Alternative Assets - Exploring SDIRAs with AltoIRA

Understanding the Self-Directed IRA and how it works Welcome to Alternative Assets. You are receiving this because you are subscribed to our General newsletter. To change your settings, scroll down to Subscription Options. We hope you enjoyed last week's deep dive on MoneyMade. Welcome to the 297 new subscribers who've joined since then. We've just passed 2,500 subscribers. Things are moving quickly here...! Today we dive into the topic of Self-Directed IRAs — an important and poorly understood retirement option that more people should know about. We also look at an alternative investment company doing some fascinating, groundbreaking work in this space. They're called AltoIRA, and we truly believe they are moving the entire industry forward. But first... As you may be aware, we are starting to publish LOTS of content. Set your preferences to let us know what to update you on. We’ll send updates for topics you follow. Okay, let's explore! 👇 History of US retirement optionsIt all began with Social SecurityRetirement in America has always been a tricky subject. When President Roosevelt signed the Social Security Act into law in 1935, it was intended to cushion the blow of the Great Depression, by paying people over the age 65 or older a continuing income after retirement. The act did its job, and for decades Social Security was considered one of America's proudest domestic accomplishments. But fast-forward to today, and the program is rife with problems. First, Social Security may be running out of money. Since it's a "pay-as-you-go" contribution program, it's subject to the whims of demographic change. The American population is aging, so as boomers retire, there is a real risk that the system will have less money coming in than payments going out. But another problem with Social Security is that the payments aren't really enough to enjoy retirement — at least not the kind of retirement we all want to have. The current average Social Security retirement benefit in 2021 is just $1,543 per month. About $18,000/year. The maximum someone can get is about twice that amount. But even so; for me and many readers of this blog, that's not gonna come close to being enough. The 401(k) FrankensteinIn the late 1970s, Congress passed the Revenue Act, which included a provision allowing employees to avoid being taxed on deferred compensation, also known as the 401(k). This random clause, essentially an accident of history, has now somehow become the standard retirement plan for corporate America, even though it was never intended to replace Social Security or pensions, and even its creators think they've created a Frankenstein. Corporate 401(k) programs were an improvement over Social Security. They give you some control over what you invest in, and contributions are often "matched" by employers to varying degrees. However, your choice of investments is not all companies match equally, and 401k's are, incredibly, not portable between jobs! So the investments you hold through one program have to be fully liquidated, and new investments must be purchased from funds under the new program. As anyone who has done this before can attest, the actual process of switching from one company's 401k program to another is absolutely comical.

