Avoid boring people - Ergodicity, what's it mean

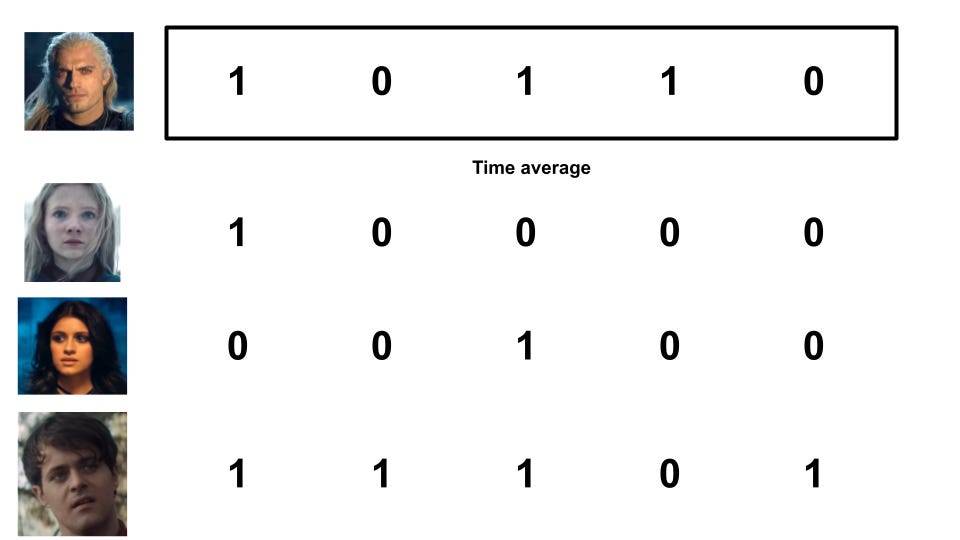

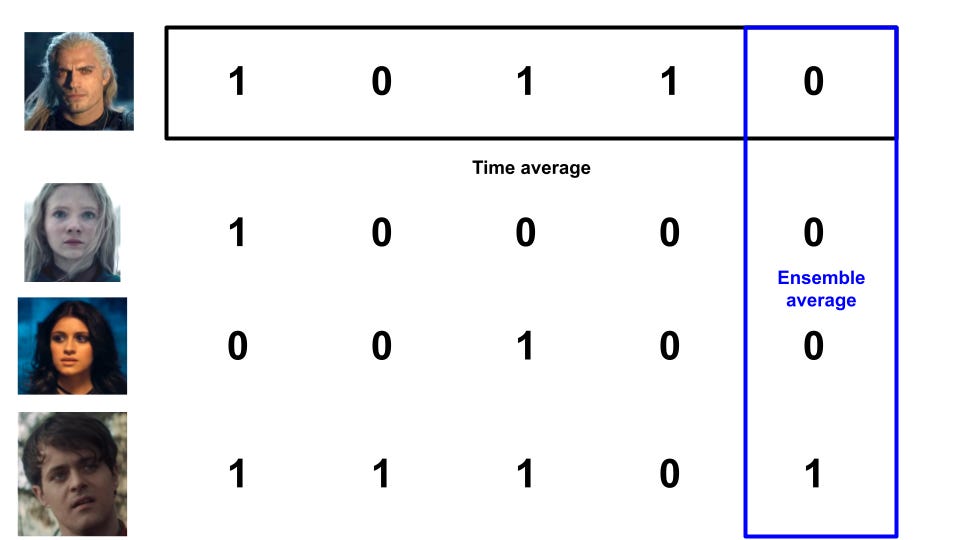

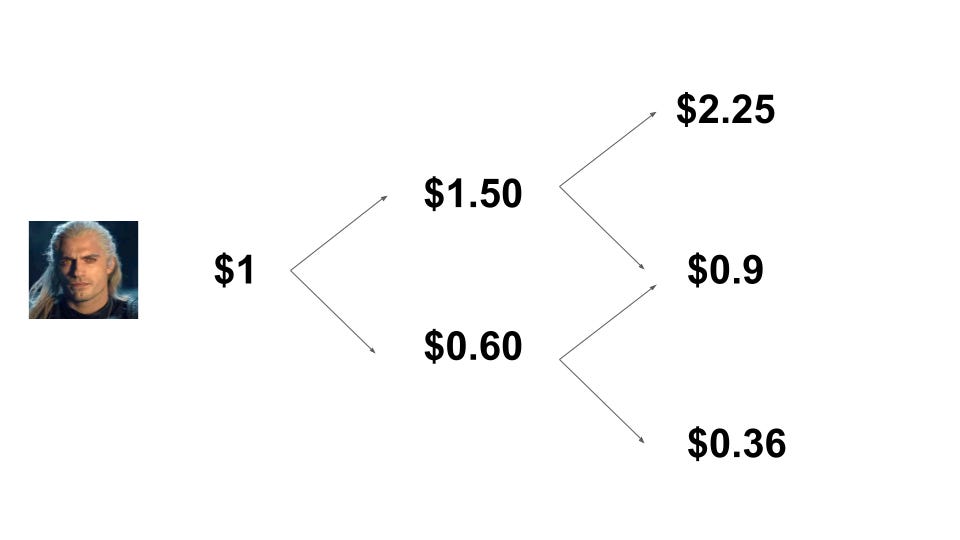

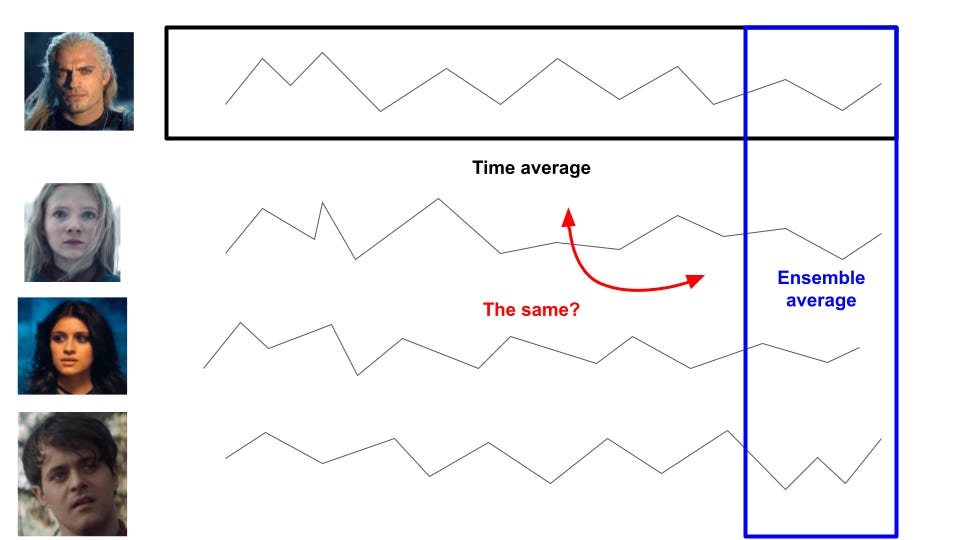

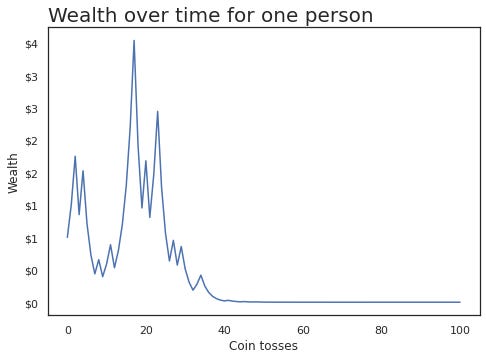

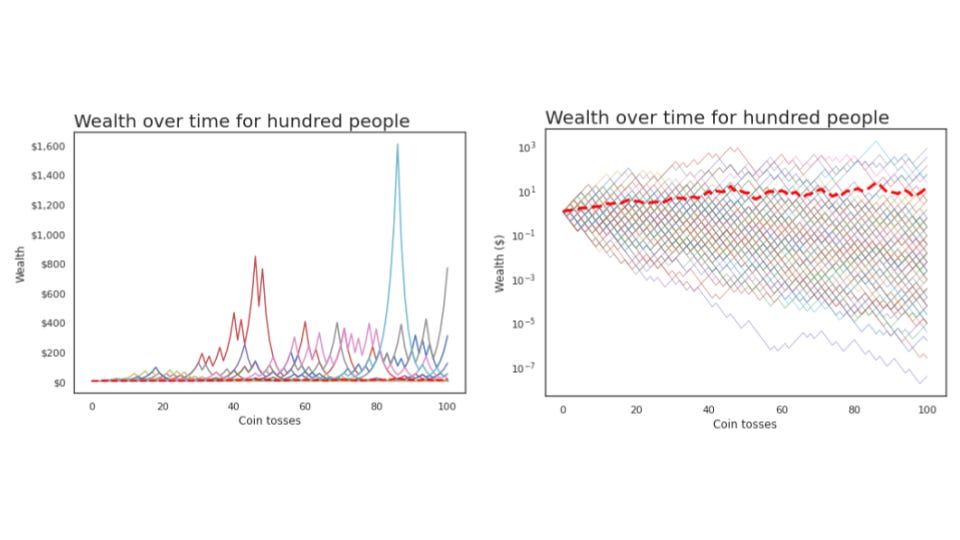

TakeawayKnowing whether a process is ergodic or non-ergodic is critical in knowing how much risk to take. Investing and wealth are non-ergodic processes, which imply that our first thoughts on expected values are very wrong. I've heard about ergodicity before, but wasn't quite able to understand it until I watched this video by Ergodicity TV. It's an important concept but seems more widely known in physics than in finance. I want to try explaining it in my own words below. We're familiar with different types of "averages" - mean, median, mode ¹. Let's focus on mean for today, and take it as the expected value of some random event ². How we define expected value can give us dramatically different results, changing our mindset on the attractiveness of bets and how much to bet. Ergodicity means that the ensemble average is the same as the time average. Something being non-ergodic means the opposite, that the ensemble average is not the time average. Yeah, I'm not sure what ensemble and time here mean ³ either, so let's look at an example of tossing a coin. Suppose some random dude tosses a coin 5 times, getting some heads and some tails. We can calculate the time average for this simulation by getting the average number of heads for one person across a period of time. There are 3 heads out of 5 tosses, so that's 0.6 heads (3 divided by 5). Suppose we get a few more people to toss coins. We get something like below, where I'm representing heads as 1 and tails as 0 for convenience: There are two types of averages we can use here. The first is the time average from before, where we get the average over some period of time for one person. The second is the ensemble average, where we get the average over one period of time for multiple