|

Photo by Jim Watson/AFP via Getty Images

"You never get a second chance to make a first impression."

On Sunday, Trump appeared at his golf club in Bedminster, New Jersey, and announced a series of executive actions he alleged would address the continued economic devastation of the coronavirus pandemic.

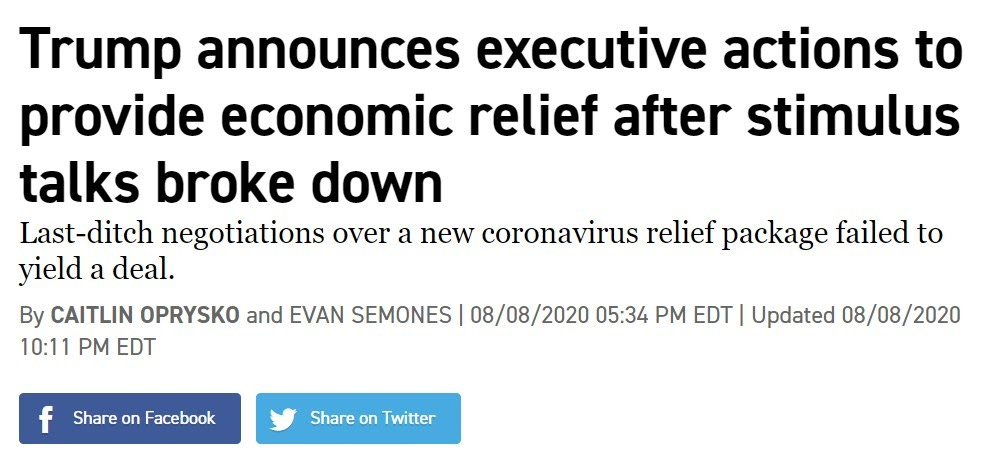

The first impression the media delivered to the public was of a decisive leader, breaking through Congressional gridlock, and delivering desperately needed aid to the American people. That was the story told by headlines in the nation's largest wire services, including the Associated Press:

That coverage is syndicated by localoutlets around the country.

Reuters:

The same themes were echoed in mainstream political publications like Politico:

|

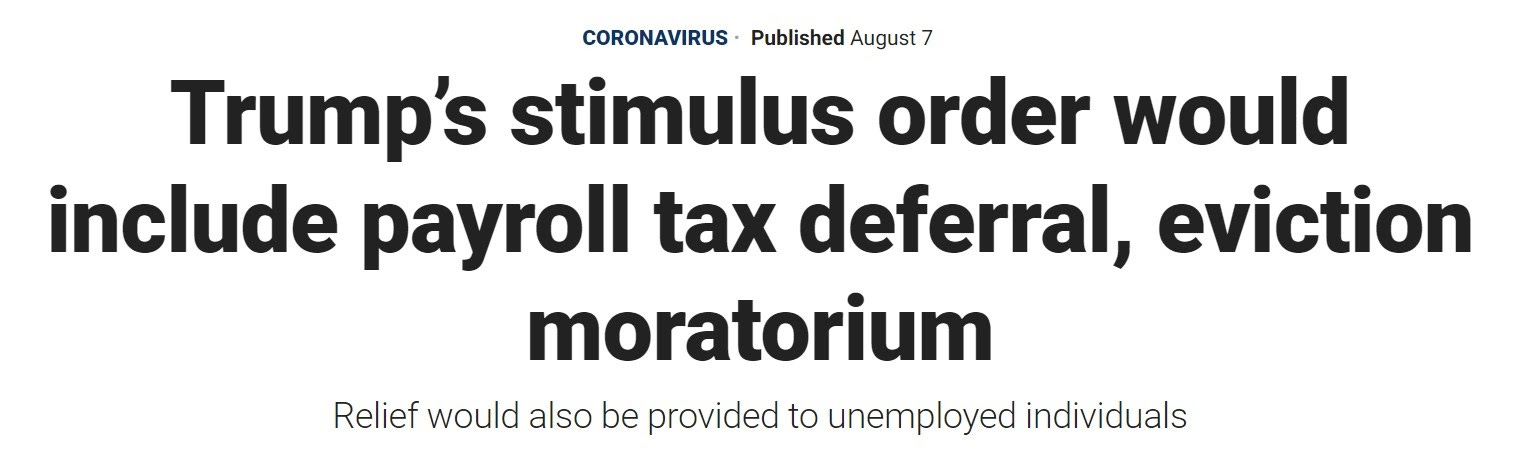

And Roll Call:

President Donald Trump on Saturday signed a series of executive actions intended to extend and expand COVID-19 relief, including suspending payroll tax collection and boosting federal support for unemployment benefits.

