Hi y’all, Cokie here.

This week I read a horrifying article about how the only barrier to being a founder is “your own motivation.” I wanted to take a moment to shine a light on why there are fewer female founders. And *spoiler alert*: it’s not because women lack ambition in comparison.

There are fewer female founders as a direct result of systemic inequality.

#1 Unpaid Domestic Labor. Pre-COVID, after the birth of a hetero couple’s first child, the mother took on an extra 2 hours of home labor a day, while men took on an additional 40 minutes per day, according to this study, while maintaining their full-time paid labor. I think that we can agree in the midst of COVID-19, everybody is taking on additional domestic responsibilities and doing their best to manage them equally, but that’s not always the case. According to this article from the New York times, while men think they’re taking on 50% of homeschooling responsibilities, less than 3% of women agree. Women for the most part have overwhelmingly shouldered the burdens of childcare and home labor during the pandemic while managing a full-time job. And, I guarantee women will be expected to continue this unpaid domestic labor even after they’ve started to see gender parity in the workforce.

#2 We’ve never been paid the same & our jobs are less secure. It’s 2020, and women still only make $0.81 to every $1.00 that men make, according to this study from Payscale. Yes, this is better than it was even just a few short years ago, but there is no reason this shouldn’t be equal. On top of that, I have seen a few reports saying that it’s actually less than $0.81, dropping into the high seventies during the Covid pandemic. This is leading experts to conclude that women were more likely to leave their jobs to take on domestic labor in the COVID-19 pandemic. Exhibit A.

Also, Sharon makes this point better than I do:

#3 Women are “risk-averse.” LOL. We are not “more risk-averse.” The system just isn’t made for us to thrive. I’d argue that whether or not someone is risk averse depends more on their astrological sign and upbringing than their gender. Take this as food for thought: In 2018, 98% of venture-funded founders were men. That means only 2% of women got funding. Do you think only 2% of entrepreneurs are women? I really didn’t. So I googled it! According to the State of Women-Owned business report sponsored by AMEX, 42% of American businesses are female founded. They just didn’t get funded. Oh, and I bet the reason wasn’t because they didn’t go ask for funding because they were “too risk averse.” *insert eye roll*

#4 Fintech specifically is actively worse for female founders. According to Forbes, female founders make up just 17% of fintech companies and women receive only 3% of VC fintech funding. I think we’ve all felt this one. Despite initiatives to actively reverse this problem in fintech, most rooms I’m (virtually) in are male-dominated. This is to all of our determinants. We’re 50% of the population and therefore 50% of your customer base, you’re missing out if you’re not giving us a seat at the table.

#5 This is all to say that Julie Verhage is now the co-founder of Fintech Today. Personally, I’m very excited FTT has a female co-founder. And that’s the story. Congratulations to my dear friends Julie & Ian, I’ll be right here by your side for the long haul.

Speaking of Julie, this week in FTT’s premium newsletter she’s going to be talking about things that startups tend to overvalue. During her time in journalism, the hustle of breaking the story first was often the top priority, when in fact, that’s not the top priority for the readers. As long as that news outlet can match whoever broke the story within a few minutes, the reader couldn’t care less. What are some things that executives, product managers and others tend to put a higher value on than their users? Find out Sunday afternoon.

We also launched a new paid tier: FTT Lite, at $10/month. We’re big proponents of making our products more accessible for our audience in the long run, and we’re excited to start offering Julie VerHage’s Sunday Column at a discounted rate. Over time, we’re planning on adding more content and other perks (👀) too. Hit the link below to sign up

The News

E-Commerce investor Clearbanc launched inventory financing. According to founder Andrew D’Souza, “Clearbanc will purchase your inventory upfront directly from suppliers so you don’t have to worry about payback until your inventory reaches your customer’s doors.” D’Souza explained that he’s seen companies spend over 50% of their revenue trying to buy products from suppliers, forcing them to choose between inventory and other important aspects of their business, like marketing. Launching inventory financing, Clearbanc hopes to keep founders from going out of stock, allowing them to allocate their capital in places of their business outside of inventory.

French fintech Lydia announced a partnership with financial API startup Tink for its in-app open banking features. Lydia, the self-proclaimed “super app for your money”, aims to centralize all personal finances and accounts. Though Lydia has been a user’s accounts to their bank through Budget Insight’s Budgea API, they’re switching over to Tink’s API moving forward. The switch will enable stronger account aggregation- connecting bank accounts and viewing most recent transactions- and payment initiation, the transfer of money from a third party service.

