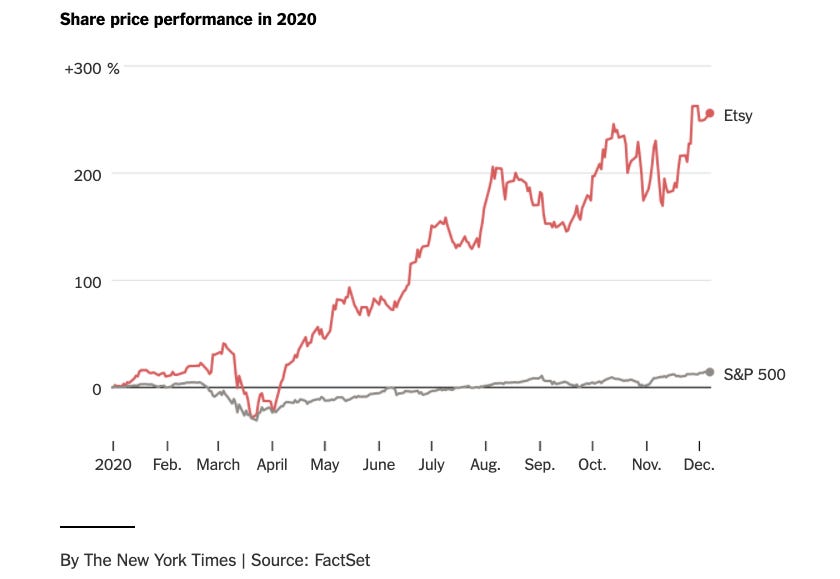

The New York Times published an interesting article this week on how Etsy became the S&P 500’s top-performing stock of the year. Etsy went public in 2015 and had a tumultuous first few years, facing questions from investors about its status as a B Corp (which it has since dropped) and competition from Amazon.

After a management team change in 2017 and an increased focus on financial performance, Etsy’s stock began to turn around. However, it didn’t start to truly outperform until Q2 2020, when the company broke records for GMS (gross merchandise sales) and revenue while also significantly improving its margin.

What caused the exceptional growth? Etsy became a prime destination for masks, which many merchants made at home. The company has sold 54M masks, totaling $600M in GMS. Etsy is seeing record growth across many categories, driven by increased e-commerce spend and consumers seeking to support small businesses.

The question now is whether Etsy can keep this growth going. They’ve done a great job keeping up with demand from new purchasers (who might be there for masks and stumble upon other products), as well as re-activating buyers from previous cohorts who haven’t been on the platform for a while. We’re curious to see what 2021 brings!

news 📣

📈 Tech IPOs soar. DoorDash, Airbnb, and C3.ai were all welcomed to the public markets with open arms!

After pricing at $102 per share, DoorDash’s stock shot up 86% on opening day, and the company ended the week at a $56B market cap. Our partner Saar Gur invested in DoorDash’s seed round - check out his reflections on the initial investment and why he still sees potential for future growth.

Despite a rocky year, Airbnb had a similarly successful public debut, with a 115% gain over its opening price on day one. The company raised a total of $3.5B (making it the largest U.S. IPO this year), and ended the week at a $83B market cap.

Enterprise software company C3.ai rounded out the week with a 143% pop over its opening price. C3.ai helps companies process their data using AI models and then take action, with use cases from anti-money laundering to saving energy.

🛍️ StitchFix earnings impress. StitchFix reported strong Q1 earnings (fiscal year begins in August), making a surprise profit. The company’s net revenue and client base grew 10% YoY, with forecasted revenue growth of 20-25% in 2021. What’s driving this? StitchFix’s personal shoppers are attracting customers that miss brick-and-mortar retail - the company added 240k net new subscribers this quarter. The “success rate” of purchased items was also at its highest-ever levels as StitchFix’s recommendation algorithm continually improves. The company’s stock ended the week up 70%.

⚖️ Facebook gets sued. After more than a year of investigation, the federal government took action against Facebook - and it was more dramatic than expected! The FTC and attorneys general from 40 states filed lawsuits asking the company to sell Instagram & WhatsApp, and notify officials of future acquisitions over $10M. Facebook’s General Counsel responded that the government cleared both acquisitions when they took place in 2012 and 2014, and that the lawsuits are “revisionist history” that will “have a chilling effect on innovation.”

