I’m not sure what the true answer is but here’s my tweet from the morning and was interesting to see Peter Weyland separately share his thoughts later on YC.

The answer is clearly both. Just as every VC now is an enterprise investor, every founder now seems to be thinking of the next great enterprise company. Yes, I am super bullish about the future of developer first but frankly, I’ve been seeing way too many zero stage companies raise at ridiculous valuations from investors looking for a “dev” play. As we all know, too much of anything is not a good thing. It will be imperative for founders to truly spend time with their potential investors to not just choose on valuation but true understanding of the business and value add (more on that below).

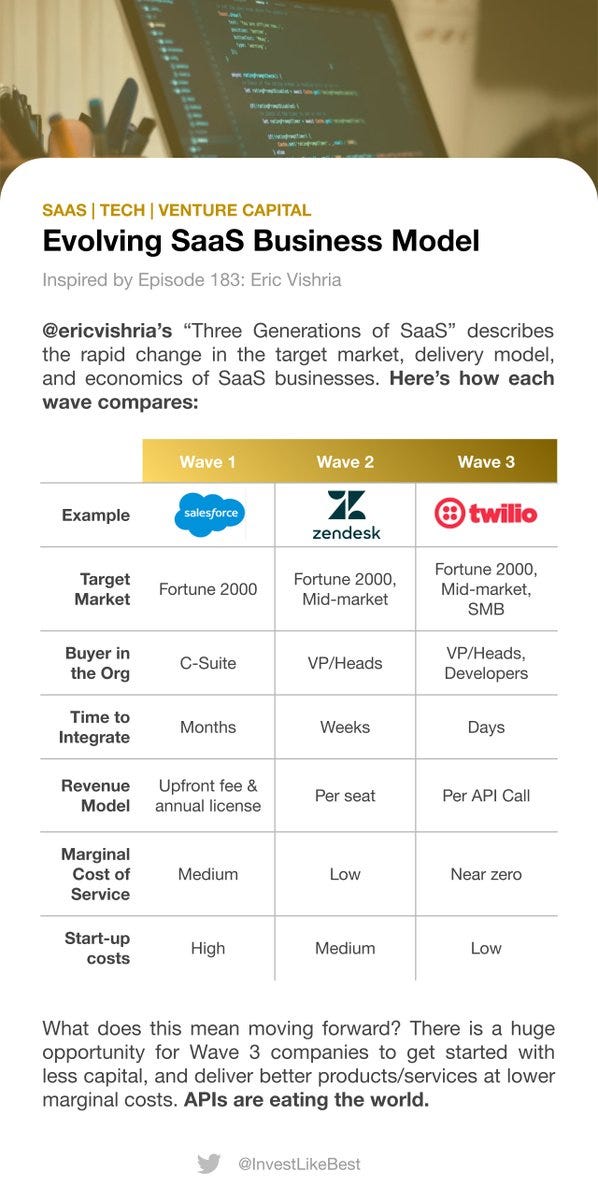

One last point, Eric Vishria from Benchmark did a great interview with Patrick O’Shaughnessy on Invest with the Best on his view of how SaaS has evolved and emphasizing we are living in an API-first world, meaning, guess what?, it’s all about the developers!

As always thanks for listening to my rants, and please like and share if you enjoy reading!