Visa struck a deal with Stripe, using Stripe Connect to enable virtual B2B payments between buyers and suppliers.“When a buyer needs to pay a supplier, the enhanced Visa Payables Automation platform allows seamless digital payments experience. The supplier will be prompted to register with Stripe Connect, provide a bank account number, and start accepting payments,” according to Chavi Jafa, head of Asia’s business solutions at Visa. Through this partnership, Visa aims to eliminate manual processing and bring on board suppliers who may not be connected to traditional banking infrastructure. The new service is now available in 30 markets around the world.

Bitcoin banking app Mode IPO’d on the London Stock Exchange, raising $8.8m on its first day. Mode is one of the first publicly listed financial services companies with a consumer-focused digital asset offering on the London Stock Exchange.

Nigeria’s fintech companies struggle to keep default rates at a tolerable level as economic uncertainty grows. With the default rate growing faster than expected, many Nigerian fintech companies are reconsidering their business models. While Olaniyi Ali, former head of Lagos Business Office attributes the relaxed industry regulations to poor risk management, retired investment banker VIctor Ogiemwonyi suggests high loan default rates are a common feature pointing to an economic downturn.

Petal launches a new card, ‘Petal 1’, and rebrands their first card to ‘Petal 2’. In light of COVID-19 Petal 1 aims to be more inclusive in providing services to people with a poor credit score. Petal explains that while the most integral aspects of Petal 1 stay the same, “Petal 1 is designed to give consumers with more complicated credit histories a better option, in an economy where it’s become much harder to get a credit card if your credit history is anything short of perfect”. The flagship Petal card, meanwhile, has been rebranded to “Petal 2”. Customers that use the Petal 1 card “responsibly” will have the opportunity to upgrade to Petal 2 card, which includes higher limits, no fees, lower APRs, and cashback on all purchases.

Chief of Square Capital, Jacqueline Reses left the company this week. Square did not provide an explanation or reasoning behind the leave, only stating that Reses "has worked at Square for five years and provided significant contributions to the Company." Square has not announced a replacement for Reses or disclosed her plans moving forward.

On Monday, Venmo launched their own credit card. They’ve already rolled it out to “select customers”, but it will soon be available to everyone in the coming months. The card, simply dubbed “Venmo Credit Card”, is a Visa that can be managed directly in the Venmo app- allowing users to view spending activity, track rewards, and make payments. Users can also use a virtual card to shop online. Just like Venmo accounts, the Venmo Credit Card comes with a unique QR code- located on the front of the card- allowing others to request and send money by scanning it with their phone camera. The card allows you to earn 3% cashback on your “top spend” category, 2% on your second-highest spending category, and 1% on everything else. Check out Ian’s write up on it here.

Fundraising News

Affirm proposed a confidential IPO to the SEC. The number of shares and price range for the offering have yet to be determined. The IPO is expected to take place after the SEC reviews and approves the submission.

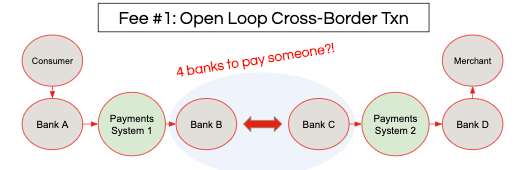

Nivelo raised a $2.5m Seed. Nivelo, founded by a former JP Morgan executive, is taking the risk out of ACH transactions. (ACH stands for “Automated Clearing House”, and refers to transactions that take or pull directly from your checking account- think direct deposits, paychecks, and paying your bills). FirstMark, Barclays, and Anthemis led the round.

Bloom Credit raised a $13m Series A. The NYC-based startup connects businesses with credit bureaus, aiming to help fintech businesses that want to provide credit products like lending, personal finance, and credit monitoring. The round was led by Allegis NL, Resolute Ventures, Slow Ventures, and Commerce Ventures.

Japanese NEC Corporation acquired 100% of shares in Swiss digital banking firm Avaloq. In making this move, NEC Corporation plans to create new solutions that combine NEC and Avaloq’s technologies and expand Avaloq’s software globally.

United Arab Emirates crypto exchange startup Emerix raises an undisclosed amount from American blockchain fund Alpha Sigma Capital, with ASC’s CEO Enxo Villani joining Emirex’s advisory board as part of the deal. Emirex currently hosts 100,000 users and 30,000 active traders from across the globe, as well as 50 listed trading partners.