Accelerated - 🚀 Which D2C brand blew us away?

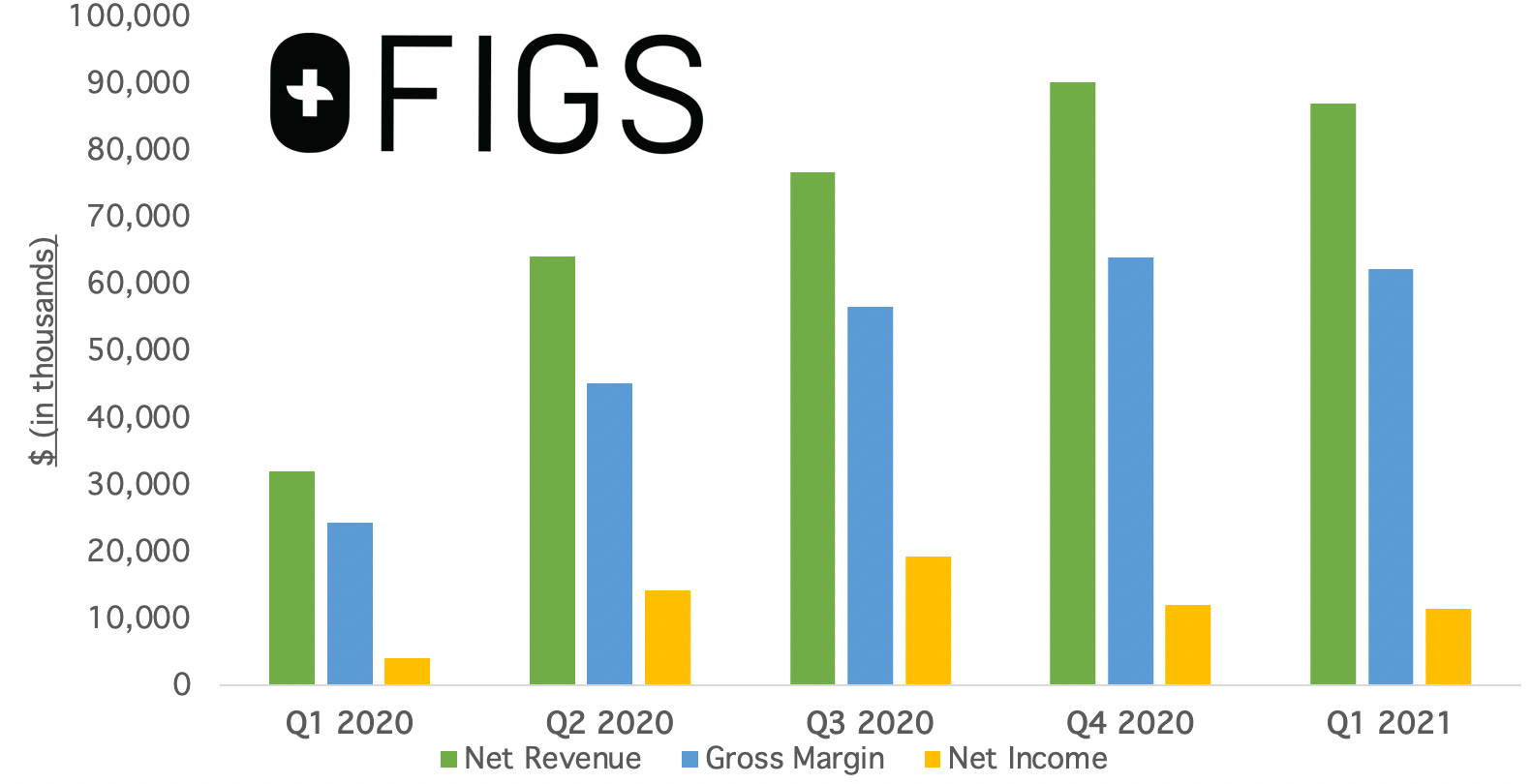

We’re excited to announce our latest investment! CRV led the seed round for Figure, which helps companies structure their compensation plans and communicate them to employees. If you’ve ever worked at a startup, you’ve probably experienced some kind of compensation-related confusion - it can be tough to understand how much your equity might be worth or the tax implications of exercising your stock options. Figure makes compensation more transparent for employees, while also providing tools for employers to manage their compensation bands and ensure pay equity. If you’re interested in learning more, you can check out TechCrunch’s feature on the company or our colleague Anna’s post on the fundraise. If you’re looking for comp software, check out this fun demo of Figure’s offer letter product! 🚨 We need your help! You may remember our survey last year about investing during COVID. We’re curious for an update on what apps you’re using, how you feel about active vs. passive investing, and your thoughts on Dogecoin. We’d really appreciate it if you could fill out this quick survey - it should take <3 minutes to complete. As always, we’ll share the results back! news 📣🐦 Twitter launches new features. It was a big week for Twitter! The company rolled out uncropped images, solving a major pain point (but ruining some jokes). Twitter also released a beta version of Tip Jar, a no-fee way to send money to creators. Lastly, Twitter acquired Scroll, which provides ad-free access to paywalled articles for a monthly fee. Scroll will be integrated in an “upcoming subscription offering.” The acquisition also resulted in Twitter sunsetting Nuzzel, a much-loved daily news email service that will reportedly be reconstituted as part of the core Twitter product. 💰 Verizon sells media assets. Six years after acquiring AOL for $4.4B, and four years after buying Yahoo for $4.8B billion, Verizon is selling both properties for $5B total. The buyer? PE firm Apollo Global Management. The move isn’t entirely surprising - you may remember Oath, Verizon’s attempt to launch a new media property, which largely stalled after CEO Tim Armstrong departed in 2018. Verizon has also sold off HuffPost and Tumblr, marking a move away from the media business. 