😌 Calm raises more cash. Meditation app Calm closed on $75M in new funding at a $2B valuation, almost two years after becoming a unicorn. Calm has 4M paying subscribers, and daily downloads have doubled year over year. Lightspeed’s Nicole Quinn, who led the round, said that Calm’s engagement increased 3x with the introduction of sleep stories. Users have listened to more than 1B minutes of Calm content in 2020 (remember Calm’s amazing ads on CNN during election night?).

HBS student Jon Ma published a great Twitter thread on how Calm overtook Headspace after starting two years later and raising less early funding - check it out here!

Despite early promise, Uber’s self-driving car dreams turned into more of a nightmare. The company was embroiled in a lengthy lawsuit with Google over allegedly stealing trade secrets (it eventually settled for $245M), and faced intense scrutiny after one of its vehicles fatally struck a pedestrian in 2018.

Uber temporarily suspended road tests following the accident, and progress slowed over the past few years. The self-driving unit (called ATG) was burning hundreds of millions of dollars per year, which hindered the company’s path to profitability. Uber spun out ATG last year to raise external funding, but still owned 90% of the company.

ATG was last valued at $7.25B in mid-2019, but that valuation dropped to ~$4B this week when Uber merged the group with a startup called Aurora Innovations. Uber is investing $400M in Aurora and giving the company its stake in ATG - in return, Uber will own 26% of the combined entity. Aurora’s CEO announced that the company’s first product will be in autonomous trucking, not ride-hailing - we’ll have to wait a bit longer for self-driving Ubers!

what we’re following 👀

Nik Sharma released a gift guide featuring D2C brands (with exclusive discount codes)!

a16z shares data on the fastest growing social apps and key metrics to track.

David Sacks explains why SaaS companies should focus on team vs. individual plans.

How TikTok’s crowdsourced Ratatouille musical became a real production.