Scaling Startups

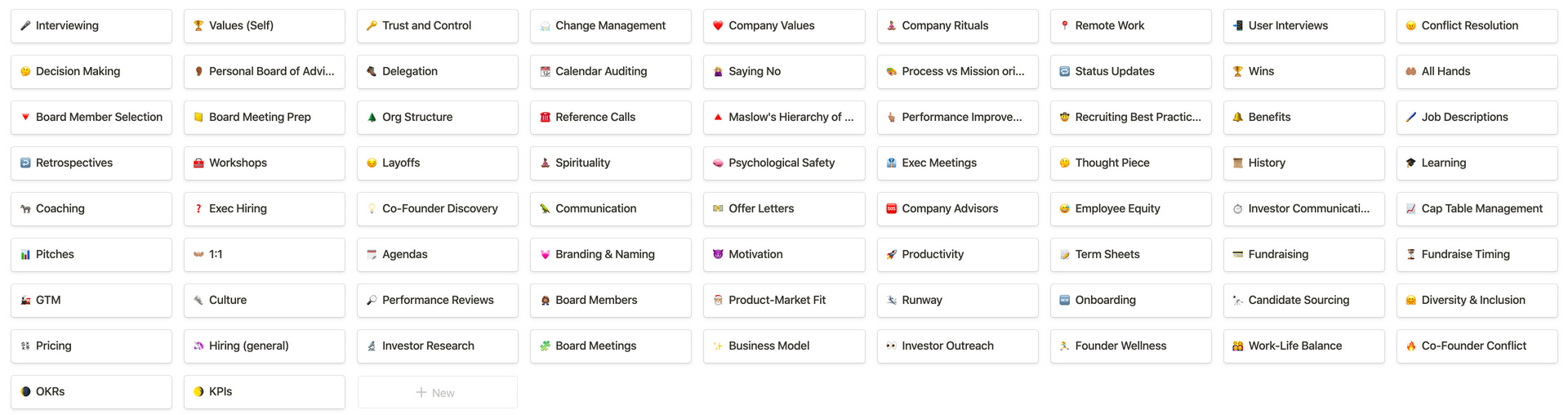

Steve Schlafman, former VC now exec coach has put together High Output Founder’s Library page covering everything from hiring to fundraising to product - certainly a great starting point for many (h/t Rob Bailey)

Founders, choose your investors wisely. Popular does not equal value add.

Along those lines Nikhil Basu Trivedi nails it in his post on “Founder-Investor Fit.”

Alex Yampolskiy, cofounder and CEO of Security Scorecard, shares his journey from technical founder to CEO and what’s important. This is so good as I’ve witnessed first-hand Alex’s evolution! So many great nuggets of wisdom on leadership here.

Before I started my own company, I truly thought having a “company culture” was not that important. I was wrong. Once I became CEO, identifying what our company culture was and communicating it meant that it permeated through every aspect of the company: from the people we hire, how we retain…

Hiring and interviewing: spot on from Jennifer Kim, ex-Head of People, Lever - NO on 10, at least 4…

I couldn’t agree more and which is why we always make room for some of these super value add specialist angels as they almost always help way more than their check size indicates - great thread with lots of names as well.

At boldstart, we have a whole Airtable of these check writers with an understanding of check size, super power, interests, etc. It takes a village to raise a startup and it begins with how the cap table is assembled and this an often overlooked facet, especially at the very beginning.

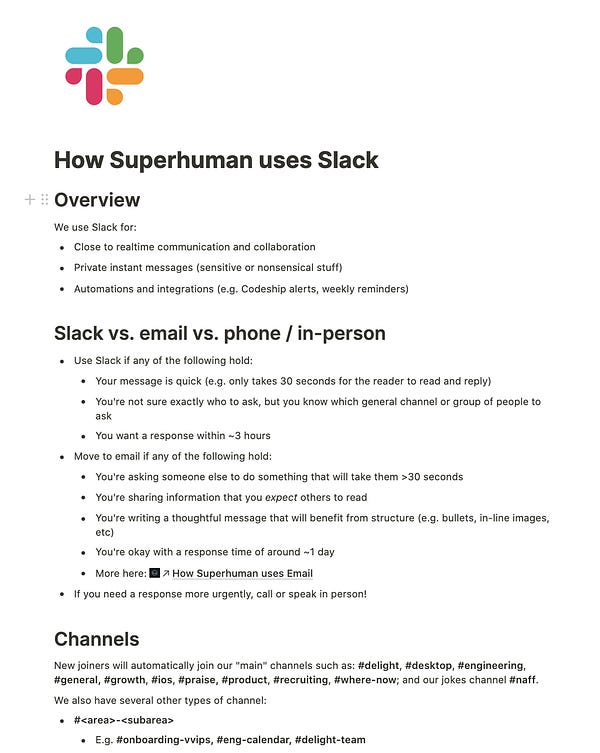

How to use Slack the Superhuman way

Cautionary tale for founders to focus on the right things, ScaleFactor raised over $100 Million in a year to automate accounting using AI but according to this Forbes article, customers weren’t getting what was promised. “ScaleFactor Raised $100 Million In A Year Then Blamed Covid-19 For Its Demise. Employees Say It Had Much Bigger Problems.”

Enterprise Tech

The next Notion? Roam Research built rabid, cult-like user base for notes and within 5 weeks of turning on premium, hit $1mm ARR. I’ve been using it for last 6 mos, definitely a steep learning curve, but so powerful over time with graph connections of ideas.