🚴♀️ Peloton recalls new treadmill. Peloton has recalled 125,000 treadmills and halted new sales after reports of dozens of injuries and one death. The recall included the $4,295 Tread+ and the $2,495 Tread, which was in beta testing ahead of a public launch this month. Peloton CEO John Foley said that the company “made a mistake” in not engaging further with the Consumer Product Safety Commission (CPSC) when it recommended recalling the Tread+ in April. The CPSC will approve both treadmills’ new safety features before they go on sale again. 📈 Square crushes earnings. Square stock rose 6% after the company reported $5.1B in Q1 revenue (massively outperforming the expected $3.4B). This growth has been largely fueled by Bitcoin - Square did $3.5B in BTC sales on Cash App, up from $306M in Q1 2020. CEO Jack Dorsey said that Square’s primary focus is on enabling Bitcoin to be the “native currency,” as this “removes a bunch of friction for our business.” Square itself holds $472M of Bitcoin, after purchasing an additional $170M in February. Facebook is moving further into local connections with the launch of a Nextdoor rival called Neighborhoods. We first wrote about Neighborhoods when the product was tested in Canada - it’s now rolling out in the U.S. Each Neighborhood will have moderators that use a set of guidelines to keep content “relevant and kind.” This is similar to Nextdoor’s Neighborhood Leads, some of whom have struggled in the last year to maintain civil discussions around social issues. We’re curious to see if Facebook has an easier time with this given that a user’s posts are “attached” to his or her existing social graph, or if the same challenges remain! what we’re following 👀How TikTok picks which songs go viral - it’s not as organic as it may appear! Which Facebook app hit the top 10 in social for the first time? The WSJ summarizes the first week of the Epic Games vs. Apple trial. Heartcore Capital’s new guide to the best consumer tech resources. D2C startup FIGS, which makes scrubs and other apparel for medical professionals, filed to go public this week. The company, which was founded in 2013, has been extremely capital efficient - it only raised ~$60M in venture funding to scale to $263M in net revenue. FIGS even generated $50M in net income last year! What’s the secret to its success? The company has benefited from (1) a strong & sticky core product (NPS=81); and (2) an impressive marketing strategy. FIGS is a household name in the healthcare community, and uses social media and an ambassador program to complement its word-of-mouth growth (more here on how FIGS capitalized on the rise of “medfluencers”). A few metrics that stood out to us in the S-1:

