In this issue:

Understanding Airbnb

Measuring Eyeballs

Property Rights

Reputational Bug Bounties

Running Out the Clock on Tariffs

Understanding Airbnb

Sharing economy companies arose at a time when capital, especially late-stage capital, was cheap. So they exist on a continuum: for some of them, the model is to move assets and operating expenses onto the company’s own financial statements; for others, the goal is to be as asset-light as possible. WeWork found that the most cost-effective way to sell building management services and lead-gen to landlords was to buy leases, and Uber, Lyft, and Doordash accepted many negative-sales to bootstrap their unit economics. Airbnb is a comparative palate-cleanser of a company: its marketing is cost-effective, and it makes use of the world’s largest asset class without putting any of it on the balance sheet.

Airbnb’s S-1, filed yesterday, is a nice bookend to Doordash’s (written up in yesterday’s Diff). Doordash was a company that burned money until the pandemic transformed it into a near-essential service that could turn a profit during hypergrowth; Airbnb generated positive free cash flow from 2016 onward, until Covid temporarily wrecked their business. Unlike Doordash, Airbnb’s financial disclosures offer a high-resolution look at what the post-pandemic transition will look like.

The document is a masterpiece of a particular kind of financial sales pitch. Investors have three basic questions about Airbnb circa 2020:

What are the qualities of the business in a normal year?

How much was that value impaired this year?

How soon will the company’s value recover?

Airbnb Today

The company’s IPO timing is not ideal from the perspective of telling a straightforward story. As the cofounders note in their investor letter, Airbnb’s IPO prep was happening in March. That timing was probably to get ahead of options expirations this November. But they’re stuck explaining an unusual company in the middle of a very unusual year.[1]

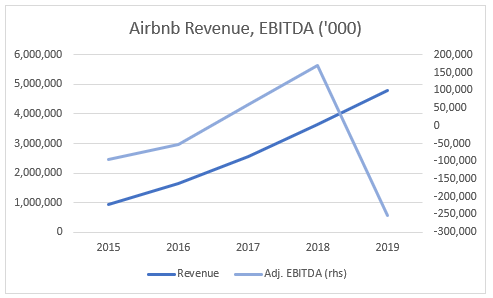

This is especially challenging for Airbnb because they have two years to explain: margins deteriorated in 2019, even though revenue kept growing:

Pre-Covid Crisis, their spending ramped up, and their profit margin, measured by a generously-adjusted non-gaap calculation, flipped from +5% to -5%.

The timing is important: 2019 was going to be the year of the high-burn, high-valuation unicorn IPO. (As it turned out, the burn rates were more real than the valuations.) Airbnb was reacting to the rumored IPO valuations of Uber, Lyft, and WeWork, not the prices those companies ultimately got. A one-year corporate planning cycle means that a plan that turns out to be suboptimal probably shouldn’t be cancelled, unless it’s absolutely disastrous, but it does mean that Airbnb’s spending in the last half of 2019 was based on assumptions about equity investors’ preference for growth over profitability circa late 2018.

As the various cash-burning IPOs of 2019 either debuted disappointingly or didn’t happen at all, I’m sure Airbnb adjusted its 2020 plan to aim for better margins and not growth at all costs. The cleanest way to estimate this is to look at their product development spending in Q1: these hiring cycles are the least sensitive to near-term revenue, and they’re a major constraint; a company doesn’t want to lay off engineers unless it’s seriously contemplating bankruptcy, whereas it can cut marketing spending a lot faster. Product spending, excluding noisy stock-based comp numbers, was rising at a +50%-80% annual clip throughout 2019, but slowed to +33% in Q1 2020.

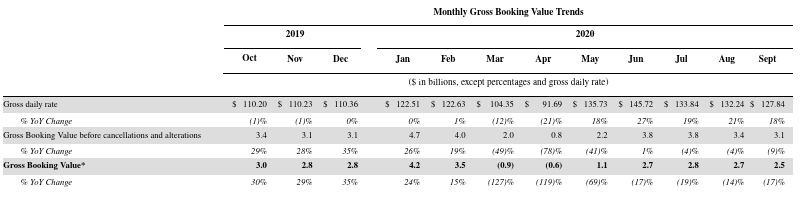

Starting at that period, the company’s financial reporting gets very granular. They provide several helpful charts explaining, blow-by-blow, how rough 2020 has been in the travel sector.