Great podcast with Howie Liu and the future of Low Code No Code on Openview’s Build

What we’re really doing is creating this new layer of data-based workflows,” said Howie. “And we’re creating this application platform for teams within any company to build their own useful business process using an end user interface that feels like a spreadsheet, but is actually powered by a relational database and all of these other powerful pieces that we give you to build a useful, tailor-made application.”

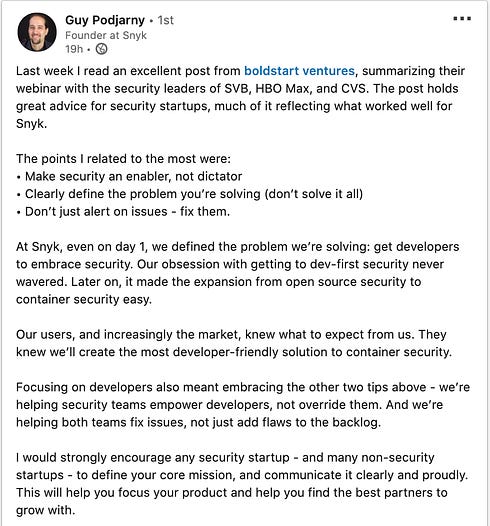

Advice for security startups from Guy Podjarny at Snyk. More importantly, it’s important for founders to remember their North 🌠, in Snyk’s case it was being the most developer friendly security product, from which each new offering is based on that notion. What’s your North Star and how does that help you think about the must-haves when you move to adjacent spaces.

Great read from Stephen O’Grady on RedMonk and Google’s strategy with BigQuery (offered cross platform) where he asks if Google is going for the “middleware” play since behind AWS…

But it seems equally plausible that Anthos and BigQuery are merely the first manifestation of a fundamentally new approach for Google. For years, would be challengers, armed only with largely similar offerings, dutifully charged up the hill that was an incumbent AWS operating at velocity in its core market. Most were cut down. Google, in particular, never seemed to benefit from this approach.

Gartner’s updated cloud spending forecast as of July 23

The worldwide public cloud services market is forecast to grow 6.3% in 2020 to total $257.9 billion, up from $242.7 billion in 2019, according to Gartner, Inc.

Desktop as a service (DaaS) is expected to have the most significant growth in 2020, increasing 95.4% to $1.2 billion. DaaS offers an inexpensive option for enterprises that are supporting the surge of remote workers and their need to securely access enterprise applications from multiple devices and locations.

👇🏼💯used to be Microsoft, then Google, and now Amazon…And as a FYI, if you’re an infrastructure company, don’t come to me and tell me AWS will be one of your acquirers - they are cheap and won’t pay up in the cloud space, only pay up for consumer cos like Ring…

From the WSJ article":

When Amazon.com venture-capital fund invested in DefinedCrowd Corp., it gained access to the technology startup’s finances and other confidential information.

Nearly four years later, in April, Amazon’s cloud-computing unit launched an artificial-intelligence product that does almost exactly what DefinedCrowd does, said DefinedCrowd founder and Chief Executive Daniela Braga.

The new offering from Amazon Web Services, called A2I, competes directly “with one of our bread-and-butter foundational products” that collects and labels data, said Ms. Braga. After seeing the A2I announcement, Ms. Braga limited the Amazon fund’s access to her company’s data and diluted its stake by 90% by raising more capital.

Nir Zuk, co-founder and CTO of Palo Alto Networks, outlines why the cyber security industry needs to reinvent itself - definitely self serving but worth a read

As someone who has spent an entire career on the front lines of cybersecurity, it is my firm belief that a platform approach is the only possible path we can take. It is the only way to effectively eliminate the inefficient silos, disparate products and reactive models that no longer work in a far more complex threat environment.

To reinvent cybersecurity, organizations need to keep the following priorities in mind:

The cybersecurity industry needs an integrated solution that seamlessly incorporates machine learning. Organizations should cut down the number of vendors they use and shift toward a holistic platform approach that delivers a unified security posture.

Embed automation across teams. Wherever possible, organizations should enforce standards and policies that drive security integration. Automate everything — including playbooks, processes, hunting for attacks, investigations of attacks, responses to attacks and everything else possible that can be automated.

CISOs/CSOs need a seat at the table. Leadership needs to drive centralized, cross-team integration with security — specifically within organizations adopting agile methodologies (CI/CD pipelines and DevOps) and cloud-native applications (containers, microservices, etc.).

