Investing in Green Energy Loans with Plenti

Hey everyone, I hope you enjoyed last week’s issue, Anatomy of a Deal: How I bought a website earning $12k/month for $2,700 upfront. After hitting PUBLISH, I realized I had a typo in the subject line! I mistakenly wrote, “How I bought a website earning $12/month for $2,700 upfront.” Nooooooo! Spending $18,000 to get $12/month would…not be wise. 😂 Anyways, this week we’ve got a shorter issue about a new P2P lending opportunity with a modern twist — investing in residential green energy loans through a company called Plenti. Sometimes I write about interesting opportunities like this. It’s not the fastest-growth vehicle to put your money into, but it’s a safe & ethical way to earn a passive income. One important note…This will be the last email I send via makerlist@substack.com. Starting in February, emails will come from stefan@alternativeassets.club and have a slightly different design. Okay! Now let’s dive in!

What is P2P lending?Peer-to-peer lending is the practice of lending money through platforms that match investors (lenders) with borrowers (people looking for a loan). The most popular P2P lending platforms are LendingClub and Prosper, where, instead of going to a bank or credit union, borrowers can get cash for all sorts of different expenses. Remodeling, auto financing, debt consolidation, or even medical bill financing (ugh). The acronym is a bit of a misnomer, as it’s not necessarily peer-to-peer, but potentially peer-to-business. For example, Lending Club offers both consumer loans and also standard small business loans. The loan mechanics are pretty simple: Borrowers take out a loan and repay it over a number of years, with interest. The platform operator acts as intermediary between investors and borrower, often taking a small slice from both sides of the marketplace. What is Plenti?Plenti is Australia’s most popular P2P lending company, with about 24,000 investors lending money to over 57,000 borrowers. Formerly known as RateSetter, the company launched in 2014 and later rebranded as Plenti (after American Express killed off its rewards program of the same name). In late 2020, Plenti itself went public on the ASX. (Full disclosure: I applied for a product role at Plenti years ago, but decided to take the role with Flippa instead. I am still in touch with a number of folks employed there today.) How does Plenti work?If you’re a reader of this newsletter, you probably agree that cash is trash. I wish that weren’t the case, but such is the world we live in. That said, being fully risk-on with your investments at all times is obviously not a good idea either. So if you’re looking for a safe place to park some cash for a few years, but want a bit higher return than what bonds or other fixed income opportunities provide (with just a wee bit more risk) Plenti is a pretty good alternative. You can invest as little as $10, or as much as you’d like. The average Plenti investor has about $24,000 invested through the platform. While you cannot choose who you fund (borrower details are kept completely hidden from the investor experience), you have significant control over what types of loans you fund. More on this below. Each fund acts as a market, where you choose the exact interest rate you’ll receive. Choosing the lowest rate will fund a loan almost immediately, whereas choosing a rate a few points higher means you’ll have to wait longer to find a match. After funding a loan, you’ll begin getting your capital back with interest via monthly repayments. Borrowers can pay their loans back early, in which case you’ll receive your principal back with interest. Either way, before the end of the loan period, 100% of the loan will be paid back, at which point you can choose to either cash out, keep the money in a holding account, or re-invest it. There are five funds to choose from. Let’s have a look. Standard Fixed Income FundsThese funds let you earn safe, attractive returns — up to around 7.5% per year — by investing in consumer loans. You’ll be funding automobiles, vacations, home renovations, that sort of thing. 3 Year Income FundThis fund ties your money up for 3 years. Keep in mind the rates fluctuate up & down depending on a number of factors. I have a loan currently locked in at 5.1%, and have seen this fund go as high as 8% in the past

5 Year Income FundThis fund ties your money up for much longer, but pays a higher interest rate. I’ve been following the data on this one pretty closely, and was able to lock into this fund at 7.1%. Historically this one has gone as high as 9.5%

1 Month Rolling FundNo, not that type of rolling fund. This is a way to park cash for a very short term (just one month) at a very low interest rate. I don’t really see much point investing in this fund at 1.8% per year, but back when interest rates were higher, this fund flirted with rates near 3.8%, which changes the equation quite a bit.

Ethical Income FundsWhat I’m really interested in, however, are Plenti’s “ethical income funds.” These funds let you earn attractive, sustainable returns by investing in green loans for Australian homes. The background on these loans is interesting. As part of Australia’s climate change strategy, Aussie homeowners can get rebates and interest-free loans to install solar panels and green energy systems. These loans are partially subsidized by the Australian government, and help defray the costs of installation. However, the loans & rebates often don’t cover the full installation costs. To make up the difference, the government solicited bids from private companies who could offer special financing schemes to borrowers. Plenti won the bid, and is now the official company the government refers borrowers to when they need green energy financing. Bottom line: With Plenti, you can invest in loans to extremely creditworthy borrowers purchasing clean energy products for their homes and businesses. Plenti has two green energy funds: National Clean Energy FundThe purpose of this market is to finance the purchase and installation of products such as solar panels, solar water heaters, energy efficient air conditioning, low energy lighting, hybrid cars and trucks and batteries for solar systems. Your money will be held for up to 7 years, which is certainly a long time. But don’t let the low interest rate scare you. Remember, you can set a higher desired interest rate and wait until you get a match, or watch the lowest rates and strike when the price is right. (I’m currently locked into this fund at 5.9%)

