In the world of micro-acquisitions, speed is everything.

The average microangel sees way more deal-flow than their institutional VC counterpart.

The game is totally different because the expected returns, and the type of startups in those ranges, are fundamentally different.

VCs are largely uninterested in Micro-SaaS because of (1) the minute revenue scale and (2) the absence of potential for a billion dollar outcome.

That means the process to microacquire is also really different. It’s less bureaucratic, more human and reads a lot like building a friendship.

While you gain much from being able to 1:1 throughout the process, there’s a risk of inconsistency when approaching new leads from the same perspective you would a new friend.

It’s important not to waste hours in the day talking to people just for the sake of it, so communication needs to be effective, too.

My work on MicroAngel is asynchronous. I could be working on it for a few days, then not touch it for a week as I focus on other stuff.

My typical day might look something like:

7am to 9am: Family awakens, clean up, prep + eat breakfast, drop daughter off at school, head back home to kickoff day

9am to 11am: MicroAngel scouting, negotiating, meetings, documents, emails, process building, process support tickets

11am to 11.30am: Brain reset, walk the dog, move, hydrate

1130am to 12pm: Prep + eat some lunch, personal calls

12pm to 3.45pm: Focused work (usually Batch)

3.45pm to 4.15pm: Wind down, pick up daughter at daycare

4.30pm to 8.30pm: Dad / Husband / Home / Financial duties

8.30pm to 11pm: Focused work (usually Batch)

11pm: Wind down, hang out, play some Valheim

12am-3am: Sleep. I really try for 12am as often as possible

I don’t always follow this pattern, but my natural day will look like this. Of course, I don’t moonlight every night, but lately I have been as I’m also bootstrapping Batch from scratch.

If you’re surprised about only spending ~4 hours per day on focused work (minus evening moonlighting), that’s by design.

Generally, I find that more time is detrimental. You only really get about 4 hours of focused work anyways, even at a 9-5 job.

I’ve noticed that in eight hours a day you have time to fall twice as far behind your commitments as in four hours a day.

To hedge against that, I give myself less time, and because I have less time, I’m at least twice as intentional about it as I’d otherwise be.

We’re welcoming a second child in a few months (!) and I’m trying to get as much done as I can while also spending as much time with my 3 year old as possible before she instantly grows up into the big sister she is so excited to become.

Despite this, every day is very much unique, and I stay flexible.

I usually pick up my kid at school every other day (both my wife and I are business owners), which gives me some additional options and “normal business hours” for at least half the week.

The shuffle of life often gets in the way. It’s actually crazy.

Whether it be obligations or unplanned but necessary activities, holidays, you name it, things always come up.

It’s like Moore’s Law powered by how many kids you have and multiplied by the number of Jewish holidays in the year all-in-one.

That’s why I took the time to build a standard of procedure for myself as it relates to how I acquire assets for the fund.

Building, fixing and growing all feels like play so I don’t feel as much need to structure those tasks as intentionally as the way I invest my funds. I don’t have a background as an investor.

I’m also a university drop-out. I learned by reading a fuckload of books and making many dozens of mistakes over my career.

I’m more concerned about standardizing my rhythm of execution because consistency is the key to compounding growth, and the only way to be consistent is to follow and repeat a proven process.

Batch was recently featured as a Staff Pick on the Shopify App Store. That’s like, the Nobel Prize of Shopify Apps. You can probably imagine where most of my brain power has been going.

For that reason, it’s critical that I have a process I can follow so I can pick up where I leave off without any loss in momentum.

That’s been really helping me lately as the work expands and opportunities rush in. While most of my focus has been on a single deal I’ve been trying to materialize and close, there’s a clear responsibility to maintain conversations and new discovery.

By and large, I’ve secured the agility to make good on these opportunities as they appear, and I’m cautiously optimistic so far with the way my process has managed to support me.

I don’t necessarily have a standard of procedure laid out for each of the tasks in my process, since this is just me and I don’t expect to ever hand-off this process in the first fund.

Also, it’s a process that will only last about 4 months maximum.

I’m already about a third of the way there!

The plan is to be complete the acquisition phase and stop buying by end of May 2021 so I can begin transitioning fully to ops.