This is so good

Markets

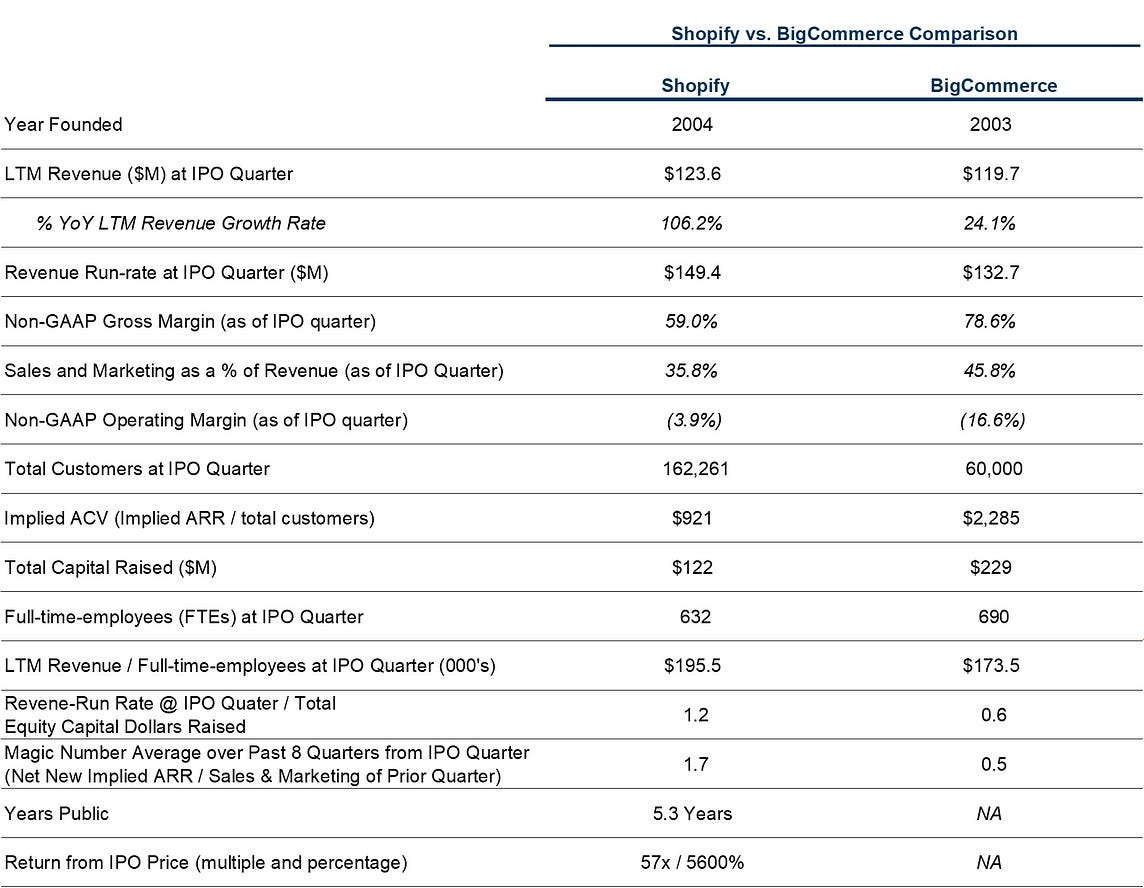

BigCommerce, a Shopify competitor, S-1 breakdown from Alex Clayton at Meritech

Microsoft revenue surges, although all eyes on cloud growth, which slowed from Q1 to Q2…

Microsoft said sales rose 13% in the April-through-June period to $38 billion, and that it generated a net profit of $11.2 billion. Sales for Azure grew 47% from a year earlier. The revenue growth rate was 64% in the fourth quarter a year earlier and 59% in Microsoft’s third quarter.

“The last five months have made it clear that tech intensity is the key to business resilience. Organizations that build their own digital capability will recover faster and emerge from this crisis stronger,” Microsoft chief Satya Nadella said in a statement.

Tech bubble? Mark Cuban compares now to the Internet bubble in mid-to-late 90s

He compared “free-traders” or retail traders using zero-commission trading platforms — like those offered by Robinhood, TD Ameritrade and E-Trade — to the day traders of late ’90s. With no barriers to entry in trading costs, as well as the buying and selling of fractional shares of stocks, traders with little to no experience can get 30% returns, Cuban said.

Getting inside of the mind of an institutional buy side investor - h/t Jillian McIntyre