This is the once-a-week free edition of The Diff, the newsletter about inflections in finance and technology. The free edition goes out to 7,971 subscribers, up 596 week-over-week. This week’s subscribers-only posts:

A profile of Disney: The World’s Leading Manufacturer of Nostalgia. Disney is an incredble machine for ingesting intellectual property and spitting out profits. But they’ve hit a natural endpoint for that model, and they identified a new growth opportunity at the perfect time.

Default Open, Default Closed was originally going to be a post about why user-generated platforms start out as a free-for-all and gradually switch to stricter moderation, but turned into a broader piece on globalization. One thing I didn’t realized until I wrote it: the most successful global brands created in China are a) TikTok, which tracks a ridiculous amount of data on phones, and b) Huawei, which gets access to lots of data from the phone users who aren’t on TikTok. It could be a coincidence, of course, but other governments have pulled shenanigans that should make one suspicious.

Microsoft and the Triumph of Fixed Mindset: Microsoft has been around since 1975, and had three CEOs. It’s been through three distinct eras, the most recent of which overlaps perfectly with the new CEO. Some things have changed, and one important thing hasn’t.

In this issue:

In Defense of Hiring Based on Side Projects

Companies as Narrative Arcs

Live Data and Pandemic Stimulus

Trucking Bailout

“Did a Chinese Hack Kill Canada’s Greatest Tech Company?”

Facebook on Boycotts; Journalists on Facebook

Rebuilding Hong Kong

Pure-Plays and Reputational Risk

Programming Note: The Diff will be off tomorrow in observance of the Independence Day. Back Monday.

In Defense of Hiring Based on Side Projects

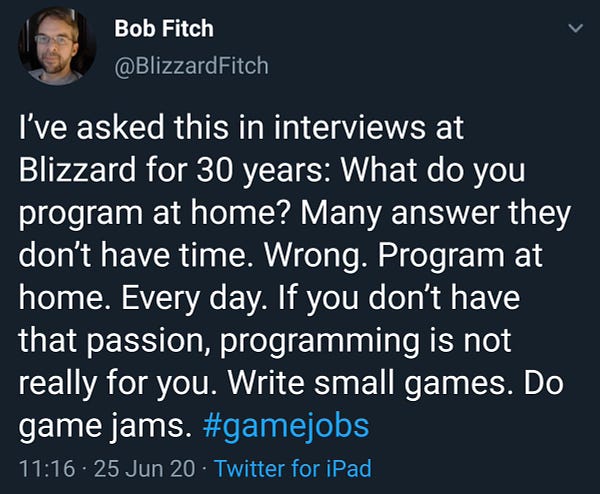

Relevant side projects differentiate the best workers. The relevance of side projects differentiates the best jobs. This is inescapably true, but painful to admit. Here’s an example of the pushback:

I don’t mean to pick on this person; there’s no reason to be familiar with the history of the US aerospace and rocketry industry (unless, of course, you’re going to make an argument that hinges on claims about the industry). As it turns out, while this argument is basically true today, it was a lot less accurate when the industry was growing. Barons of the Sky is a nice history of the early days of the aerospace industry, and it shows that in the early days, everyone was a hobbyist. Unlike other hobbies, like writing computer games for fun, this was a high-stakes pursuit. Good amateur plane designers made the front page when they set records, the bad ones made the obituary page instead.

Curtis-Wright was the largest aircraft manufacturer in the US from the 20s through the 40s. The Wrights were, of course, were bicycle shop operators who built a plan as a hobby. Glenn Curtis was a motorcycle racer (he held the motorcycle land-speed record from 1907 to 1920), who decided to dabble in planes, apparently because he was bored with motorcycles' safety records. One of Curtiss' early designs inspired Glenn Martin to build his own plane (that’s the “Martin” in “Lockheed Martin”). The “Lockheed” in “Lockheed Martin” was Allan Lockheed, who also got started in aviation by building planes for fun.

And since the tweet mentioned rockets, it would be wrong to ignore one of the founders of the Jet Propulsion Laboratory, Jack Parsons, who helped invent modern rocketry, founded a cult, got expelled from Caltech for a bit of both, and died from a rocket explosion at his home lab.