As I kicked off my work as a microangel, I started to ask myself how much investing I’d be doing and based on the lifecycle of the fund, that’s going to work out to about 25% of my time at the most:

Buying → Investing

Fixing → Operating

Improving → Operating

Growing → Operating

Roll up → Operating

Exit → Investing

All in all, I’ll spend roughly six months between the buying and exiting stages. Out of 24 months, that works out to about 25% of my time. Most of my time will be spent on improving and growing.

Given that distribution, I can’t justify spending too much energy building systems to support investing activities. It feels like an over-optimization relative the energy I should be spending on the businesses themselves.

Future-proofing and automating lead flow is something I should think about once a rolling fund becomes part of the conversation, and it’s far too early to be thinking about that. I haven’t even confirmed most of the fund’s hypotheses yet.

For that reason, I like to hit the ground running with every new opportunity. I’m objective about what I can see, feel and touch, and try to base most of my decision to move forward on hard data.

Sometimes, I’ll allow my experience and gut to flip the proverbial coin. For example, a prospective product the documentation of which is complete and detailed gives at least some indication as to the level of attention that was brought to bear on the product itself.

An eponymous concept called Conway’s Law proposes that any piece of software reflects the organizational structure that produced it. An organized team will likely approach production in a very organized manner, an envious quality I want to invest in.

I’ve learned that I actually have really great instinct, and have failed just about 100% of the time I’ve hesitated or questioned myself when I had a really strong hunch about something.

Don’t misconstrue guessing with instinct. Instinct is either innate or learned through trauma. My trauma is 10+ years in tech startups.

In fact, I’ve learned that by now, these hunches are just my subconscious formulating an agreement that something is worth my attention despite being unable to immediately quantify or quality what or why exactly that is.

I’m describing a context in which you recognize that neural pathways already exist relative to the topic at hand.

Merely recognizing this is a superpower, because it shows that even if you can’t quite put your finger on it, you’ve already confirmed this in the past.

When you take the time to dig deeper, in hindsight, your first reaction is usually the correct one. That rule of thumb turned out to be true.

Thus, when I started designing my process, I started from the perspective that there were things that would be important to me as a seller, and then filled in my current requirements as an investor.

Your process should enable or filter the transaction you are analyzing as quickly as possible.

It’s like time-to-value for SaaS applied to micro-acquisitions.

The quicker you can reach a binary outcome, the better your process is. Ripping out anything that slows or complicates it is probably the best thing you can do after having documented your approach.

You should still have a rock-solid process because regret is the absence of preparation. You don’t regret something you prepare for.

A powerful goal for micro-acquisition transactions is to aim for a 30 day closing period from the moment of discovery.

That sort of service-level agreement will create a forcing function causing you to move faster, and that new requirement will create a need for efficiency under load, which a process will enable.

With the why out of the way, let’s explore the how. I have an asynchronous, sequential approach to micro-acquisition deal-making.

It’s a human, simple playbook that cuts out as much fat out of the process as possible, with the goal to close in <30 days from the moment a new opportunity is discovered to closing.

Like all things in life, mine is a work in progress, and I regularly revisit the playbook as I discover and learn things.

Discovery

This is worth a whole post, and you know I’ve got you fam, but the main top-of-head headlines are the following:

Put the flow in “deal flow” — it’s about building a personal grapevine that you can pull new potential deals from regularly and reliably into your watchlist

Keep track of different online marketplaces and brokers. If you’re technical, creating listening tools can become a huge time-saver. I’d do this if I invested year-long

Keep track of indie hackers on Twitter and reach out plainly via DM

I’m focused on Shopify apps, so I do outreach via the App Store directly. I try to avoid using support channels because I find that highly annoying as an app developer

Take a look at Google Trends, search the trending keywords, discover tools that rank well for keywords but may not be large, and reach out to gauge their size + interest to sell

Find interesting tools advertising on social and reach out through LinkedIn or Twitter to the CEO

etc.

Discovery implies a state of learning, and that means you need to put yourself out there and try different things while wearing a Humbling Hat that opens you up to pattern finding.

Very early in my career, I discovered that the secret to raising money from VCs relies on actually building a relationship.

Attempting to close any kind of deal cold, in one shot, is next to impossible. You’re setting yourself up for failure.