people. The big question that ergodicity tries to answer is: Should we expect these two averages to be the same in the long run? If we think for a while, we'll be able to reason that we should, in this example. A coin toss is random, and doesn't depend on the previous result. The ensemble average is the same as the time average in the long run. With enough coin flips, we'd expect these averages to be 0.5 ⁴. That was a lot of words to show something you probably already believed, so why do I think this is so important? Let's build on the example, by having the people bet on the coin toss. Everyone starts with $1, gets 50% profit if they win, and pays 40% of their bet if they lose. For example: Rather than the coin toss results themselves, let's think about the wealth that each person will have. If we plot these, should we expect the time average of one person's wealth to be the same as the ensemble average of everyone's wealth in the long run? Or put another way: would you want to take such a bet if offered repeatedly? The expected value of such a bet is 50% times $1.50, plus 50% times $0.60, to get $1.05. With a positive expected value, it seems like we should keep betting. Let's simulate some coin tosses to see what happens. I've coded a simulation of coin tossing in this jupyter notebook ⁵. Running the above scenario for one person doing 100 coin flips, we notice that their wealth increases to as much as $4, before falling to essentially $0. Hmm, maybe we got an unlucky scenario. Let's repeat this with 100 people instead, still doing 100 coin flips. I'll also calculate the average wealth (ensemble average) at each coin flip and represent that with a dashed red line ⁶. The two graphs below are identical in data; I'm just rescaling with a logarithmic axis for better visualisation. Something strange is happening. We see one lucky outlier who got to $1k in wealth, and also see that the average wealth (dashed red line) is continuously increasing. However, notice that the majority of these people lost money! In this simulation, 94 out