Powerful Congressman buying cannabis stock, pushing legalized weed

This is a two-person newsletter that often includes essential reporting and research you won't find anywhere else. Here's why:

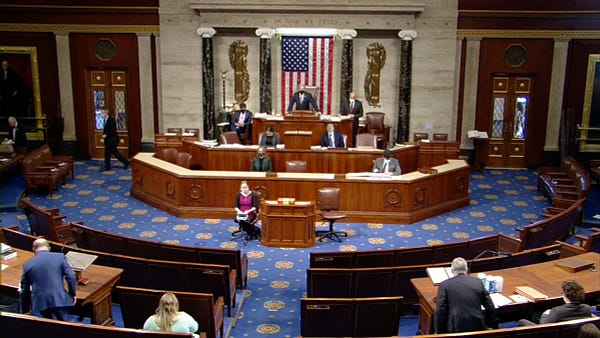

You can support this work with a paid subscription. Popular Information only exists because of readers like you. We believe that independent accountability journalism is vital and we need more of it. If you agree, please join us. Congressman John Yarmuth (D-KY), the powerful chairman of the Budget Committee, has recently purchased several cannabis industry stocks while championing legalization legislation that could increase their value, a Popular Information investigation reveals. The transactions illustrate the ethical problems created when members of Congress, whose official actions can make or break industries, trade individual stocks. According to a filing with the Clerk of the House Representatives, obtained by Popular Information through CongressTrading.com, Yarmuth purchased three cannabis industry stocks on November 5: Canopy Growth Corporation, Aurora Cannabis, and Tilray. The law only requires Yarmuth to report the range of the purchase price. The Congressman purchased between $1,000 and $15,000 of each stock. On December 3, Yarmuth promoted his cosponsorship of the Marijuana Opportunity Reinvestment and Expungement (MORE) Act, which would decriminalize and deschedule cannabis in the United States: The MORE Act passed the House on December 4. The bill was initially scheduled for a vote in September, but that plan was shelved because of pre-election messaging concerns. The House did not announce their intention to reschedule the vote until late-November. It was the first time either chamber of Congress has passed a bill to legalize marijuana. The bill envisioned sales of cannabis products nationwide, along with a "federal five-percent tax on cannabis retail sales." Although the MORE Act did not receive a vote in the Senate, it was nevertheless viewed as an important step toward marijuana legalization. On February 5, after the new Congress convened with Democrats controlling both chambers, Yarmuth signed on as a co-sponsor to legislation that would make "cannabidiol derived from hemp, and any other ingredient derived from hemp lawful for use." Cannabidiol, also known as CBD, is a popular derivative of marijuana. Although CBD is widely available, the marijuana companies that Yarmuth invested in produce CBD products and would benefit from its formal legalization. The momentum for marijuana legalization has increased the value of Yarmuth's November stock purchases. Tilray, for example, was valued at $7.82 per share when Yarmuth purchased the stock on November 5, 2020. When the market closed on Monday, Tilray was trading at $26.29 per share. Yarmuth has recently increased his holdings. In new disclosures filed on February 19, Yarmuth reported he purchased an additional $1,000 to $15,000 shares of each of the three stocks — Canopy Growth Corporation, Aurora Cannabis, and Tilray — on February 12. The future value of these stocks, however, will be influenced by the actions of Congress. Here is how Investors Business Daily analyzed the situation:

But Yarmuth, as one of the most powerful Democrats in Congress, will help determine how much of a priority marijuana legalization will receive in the 117th Congress. Further, as a committee chairman, he likely has insight into the strategic priorities of Pelosi and other House leaders. Craig Holman, an expert on government ethics with Public Citizen, told Popular Information that Yarmuth's pattern of trading "certainly doesn't look good." Holman said that by trading in stocks that could be impacted by legislation he is sponsoring, it gives the impression that Yarmuth is "using his official office for personal gain." Christopher Schuler, Yarmuth's communications director, defended the stock transactions in a statement to Popular Information. "Congressman Yarmuth purchased the stocks after seeing four states legalize the use of recreational marijuana in the November elections. He was transparent about it and followed all House Ethics and financial disclosure rules," Schuler said. Republican Congressman invests in cannabisYarmuth is not the only member of Congress to profit from the rise of marijuana stocks in recent months. Congressman Brian Mast (R-FL) purchased between $15,000 and $50,000 of Tilray stock on November 6, the New York Times previously reported. Mast was one of just five Republicans who voted for the MORE Act. Mast lost his legs while serving in the military in Afghanistan and "generally supports exploring alternative medical treatments." Nevertheless, the New York Times notes that the timing of his Tilray purchase could be seen as "undermining trust." A spokesperson for the Congressman said that Mast "bought and sold this stock a few times over the past few years." Taking STOCKThe STOCK Act, which was passed in 2012, "makes it illegal to use inside information to trade but does not preclude lawmakers from buying or selling individual stocks." The law was approved "in the wake of studies showing lawmakers financially benefiting from their government work." Members of Congress were "receiving extraordinarily high returns, better than any hedge fund." One 2011 study, Abnormal Returns From the Common Stock Investments of Members of the U.S. House of Representatives, noted that "members of Congress have access to non-public information that could have a substantial impact on certain businesses, industries, or the economy as a whole." The study found that "common stocks purchased by Members of the U.S. House of Representatives earn statistically significant positive abnormal returns," beating the overall market by about 6% per year. But, despite the passage of the STOCK Act, serious problems remain. Former Senator Kelly Loeffler (R-GA), for example, came "under fire for selling $20 million in stock after a briefing in the weeks building up to the coronavirus pandemic." Loeffler sold stock in companies that were ultimately hit hard by the pandemic including Ross Stores, TJX Cos. (TJ Maxx and Marshalls), and Lululemon. She also purchased stock in "Dupont, which produces critical protective gear to combat transmission of the virus" and a "telecommuting company Citrix." The Justice Department and Senate Ethics Committee investigated Loeffler but ultimately cleared her of wrongdoing. Insider trading allegations under the STOCK Act are notoriously difficult to prove because they require prosecutors to establish that the member of Congress obtained "'material' 'non-public' information during the course of his or her official duties" and then used that information to make a trade. Loeffler claimed she wasn't involved in stock transactions made on her behalf in February and March. No member of Congress has ever been successfully prosecuted under the law. The allegations, however, dogged Loeffler throughout her reelection bid, which she lost. A simple fix would be to ban members of Congress from trading in individual stocks. Absent such a ban, the SEC could take action. Andrew Ross Sorkin reported that the SEC could implement a rule that would require members of Congress to "personally answer a questionnaire every time a trade is executed, irrespective of whether the trade is instigated by them or a financial adviser." The members would be required to disclose, for example, whether they "attended any meetings in the past 28 days that could be perceived as being related to or possibly influencing your decision to make this trade." The point of these questions would be to reduce or eliminate questionable stock trading by increasing transparency. At present, there are many members of Congress who continue to make money by actively trading individual stocks. But how they arrive at their trading decisions remains shrouded in secrecy. |