Today, aircraft manufacturers would prefer someone with an aerospace engineering degree to someone who had gained knowledge and lost fingers figuring things out on their own. But that reflects the complexity and regulation of modern planes. The problem to solve is not “how do you make it go up?” or “how do you make it go fast?” It’s “how do you reduce the odds that it crashes 0.6 in a million to 0.4 in a million?” That’s not really something you can do on your own. The Boeing 787 has 2.3 million parts and is controlled by software with 14 million lines of code. So any specific problem an engineer is solving is a complicated edge case involving numerous dependencies—it’s less about first principles and more about engineering and math chops and an encyclopedic knowledge of 787ology.

Other fields have similar trends. The lawyers I know have said that a) almost nothing in law school had any relevance whatsoever to the work they ended up doing, although it required similar skills, and b) that the best way not to get into a good law school is to say “I want to be a lawyer because I like to argue.” I haven’t checked, but presumably med schools and hospitals look down on people who perform dissections for fun.

Not so in tech! the infamous Github is Your New Resume post is almost a decade old. It’s very common for programmers to get judged by their side projects and open source contributions.

Hedge funds do this, too. At a typical stock-picking hedge fund, the decisive interview questions are about what stocks you like and which ones you hate. Some anecdotes:

Lars Kroijer, a young MBA, scored an interview with a very good hedge fund in the 90s. He describes the interview in his memoir. The manager asked him for stock picks. He said the market was inefficient, so the manager asked him to leave. Ouch! Lars straightened himself out and went on to run a successful fund, then retired at the right time.

At another fund I’ve heard about, the head of research liked to poll the interns and ask them if they thought the market was efficient. If the answer was yes, he said, they were fired effective immediately. Fortunately, in an efficient market it should be effortless to get an equally attractive job elsewhere.

I’ve bombed at least one interview by not having any good trading pitches handy. (In fairness to me, it was a fund using a strategy I hadn’t ever worked on. In fairness to them, I knew this.)

The assumption, often correct, is that people who are obsessed with investing will do better than people who are merely in it for the money. And there’s the side benefit that knowledge compounds non-linearly: learn about one company, and you know the story they want to tell. Learn about every company in the industry, and you’ll spot the stuff the first company is oddly reticent about. Learn everything about a company, its suppliers, its customers, and its competitors, and you’re ahead of everyone else, because you’re finally in a position to identify who’s prospecting for gold and who’s selling pickaxes.

Unlike designing a plane, the space of possible improvements to an investment thesis or a software product has many dimensions, some unknown. Making a habit out of constantly improving the craft is good because it speeds up your execution of known tasks (“Figure out why this button looks weird in IE,” “Update this financial model to account for the customer they just lost,”) but also because it helps reduce the Knightian uncertainty around what problem to solve.

It’s very interesting to explore the boundary between jobs where hobbies help and jobs where they don’t really matter. Churchill relaxed by writing history when he wasn’t busy making it. Kissinger, too. Today, it’s hard to name a book by a politician that’s worth reading. In fact, it’s hard to imagine. Boris Johnson writes, but his flair is for punchy articles, not full-length books. The long lag between finishing a book and getting it printed doesn’t give him enough time to change his mind.

The side project vs not efficient frontier seems to have a strong correlation with how incremental the work is, and how many degrees of freedom there are to pursue it. A given software product could be monetized by selling every user a subscription, selling a subset of users a subscription, taking a cut of transactions, taking money from ads, selling data, or just being so irritating to a big company that they buy the business before it figures out a business model. An investment could be driven by a macro thesis, an argument about sentiment, a new product launch, a technical factor (“The only portfolio manager who loved this at XYZ LLC just got fired, so they’re blowing out all his positions.”), a short-term change in supply and demand for what they sell or the raw materials they buy, a long-term change in the pricing power for the same, or reading the comp committee tea leaves.

When there are many possibilities, there are at least a few possibilities that are intellectually stimulating even absent the chance to make a lot of money. Making money ultimately comes from betting on the convergence of some gap between perception and reality.[1] So developing a nose for the variant ideas worth exploring is a valuable skill. At least when you can explore them; it’s mostly frustrating if you can’t.