The Individual Retirement AccountIRAs were another option born out of the 70s. Independent of Social Security and 401(k)s, people could now contribute up to $1,500 into a dedicated brokerage account (now up to $6,000) and reduce their taxable income by the amount of their contribution. (Another retirement option and a tax break! Hooray!) This provided even more flexibility. Instead of having zero control over your investments (Social Security) or being forced to invest in the pre-set menu of funds available to you (401k) you could now could choose to invest in individual stocks as you see fit. As long as your IRA "custodian" (i.e., your brokerage firm) allows you to purchase an asset, you can add it to your retirement portfolio. The problem is that this is still limiting! Many IRA custodians limit you to traditional investments such as stocks, bonds, and mutual funds. Even real estate is only be permitted if held indirectly, such as through a REIT. There are some exceptions, but not many. Bottom line: Alternative assets cannot be held in a traditional IRA. So what do you do if you want to invest in alts? You're out of luck, right? Nope, not at all. Enter the Self-Directed IRA. SponsoredLooking for a passive income source? Has investing in websites and online businesses always been on your mind, but you didn't know where to start? BlackBook Investments has got you covered. Get access to undervalued web properties and earn a much higher ROI compared to other asset classes. Whether you're looking for a consistent income or big capital gains, website investing can help you achieve that. BlackBook makes website investing totally passive for you. With their personalized, comprehensive service and a vast network of buyers, sellers, and brokers, Blackbook has been helping folks like you invest in websites for almost a decade. Fill out their Investor Questionnaire and see if website investing is right for you. What is the Self-Directed IRA?The Self-Directed IRA, or SDIRA, is a somewhat unofficial type of IRA that can hold a variety of alternative investments normally unavailable through regular IRAs. Although the account is still administered by a custodian, you manage the investments yourself. The way it works is a bit complicated. Essentially you form a single-member LLC to wholly own your IRA, in what's known as a "Checkbook IRA." This allows you, as the account holder, to write checks using the IRA's cash. You then direct your IRA custodian (basically a financial institution that holds your investments and ensures IRS regulations are adhered to) to purchase 100% ownership of your new LLC, using your existing IRA funds. Finally, you can use those funds to purchase alternatives, such as real estate, crypto, even startups. The funny thing about SDIRAs is that they have actually been around since 1996 — and they were born out of a lawsuit of all things! In the case of Swanson vs Commissioner, James Swanson (← American hero 🇺🇸) decided to break the mold and create a business entity (essentially a SPAC) which was "owned" by his IRA. He made himself the manager of this new business entity, allowing himself full investment control. The IRS challenged Swanson, claiming this was prohibited, but the judge found in favor of Swanson. The IRS challenged it again in 2013, but the court's decision confirmed that a self-directed IRA can fund a newly established LLC to buy and sell alternative assets. What are the advantages of using an SDIRA?The advantage is simple. Taxes, taxes, taxes. SDIRAs can be set up as either regular IRAs, or Roth IRAs. If you set your SDIRA up as a regular IRA, funds you contribute are considered tax-free contributions. So basically, you can reduce your taxable income by up to $6,000/year, while investing in the world of alts we all know & love. If you set up a Roth IRA, the income is taxable upfront. But while you don't get an immediate tax break when you contribute to a Roth IRA, your contributions and earnings grow tax-free. And you can even get qualified tax-free distributions. It's basically a question of if you want to pay tax now, or pay it later. In 2012, PayPal co-founders Peter Thiel and Max Levchin used SDIRAs to realize astronomical tax-free gains.

What can you invest in with an SDIRA?Interestingly, to this day, the IRS does not explicitly outline what a self-directed IRA can invest in, only what it cannot invest in. There are a few types of prohibited investments. Restrictions include:

Self-directed opportunities outside the USThis is all part of the financialization of culture trend. People are shunning traditional financial advisors and taking more direct control over what they invest in. This cat is firmly out of the bag, and there is little chance it will ever go back. It's also fair to assume this Cambrian explosion will spread throughout the world. Here in Australia we are lucky for lots of reasons. One of them is because of something called Superannuation. Superannuation, or "Super" for short, is Australia's version of social security. By law, employers are required to pay at least 9.5% of your salary each year into your personal Super retirement fund. This means that nearly every single Australian is invested in the stock market from the time they start working, until they day they retire. Although flawed, Super is a phenomenal program, and is one of the biggest reasons Australia has the richest citizens, per capita, in the entire world. However, even with Super, the latest trend is leaning towards something called the Self-Managed Super Fund (SMSF). 4% of Australians (mainly the wealthy and forward-thinking citizens) already have an SMSF. Aside from the funding sources (IRAs are funded by you, whereas Super is funded by your employer) the structure and benefits are surprisingly similar to America's SDIRA. You save on taxes, but there are self-dealing restrictions. If you buy a house with your self-managed super fund, you can't live in the house, etc. How to open a Self-Directed IRA?To open a self-directed IRA, you’ll first need a qualified IRA custodian. These are brokers or nonbank trustees who are approved to handle IRAs, 403b's, education & health savings accounts. Nuwireinvestor.com has put together a nice list of Self-Directed IRA Custodians you can choose from. But it will take some research and setup. You'll need to "go fishing," sifting through fee tables, legalese and fine print, and it will take some time to get approved and set up. If you want to catch a fish right away, there's another way to do this quickly and easily. One of them is through a company called AltoIRA. What is AltoIRA?AltoIRA streamlines the process of investing your retirement dollars in alternative assets. No commissions, no paperwork. How AltoIRA worksThe way it works is simple:

It must be stressed how easy AltoIRA makes this process, compared to how complicated & convoluted it normally is. They handle nearly the entire process of transferring your existing assets into your new Alto IRA, including taking care of paperwork requirements, executing documents, and handling tax reporting. In fact, the existing frustration with creating an SDIRA is partly what inspired Eric Satz to start the company in 2018. As he put it, "...It took way too much time, and I did all the work." A starter account on AltoIRA costs $10 per month, and gives you access to Alto’s investment partners. There is a $10 to $50 investment fee for each investment execution. The Pro IRA costs $25 per month, and gives you access to non-partner investment firms, for a $75 per-investment fee. Alto's CryptoIRAAs you probably know, crypto has had a bonkers year. As of this writing, Bitcoin is up a measly 777% this year, and the total market cap of all cryptocurrencies is approaching $1.8 trillion. So it makes sense that AltoIRA has an option for investing in crypto, known as their CryptoIRA. With the CryptoIRA, you can use your retirement savings to buy, sell, and trade directly through a key partner, Coinbase. You can invest in any cryptocurrency offered on the Coinbase exchange. When investing in cryptocurrencies with an Alto CryptoIRA, you do not need to create an LLC, and there is only a $10 investment minimum on market orders. Alto’s CryptoIRA has a 1% annual fee, and a 1.5% transaction fee. As expected, Alto holds your hand for this process and helps simplify everything for you. (Interestingly, creating a separate crypto product is done out of an abundance of caution. Alto’s CRO Tara Fung noted that regulators are just starting to look at whether tokens like Bitcoin should be held in retirement accounts. So when it comes to this brave new world, it's best to pay it safe and keep the products separate.) We highly recommend checking out AltoIRA. Sign up before March 31 and get up to $75 cash back on your monthly account fees. Sponsored

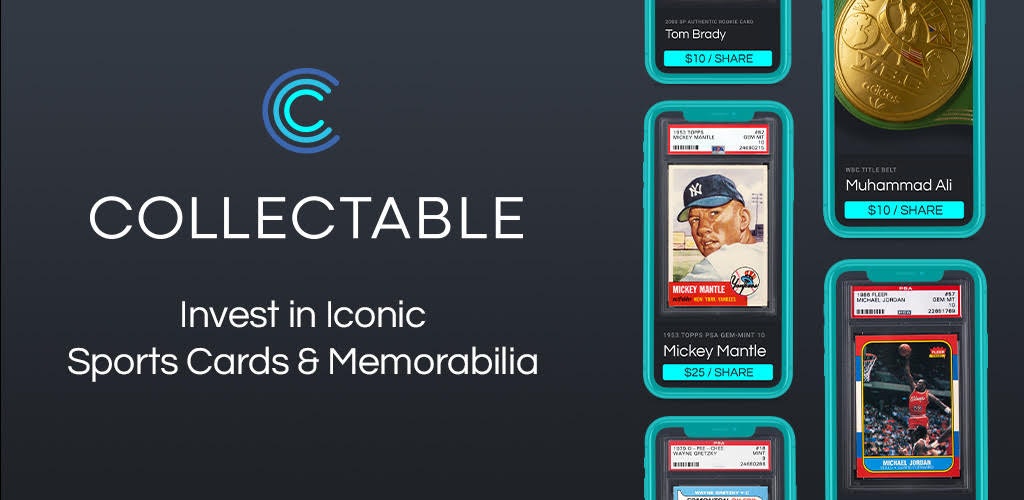

Collectable exits so far: 75.0% ROI in 3 months for 139 investors... 2009 Signed Steph Curry Rookie Cards Basket

104.5% ROI in 3.5 months for 152 investors... 1980 Magic Johnson, Larry Bird & Dr. J Scoring Leader PSA 10

35.2% ROI in 1.5 months for 196 investors... 2017 Patrick Mahomes Panini Flawless Emerald Rookie Patch Auto

Since January 2008, high value sports cards have outperformed the S&P 500 by 81% (source: PWCC). Join over 20,000 investors and invest from just $1 per share in some of the most rare and exciting sports collectibles in the world! Please review risks and disclosures in our offering circular, and at collectable.com. What are the risks of SDIRAs?Even if AltoIRA abstracts away the difficulties with creating & managing an SDIRA, an IRA LLC comes with some knowledge requirements and the need for discipline with respect to how you conduct business. It's important to understand the implications and risks.

