a53aab1f521d_1744x1080.jpeg)