South Australia Renewable Energy FundIn 2016, the state of South Australia suffered an infamous blackout which rendered the entire state powerless for 48 hours. Yes, that’s right: The. Entire. State. Was without power. For two whole days. In the middle of an Australian summer. The government put out an emergency bid to companies who could solve the state’s growing power woes. This prompted the interest of none other than Elon Musk, who not only accepted the bid to build a gigantic battery, but promised that Telsa would build it in 100 days, or it would be free. He kept his promise. The Hornsdale Battery is now the biggest lithium-ion battery in the world, and is helping to avert blackouts and lower costs throughout the country. In fact, it’s estimated that Tesla’s battery has reduced South Australia’s grid service cost by 90% Since then, the South Australian government has been gung-ho about green energy. And for that reason and others, loans in this fund pay out a bit more than the National Clean Energy Fund.

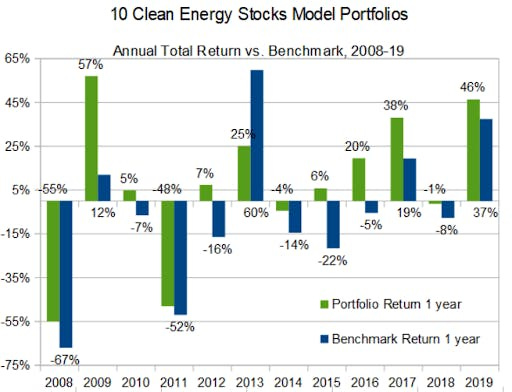

Does green energy have good returns?Up until relatively recently, investing in renewable energy was not exactly famous for producing great returns. Part of the reason is that as technology improves, the price of solar, wind, and other renewables continues to plummet. This has been great for consumers and of course for our planet, but bad for investors However, over the past half decade or so, this has started to rapidly change. In the US during that timeframe, renewables yielded 200% returns versus 97% for fossil fuels. Investing in green energy stocks is also becoming far less volatile than fossil fuels. Renewables have held up remarkably well even during the pandemic, compared with the near total collapse of oil and gas.

But remember, investing with Plenti is different from investing in green energy stocks. This is a way to support green energy indirectly, with less risk, and while enjoying a stable, fixed return What’s are the risks of investing in Plenti?One thing I love about Plenti is the lower risk profile. You’re lending to Australian homeowners who are looking to finance solar panels on their roof. Not exactly subprime lending. Lending risk is greatly reduced by the excellent demographics, and a special protection fund called the Provision Fund. Demographics