For example, here’s their bookings cadence, featuring negative 4.1m trips booked in April 2020:

The revenue picture is brighter, as the recovery happened faster in the higher-rate US:

And much deeper in the S-1, there’s a more granular analysis of what’s driving that recovery. Airbnb dissects several travel trends, and finds that their recovery is driven by:

Growth in same-country travel, offset by a decline in international travel. Domestic travel in September was up 14% Y/Y in terms of nights, and 35% Y/Y in terms of spending.

Growth in short-distance travel showed similar trends.

Cities outside the top twenty saw declining booking volumes and flat total spending, while top-twenty cities were crushed.

28-day-or-longer trips were up 23% in terms of nights booked and up 50% in terms of spending.

Most parts of the travel sector require significant upfront investment; it’s a service-sector business, but planes, cruise ships, and hotels are not capital-light. Airbnb’s capital assets are both the most ubiquitous on earth (residential real estate is the single biggest category of investment) and the most adaptable, because what Airbnb offers is the package of home-plus-host. An Airbnb unit meant for an overnight stay is not that different from one meant for a six-month escape, so Airbnb was able to deploy its assets to where they’re most effective. Long-term stays had been creeping up as a share of Airbnb revenue before, rising from 13% in 2018 to 14% in 2019, before hitting 24% in the first three quarters of 2020. (The extended stay hotel chains like to point out that the share of hotel stays longer that four weeks far exceeds the share of hotel rooms at extended-stay hotels, but Airbnb has solved the supply gap faster than they could.)

Local travel has another perk for the company: they note that 23% of 2019’s hosts were previously Airbnb guests. They have a tangible network effect where every room-night booked means an empty bed that could also be sold on their platform, and local travel tightens up that feedback loop.

In one sense, it’s unsurprising that Airbnb would be so adaptable, and that they’d be able to bend their growth trajectory upward despite an ongoing pandemic. The company’s cereal entrepreneurship days have been well-covered—to pay the bills in 2008, they made novelty breakfast food celebrating Barack Obama and John McCain. Less emphasized is the fact that the business had to launch no fewer than three times before it got traction: first during a design conference in 2007 (three guests), then at SXSW (two guests, one of whom was an Airbnb cofounder), then at the 2008 Democratic National Convention. The company is just very resistant to getting killed.

Even in the depths of the pandemic, they’ve displayed a knack for adapting aggressively. When they laid out new cleaning protocols in late April, they gave extensive interviews to USA Today. That newspaper is not generally a top-tier tech or business publication, but it is distributed free to hotel rooms around the country; while Airbnb’s finance team was fighting for the company’s survival, the PR team figured out how to launch a low-CPM direct mail campaign hitting their competitors' customers.

Airbnb Over Time

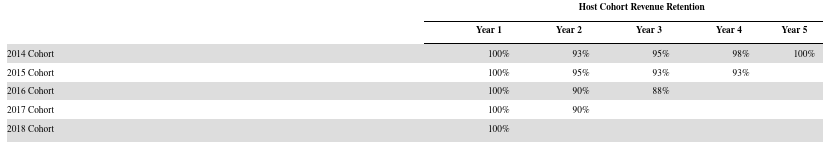

The S-1 makes a good cast that Airbnb will survive. But what about its long-term growth? They disclose cohort economics for both travelers and hosts. On the host side, cohorts look like this:

Airbnb talks up their hosts' economics: 50% of hosts get a booking within four days of signing up for the site, and Airbnb gives them pricing software so they don’t have to figure out yield management on their own. The supply of Airbnb-able property should be countercyclical, while demand will be cyclical; since both sides of the network effect are established, this means that in more normal times Airbnb can calibrate its marketing to emphasize whichever side of the service needs more growth. They note that the total number of active properties on their platform remained fairly stable at 5.6m, despite some hosts being too cautious to use the service. That’s evidence that their retention and counter-cyclicality are strong. (Hosts on the site grew 32% in 2018 and 29% in 2019, so organic growth is there, too).