of the 100 people who played ended up with less than the $1 they started with. If you're not convinced, the notebook has an example with one thousand people; also feel free to adjust the parameters. What we're seeing is that even though the expected value is positive, and the ensemble average is increasing, the time average for any single person is usually decreasing. The average of the entire "system" increases, but that doesn't mean that the average of a single unit is increasing. Large outliers skew the average, but the majority of people are losing. This bears repeating. Even when the expected value of such a bet was positive, 94 out of 100 people who played in such a game lose most of their money. Those outcomes happen within the same system, but give you the opposite takeaway on whether you'd want to play. Wealth in this scenario is non-ergodic, since the wealth in the future depends on the wealth of the past (path dependence). The ensemble average does not equal the time average. Wealth in general is also non-ergodic, since your investment portfolio's return tomorrow is dependent on the current size and allocation of the portfolio today. Practically, what this means for investing is: Be careful about how you're applying expected values, since you want to know if that's the average of the entire system, or what an individual like you should expect on average. If you have probabilities in mind, model them out and see what that implies What can seem attractive at first is often terrible, as a small number of outlier values skew the average upwards ⁷. If you don't like the odds you're seeing, try changing the game. The previous post I did on the Kelly Criterion talks about sizing your bet, which will affect how much you gain or lose. In summary, ergodicity is about whether the long run average over many simulations is the same as the average over one simulation. When things are non-ergodic, and many things in life are non-ergodic, you have to be extremely careful about the amount of risk you're taking. Further readingOther