jobs 🎓Parade - College Lead (Remote) Unshackled Ventures - Head of Community (Remote, SF) Kapwing - Product Manager (SF) Gorgias - Biz Ops & Strategy (SF)* Primer - Growth PM (SF) Cambridge Associates - Investment Analyst (SF) goPuff - Investment Associate (SF, LA, NYC) PayPal Ventures - Analyst (San Jose)* Vulcan Capital - VC Associate (Seattle) Bev - Marketing Associate (LA) The Farmer’s Dog - Associate Product Manager (NYC) FirstMark - IR and Ops Associate (NYC) Redesign Health - Market Research Lead (Remote, NYC)* *Requires 3+ years of experience. internships 📝Techstars - Finance & Investment Data Intern (Remote) Orchard - Social Media Intern (Remote) Celo Labs - Platform Product, Support Product Interns (Remote) GoodRx - Social Media & Community Content, Broadcast Marketing Interns (Remote) Laika - Customer Experience Intern (Remote, NYC) Carbon Health - Corp Dev Intern (SF) Zoom - Social Impact Intern (SF) Modern Animal - MBA Brand Management Intern (LA) Public - Growth Partnerships Intern (NYC) Stadium Goods - PM Intern (NYC) Grailed - Marketing Associate Intern (NYC) Lunchbox - Finance Intern (NYC) puppy of the week 🐶Incredibly excited to announce that we now have our very own puppy of the week! We welcomed Matilda, a two-month-old labradoodle, on Wednesday (as you can see from these photos of our first meeting, we may have overwhelmed her with joy). Matilda (Tilly) was born in Charleston, South Carolina, but now lives with us in the Bay Area. Her hobbies include napping, growling at her toys, playing with her sister Moka, and using her sister Kai as a pillow. You can follow her on Instagram @matildadoodlebear! Hi! 👋 We’re Justine and Olivia Moore, identical twins and venture investors at CRV. Thanks for reading Accelerated. We’d love your feedback - feel free to tweet us @venturetwins or email us at twins@crv.com. If you liked this post from Accelerated, why not share it? |

Older messages

🚀 Neobanks cash in on Gen Z

Sunday, May 2, 2021

Plus, special access to a new app for Accelerated readers!

🚀 How to escape the Internet hype cycle

Sunday, April 25, 2021

Plus, which viral Super Bowl company filed for IPO?

🚀 Dogecoin heads to the moon!

Monday, April 19, 2021

Plus, the SEC puts SPACs on ice.

🚀 Coinbase preps for takeoff

Sunday, April 11, 2021

Plus, which country launched its own digital currency?

🚀 Everything's coming up Clubhouse

Sunday, April 4, 2021

Plus, a deep dive on Olivia Rodrigo & the future of the music industry

You Might Also Like

AI Assistants Will Be Great (Especially for the Biggest Companies)

Friday, February 14, 2025

Plus! Short Selling; Crypto Treasury Gresham's Law; The Joy of Higher Rates; Labor Substitution; Pricing Black Swans AI Assistants Will Be Great (Especially for the Biggest Companies) By Byrne

🏈 The Super Bowl flight that upped tariffs

Friday, February 14, 2025

The US stamped 25% tariffs on key metal imports, France is coming for America's AI reputation, and chocolate tinned fish | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Why Economists Got Free Trade With China So Wrong

Friday, February 14, 2025

“The China Shock” gets revisited View this email online Planet Money “The China Shock” Revisited by Greg Rosalsky By now, many economists are hoarse screaming that higher tariffs and a trade war will

FinTech is People - Issue #508

Friday, February 14, 2025

FTW Opinions: When fintech principles shape government finance, the stakes go beyond efficiency—trust, security, and oversight are on the line ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Special Announcement From Harry Dent

Friday, February 14, 2025

Harry Dent February 11, 2025 Many of you have heard me talk about John Del Vecchio, one of our trusted partners at HS Dent. He runs two highly successful programs, Microcap Millions and FAST Profits,

Using AI as a Retirement Vision Board

Friday, February 14, 2025

This tool paints a picture of your financial future ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Get a life insurance quote in seconds

Friday, February 14, 2025

And get approved just as fast ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

❌ Altman dissed Musk's OpenAI bid

Friday, February 14, 2025

Musk bid nearly $100 billion for OpenAI, Europe prepared its own diss for the US, and the egg undercurrent | Finimize TOGETHER WITH Hi Reader, here's what you need to know for February 12th in 3:04

Fossicking in the dark or twenty-twenty foresight?

Friday, February 14, 2025

Rishi Khiroya and Lydia Henning If you asked people what skill they would most love to have, you might receive answers like 'to fly', 'to be invisible' or even 'predicting the

I love you(r high credit score)

Friday, February 14, 2025

plus Benson Boone + pizza perfume ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