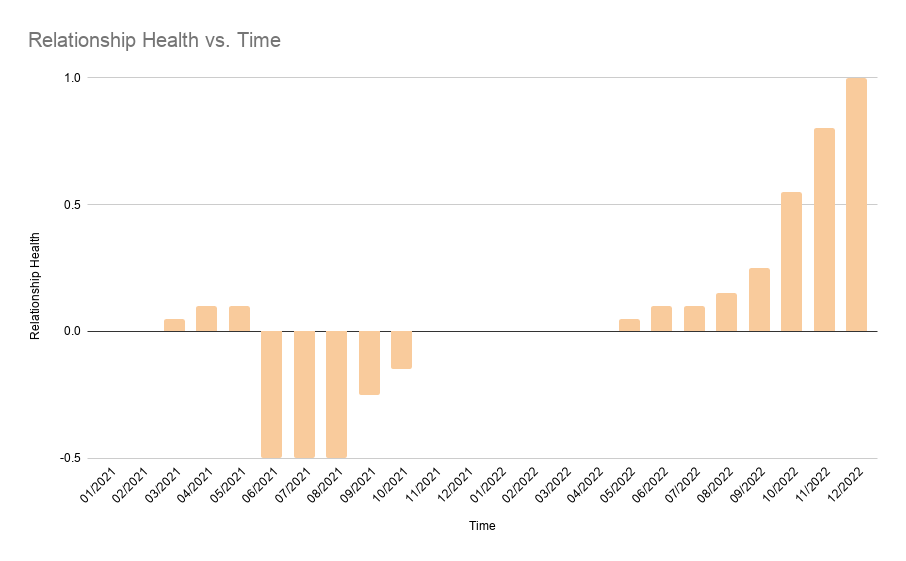

I’ve found that a great way to visualize your progress is to imagine a literal chart where the x axis is time and the y axis is an index between -1 and 1 representing how much the other parties knows, likes and trusts you.

On the previous VC example, consider a young, inexperienced founder knocking on doors, attending events and generally trying to gain attention from investors from the outside in.

Eventually, the founder meets a VC. The relationship is neutral. The investor identifies some early potential in the individual and invites them to stay in touch.

At this point, the founder reads “No,” gives up and starts to reach out to other investors in a haphazard way, indicating to the original investor that the founder is not very deliberate.

Worse, there may not have been any followup or meaningful progress since first meeting, and the early relationship suffers for it.

Eventually, the founder gives up on raising funds and starts focusing on their craft. A breakthrough occurs and the investor takes notice of the founder, and tries to gain their attention to explore an investment.

The story, progress and what happens over time charts the progress of the deal. That accumulated progress either leads you closer to the transaction or pushes you further from it.

The point is that deals don’t always happen quickly, and you ought to keep track of the progress of products on your watch list rather than buying and discovering your velocity afterwards.

In fact, continued progress will excite you and likely cause you to graduate watchlist items into new opportunities.

On a given week, I probably discover between 5 to 20 deals. A solid 40% of that is outreach, another 40-50% is marketplaces, and the rest is referrals, which I’m blessed to be receiving.

Discovery is by far the most asynchronous of all the tasks in the playbook. That’s why you need a clear bucket to place these opportunities into as you will inevitably discover them while doing other stuff.

