Gumroad's crowdfunding campaign raised $5M in 24 hours: - **Anyone could own a piece of Gumroad** for a minimum $100 investment, and over 8,000 people seized the chance. But not everyone's happy: ConvertKit CEO Nathan Barry blasted Gumroad's crowdfun

Gumroad's crowdfunding campaign raised $5M in 24 hours:

-

Anyone could own a piece of Gumroad for a minimum $100 investment, and over 8,000 people seized the chance. But not everyone's happy: ConvertKit CEO Nathan Barry blasted Gumroad's crowdfunding campaign, claiming that the company doesn't take care of its creators.

-

A new report estimates that extended reality (XR) will be a $160B industry by 2023. Today, most XR spending comes from consumer products. However, the manufacturing space will overtake that this year, making it a great time for interested founders to dive in.

-

CryptoKitties sold an animated NFT for nearly $600K as the "KittyVerse" continues to explode. Don't have any cartoon cats to sell? No worries: Dru Riley recommends rewarding your early adopters with retroactive airdrops.

Want to share your ideas with nearly 70K indie hackers? Submit a section for us to include in a future newsletter. —Channing

🛣 Gumroad's Call for Investors Raises $5M in 24 Hours

from the Indie Economy newsletter by Bobby Burch

Well, that was fast: In less than 24 hours, creator marketplace Gumroad raised $5M from unaccredited investors, pushing the company to a $100M valuation.

Gumroad's investor rush

Gumroad 101: Gumroad is a platform where creators can sell their work via downloads, email newsletters, integrations on websites and social media, and affiliate sales. Gumroad CEO Sahil Lavingia founded the company in 2011, and has raised more than $8M to date. Gumroad earned $9.2M in 2020 revenue, up 87% from 2019.

The no-background: San Francisco-based Gumroad listed its round on the crowdfunding service Republic, allowing investments from anyone willing to spend at least $100. Gumroad offered 6% ownership through the funding campaign.

Tapping into a new rule: Gumroad is one of the first US companies to take advantage of a new Securities and Exchange Commission rule allowing companies to raise up to $5M a year via crowdfunding. Sahil told Techcrunch that the new rule may change how Gumroad raises capital in the future.

A new round of critiques

Not everyone is thrilled with Gumroad's new funding plan. ConvertKit CEO Nathan Barry, voiced his concerns via Twitter, criticizing Gumroad for its poor management. He also cautioned people about backing the company, alleging that Gumroad's original team has no equity. Claiming that the company doesn’t take care of its creators, he warned investors about the company's alleged carelessness:

If you don't take care of the creators you serve, or the creators who built the product, it's hypocritical to ask a new batch of creators to invest in your platform.

Indie Hackers has not independently verified Nathan's claims.

Competitive creator economy: Creators on Gumroad have sold more than $418M worth of products since 2011. In 2020 alone, the company processed $143.8M in creator sales. As companies continue to tap into the $10B creator economy, their successes will shape the norms, culture, and expectations of the space.

While spats between founders serving the creator economy are rare, they are inevitable as companies battle to be the definitive voice on creator economy values. Creators and their supporters, however, will always be the ultimate deciders.

Do you sell on Gumroad? What are your thoughts on its crowdfunding plan? Share in the comments.

Discuss this story, or subscribe to Indie Economy for more.

📰 In the News

from the Volv newsletter by Priyanka Vazirani

🏧 Bitcoin ATMs are rapidly springing up across the US. Customers can buy or sell digital currency, and sometimes extract hard cash.

🦍 Reddit's WallStreetBets has raised over $338K to save gorillas.

🧾 Wikipedia to charge Google, Amazon, and Apple for using its content.

👀 Apple will prompt Russian users to install certain government-approved apps when they begin using an iOS device.

⬇️ Google Play is dropping commissions for developers from 30% to 15%, giving 99% of developers a 50% fee reduction.

Check out Volv for more 9-second news digests.

🛠 Extended Reality is Extending into the Manufacturing Space

from the Exploding Topics newsletter by Josh Howarth

Extended reality is predicted to be a $160B industry by 2023, and the market is shifting from consumer spending to manufacturing products. The shift is predicted to be complete by the end of the year, so interested founders should explore this emerging market very soon.