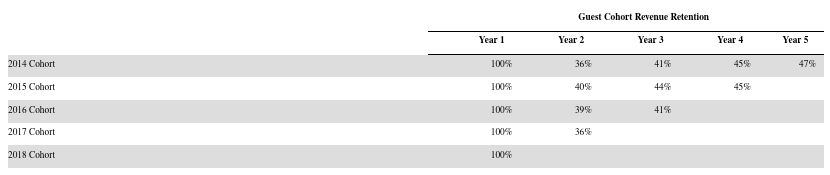

For guests, there’s a less enticing cohort analysis:

But this makes sense. As Airbnb notes, vacations are an intermittent purchase. For a customer who takes one big vacation a year, Airbnb would need to get 100% market share of their vacation-lodging spending to have positive dollar retention in year two. What’s most interesting about these cohort numbers is that they improve after year two, which implies some combination of a) people choosing to return to Airbnb over time, and b) Airbnb increasing the total demand for vacations by lowering the price. One factor in point B is the low average age of their customers: “The majority of our guests who have ever made a booking on Airbnb were between the ages of 18 and 34.” This is positive for their dollar retention; while young people don’t earn much, their compensation rises faster in that age range than at any other time in their lives.

Those cohort economics show up in their overall numbers: 84% of revenue in 2019 was from hosts who started in prior years; 69% of revenue was from returning guests. Both numbers have been trending up over time.

Airbnb’s leisure travel skew has another benefit looking ahead to 2021 and beyond: leisure travel is price-sensitive (“Basic Economy” seating on planes is not something anybody asked for, but leisure travelers sort by price and airlines know low prices stimulate more travel), while business travel is ROI- and signaling-sensitive. Once business travel basically stopped, it lost some signaling value, and that will slow its recovery.[2] But cheaper airfare is a pretty straightforward subsidy for leisure travel. Airlines have taken on significant debt to survive, and their fleets are operating well below capacity. While the industry as a whole would benefit from constraining supply, any given airline has an incentive to fly every plane that can produce an operating profit, which means plane ticket prices will recover much more slowly than airline revenue; that’s to Airbnb’s benefit.

|

Airbnb’s margin picture starts to get more compelling in the out years. (As one would hope! A business that did $38bn in gross bookings last year is a fairly mature one, although those bookings were up 29% Y/Y from 2018.) While delivery and ridesharing companies place a large share of the unit cost variability on their own profit and loss statements, Airbnb’s biggest out-of-pocket risk is incentives and refunds, which were running at a steady 5-6% of revenue until the pandemic, and were 14% of revenue in the last nine months. Cancellations remain elevated, at 18% of gross nights booked in September, compared to a 13-14% range in Q4 of last year. But they’ve been steadily trending down, both as a percentage of bookings and in absolute numbers.

Meanwhile, Airbnb has some cost levers to pull. They note that contactless checkin, a safety measure now, could be a cost-saving one in the future. And, ironically, they’ve saved $28.6m year to date in travel costs, 74 basis points of their prior cost run-rate.

On the marketing side, Airbnb cut spending dramatically early in the pandemic. They plan a strategy shift, with lower performance ad spending and more branded spending, with a net result that marketing costs will be lower in 2021 than they were in 2019. The brand advertising has been working so far: in 2019, in the midst of their growth push, 77% of site traffic was still organic. This year, it’s 91%.

Regulation remains a risk for Airbnb, but it’s been mitigated over time. There just aren’t major cities that haven’t written some kind of rules for Airbnb hosts to follow (well, there are one or two). And the S-1 discloses that no single city is more than 2.5% of revenue or 1.5% of listings. This actually gives the company some regulatory upside: tech companies are much better at lobbying nationally than locally, so regulatory changes that end up materially affecting Airbnb are more likely to be beneficial.

Regulatory risk ties into one of the skeptical cases against Airbnb: that it’s a pure regulatory arbitrage. But running down the list of big cities and their rules in the S-1 makes that a tough claim to swallow: Airbnb is following rules everywhere, and still earning money (in fact, they hit record high adjusted EBITDA in Q3 of this year). The strongest argument against the regulatory-arb theory is that Airbnb’s founders had no idea there were incumbents they were disrupting. When the company first pitched investors, Sam Altman of Y Combinator famously told them to adjust their estimate for potential future revenue by changing the word “million” to “billion.” They assumed they were doing something completely new, and only later discovered that it was an older model with existing rules.

Airbnb has executed a unique business move: a phase change in a major asset. Residential real estate was solid, now it’s liquid; owners and renters can sell off access by the room and by the day, so supply and demand are better-matched than ever before. The business got to breakeven without disrupting growth, and survived a pandemic that followed a year of stepped-up expenses. Unlike other travel companies, their supply doesn’t really go away when demand dries up; the Airbnbable real estate still exists when customers are rare, and can be repurposed for longer stays before the travel market recovers.