Older messages

After January 6 riot, major credit agency donated to Republican objectors

Monday, February 22, 2021

After the deadly riot at the United States Capitol on January 6, dozens of companies suspended donations to the 147 Republicans who tried to overturn the presidential election. Many others paused all

Immoral hazard

Thursday, February 18, 2021

Kroger, the nation's largest grocery store chain, ended hazard pay for its workers on May 17, 2020. The company seems determined not to reinstate any additional pay for frontline employees. It is

The truth about Cuomo

Tuesday, February 16, 2021

As the pandemic took hold of the United States last March, upending life as Americans knew it, Trump offered little consolation. The president claimed COVID would

Impeachment, Take 2

Saturday, February 13, 2021

Tuesday was the first day of Trump's second impeachment trial. And honestly, I was torn. On the one hand, the day featured a gripping account of…

The next insurrection

Saturday, February 13, 2021

The January 6 siege of the United States Capitol was not an isolated incident. It is the latest in a series of attacks by violent extremists seeking to undermine federal and state governments. Now, a

You Might Also Like

Open Thread 364

Monday, January 13, 2025

... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Searching for Justice and the Missing in the New Syria

Sunday, January 12, 2025

The prisons are open, the secret files are unlocked. Now Syrians are trying to figure out how to hold war criminals accountable. Most Read Leaked Meta Rules: Users Are Free to Post “Mexican Immigrants

Monday Briefing: Number of missing rises in L.A.

Sunday, January 12, 2025

Plus, how cured ham fixed an antique organ in France View in browser|nytimes.com Ad Morning Briefing: Asia Pacific Edition January 13, 2025 Author Headshot By Emmett Lindner Good morning. We're

GeekWire's Most-Read Stories of the Week

Sunday, January 12, 2025

Catch up on the top tech stories from this past week. Here are the headlines that people have been reading on GeekWire. ADVERTISEMENT GeekWire SPONSOR MESSAGE: GeekWire's special series marks

9 Things That Delighted Us Last Week: From Fleece Shellaclavas to Portable Sound Machines

Sunday, January 12, 2025

Plus: Ceremonia's new nonaerosol dry shampoo. The Strategist Logo Every product is independently selected by editors. If you buy something through our links, New York may earn an affiliate

LEVER WEEKLY: How To End This Disaster Movie

Sunday, January 12, 2025

We get to decide whether the LA fires are a wake-up call or a funeral pyre. How To End This Disaster Movie By David Sirota • 12 Jan 2025 View in browser View in browser A helicopter drops water on the

6 easy(ish) ways we’re resetting for the new year

Sunday, January 12, 2025

Future you will thank you View in browser Ad The Recommendation January 12, 2025 Ad How Wirecutter journalists reset for a fresh year An image of Wirecutter's picks for best kids backpacks, best

☕ Fannie and Freddie

Sunday, January 12, 2025

Can the NHL pull off outdoor games in Florida? Morning Brew January 12, 2025 | View Online | Sign Up | Shop Walking a bike on a snow-covered bridge in Amsterdam. Marcel Van Hoorn/ANP/AFP via Getty

DEI Loses Popularity, Death Toll Rises in LA, and a Special Kind of Library

Sunday, January 12, 2025

Meta is ending its key diversity, equity and inclusion programs, joining corporate giants Ford, McDonald's and Walmart that have pulled the plug on DEI initiatives. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

UW and computer science student reach truce in ‘HuskySwap’ spat

Saturday, January 11, 2025

Blue Origin set for first orbital launch | Zillow layoffs | Pandion shutdown | AI in 2025 ADVERTISEMENT GeekWire SPONSOR MESSAGE: GeekWire's special series marks Microsoft's 50th anniversary by