Accelerated - 🚀 How much is Coinbase worth?

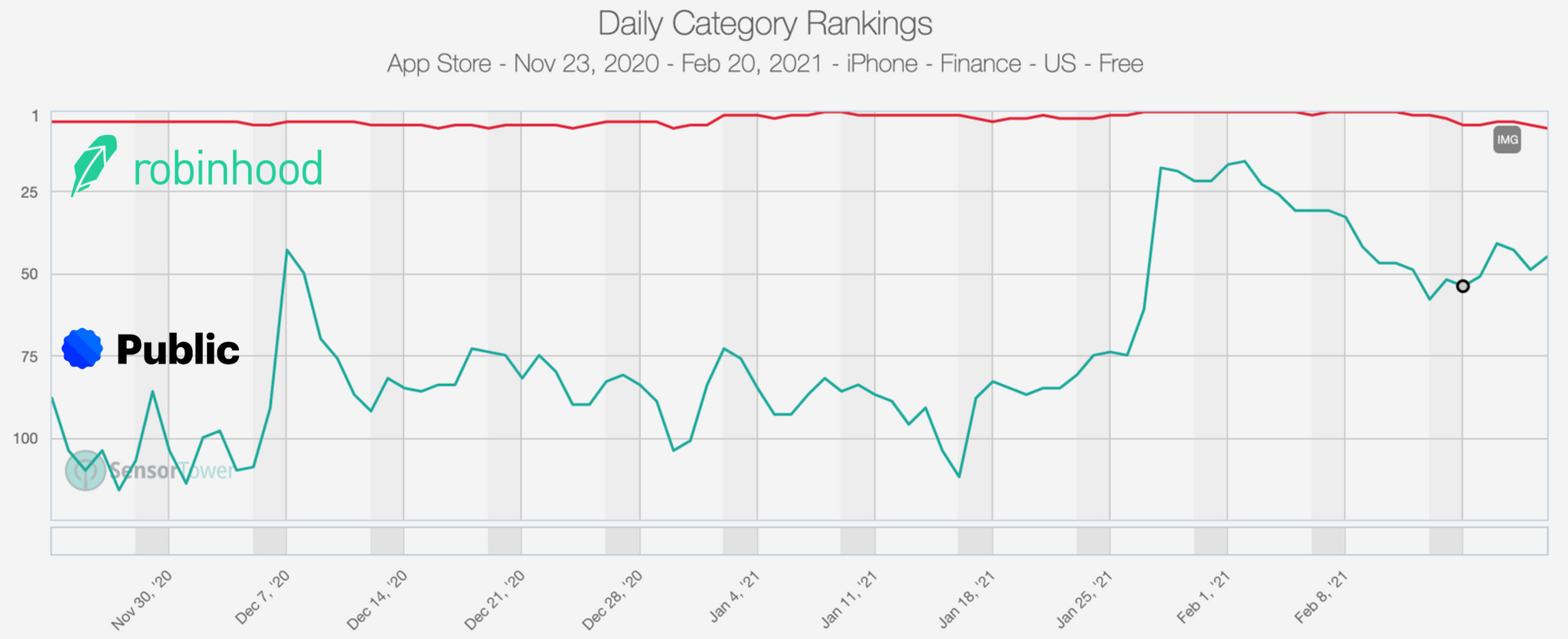

We’re excited to share our latest blog post, a deep dive into the future of retail investing! For the TL;DR version, check out our tweetstorm with key takeaways. Over the past decade, we’ve seen a dramatic evolution in how consumers access investment products. Retail investors are more empowered than ever before, as we’ve seen with “meme stocks,” crypto, and sports cards. Now, they're looking to invest in the alternative assets that are available to institutional investors and wealthy individuals - everything from private startups to real estate to collectible cars! Startups like Rally Rd, Otis, and Vinovest have democratized access to these assets by giving consumers the opportunity to buy fractional shares in high value assets, from vintage Pokemon cards to fine wine. We’re excited to see the next wave of companies in this space - marketplaces that allow consumers to trade these assets among themselves, with social features to “gamify” the investing experience. Would love to hear your feedback & companies we should be looking at in this space! news 📣📦 Shopify reports Q4 earnings. Thanks to a strong holiday season, Shopify crushed analysts’ expectations for Q4 earnings- revenue grew 94% YoY (to nearly $1B!), while net income grew a stunning 198%. 2020 was a record year, with 457M consumers worldwide spending a total of $120B at Shopify stores. The company warned that 2021 growth will likely decelerate as IRL shopping resumes, though newer initiatives like Shop Pay and the Shopify Fulfillment Network should continue to fuel future growth. 💰 Coinbase preps for direct listing. It’s been a big week for crypto! Bitcoin continues to climb - it crossed $50K for the first time ever and is now trading at a $1T+ market cap. Meanwhile, Coinbase was reportedly valued at $100B in a secondary transaction. The company plans to go public via direct listing, and has been selling shares to determine a reference price for the offering. As a point of comparison, there are only 150 companies worldwide with a $100B+ market cap. 🇦🇺 Facebook vs. Australia. The ongoing battle between Facebook and the Australian government reached a breaking point this week. Australia is on the cusp of passing a new law that will require tech platforms to pay publishers for hosting their content. Google has been signing deals with publishers (its search product can’t function without news), while Facebook refuses to play ball, and instead restricted users & publishers in Australia from posting local or international news. If you’re interested in learning more, we’d recommend checking out this thoughtful piece from Casey Newton. Dispo, a new social app co-founded by David Dobrik, launched in TestFlight this week and basically broke the Internet! You may remember Dispo as “David’s Disposables,” a nostalgic camera app that went viral on Christmas 2019. The app was based on an Instagram profile that Dobrik created for photos taken with a disposable camera. 2020 was a busy year for Dispo! The company hired a full team, raised a seed from Alexis Ohanian’s new venture fund (Seven Seven Six), and built a new product. The app lets you take photos with a cool retro filter, but they don’t develop until 9am the next day. Instead of immediately taking, re-taking, and editing your photos for social media, Dispo forces you to live in the moment. The new version of Dispo also includes social features. You can add photos to public or private “rolls,” and invite other users to collaborate on shared rolls. Gone are the days of trying to create an iCloud or Google Drive album just to share photos from a trip or party with friends! Unsurprisingly, the Dispo beta quickly hit the 10k user limit on TestFlight. We’re among the lucky early users, and think the team is onto something special. Dispo feels like the “good old days” of the Internet, before all of our profiles were