Which Stocks Will Gain the Most from a Coronavirus Vaccine?

|

Older messages

What Is Debt Consolidation?

Saturday, November 7, 2020

Daily Money Everyday Money What Is Debt Consolidation? And how such tools as loans and balance transfer credit cards can help you achieve it. Investing How to Invest in Index Funds Don't spend all

How Much Should You Save for Retirement?

Friday, November 6, 2020

Mortgage rates drop to record lows Retire with Money I'm old enough to remember when a million dollars was the magic number for retirement savings. Now? No one in the financial services industry

How Much Should You Save for Retirement?

Friday, November 6, 2020

Daily Money Retirement How Much Should You Save for Retirement? You can't count on Social Security to fund all your expenses. Family Finance How to Pay for College It's never too early to start

A New Rule Lets Debt Collectors Text and Email You. Expect Scams to Follow

Thursday, November 5, 2020

Daily Money Everyday Money A New Rule Lets Debt Collectors Text and Email You. Expect Scams to Follow Here's how to protect yourself. Shopping Apple AirPods Are on Sale for Their Lowest Price Ever

Issue #67: Get in, loser, we’re going shopping (online)

Wednesday, November 4, 2020

plus sheep pickup + McFlurries November 4, 2020 // ISSUE #67 Dollar Scholar Hi y'all — Because of the way my publishing schedule works, I write Dollar Scholar every week in advance. That means I

You Might Also Like

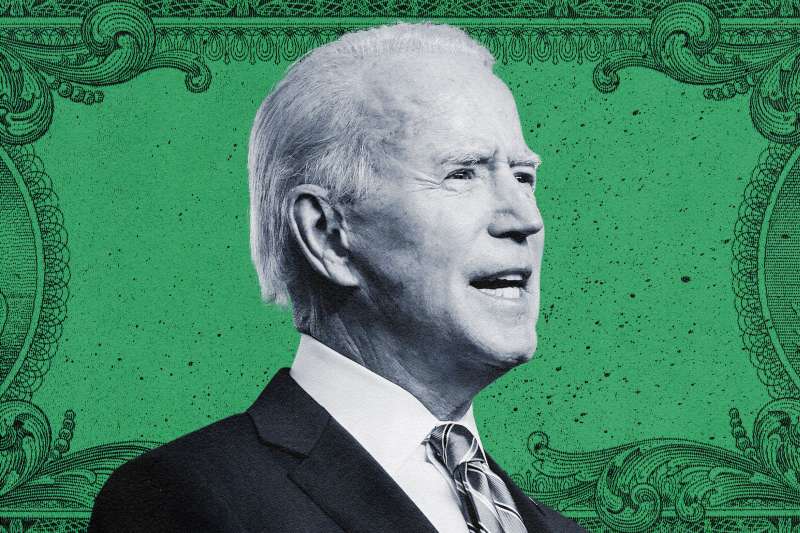

After inauguration, it's time to talk taxes

Wednesday, January 15, 2025

plus toad fashion + Post Malone ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Harry's Take 1-15-25 Stocks Look to Break Lower: Another Sign of a Top on December 16

Wednesday, January 15, 2025

Harry's Take January 15, 2025 Stocks Look to Break Lower: Another Sign of a Top on December 16 As we go into the new year, already with signs of a failed Santa Claus Rally and a failed first 5

🇺🇸 America's tariff future

Tuesday, January 14, 2025

A possible go-slow approach to tariffs, a spending worry for China, and the next obesity drugs | Finimize TOGETHER WITH Hi Reader, here's what you need to know for January 15th in 3:14 minutes. The

It’s a new year, get a new savings account

Tuesday, January 14, 2025

Earn more with high-yield options! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Private Equity Is Coming for Your 401(k)

Tuesday, January 14, 2025

The industry wants in on Americans' $13 trillion in savings ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

This Skateboarding Economist Suggests We Need More Skateparks And Less Capitalism

Tuesday, January 14, 2025

A skateboarder presented an unusual paper at this year's big meeting of American economists. View this email online Planet Money Skateonomics by Greg Rosalsky “The Skateboarding Ethic and the

Elon Musk Dreams, Mode Mobile Delivers

Tuesday, January 14, 2025

Join the EarnPhone revolution ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Shaping inflation expectations: the effects of monetary policy

Tuesday, January 14, 2025

Natalie Burr In economic theory, expectations of future inflation are an important determinant of inflation, making them a key variable of interest for monetary policy makers. But is there empirical

🌎 Another hottest year

Monday, January 13, 2025

Global temperatures crossed a threshold, oil prices bubbled up, and crypto's AI agents | Finimize Hi Reader, here's what you need to know for January 14th in 3:06 minutes. Oil prices climbed

Have you seen the Best Cars & Trucks of 2025?

Monday, January 13, 2025

Get a quote and protect your new wheels with Amica Insurance ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