Popular Information - America's tax cheats

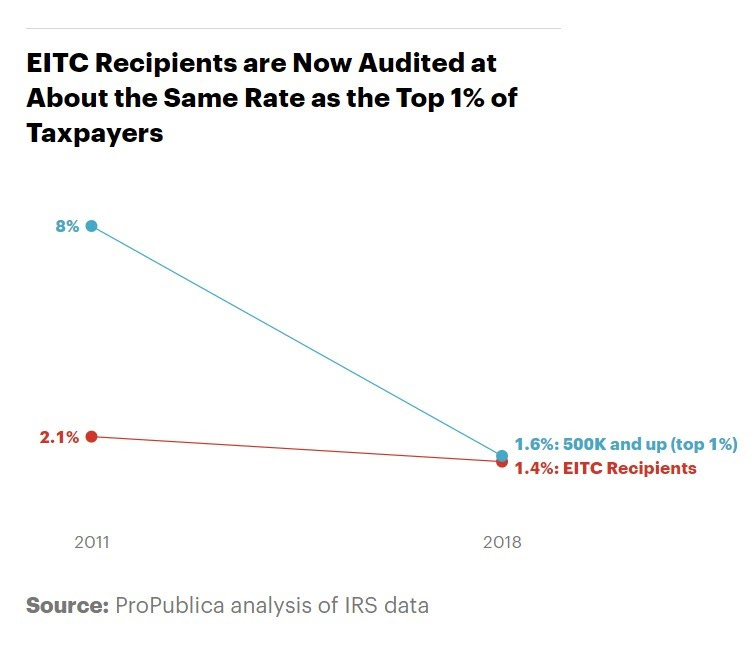

Welcome to Popular Information, a newsletter about politics and power — written by me, Judd Legum. On Wednesday evening, Biden will introduce the "American Families Plan," a sweeping proposal that calls for hundreds of billions in spending on "child care, universal prekindergarten, and paid family and sick leave." The package would be paid for, in part, by modestly higher tax rates on capital gains and wealthy individuals. But the single largest source of funding, an estimated $700 billion over 10 years, is expected to come from cracking down on Americans who cheat on their taxes. How is this possible? It's not the case that the typical taxpayer is trying to shortchange Uncle Sam. The vast majority of Americans — more than 80% — pay the taxes they owe on time. For most people, cheating isn't even an option. Their taxes are automatically withheld from each paycheck. People who receive W-2 forms have a tax compliance rate approaching 100%. But some "taxpayers with more complex sources of income, most of whom are in high-income brackets" are able to avoid paying what they owe. In recent testimony before Congress, IRS Commissioner Chuck Rettig said that he believes the "tax gap" — the difference between what is paid to the IRS and what is owed — could exceed $1 trillion annually. A paper published in March from the National Bureau of Economic Research found that Americans in the top 1% underreport their income by an average of 21%. These individuals then hire "sophisticated lawyers and accountants capable of expanding years and significant resources on fighting IRS claims." The privileged few are taking advantage of an agency that has been hollowed out. Years of ideological warfare have left the IRS with a small fraction of its previous capacity to enforce the law. It's easier than ever for the wealthy to get away with cheating. Biden's plan attempts to reverse these trends. His proposal would invest about $80 billion in the IRS over 10 years in an effort to recover $780 billion. Kneecapping the IRSThe IRS "lost more than 33,378 full-time positions" between 2010 and 2020. Many of these were auditors tasked with catching tax cheats. As of 2019, there were 8,526 auditors working at the IRS. The last time the agency had fewer than 10,000 people working in that role was 1953 "when the economy was a seventh of its current size." As a result, the IRS conducted "675,000 fewer audits in 2017 than it did in 2010, a drop in the audit rate of 42 percent." For the top 1%, audit rates "have fallen from about 8 percent in 2011 to 1.6 percent in 2019." The IRS currently lacks the resources to pursue people who don't file their taxes at all. Investigations of non-filers dropped from 2.4 million in 2011 to just 362,000 in 2017. If the government doesn't pursue tax obligations within 10 years, the debt expires. In 2010, the IRS let $482 million in tax debt expire. By 2017, that figure ballooned to $8.3 billion. None of this was an accident. Republicans have demanded substantial budget cuts to the agency over the last decade. This was motivated by Republicans' long-held belief that the IRS was emblematic of "big government" and by the agency's role in administering Obamacare. Overall, the IRS budget was cut by about 21% in inflation adjusted dollars between 2010 and 2020 even as the number of returns increased by 9%. Funding for enforcement fell by more than one-third. Cracking down on the poorest AmericansAs resources for enforcement shrunk, the IRS began focusing a larger proportion of its efforts on auditing the poorest filers. In 2017, about 36% of all audits were targeted at the working poor. In 2018, filers who received the Earned Income Tax Credit (EITC), which is mostly available to Americans earning less than $20,000 annually, were audited at 1.41% rate — roughly the same as the audit rate for millionaires (1.56%). According to Senator Ron Wyden (D-OR), the IRS is focusing on auditing the poor because it is less time consuming. "While the wealthy now have an open invitation to cheat, low-income taxpayers are receiving heightened scrutiny because they can be audited far more easily. All it takes is a letter instead of a team of investigators and lawyers," Wyden said in 2019. While the IRS ignores very wealthy Americans who don't bother to file taxes at all, "the five counties with the highest audit rates are low-income, disproportionately African American, communities." Many of America's largest corporations are not auditedCorporations underreport income at a similar rate to wealthy individuals — about 20%. Previously, virtually all corporations with revenues of $20 billion or more were audited. Today, the IRS only has the resources to scrutinize half of these returns. Overall, "audits of corporate tax filings fell by 37 percent." Even when the IRS audits a large company, it is ill-equipped for the task. Corporations "can pour resources into tax planning, litigation, and lobbying to try to shift the boundary between permissible tax avoidance and unlawful tax evasion — and to stretch out their cases as long as they can." The IRS has little recourse to push back. As a result the IRS frequently settles with corporations "for much smaller amounts than it believes they owe." Biden's proposal would not level the playing field. Nor would it eliminate tax cheating by corporations and the wealthy. But it would give the IRS a fighting chance. Popular Information is two-person operation, but we have an outsized impact. This newsletter won the 2020 Online Journalism Award for Excellence in Newsletters — beating out entries from the New York Times and the Washington Post. Our reporting has helped secure paid sick leave at one of the nation's largest restaurant chains, pressured large corporations to return tens of millions of taxpayer dollars intended for struggling small businesses, and uncovered how Facebook gives preferential treatment to right-wing publishers. Bloomberg reported that, following the January 6 attack on the Capitol, this newsletter’s accountability journalism created a “political reckoning" in corporate America. With your help, we can do even more. Popular Information accepts no advertising and only exists because of the support of readers like you. |