Watch list

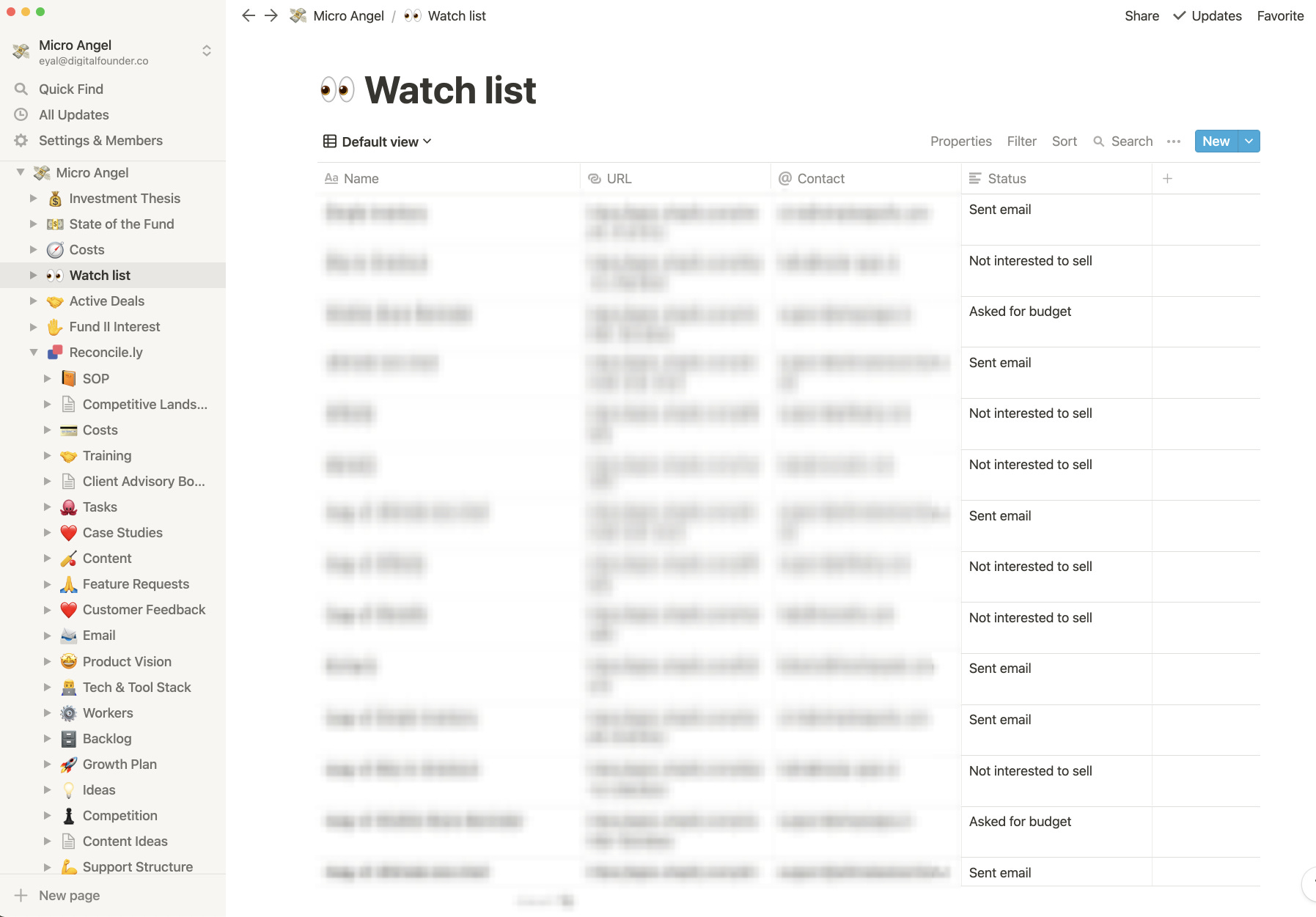

I use Notion to organize my work. I keep it simple as much as possible. Everything has a place, and I try to avoid duplication where and when I can by linking to and from pages.

I throw most of my discoveries into my watch list.

It’s just a list of products I found interesting and am keeping tabs on. If I click into the card, I can add any details or screenshots.

I’ll usually add to my watch list after I send an email to the owner of the app to see if there’s an interest. The majority of the stuff on my watch list is products I personally find in the wild and do outreach to gauge interest.

The success rate is probably maybe 20%, though the response rate is very very high (~80%). I much rather get a straight “no, we’re not looking to sell” than, well, no response at all.

Positive replies are usually surprised individuals interested in exploring an exit. From there, I continue with my process.

For products I discover on marketplaces like MicroAcquire, I add them to my active deals directly instead.

I graduate opportunities from my watch list to active deal opportunities when appropriate, but marketplace deals are active deals by definition since the information is precompiled and a seller is ready, willing and present.

This illustrates the incredible value of the ecosystem by its ability to create free, organic deal flow for microangels such as myself.

It also illustrates the sales DNA involved in this process. You can’t be haphazard about it. You need to know where the current pieces are positioned so you don’t waste time, or worse, forget to followup.

Send a list of required information, including costs

I send a very transparent list of requirements ranging from must-sends to nice-to-haves. I simply ask for what is available, and offer to sign an NDA if that’s something that is important to the seller.

If the previous statement surprises you, well, it surprises me too. There is a decent number of individuals who don’t have any interest in protecting themselves relative to the data they share. Some are already building in public.

My list changes from opportunity to opportunity. Here’s a message I sent to a seller a couple of weeks ago:

This is an interesting opportunity for me.