What is extended reality?

Extended reality (XR) is the combination of real and virtual environments via technology, including AR, VR, and wearables.

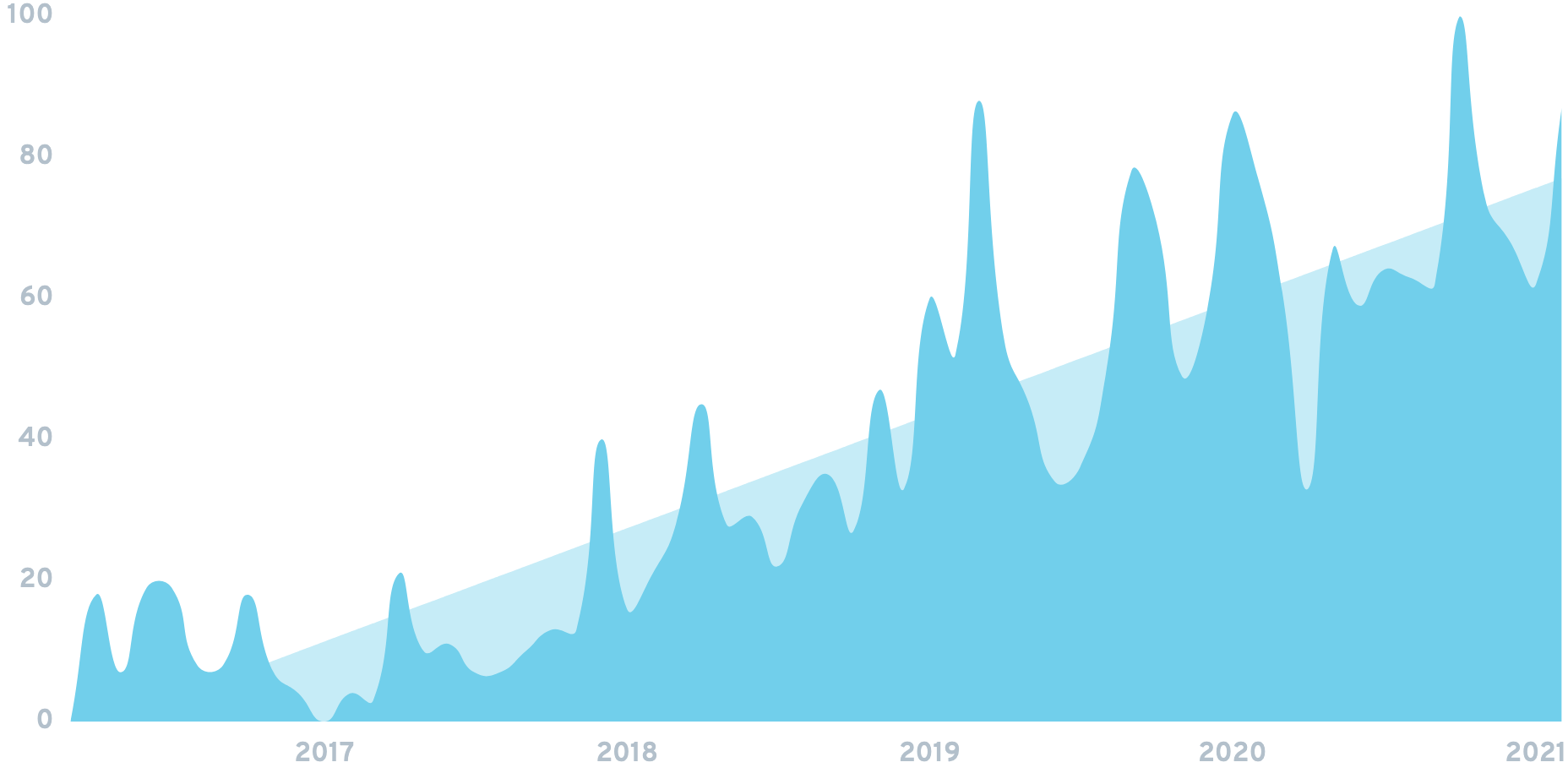

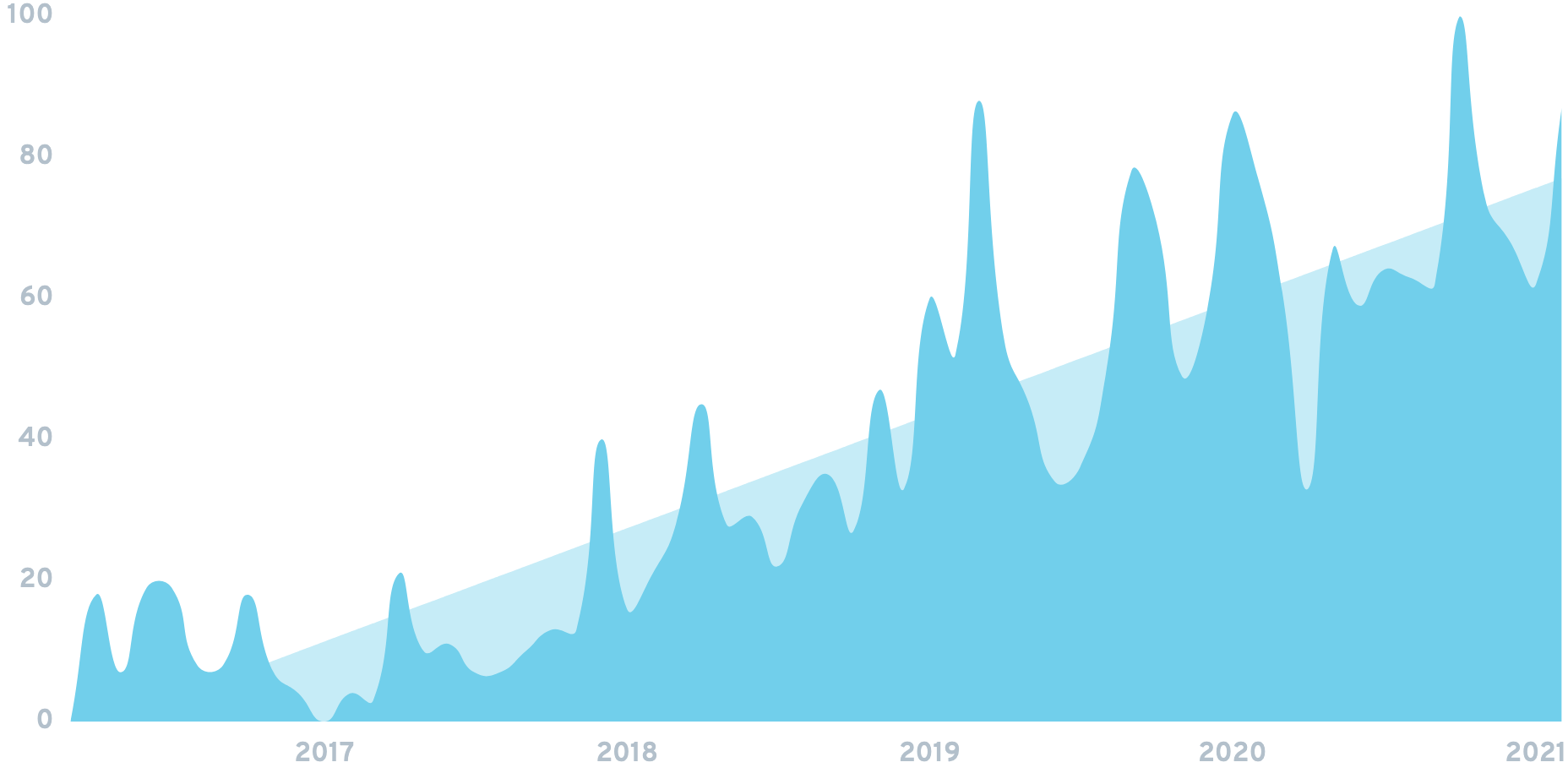

Searches for “extended reality” have increased by 8.6x over the last five years, and by 1028% over the last six months.

What sets the XR market apart from traditional VR is XR’s large number of commercial and industrial applications.

53% of extended reality spending comes from consumer products. But Accenture reports that the XR manufacturing space will overtake consumer spending this year.

The same study estimates that XR spending by the manufacturing and construction industries alone will reach $35B by 2023: That's nearly 2x what the entire industry is worth today.