Older messages

The myth of the "woke corporation"

Tuesday, April 27, 2021

In the pages of the New York Post on Monday, Senator Marco Rubio (R-FL) engaged in one of the Republican Party's new favorite pastimes — decrying "woke" corporations. Rubio, without

Tucker, Lachlan, and subsidized speech

Monday, April 26, 2021

Last week, Fox News host Tucker Carlson's yearbook from his senior year at Trinity College resurfaced. In the short entry from 1991, Carlson wrote that he was a member of the "Dan White

Request for feedback: What's next?

Thursday, April 22, 2021

Tesnim and I have been thinking about what topics to focus on for the remainder of 2021. Of course, we will continue to keep you fully updated on

Mob tactics

Wednesday, April 21, 2021

Senator Rick Scott (R-FL) is irate. Scott was one of eight Senators to object to the certification of the Electoral College. It was an effort to overturn the results of the election based on

Why the body count hasn't slowed down America's gun industry

Tuesday, April 20, 2021

The spring of 2021 has brought a stream of mass shootings across the country. Eight people killed at a FedEx warehouse in Indianapolis, Indiana. Ten people killed in a grocery store in Boulder,

You Might Also Like

Tuesday Briefing: Trump’s criminal cases likely to be dismissed

Monday, November 25, 2024

Plus, a possible cease-fire deal in Lebanon. View in browser|nytimes.com Ad Morning Briefing: Asia Pacific Edition November 26, 2024 Author Headshot By Justin Porter Good morning. We're covering a

Organ Grinder

Monday, November 25, 2024

Your Aging Parts, Robots Advance ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Ready For Master Plan Season Two?

Monday, November 25, 2024

We are ready to start Master Plan season two, which will be just as powerful as season

Five new startups to watch

Monday, November 25, 2024

Former Amazon Care leader's startup provides virtual support for caregivers | SparkToro co-founder launches game studio ADVERTISEMENT GeekWire SPONSOR MESSAGE: Get your ticket for AWS re:Invent,

☕ Rage against the returns

Monday, November 25, 2024

Retailers take steps to curb returns. November 25, 2024 Retail Brew Presented By Bloomreach It's the last Monday before Black Friday, and Chili's just released a line of bedding products that

☕ Cann do

Monday, November 25, 2024

Why the beverage brand Cann is putting one creator front and center. November 25, 2024 Marketing Brew Presented By Klaviyo It's Monday. Ahead of Thanksgiving, the box office is having its best

A trans bathroom controversy in Congress.

Monday, November 25, 2024

We get into a recently proposed bathroom bill for federal buildings. A trans bathroom controversy in Congress. We get into a recently proposed bathroom bill for federal buildings. By Isaac Saul • 25

Good Egghead

Monday, November 25, 2024

More great reading is a mouse click away Good Egghead By Caroline Crampton • 25 Nov 2024 View in browser View in browser How To Give A Good Speech Tim Harford | 21st November 2024 | U There is no one

👾 Meet the Queen of PlayStation

Monday, November 25, 2024

Plus: The best spy thriller of the year might be too good for us. Inverse Daily Shawne Benson is responsible for finding all your favorite indies — and more. Ariela Basson/Inverse; Courtesy of Shawne

How Friendsgiving became America's favorite made-up holiday

Monday, November 25, 2024

Plus: The real story behind FX's "Say Nothing," the horrifying effects of air pollution in South Asia, and more. November 25, 2024 View in browser Some of you may have received