Would you be able to share some additional information with me? I'm happy to sign an NDA if you like.

Generally, access to partnermetrics.io and/or a copy of the payouts.csv would be really useful (please don't forget to remove customer emails). I can do my own analysis from there.

Other questions:

- What's the growth rate looking like?

- What's the churn looking like?

- Do you have anything on the roadmap that customers want that you haven't yet released?

- What are the top 3 customer support queries about?

- What's the tech stack?

- Who would be staying? The support staff are external I'm guessing?

- Do you see any revenue expansion at all (customers upgrading from one paid plan to a higher paid plan)?

Lastly, I can say I'd be willing to explore a strong offer provided you're open to a small cash balance component, typically not more than 20% (paid over no longer than 12 months usually).

Let me know if there's any interest!

Eyal

If you’re wondering where the magic is, I’m sorry to disappoint! No tricks here. It’s just persistent outreach.

I send a direct, straight-to-the-point note of what I’m looking for to move the deal forward, with a tangible insight that the seller can use to determine if they want to invest any energy into the deal.

Send or Receive NDA if applicable

Naturally, a request for information should be followed with an offer to sign a non-disclosure agreement. It’s not just the respectful thing to do, I think it’s the only way to do things if there’s business-critical information being shared.

I don’t include SaaS metrics as business-critical information. Unit economics (i.e. cost of acquisition), maybe. But the high-level stuff is a requirement and much of it is often shared in prospectuses or on marketplace listings.

Basically, any kind of information that would not be cool to share publicly probably ought to be protected under NDA.

Be respectful and responsible of other peoples’ work, and protect yourself when and where appropriate. I’d say I sign an NDA 9 times out of 10. And I’ll offer the document maybe 50% of those times if the seller can’t be bothered to have one.

I’ve got an NDA agreement template for you if you need one.

Sign NDA if applicable

I use PandaDoc for most of my documents. It’s crazy it took this long to get a good freemium digisig solution that doesn’t suck. They’ll be a huge success if they aren’t already.

They have a generous free plan with unlimited documents. I literally don’t need to do anything else and am very happy with the base product.

Receive counter-signed NDA, save to Google Drive, if applicable

I don’t like leaving stuff on PandaDoc, so I just download signed documents and throw them in their Google Drive folders. I have a folder for each deal where I store DD, analyses, legal docs and any uploads.

Qualitative exploration

Once my interest and requirements has been formally sent to the seller, I kickoff my own qualitative exploration with publicly available information. This is a highly asynchronous activity.

This too could be an entire post (let me know if that’d be useful), but the general idea is to get a high-level grasp of what’s what with the product. It’s pattern finding.

In the case of MicroAngel, I’m looking for simple products. I can dive deeper into the offering and determine just how simple the product really is, and whether it is stable enough to be worth buying.

A non-exhaustive list of qualitative stuff I look out for:

Branding, messaging, positioning

Market/Model fit comparing the pricing mechanism with the intended target market — does it make sense?

Depth of detail. For example, was the support documentation hastily put together and thus contains typos? How high/low is the quality bar upon which the product has grown

Investor/Product-fit. Is this something I’d be good at?

Look at reviews/what customers are saying

Load in competitors into Facebook Ad Library to see what ads are working for them if at all

A neat trick is to simply insert the name of the app and its competitors into the App Library.

That will show what kind of messaging resonates the most with the end-customer, and the disparity between the product in-question and competitors.

It will also indicate if paid spend is being oriented into this niche, which is a positive indicator that paid ad spend can be a profitable way to buy MRR.

Receive first batch of required information (i.e. payouts)

I usually receive a qualified response with some documents within 24-48 hours of submitting my request.

The vast majority of sellers on marketplaces will have information sent to you pretty quickly since you’re one of many buyers on a conveyor belt of possibilities and tend to have a prospectus ready.

Kudos to them for that. It’s a lot slower with manual outreach since the seller wasn’t expecting your outreach and has to [bother] compiling the information, and the time that will take is directly correlated to their initial interest.

Valuable metric to keep track of. Fast replies indicate high interest.

Website + SEO benchmarking, load the product into Ahrefs & qualify SEO profile

Kickoff most quant analysis on Google. I search the product, look at the results, get an idea of what other keywords the product ranks for, and what the competitors of those keywords are.