The headlines in the conservative media, which reach Trump's base, were even more effusive. Here is how Fox Business covered Trump's announcement:

|

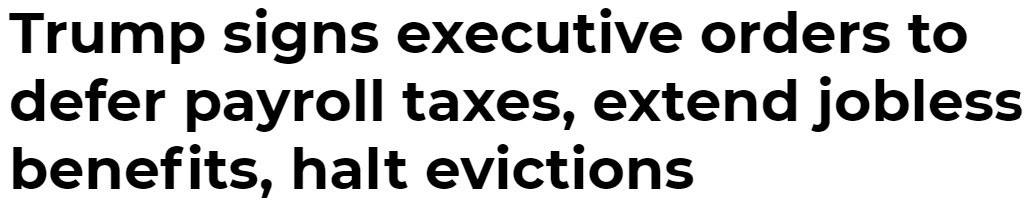

There was similar coverage in the right-wing Washington Times:

|

None of this is true. Trump did not "extend" federal unemployment benefits — he cut them. Trump did not impose an "eviction moratorium" of any kind. And Trump's payroll tax deferral is optional for employers, broadly opposed by members of both parties, and would provide negligible economic relief.

But the point was to generate positive headlines, depicting Trump as a compassionate and decisive leader. On that score, he was successful.

If you look beyond the headlines and into the substance of Trump's announcement, however, it tells a much different story.

Trump cuts federal unemployment benefits in half; millions will likely get nothing

The CARES Act, which was signed into law in March, provided an additional $600 of weekly federal benefits to unemployed Americans. Trump did not "extend" that benefit, which is what the Democratic leaders in Congress wanted. Instead, he halved the federal contribution to $300 per week. The Trump administration's insistence that federal unemployment benefits be cut was one of the reasons that a legislative coronavirus relief package has stalled.

But millions of Americans may not get any additional federal unemployment relief. That's because Trump conditioned the federal money on states contributing another $100 per week. For many states, already facing gaping budget gaps due to the coronavirus, that will not be possible. (Unlike the federal government, most states are required by law to balance their budget.) Democrats proposed about $1 trillion to help states and local governments. The Trump administration opposed providing that aid to states.

If even some states are able to come up with the cash, the federal money is not likely to last long. Trump is attempting to tap federal disaster relief money from FEMA to pay for the benefit. It's a risky move as the United States begins hurricane season and is likely to be challenged in court. But even if Trump's plan does go forward, the fund will likely be exhausted within a few weeks.

The mythical "eviction moratorium"

It's not just conservative media that is pushing the notion that Trump imposed an "eviction moratorium" on Sunday. It is a myth that is also being propagated by the New York Times. "Mr. Trump’s measures include an eviction moratorium," the paper reported.

The text of Trump executive action is clear that there is no eviction moratorium. The CARES Act created an eviction moratorium and Trump did not extend it. Landlords will be able to evict tenants.

Trump's action directs various federal agencies to see if there is anything they can do to prevent evictions. "It is the policy of the United States to minimize, to the greatest extent possible, residential evictions and foreclosures during the ongoing COVID-19 national emergency," the text says. That is very different than an eviction moratorium.

For example, Trump directs the Treasury Department and the Department of Housing and Urban Development to see if there are any extra funds that could be used to provide financial assistance to renters and homeowners:

The Secretary of the Treasury and the Secretary of Housing and Urban Development shall identify any and all available Federal funds to provide temporary financial assistance to renters and homeowners who, as a result of the financial hardships caused by COVID-19, are struggling to meet their monthly rental or mortgage obligations.

Such an undertaking does not provide any assurances that even one family will avoid eviction — much less the millions struggling to pay their mortgage or rent.

A temporary payroll tax deferral will not provide economic relief

Payroll taxes are used to fund Social Security and Medicare, two popular federal programs. Trump's executive action gives employers the optionto defer collecting these taxes, which amount to about 7.65% of income, for a few months from employees that make about $100,000 or less annually.

But Trump's action does not eliminate the tax. When people file their taxes next year, the payroll tax for these months will still be due. That means employees, many of whom are used to receiving a refund, could be stuck with a tax bill they are unable to pay. To avoid this scenario, many employers will likely opt to continue collecting the payroll tax, according to an analysis by the National Taxpayers Union:

Under Section 3102(f)(2)-(3) of the Internal Revenue Code, any tax not collected by the employer shall instead be paid by the employee, with the employer owing penalties. Would employers just continue collecting the tax and paying it to the Treasury, instead of putting the tax obligation on their employees and risking IRS penalties for non-payment? If the Treasury refused payments (which would go beyond the powers granted by Section 7508A), would companies just hold on to the money rather than paying it out to employees in case they have to turn around and pay it to the government?

...Without detailed answers to some of these questions, employers might just steer clear of all of it by continuing to do what they’ve always done, blunting the desired economic impact of reducing taxes.

Trump says that, if he's reelected, he will sign legislation that forgives the unpaid payroll taxes and repeals the payroll tax permanently. In order to do this, however, Trump would need the cooperation of Congress. Since eliminating the payroll tax would also eliminate the dedicated funding stream for Social Security and Medicare, there is little chance Congress will vote to get rid of it.

While the media cast the payroll tax deferral as part of a package to bring "economic relief" to Americans, it is much more likely to bring confusion.

If you value this work, please help spread the word! The bigger we grow the Popular Information community, the bigger our impact.

Click HERE for your unique referral link. As your friends and family sign up, you'll earn Popular Information merch and invitations to special events.

You can learn more about the impact this newsletter has had this year here.

|