As many people point out, the norm in favor of side projects is unfair to anyone with limited free time. What they don’t add is that this is a progressive tax: there’s a positive correlation between educational attainment and hours worked per week, as well as between income and hours worked per week. This was not always the case; “The idle rich” used to be a statistically accurate observation, but now the rich work longer hours and have less leisure time than average. But the average American watches four and a half hours of TV per day. If your work happens to be fun, you can devote that leisure time to side projects. If your work is boring, you probably shouldn’t complain that people who like their craft more than you and devote more effort to it are rewarded.

(As a friend put it a few years ago, when such pop culture references were relevant, “If you know what a ‘Khaleesi’ is, you had time for side projects.”)

In my case, my available-for-work hours have been declining for a while. When I was young and single, I had zero non-work obligations. Now I have three kids and a dog and work from home, which really cuts into my time. What I’ve noticed is that my total focused work time has actually gone up, compared to a few years ago. As it turns out, the work I do now is fun and rewarding, while playing video games or watching netflix when there’s research and writing to be done is painful. My framework is pretty simple: I can’t control luck, and I can’t control talent. But one thing I can control is whether or not someone less talented than me is more successful purely because they tried harder. In a field with a low marginal cost of scaling results and tournament-like economics (for example: investing, software, writing, some kinds of hardware), there’s a moral component as well. The better you think you are, the more it’s your responsibility to work extra hard, since the results will be distributed so widely.

Using side projects to get a job is not to everyone’s taste, and it’s not to everyone’s benefit. But it’s good for the world that such jobs exist, and that there are companies trying to unite a band of obsessives. Your work doesn’t have to be the most important thing in your life, and for the majority of people it’s not. But an organization built by and for obsessives can exert a fantastic positive influence on the world. Three decades after Curtiss, Martin, and Lockheed were goofing around with planes, the companies that bore their names produced almost 300,000 aircraft to win the Second World War. Less than two decades after Jack Parsons blew himself up, human beings walked on the moon. Technological revolutions get built through long efforts with large teams. But the building starts on nights and weekends.

[1] Broad claim, but I stand by it: if you live above the subsistence level, it’s from some kind of knowledge. If you’re not a hermit—and hermits don’t have or need much money—then you make money because you exchange goods or services with other people who do things you can’t or won’t do. And you’re in the same position with respect to them. So all of you have some form of specialized knowledge. In a very simple economy, that knowledge is very specialized and localized: you know how to farm your plot of barley, your neighbor knows how to farm his plot of wheat, you trade and you’re both better-off. In a more complex economy, we’re all reliant on skills and capital accumulated by others, and those skills and capital both represent embodied knowledge.

Elsewhere

I had a few pieces published on other sites this week. I wrote up Nikola, a mostly nonexistent company with a $23bn market cap for Marker. In Coindesk, I have a piece on why reserve currencies take forever to collapse. And in Palladium, I compared and contrasted the responses of big tech and the US government to Covid-19.

Companies as Narrative Arcs

Leon Lin has a great piece on storytelling and stocks. It’s a riff on Kurt Vonnegut’s theory of the emotional cadence of stories. Companies' fortunes have similar cadences, with ups and downs, happy endings and sad ones. I’ve written before about how business books focus on failures because they have the plot structure of a Greek tragedy: hubris, then failure. But for the investor rather than the company, every story can have a storybook ending; when you exit the position, the story is over.

Live Data and Pandemic Stimulus

Official data releases are a lagging indicator of how the economy is performing. Usually that’s not important, because usually segments of the economy aren’t being halted and restarted on a week-to-week basis. The White House looks at some real-time indicators that are showing worse trends than upcoming headline numbers will indicate. That will have an effect on what kind of stimulus gets passed or renewed.