Try to get a general sense of what the authority of the product is relative to the rest of its ecosystem.

My investment focus in Shopify apps, and those tend to get most of their user acquisition from the App Store.

Plug in both the app store listing as well as their .com address, if there is one — some products successfully utilize content to drive demand.

Product demo, use it

Sign up for the product, try to use it and ideally get a deep understanding of the customer, value proposition, business model and run of business.

Compile questions about the product and any of its integrations. Especially anything that might puzzle me from an engineering perspective.

Review social media

Go through any and all social media accounts and take inventory of the total approximate reach and activity available.

The goal is mostly to understand whether there is any benefit to maintaining or growing those channel as a means of engaging with customers or acquiring new ones regularly.

Create analysis spreadsheet

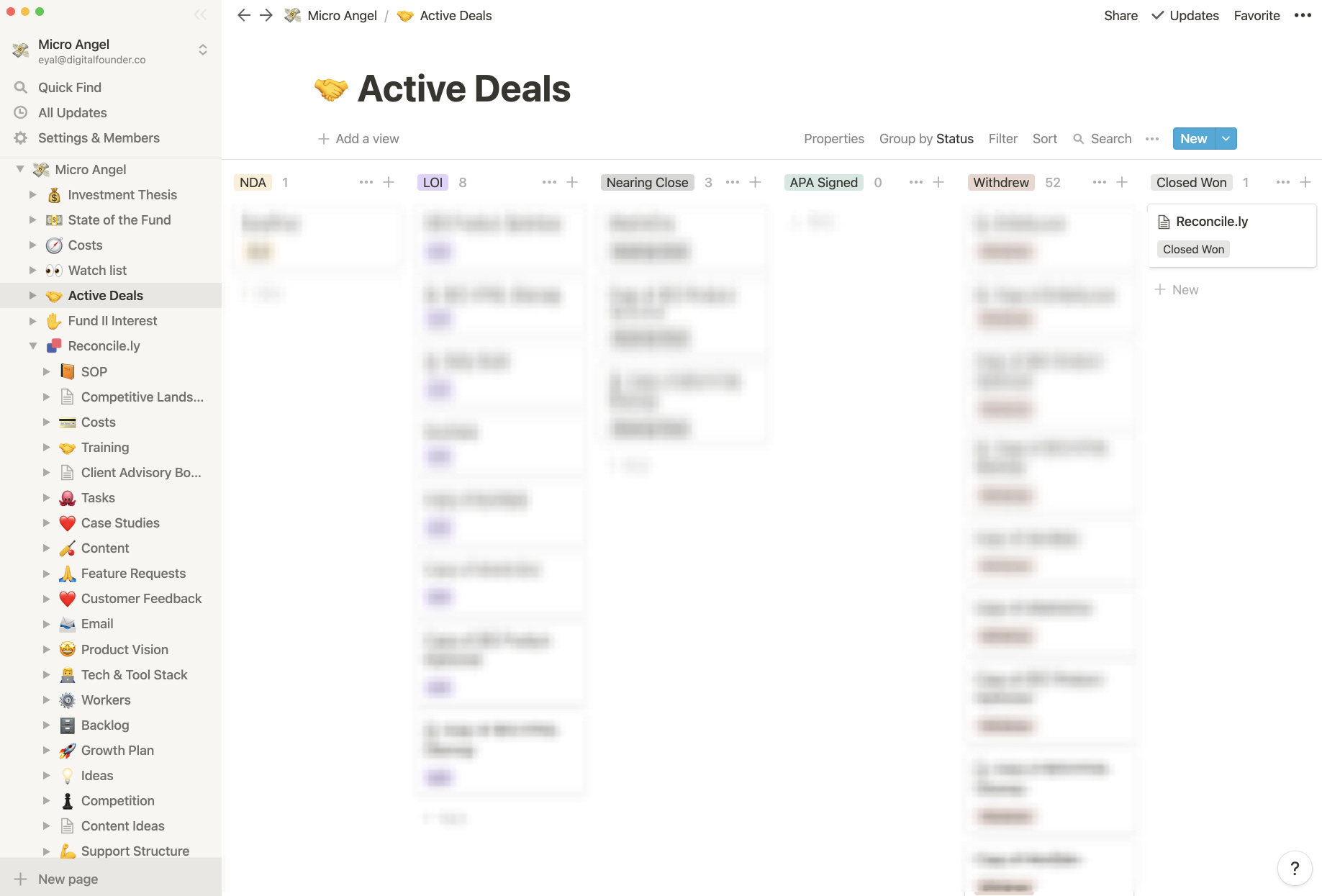

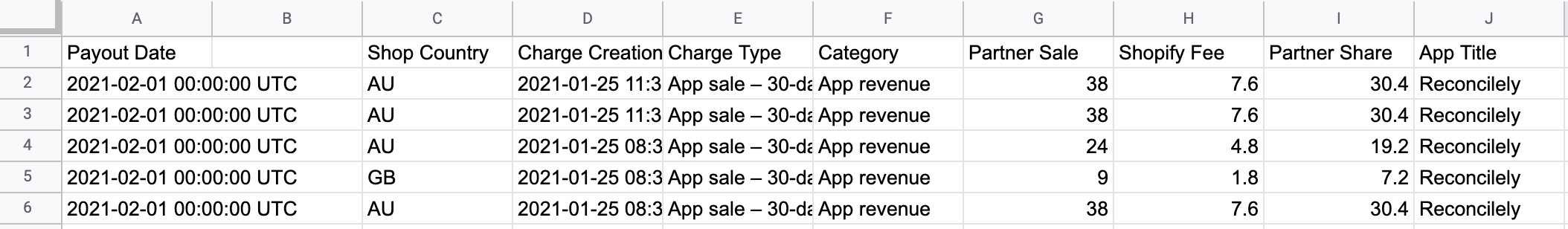

Drop information into a spreadsheet dedicated to the deal. The most important element here is to begin charting historical revenue over time and to qualify it using the payouts data from Shopify, Stripe, or anything similar.

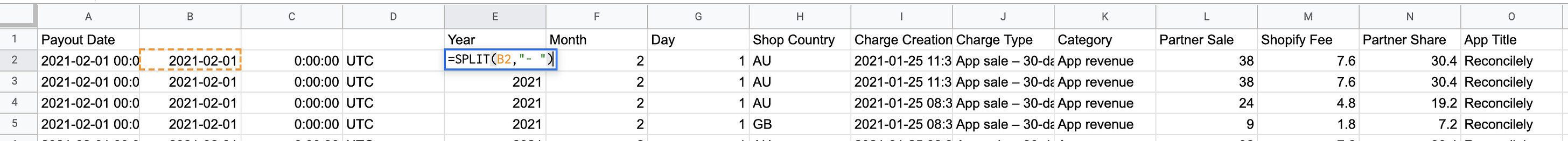

For Shopify apps, the payouts.csv you can export from the Partner Dashboard contains plenty of information you can use to determine what the revenue performance has been.

You’ll find a list of every transaction every day, with columns listing the date, plan, transaction amount, shopify fee, and partner share:

You can split the date column into Year/Months/Day:

Then kickoff your pivot table and start digging:

Build ARPU growth chart

Following the same process, you can use the pivot table to compute revenue averages over time.

I find it useful to do this to get a sense of the product’s ability to collect greater revenues from customer over time, which gives me a general idea of natural expansion.

Build plan breakdown chart

If you’re importing data from Baremetrics, Stripe, ChartMogul or Shopify, odds are you’ll have access to plans for each line item.

You can use this information to compute monthly revenue churn and expansion by reverse-engineering the revenue deltas between plans for each month.

Review + update spreadsheets with monthly revenue numbers

As you analyze different sections of data, update your sheet to start building a pro forma. It can be pretty close to a napkin calculation since you’re really trying to get an understanding of the unit economics and their impact on the business.

I don’t think it’s worth spending too much time on the quant stuff mostly because the point is to qualify the numbers you can benchmark against your investment thesis.

You have a limited data set and even more limited time to make a decision. Don’t get stuck on minutiae. You should know what you’re looking for before you open the document.

Benchmark growth rates for new, churn & expansion revenue

Once you have a strong grasp of the present picture, take some time to compute what the growth rates have been for the major revenue functions between new, churn, expansion and contraction.

Once you have a general idea of the trialing 6 months, you can fairly reliably chart out what the next 6 months will be, provided you maintain the rhythm established by the seller, which is an insight you’ll want to collect during diligence.