[1] It took me a long time as an investor and analyst to notice that every year appears to be, at the time, an unusual year. Taking a look at the Fama-French data library, I see that the arithmetic average equity return since 1926 is 11.92% annualized, which makes 2004’s 11.92% return the most normal return ever. In that year, oil rose 33%, the dollar lost 12% of its value against the Euro, US Airways and Hostess went bankrupt, the Iraq war was raging, and there was a revolution in Ukraine and a spate of terrorist attacks elsewhere. That is the level of news flow that produces US financial history’s most unremarkable returns.

Nevertheless, 2020 is a more-unusual-than-usual year.

[2] As Alex Danco has argued, it sends a stronger signal when it happens. But I suspect that a large chunk of business travel happens by default. When you assume in-person meetings, suggesting Zoom is an insult, but when Zoom is the default, inertia keeps travel spending lower for longer.

Elsewhere

Measuring Eyeballs

TV has always been an effective advertising medium, but as online platforms get bigger audiences, TV’s relative deficiencies in measurement get more obvious. Ads can be targeted and measured at the household level, but not at individual consumers. Now a startup, TVision, aims to fix this by using eye-tracking to measure attention. This solves two problems at once: first TVision’s panel can disaggregate household viewing into individual viewing. Second, it can get a better sense of ad visibility. Direct response advertisers have always been able to measure response rates—if the ad has a URL or an 800 number, it’s trivial to see how much it drives sales. Branded advertising involves more guesswork, and online advertisers have been better at connecting ad views to future purchases. Now TV is closer to meeting them halfway.

Property Rights

One of the most powerful tools for analyzing economic changes is to look at explicit and implicit property rights. A few notable stories in that vein:

Facebook is making it easier for page owners on Facebook and Instagram to protect image rights and send takedown notices. I’ve written before about the economics of images with attribution cropped out; content tends to find its way to the platform with the shortest consumption time, and get stripped of credit along the way. Facebook is slowing this process down, which is a subsidy for pages with better content and worse distribution. It’s the influence equivalent of a more progressive tax code.

Github has reversed course on a takedown notice for youtube-dl, a software library for downloading YouTube videos. This is a property rights argument in two directions: a question of who owns the content on YouTube, and the question of whether coders or Github control what stays on Github. Also notable is the outcome: “GitHub will establish and donate $1M to a developer defense fund to help protect open source developers on GitHub from unwarranted DMCA Section 1201 takedown claims.” $1m is enough money to slap down frivolous claims, and not nearly enough to defend a product that’s clearly designed for piracy, so this is an affordable way for Github to draw the right line.

An indirect kind of property right is the ability to repair or modify something. As products get more complicated, economic ownership slowly reverts to the manufacturer, since consumers are less and less equipped to fix them. In cars, this turns out to be a nice subsidy for auctioneers like Copart; the line between a working car and a junked car has sharpened for car owners but not for experts, and Copart arbitrages that gap.

Reputational Bug Bounties

Twitter suffered an embarrassing hack in July, when Bitcoin scammers took over several prominent accounts. (For thoughts on the economics of this—including the question of why the scammers tried to steal a small amount of Bitcoin rather than setting off a market crash, faking a major merger, or trying to start a nuclear war—see this Diff writeup.) They’ve hired a very well-known hacker, Mudge, as head of security. Infosec recruiting is a signaling move, that focuses on both aptitude and attitude; hiring someone who has taken a belligerent approach to security vulnerabilities in the past is a precommitment to not having many of them in the future.

This closely follows the template set by Zoom earlier this year. As I wrote at the time:

But Zoom has hired Alex Stamos as a security consultant. Stamos has an excellent reputation, but it’s a strong signal that they plan to tighten up fast: Stamos left Yahoo when they let the government read some users' emails. He joined Facebook, and after quitting there called for Mark Zuckerberg to resign. This is a massive reputational Bug Bounty on Zoom’s part.

Running Out the Clock on Tariffs

Tariffs are designed to be a relative tax on imports and subsidy for domestic production, but implementing them is tricky. Some assets are stationary, but some are, by design, mobile. Delta Airlines has been taking delivery of Airbus planes despite tariffs, but basing them overseas to avoid having them count as imports. This kind of thing seems to be part of Delta’s competitive advantage. When a 300% tariff was imposed on Bombardier planes in 2017, Delta said they would absolutely not pay it. Ultimately, they didn’t; the tariffs were overturned, and Delta got its planes.