|

On September 1, the Centers for Disease Control and Prevention (CDC) announced a "Temporary Halt in Residential Evictions To Prevent the Further Spread of COVID-19." The order will remain in effect until the end of the year. Many states also have their own eviction moratoriums in place.

And yet, as the pandemic continues to hobble the economy, Americans continue to be evicted from their homes.

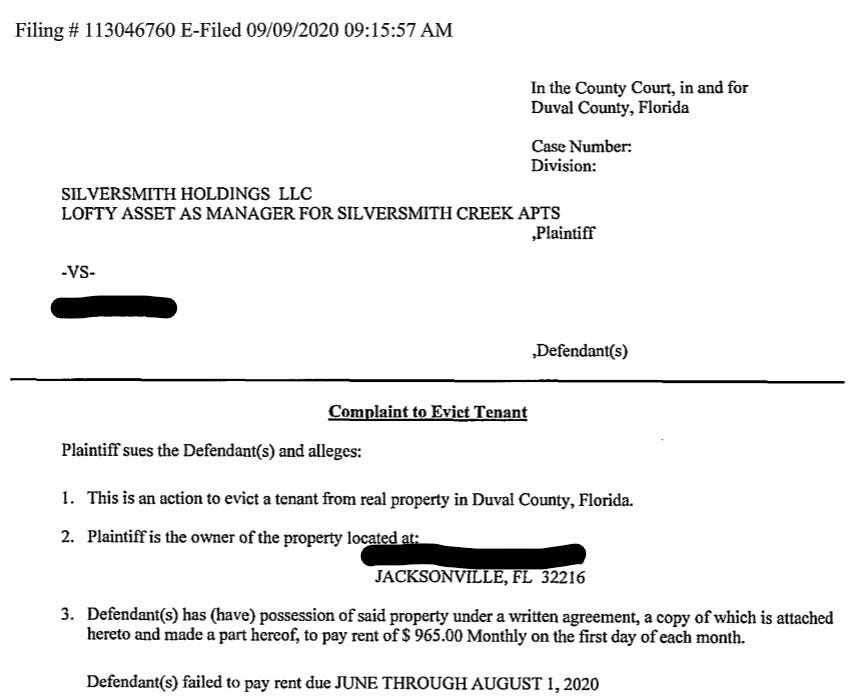

In Florida, for example, Governor Ron DeSantis (R) recently extended the state eviction moratorium until October 1. But despite the state and federal moratoriums, 270 eviction actions have been filed by landlords in Duval County, home of Jacksonville, since September 1, according to a review of court records by Popular Information.

For example, here is an eviction complaint filed with the Duval County Clerk on September 9.

|

These complaints are being served to thousands of people across the country. What's going on?

The federal moratorium and most state moratoriums are not self-executing. They rely on renters actively asserting their new legal rights. This allows landlords to exploit renters who do not have legal counsel to advise them of their rights. Just 10% of renters have legal representation. But 90% of landlords have lawyers.

The federal moratorium requires renters to fill out a declaration and deliver it to their landlord. (The form for the declaration is available here.) The form requires renters to certify:

1. That they have "used best efforts to obtain all available government assistance for rent or housing."

2. That they make $99,000 or less. ($198,000 for a couple.)

3. That they are unable to pay their "full rent...due to substantial loss of household income, loss of compensable hours of work or wages, lay-offs, or extraordinary out-of-pocket medical expenses."

4. That they "using best efforts to make timely partial payments that are as close to the full payment as...circumstances may permit, taking into account other nondiscretionary expenses."

5. That they "would likely become homeless, need to move into a homeless shelter, or need to move into a new residence shared by other people who live in close quarters because I have no other available housing options."

Renters also must certify they understand that "any false or misleading statements or omissions" on the declaration "may result in criminal and civil actions for fines, penalties, damages, or imprisonment."

Even if a renter learns of this document, fills it out, and delivers it to the landlord, that does not stop the landlord from filing an eviction proceeding and challenging the declaration in court.

In Florida, the Governor's latest extension of the eviction moratorium requires tenants to "show proof to a judge, within five days, that they can’t pay rent specifically because of the pandemic." These requirements are being imposed on tenants who are often looking for a job, without childcare, and struggling to meet their families' other basic needs.

Not surprisingly, many renters are not able to navigate these legal hurdles during a pandemic. In Clay County, a smaller Florida county located south of Jacksonville, "law enforcement officers have evicted five families and individuals" since September 1.

Notwithstanding the federal and state moratoria, Stout, a global advisory firm, estimates that 2 million evictions will be filed in September.

The federal moratorium is helping some tenants temporarily, but it is also compounding problems down the road. The federal moratorium policy was not paired with any rent assistance or abatement. That means renters are piling up debt, creating a massive eviction bubble that — absent government action — will burst on January 1, 2021.

Who is filing evictions

Landlords come in all sizes, but a significant percentage of the eviction activity is being driven by massive property management companies. In Duval County, for example, 45 of the 270 eviction actions filed since September 1 have been filed by Princeton Enterprises. The company owns thousands of residential properties across 15 states. The CEO of Princeton Enterprises, Matt Lester, describes his company as one of "the largest holders of multi-family assets in the country today."

Princeton Enterprises is aggressively pursuing evictions in Florida despite a state and federal moratorium. But the company has received taxpayer funding to support its own operations during the pandemic. In April, Princeton Enterprises received a forgivable loan through the federal Paycheck Protect Action of $350,000 to $1,000,000.

Lester serves as the president of the Apartment Association of Michigan. In an April 14 letter addressing the pandemic, Lester wrote that he has been "uplifted by the essential role our rental housing plays in further fulfilling the basic human need of shelter."

Across the country, private equity firms and other corporate landlords have filed more than 1500 new eviction cases since September 1, according to data collected by the Private Equity Stakeholder Project and shared with Popular Information.

A massive loophole

There are also major loopholes in the moratoriums that allow landlords to evict tenants. The federal moratorium, for example, only explicitly prohibits evictions for reasons of non-payment of rent. This means that, subject to the interpretation of state judges, landlords can continue to evict tenants when their lease expires.

That's exactly what happened to Nancy Plake, a renter in the Indianapolis region, who showed up in court last week with "her face mask, comfortable shoes and documentation showing she qualified for protection under the federal eviction moratorium."

Plake told the judge that, if evicted, her only option was to sleep, with her two adult children, “in the car in the parking lot.” She applied for an Indianapolis rental assistance program and "was placed on a waitlist behind 17,000 other applications."

The judge ordered her to vacate her apartment by midnight on October 8. Plake's lease had expired, and the judge ruled that the "moratorium does not cover non-renewal of leases."

The scope of the problem

How many people may be impacted by evictions? Stout estimates that there are 17.3 million households currently unable to pay rent and at risk of eviction. This represents more than 42% of all renter households. There is the potential for 11.7 million eviction filings over the next four months.

At present, the total rent shortfall is $21.5 billion. This seems like a lot of money but, it is a small fraction of the total amount spend on COVID-19 relief, $3.48 trillion. The CARES Act, for example, provided the Treasury Department with a $500 billion fund that will be used by the Federal Reserve to support trillions in lending to larger businesses. A small fraction of those funds could help keep millions of the nation's most vulnerable families off the streets.

|