One option being considered is an unemployment top-up that’s scaled to state-level unemployment rates. This sounds like a good technocratic solution: overall demand increasingly takes care of itself as unemployment drops. But it has a serious drawback for states with a low cost of living and a high share of low-wage workers: unemployment benefits are often higher than what the lowest-paid workers could get at their jobs, which can trap some states in a position where unemployment is high because the checks are big, and the checks are big because unemployment is high. A better tweak: tie the size of the check to the state’s cost of living and minimum wage. Or if you wanted to get really technocratic, have a mix of higher unemployment benefits and a temporarily increased earned income tax credit, where the ratio between the two is determined by a state’s Covid-19 cases.

Pandemics require national-level policy responses, because people travel from state to state and respond to incentives. But those national responses need to account for local realities, one of which is that $600/week is a much bigger share of average income (and average cost of living) in New Jersey than in West Virginia.

Trucking Bailout

Trucking company YRC has gotten a $700m government loan, which includes a 30% equity stake for the government. The best way to think about the equity piece is that it’s “Schmuck insurance.” The decision to treat YRC as a company of national security importance—not just because of its strategic supply of employees who are members of the Teamsters union—makes the company more valuable to investors. A lender doesn’t capture that upside; an equity owner does. I’ve long been an advocate of the “bail out and cram down” approach, where the governments keep companies alive when they face unpredictable external shocks, but take a big piece of the upside in exchange.

“Did a Chinese Hack Kill Canada’s Greatest Tech Company?”

Nortel was 35% of Canada’s benchmark equity index. Now it’s bankrupt. Failure is always overdetermined; big companies can survive so many missteps that you never know which one finally did them in. But one mistake they made was getting hacked. One Huawei mystery is that their position in 5G equipment sales is far behind their position in “standard and essential” patents, where they’re between 4th and 6th place.

Facebook on Boycotts; Journalists on Facebook

The Information has a transcript of a Facebook internal meeting. The gist: Facebook is not dependent on high-profile advertisers, and the main effect of their spending cuts is on PR, not revenue. The market seems to agree, as Facebook has recovered most of the stock price hit from the boycotts. Jack Shafer makes the interesting observation that most of the prominent boycotters are companies that face boycotts themselves. In tech terms, activists have proven out a go-to-market strategy, acquired customers, and launched a new product they can upsell to existing users.

CJR has a long piece on Facebook’s PR. Apparently, in the early days Facebook was very generous with scoops, and liked to give media outlets exclusives. This was bad, because it meant that Facebook controlled the narrative. But now Facebook is ignoring journalists, and senior employees are tweeting instead. This is basically the opposite of the first thing, but is still bad according to CJR. The article does mention some actual misbehavior, like talking up a drone test flight without mentioning that the drone crashed at the end. But mostly it reminds me of Flash Boys: a former middleman is sad to be disintermediated.

Rebuilding Hong Kong

With the implementation of Hong Kong’s new security law, Japan’s government is considering giving Hong Kong residents a fast-track immigration process. While some Hong Kong residents have been granted refugee status by the US, and many more will be able to leave for the UK, it’s significant that a country whose population is just 1.8% foreign-born is considering this.

Hong Kong was built on labor and immigration arbitrages: its economic growth in the last half of the 20th century was originally the result of an influx of refugees from Communist China. Later, Hong Kong’s economic role was as a jurisdiction with close trade and financial ties to China, but with a basically British commercial code. That’s over now, but the arbitrage opportunity remains: there’s a skilled population that’s suddenly living in a less free and less safe country, and, like Hong Kong itself in the 40s and 50s, someone else can benefit from letting them in.

Pure-Plays and Reputational Risk

One of the points I made in Default Open, Default Closed was that as a company scales, its overall PR risk goes up, while its reward from any one activity it allows goes down. US-based tech companies have learned that any government contracts they take involving defense, intelligence, law enforcement, or immigration can lead to blowback. And that gives companies like Anduril, which just raised $200m, an opportunity.

Normally, when a company accepts front-loaded reputational risk, the tradeoff is that it gets a monopoly on immediate opportunities, but sacrifices long-term scale. The anything-goes alternatives to Reddit and Twitter, for example, are a lot smaller than the real thing. But in Anduril’s case, the total addressable market is $738 billion. Growth today, a known and large TAM, and competitors who graciously refuse to compete—there are many small companies that one can imagine will be huge some day, but with Anduril huge is the default.