carefully curated and we over-analyzed every post. We can’t wait until more people can try it out! what we’re following 👀A look at the demise of Ample Hills, a VC-backed ice cream brand with an incredible product (we ate way too much of it 😂) that struggled to scale. The Washington Post investigates why ESPN pulled the plug on its esports division. Greg Isenberg on the new apps defining the “spontaneous Internet.” TechCrunch interviews the team behind Olive, a sustainability-oriented startup that aggregates your weekly e-commerce purchases into one reusable package! The retail investing space continues to heat up, with commission-free trading app Public raising $220M a $1.2B valuation. Public, which launched 18 months ago, competes with other consumer brokerages like Robinhood and Webull. The app now has 1M users (compared to 13M for Robinhood). Public is more social than many other brokerage apps - you can follow other users, see a live feed of trades, and even chat about individual positions. The company is also trying to differentiate via their business model. Both Public and Robinhood previously made money from payment for order flow (PFOF), which is when market makers (like hedge funds & investment firms) pay brokers to execute their trades. In the wake of the GameStop saga, Public announced it would end PFOF in favor of optional tips. Why? Customers want their broker to send orders to the market maker with the best stock price, while the broker could (theoretically) send it to whoever pays the most. Whether or not this actually happens is debatable - we’d recommend checking out a16z’s post or this video from Robinhood’s CEO for more info! How will this impact Public? Retail investors care about transparency and aligned interests (especially post-GameStop!), and this move may help the company acquire customers. However, costs will go up for Public now that it has to route trades directly to exchanges, and the optional tips may or may not fully replace PFOF revenue. Are you a Public user, a Robinhood user, or both? Comment below to let us know! jobs 🎓Carrot - Global Solutions Associate (Remote) Mercury - Special Projects, Onboarding Specialist, Community Experience (SF) Kapwing - Customer Relations Specialist (SF) Pave - Product Ops Analyst (SF) Monzo - Strategy Associate (SF)* CircleUp - Strategy Ops Associate (SF)* Rivian - Junior Product Designer (Palo Alto) Techstars - Program Manager (LA)* Nyca Partners - Investment Associate, Finance & Ops Associate* (NYC) Olive - Software Engineer (NYC) Rhapsody Venture Partners - Associate (Boston) Hummingbird Ventures - Investor (London) *Requires 3+ years of experience. internships 📝White Star Capital - Summer Analyst (Remote) thredUP - Marketing Comms Intern (Oakland) Uber - Marketing Associate Intern (SF) Plaid - New Business Associate Intern (SF) Impossible Foods - MBA Product Management, Social Good Interns (Redwood City) Tile - Product Management Intern (San Mateo) Snapchat - Marketing Ops Intern, MBA PM Intern (LA) DocuSign - Program Manager Intern (Chicago) Zendesk - Product Management Intern (New Jersey) Gainful - Social Media Intern (NYC) TikTok - MBA Monetization Strategy & Ops Intern (NYC) puppy of the week 🐶We’re featuring our fluffy angel and BFF Kai (for probably the fifth time) in honor of her birthday yesterday! 🎉 Kai is a six-year-old bernedoodle who lives in the Bay Area. She enjoys attempting to train her baby sister Moka, working in venture capital (see middle photo of her in the office), and trying to eat grass. If you’d like to wish Kai a happy birthday, you can do so here (we’ll read her the messages!). You can also follow her on Instagram @kaithebernedoodle. Hi! 👋 We’re Justine and Olivia Moore, identical twins and venture investors at CRV. Thanks for reading Accelerated. We’d love your feedback - feel free to tweet us @venturetwins or email us at twins@crv.com. If you liked this post from Accelerated, why not share it? |