SponsoredWant to supercharge a website before you start building? ODYS is a fantastic new way to kickstart the site of your dreams with an aged, brandable domain that’s relevant and full of link juice. Limited-Time Offer: ODYS is currently giving $500 FREE credit to all current and existing users. This credit must be used by April 1st. These aren’t just premium domains, they come with a juiced-up backlink profile that can boost your site for years. Think of it like building a house: Instead of starting from scratch, you can build on top of a strong existing foundation. In fact, this is such a well-kept secret that ODYS doesn’t just let anyone in. Your referral code is Alternative Assets. Other newsMoney is pouring into alternative assets!Venture capital is heating up in the space. Here are the biggest new deals over the past few weeks:

And there were at least three deals in the NFT space alone!

Recently discovered

Share Alternative Assets, Get RewardsEnjoying Alternative Assets? Now you can share your personal referral link and get rewarded. Get hoodies, tees, and other cool swag. When someone signs up through your link, your referral count goes up. It's a generous program. Rewards start at just 2 referrals!

It's easy. Click the button below to access your rewards hub: Or copy & paste your referral link here: https://alternativeassets.club?rh_ref=2e096c1b Share on Twitter | Share on Facebook | Share via email Thanks for spreading the word! See you next time, SponsorshipInterested in sponsoring Alternative Assets? Let’s chat. Each issue of Alternative Assets receives over 2,500 impressions. Three ad units are available per issue. Subscription OptionsStart your free trial of Insider.Deep research and investment insights, now on thirteen alternative asset classes. Start today. Unfollow General NewsletterThis will remove you from the General newsletter. You'll continue to receive updates on other asset categories you follow. Follow Other CategoriesSet your preferences to receive updates on other categories. You can follow as many as you'd like. |

You Might Also Like

CDs supercharge your savings

Monday, March 3, 2025

You could earn up to 4.10% for a 1 year term ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI's Impact on the Written Word is Vastly Overstated

Monday, March 3, 2025

Plus! VC IPOs; Sovereign Wealth Funds; The Return of Structured Products; LLM Moderation; Risk Management; Diff Jobs AI's Impact on the Written Word is Vastly Overstated By Byrne Hobart • 3 Mar

Know you’re earning the most interest

Sunday, March 2, 2025

Switch to a high-yield savings account ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Longreads + Open Thread

Saturday, March 1, 2025

Hackers, Safety, EBITDA, More Hackers, Feudalism, Randomness, CEOs Longreads + Open Thread By Byrne Hobart • 1 Mar 2025 View in browser View in browser Longreads A classic: Clifford Stoll on how he and

🚨 This could be a super bubble

Friday, February 28, 2025

An expert said we're in the third-biggest bubble ever, the US poked China one more time, and OpenAI's biggest model | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Boring, but important

Friday, February 28, 2025

For those life moments you might need . . . ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Last Trader Standing

Friday, February 28, 2025

The Evolution of FX Markets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

My secret 15-minute video sharing my triple digit options strategy

Friday, February 28, 2025

Free training + book ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👋 Bye bye, bitcoin

Thursday, February 27, 2025

Bitcoin's biggest one-day blow, Trump's latest tariff threat, and robots playing soccer | Finimize TOGETHER WITH Hi Reader, here's what you need to know for February 28th in 3:12 minutes.

Don't Overlook this Sector Billionaires are Quietly Investing In

Thursday, February 27, 2025

The Billionaires' Energy Secret (You Can Get In) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