Project expected growth over lifetime of investment

By the time you have a realistic, conservative idea of how the product is expected to grow (or not), you can begin getting intentional about your exit numbers provided your overall model.

Dive into cost profile and possible improvements

Before you can count your eggs, discount any and all costs associated to the run of business and compute gross profit.

Historically, I’d say 80%+ of sellers underestimate their costs. Not by a lot, but by a decent margin. It’s sometimes a question of oversight.

I often lose track of the vendors I use for side projects, and we’re talking about buying side-projects a lot of the time, so blame would hardly be justified.

Discount tax

This will depend on the way you’ve structured your fund. I’m buying personally, so I won’t be paying business tax, but I will be paying income tax.

For that reason, I also need to think about what deductible expenses I might be able to assign to the business post-acquisition as a means of decreasing my tax burden and increasing my take-home.

I’ve managed to reach a pretty good rule of thumb and I now save about 25% of my income for tax purposes. Living in Quebec absolutely blows in that regard, but that’s another story.

Thus, I’d cut 25% of the gross from here and move on.

Determine general profitability of the product

Once I have a general idea of the take-home, I can start designing would-be cash-on-cash returns provided given investment ranges.

Those are usually pretty crude, and the range will tighten as my analysis progresses.

Establish an approximate CAC:LTV ratio

Once I have a handle on the fundamental health of the business, I’ll start diving into how the business acquires customers, delivers product value, and captures revenue as a result.

My aim is to obtain an LTV figure that I can then eventually compare to CAC estimates I’ll compute further on. A strong LTV:CAC and/or quick ratio will excite me, obviously.

Determine a general multiple range from above diligence

Now we’re getting into the meat of investing.

Formulating an offer is highly subjective. Someone with fuck you money might not even be as careful. Superangels typically do this.

In my case, I’ve come up with a pretty standard way to categorize opportunities. I marry my above research to other qualitative elements that might provide more advantage to me as an operator.

That’s why offers are subjective. It depends on how you view the assets relative your own ability to leverage them post-acquisition. Someone might puke at a flat revenue product that another would happily consider.

0-1x: Tiny or slowing MRR and side-project/small apps

Something with MRR under $1k or side-projects that have recently launched just don’t get a lot of value in my eyes. I can code an MVP and launch it to $500 MRR. I just won’t pay a lot for that.

1-2x: Zero or stable growth, ARPU high enough to do some damage

If the revenue growth is at minimum positive, I’ll go beyond 1x. If the ARPU is also decent for a MicroSaaS (usually $15+) then that’ll push that multiple up because it grants me the ability to grow faster with less customers.

Importantly, a strong ARPU lets me afford a higher customer acquisition cost, which I’ll rely on to buy MRR downstream.

2-3x: Revenue and churn at <= 10%

Once revenue growth is at 10% monthly, I’m looking at 2x+. From here, the churn is going to have a direct impact on how close to 2x the offer will be. The lower the churn is (from 10% down), the higher the multiple. It’s not linear or anything, more qualitative.

3-4x: Net positive retention, 10k+ MRR, search authority

A product with positive revenue retention gets 3x any day of the week in my books. I define that as the ability to cancel out revenue churn by way of revenue expansion, and keeping all new revenue.

If the product is producing over $10k MRR, it has a special significance for my fund, as it has a direct and significant impact on my number 1 fund goal ($15k MRR of cash flow for 24 months).

I value SEO as the number 1 channel for SaaS. No contest. It is the literal magical ability to produce web content that is found by eventual customers, CPA-free (minus sweat + freelancers).

4-5x: Runaway successes in the making

Something growing hyperbolically requires a very strong offer to entice a seller to part ways with what is effectively a winner.

These are pretty much out of my range due to the expected offer number. If I offer 5x, the higher ARR I can buy is $70k since I only have $350k left in funds to field.

I can’t do that, since that would fail to hit my revenue goals. But the revenue growth might be so extreme that I might forego MRR today knowing it is rapidly approaching a few months later.

In part 2, I’ll transition to the buying side. Namely, computing cash-on-cash, compiling research into an offer, financing options, LOI submissions & closing the deal.

If you enjoyed part 1, get yourself a MicroAngel subscription as part 2 is going to be reserved for subscribers. Be swift about it, I’m sunsetting monthly subscription options on April 1st. 👻