What’s Next:

Examples of industrial and B2B XR startups include:

Varjo: Industry-focused XR hardware company known for its “dual-resolution displays.” Use cases for Varjo’s hardware include industrial design, research, training and health care. The company has raised $99M to date, including a $54M Series C in September.

Nreal: China-based XR startup that develops a line of lightweight mixed reality headsets. The company raised a $40M seed round in September.

Labster: Virtual lab startup focused on the university and high school market. Labster’s user base has increased 15x since last March. Labster raised a $9M round in August to fund expansion into the Asian market.

Check out the full post to see this week's other three exploding topics.

And join Exploding Topics Pro to see trends 6+ months before they take off.

Discuss this story, or subscribe to Exploding Topics for more.

🤥 Marketing Lie: You Should Only Highlight Your Best Product Reviews

from the Demand Curve newsletter by Julian Shapiro

The lie: Only highlight your best product reviews.

The truth: Imperfect reviews are more valuable, and generate more sales than 5-star reviews.

Here's why: When a review weighs the pros versus the cons, and concludes that the product was worth purchasing anyway, people see the review as real and authentic.

So don't bury slightly negative reviews.

Subscribe to Demand Curve for more.

🖼 How Founders Can Incorporate NFTs for Growth

from the Trends.vc newsletter by Dru Riley

Non-Fungible Tokens (NFTs) are all the rage, with a recent piece of digital artwork selling for $69M. Founders don't have to own Dorsey's first tweet to use NFTs to enhance their products.

What are NFTs?

The no-background: Traditional art is hard to secure, sell, authenticate, store, tokenize, and collateralize. In-game items have weak property rights. Communities have weak alignment.

Non-Fungible Tokens represent one-of-a-kind items. Physical, non-fungible assets include the Bubble Palace, this 1993 MVP Trophy and Michael Jordan's "Flu Game" shoes. There are no equivalents. Here's another way to look at it:

- Bitcoins are fungible. Tradable 1 for 1.

-

This CryptoKitty is non-fungible. It's 1 of 1.

NFTs are digitally scarce. They are easier to store, sell, authenticate, collateralize, tokenize, and value, and they have stronger property rights than physical assets.

NFT use cases:

-

Art: Help prove ownership and authenticity.

-

Voting: "Burn" tokens to affect change.

-

Games: Buy, sell and trade in-game items.

NFT marketplaces:

Famous NFT artists:

The future of NFTs

Predictions: Creators and communities will retroactively airdrop tokens. RAC used Zora to give early Twitch, Bandcamp and Patreon fans $RAC.

NFTs will become cash-flowing alternative assets. (Guy J sold royalty rights to "Cotton Eyes" for $26K.)

Projects will piggyback on the success of others with inter-operable NFTs. KittyRace and KittyHats build on CryptoKitties. These are two, of many, projects in the KittyVerse.

Opportunities for founders

Monetize trust and attention:

Reward early adopters with retroactive airdrops: RAC used Zora. Roll and Unite are other options. Seed Club offers social-tokens-as-a-service.

Incentivize attendance: The Proof of Attendance Protocol lets users collect badges. See this live drop on The Nifty Show using Atomic Hub.

You can also check out who's bought/sold NFTs and A Beginner's Guide to NFTs.

Remember that belief drives the price of art and most currencies. Taxes, corporations and nations are also collective hallucinations. Timing and access, not price, are the primary sorting functions of drops. Brands build hype and leave money on the table with artificial scarcity. This is a flippers' profit.

What are your thoughts on NFTs? Would you invest in them?

More Reports

Go here to get the Trends Pro report. It contains 200% more insights. You also get access to the entire back catalog and the next 52 Pro Reports.

Subscribe to Trends.vc for more.

🐦 The Tweetmaster's Pick

by Tweetmaster Flex

I post the tweets indie hackers share the most. Here's today's pick:

🏁 Enjoy This Newsletter?

Forward it to a friend, and let them know they can subscribe here.

Also, you can submit a section for us to include in a future newsletter.

Special thanks to Jay Avery for editing this issue, to Nathalie Zwimpfer for the illustrations, and to Bobby Burch, Priyanka Vazirani, Josh Howarth, Julian Shapiro, and Dru Riley for contributing posts. —Channing