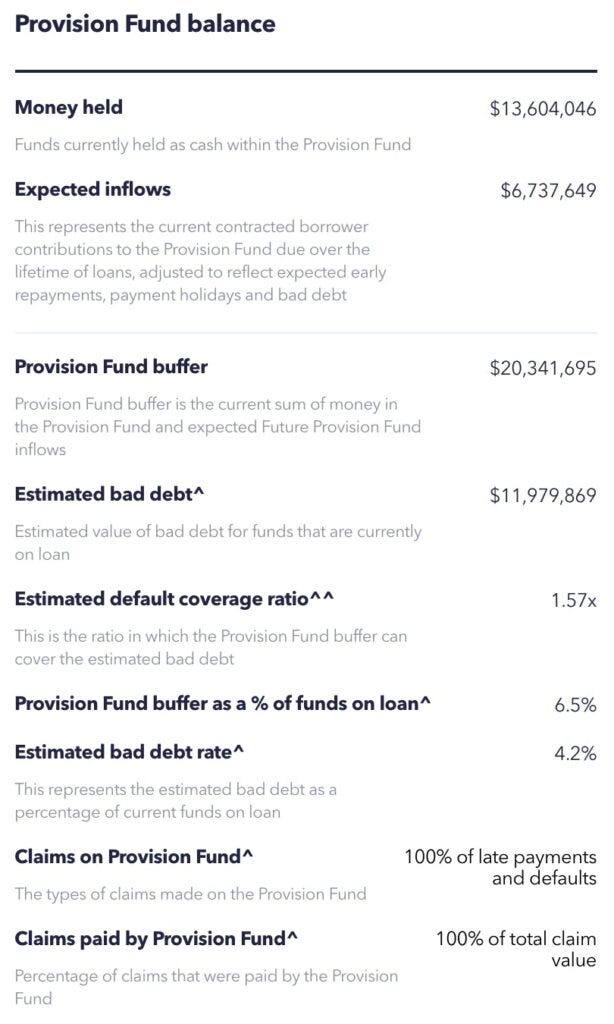

The Provision FundWe all know that sometimes even creditworthy borrowers are unable to repay their loans. So you’re probably wondering what happens if you fund a loan and the borrower defaults. To protect investors, Plenti has set up the Provision Fund; a pool of funds designed to protect investors in the event a borrower misses a payment or defaults. All borrowers pay a small amount into the fund, which reimburses investors in the event of a default. And so far it has a perfect track record. Since inception, every single Plenti investor has received 100% of their principal and interest payments. However, it is important to remember the Provision Fund is not a guarantee nor an insurance product. Even if they set aside compensation funds, if shit ever really hit the fan for some reason, there simply may not be enough to compensate everyone. Still, in my view this fund is a much stronger portection than the ‘buyback guarantee’ that other P2P marketplaces offer. Who can invest with Plenti?As an Australian company, Plenti is definitely geared towards residents and those with Australian bank accounts. But here’s the good news. The site doesn’t feature it, but Plenti is actually open to overseas & non-resident investors. They don’t have an online application for overseas investors, as the website is designed for Australian details only. But if you send an email to contact@plenti.com.au, they’ll give you a link to provide your details and create an account for you manually. Verify your identity, certify a few documents, and you should be good to go! Other newsM&A is heating up…Recent data is showing there were more takeover deals last November than in any other month in 2020. Last spring, mergers & acquisitions pretty much ground to a halt along with nearly everything else. But as of Q4, dealmaking has begun to bounce back, big time. Companies around the world have completed $760 billion worth of acquisitions — the most in any quarter since 2016 There are a number of reasons for all this activity. Some companies are clearly trying to scoop up a struggling businesses on the cheap. Others may be trying boost their top line revenue to counter-act any pandemic-driven downturn. (This is arguably one of the reasons Salesforce probably overpaid for Slack.) However, mega deals like this are not the only way to go. McKinsey has recently found that while making the right big acquisition can certainly pay off, making lots of smaller acquisitions is mathematically the way to get the most value. ShoutoutsFinally, I wanted to give some shoutouts to subscribers from around the world who are also killer newsletter authors.

How’d you like this issue? |

Older messages

MakerList has been acquired!

Monday, January 25, 2021

Hey everyone, It's been a while! I conceived of MakerList back in February as a newsletter for indie hackers. Each issue featured articles and case studies about founders who have grown their

🚀 Welcome to Alternative Assets

Monday, January 25, 2021

Unique investment ideas worth exploring

Anatomy of a deal

Monday, January 25, 2021

How I bought a website earning $12/year for $2700 upfront

You Might Also Like

Boring Strategy, Remote Nomad Jobs, GenFuse AI, Mochi Video AI, Notepad Online, and more

Wednesday, December 25, 2024

a powerful tool that transforms your ideas into a video BetaList BetaList Weekly Mochi Video AI a powerful tool that transforms your ideas into a video Remote Nomad Jobs 100% remote jobs for digital

💥 Make 2025 The Best Year of Your Life - CreatorBoom

Wednesday, December 25, 2024

Six Figure Local Newsletter, How Eddie Shleyner Built Very Good Copy, 10 Newsletter Success Stories Generating $1.1M in MRR, 4 Boring Websites That Make over $35k Per Month, 6 Things to Do if Your

🚀 This holiday, learn from the best & transform 2025

Wednesday, December 25, 2024

These experts have built $100M+ businesses—now they're here to help you do the same. fdrlogo Hey Friend , What do 30000+ Foundr students know that you don't? They know the difference between

🗞 What's New: AI video editing is coming to Instagram

Tuesday, December 24, 2024

Also: Mobile app earnings jumped 15.7% in 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[CEI] Chrome Extension Ideas #171

Tuesday, December 24, 2024

ideas for Amazon, Podcast, Twitter, and AI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Top angel investors in the U.S.

Tuesday, December 24, 2024

Inspiration for who to raise from when you're raising your early rounds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🎁 🎄 HO HO HO! Here's the ultimate gift for your business journey

Tuesday, December 24, 2024

Unwrap your holiday gifts and start building your dream in 2025! fdrlogo Hey Friend , HO HO HO! Your holiday gifts have arrived! This isn't your typical holiday surprise—these gifts are proven

Biggest rounds of 2024

Tuesday, December 24, 2024

+ Sriram Krishnan joining Trump's government View in browser Sponsor Card - Up Round-35 Good morning there, Welcome to the last Sifted Daily newsletter of 2024, in which we look back on the biggest

The Corner Office & Low Exp 👩💼

Monday, December 23, 2024

And some holiday news͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🗞 ICYMI: insights on o3, AI job disruption, marketing on Bluesky

Monday, December 23, 2024

Also: a new social network ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