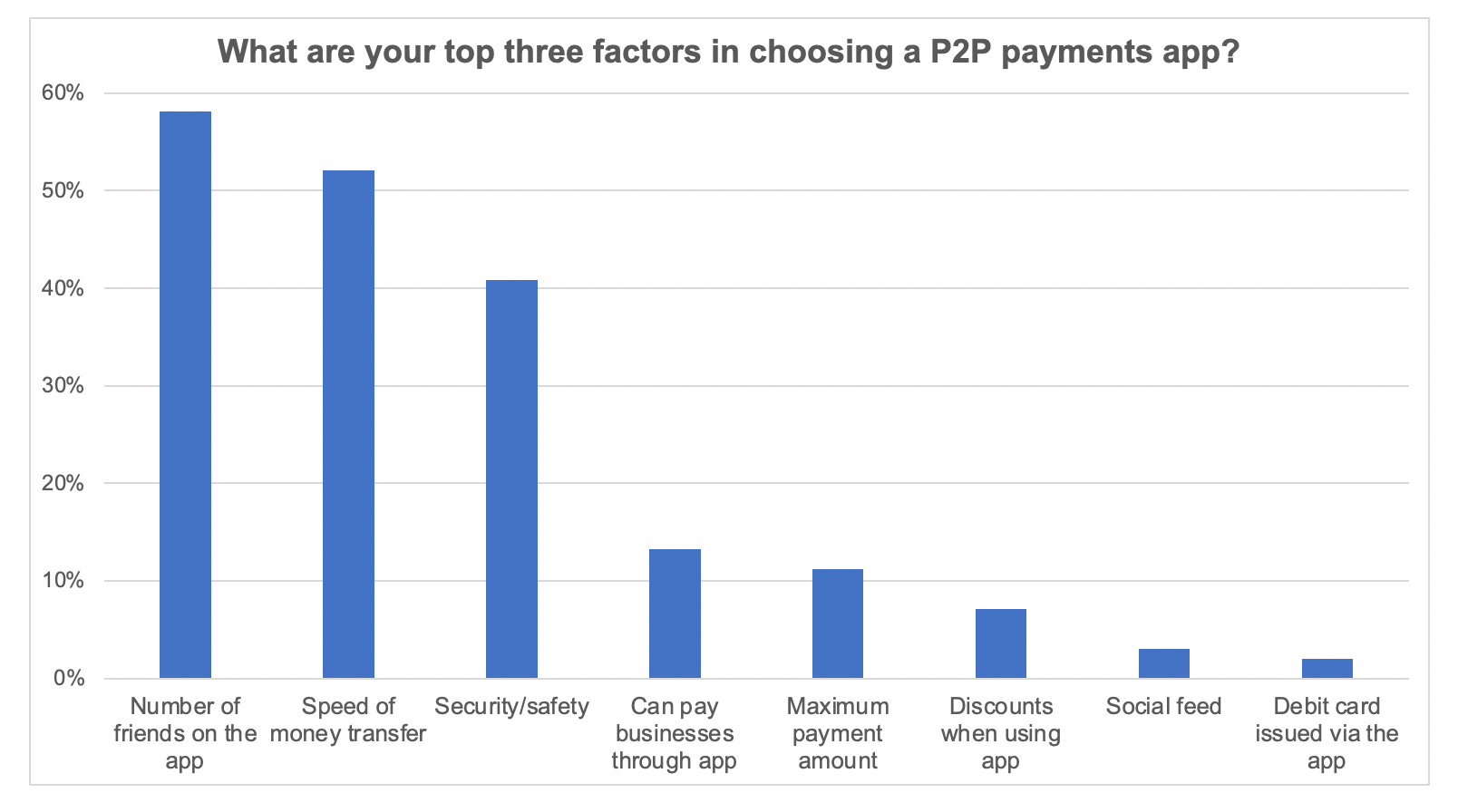

Thanks to everyone who took our survey last week on P2P payment apps! We’re excited to share the results back with you. A few takeaways:

Your #1 app was Venmo (78% of you said it was your favorite), followed by Cash App with 12% of the vote. No other app got more than 3%.

When asked about what drives you to pick one app over another, you were most motivated by # of friends on the app (76% put this in your top three reasons), followed by speed of transfer (73%), and then safety/security (56%).

While many of these apps are heavily promoting their debit cards, only 5% of you said this was one of your top three reasons for picking an app.

Crypto traders were 3x more likely to choose Cash App as their top P2P payment app - likely because Cash App makes it easy to buy Bitcoin!

jobs 🎓

Vial Health - Biz Ops Generalist (SF)

Atomic - Product & Money Ops (SF)

Craft - BD Associate (SF)

Cardless - Product Manager (SF)

Coinbase - New Grad APM (SF, Remote)

Hebbia - Fullstack Engineer, ML Engineer (SF, LA)

C3.ai - Strategy Associate (Redwood City)

Legacy Venture - Investment Analyst (Palo Alto)

Tusk Venture Partners - Investor (NYC)

Oscar Health - Launch Analyst, Strategic Partnerships (NYC)

Hopin - Biz Ops Analyst (NYC)

Thrasio - Brand Ops Analyst (NYC)

Saturn - Associate Community Manager, iOS Engineer (NYC)

internships 📝

EVCA - Undergrad VC Fellowship (Remote)

Curated - Social Media Intern (Remote)

Petal - Data Analyst Intern (Remote)

Chicago Ventures - Social & Comms Contractor (Remote)

Accion Venture Lab - HBCU Fellow (Remote)

Hydrow - Marketing Intern (Remote)

DocuSign - MBA Intern (Remote)

Wish - APM Intern (SF)

West Venture Studio - Growth Intern (SF)

Bill.com - PM Intern (Palo Alto)

AppLovin - DevOps Intern (Palo Alto)

Atom Finance - Intern (NYC)

Carta - Biz Ops Intern (NYC)

Chewy - Undergrad Biz Analyst Intern, MBA Consulting Intern (Boston)

puppy of the week 🐶

Meet Boba, a five-month-old mini merle bernedoodle who lives in Pittsburgh.

Her hobbies include exploring the city, going on hikes, and eating snow.

Check her out on Instagram @talesofbobadoodle!

Hi! 👋 We’re Justine and Olivia Moore, identical twins and venture investors at CRV. Thanks for reading Accelerated. We’d love your feedback - feel free to tweet us @venturetwins or email us at twins@crv.com.