1 2 I might be conflating mean and expected value here, but I think we can simplify for this explanation 3 Hmm. 4 50% chance of heads and 50% chance of tails, by definition 5 Someone should really check my code. Also I think there's a more elegant way of coding it in fewer lines. 6 This is not the theoretical ensemble average actually, which would be 1.05 to the power of the number of coin flips and increase linearly. Here I'm just doing the average of the actual results, which is why the line doesn't continuously increase (monotonically increase) 7 Wealth has a floor at $0 but no cap, so the average is unbounded too I think You’re on the free list for Avoid Boring People. For the full experience, become a paying subscriber. |

Older messages

Min, max, and 10x people

Saturday, February 27, 2021

What things do scale?

First Plaid, then the world

Saturday, January 30, 2021

Abstraction, APIs, and Plaid as Plumbing

Avoid Boring People in 2020

Thursday, December 31, 2020

Favourite articles, reflecting on the year, and a reader competition

Remembering faces

Wednesday, December 16, 2020

Memories and the morning after

Having faith in the Kelly Criterion for angel investing

Friday, December 4, 2020

Using math to estimate optimal portfolio sizing

You Might Also Like

AI's Impact on the Written Word is Vastly Overstated

Monday, March 3, 2025

Plus! VC IPOs; Sovereign Wealth Funds; The Return of Structured Products; LLM Moderation; Risk Management; Diff Jobs AI's Impact on the Written Word is Vastly Overstated By Byrne Hobart • 3 Mar

Know you’re earning the most interest

Sunday, March 2, 2025

Switch to a high-yield savings account ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Longreads + Open Thread

Saturday, March 1, 2025

Hackers, Safety, EBITDA, More Hackers, Feudalism, Randomness, CEOs Longreads + Open Thread By Byrne Hobart • 1 Mar 2025 View in browser View in browser Longreads A classic: Clifford Stoll on how he and

🚨 This could be a super bubble

Friday, February 28, 2025

An expert said we're in the third-biggest bubble ever, the US poked China one more time, and OpenAI's biggest model | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Boring, but important

Friday, February 28, 2025

For those life moments you might need . . . ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Last Trader Standing

Friday, February 28, 2025

The Evolution of FX Markets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

My secret 15-minute video sharing my triple digit options strategy

Friday, February 28, 2025

Free training + book ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👋 Bye bye, bitcoin

Thursday, February 27, 2025

Bitcoin's biggest one-day blow, Trump's latest tariff threat, and robots playing soccer | Finimize TOGETHER WITH Hi Reader, here's what you need to know for February 28th in 3:12 minutes.

Don't Overlook this Sector Billionaires are Quietly Investing In

Thursday, February 27, 2025

The Billionaires' Energy Secret (You Can Get In) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Giveaway: Set Sail on Your Next Adventure 🚢

Thursday, February 27, 2025

Enter to win a chance to win a free trip from Virgin Voyages. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