Older messages

🚀 Can Snap beat TikTok in short-form video?

Sunday, February 7, 2021

Plus, announcing our latest investment!

🚀 A note on Internet culture

Sunday, January 31, 2021

Plus, we need your thoughts on dating apps!

🚀 Netflix crosses major milestone

Sunday, January 24, 2021

Plus, what % of companies are now starting fully remote?

🚀 Airbnb presses pause on D.C.

Sunday, January 17, 2021

Plus, apps to level up your life in 2021!

🚀 Trump gets deplatformed

Sunday, January 10, 2021

Plus, Roblox shakes up its plans for going public!

You Might Also Like

AI Assistants Will Be Great (Especially for the Biggest Companies)

Friday, February 14, 2025

Plus! Short Selling; Crypto Treasury Gresham's Law; The Joy of Higher Rates; Labor Substitution; Pricing Black Swans AI Assistants Will Be Great (Especially for the Biggest Companies) By Byrne

🏈 The Super Bowl flight that upped tariffs

Friday, February 14, 2025

The US stamped 25% tariffs on key metal imports, France is coming for America's AI reputation, and chocolate tinned fish | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Why Economists Got Free Trade With China So Wrong

Friday, February 14, 2025

“The China Shock” gets revisited View this email online Planet Money “The China Shock” Revisited by Greg Rosalsky By now, many economists are hoarse screaming that higher tariffs and a trade war will

FinTech is People - Issue #508

Friday, February 14, 2025

FTW Opinions: When fintech principles shape government finance, the stakes go beyond efficiency—trust, security, and oversight are on the line ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Special Announcement From Harry Dent

Friday, February 14, 2025

Harry Dent February 11, 2025 Many of you have heard me talk about John Del Vecchio, one of our trusted partners at HS Dent. He runs two highly successful programs, Microcap Millions and FAST Profits,

Using AI as a Retirement Vision Board

Friday, February 14, 2025

This tool paints a picture of your financial future ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Get a life insurance quote in seconds

Friday, February 14, 2025

And get approved just as fast ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

❌ Altman dissed Musk's OpenAI bid

Friday, February 14, 2025

Musk bid nearly $100 billion for OpenAI, Europe prepared its own diss for the US, and the egg undercurrent | Finimize TOGETHER WITH Hi Reader, here's what you need to know for February 12th in 3:04

Fossicking in the dark or twenty-twenty foresight?

Friday, February 14, 2025

Rishi Khiroya and Lydia Henning If you asked people what skill they would most love to have, you might receive answers like 'to fly', 'to be invisible' or even 'predicting the

I love you(r high credit score)

Friday, February 14, 2025

plus Benson Boone + pizza perfume ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