Your Weekly Update On All Things Crypto |

|

MakerDAO Takes Swing at Traditional Banks: Offers Decentralized Mortgage Financing |

Last month MakerDAO, the largest decentralized, autonomous bank in the world, took a swing at the traditional banking industry when they started offering decentralized mortgage financing to users who were looking to fix and flip houses. Maker requires users to deposit collateral (in the form of ETH) and in return issue dollar-denominated loans in the form of their native stablecoin DAI. Users then take their newly minted DAI, use it to fund the renovations on their home, sell their home for profit, repay their initial loan (plus interest), recover their collateralized ETH, rinse and repeat.

If traditional banks were nervous about the emergence of defi (decentralized finance) before, this new innovation is sure to send shivers down their proverbial spins. Not only is there no need for pre-approval or applications on MakerDAO, but the fees are also much more competitive due to the lack of regulation and compliance cost needed to secure such defi loans. Essentially anyone holding ETH can lock up their crypto as collateral and receive a loan... no questions asked.

While this service offering is still in its pilot phase in the U.S., MakerDAO already secured $500K in loan financing last month. They are targeting $300 million in real-world loans by the end of this year spanning from freight invoice lending, financing of U.S. farm properties, and loans to solar facilities.

What this means for Defi

While most activity in the defi space has been mostly relegated to crypto-native assets, this feels like the first time the gloves are coming off and the Defi space is ready to directly compete with traditional leading institutions. Not to be easily outdone, this will surely spark a flurry of lobbying from traditional financial institutions to impose strict regulation on the defi industry... "If you can't beat them, regulate them out of existence." While the multi-trillion-dollar banking industry is surely a formidable opponent, my thesis on this is simple; the market always chooses what is better, faster, stronger. If I was forced to bet, I'm putting my money on defi 10/10.

|

|

Elon Pulls Rug On Bitcoin Citing Environmental Sustainability Concerns |

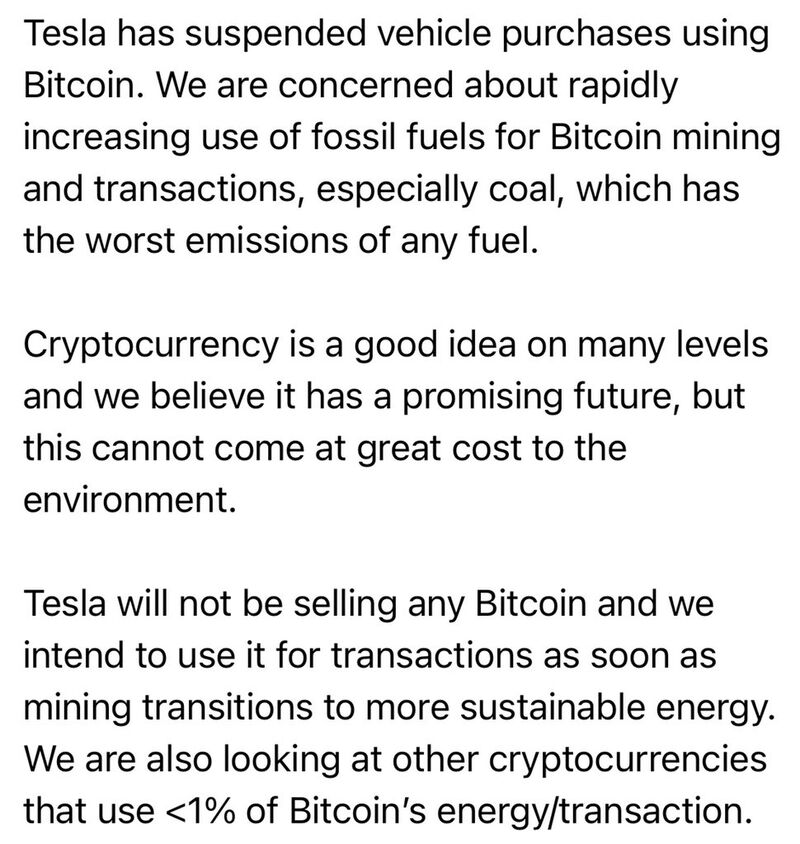

Last week was a sad week for Bitcoin diehards as one of our most beloved champions, Elon Musk, seemingly pulled the plug on his Bitcoin bet, saying Tesla would no longer accept Bitcoin as payment for their cars due to environmental sustainability concerns. In a direct assault on the world's largest cryptocurrency, the worlds largest man tweeted,

|

While it is understandable that a company so closely tied to environmental preservation and sustainability would take such a stance, it is still hard to believe that the company could flip-flop so dramatically on the issue in the span of a few months.

The first elephant in the room is that the Bitcoin energy consumption debate is largely unfounded in reality. As reported in our March 1st newsletter, a study by the University of Cambridge showed that roughly 76% of crypto miners use energy from renewables as part of their energy mix, with 39% of the total electricity consumed coming from renewables. For those who have done their research on Bitcoin's energy consumption, it feels less like this action was due to the environmental sustainability of Bitcoin, and more about the perceived environmental sustainability of it. For a company, and a man, so tied to environmental sustainability, it feels like this was a reaction to a narrative risk, as opposed to the truth that underly the topic.

As the energy debate has clearly become the top narrative for Bitcoin detractors, it is now more important than ever for cryptocurrency enthusiast to find their voice and arm themselves with the facts to debunk the FUD. However, this announcement did not come without a glimmer of hope. The tweet also made it clear that at this time Telsa does not plan to sell the Bitcoin they currently hold. Clearly, they still believe in the project, but this may be a means of saving face for their die-hard environmentalist investors.

Although this news dealt a sizable blow to the market cap of Bitcoin, we must not forget the impact of a 24h news cycle. With prices falling fast, institutions are licking their chops to heavy up their exposure. It won't be long before the news comes out of the next multi-million dollar Bitcoin purchase and the cryptocurrency world is set back in alignment.

|

|

Cowen Leads $53M Series B Round for Custody Partner PolySign |

|

Cowen, the American multinational independent investment bank and financial services company with over $11.8 billion under management, will now offer crypto custody solutions to hedge funds through it's partnership with PolySign, an early stage fintech company looking to drive the global use of digital assets by building critical custody and payment infrastructure solutions for institutions.

As per the partnership agreement, Cowen took a $25 million stake in PolySign and lead the companies $53 million Series B that was announced last Thursday. The round also saw participation from Blockchain.com, Race Capital, Sandia Holdings and PilotRock Investments. PolySign will use the fresh capital to accelerate it's mission-driven development of institutional grade blockchain applications.

“Led by a best-in-class team of cryptocurrency and financial services pioneers, PolySign has developed proprietary, next-generation blockchain technology that we believe will be foundational to the development of secure, trusted digital asset infrastructure," stated Jefferey M. Solomon, CEO of Cowen. Headquartered in SanFrancisco's Bay Area, PolySign.io indeed has a talented roster behind it. Founded in 2018 by Arthur Britto, the Co-Founder of Ripple Labs and co-designer of XRP Ledger, the leadership group consists of Jack McDonald, previously the CEO of Conifer Financial Services, Tim Keaney who served as VC for BNY Mellon, Antoinette O'Gorman, previously CCO at Ripple Labs, and David Schwartz who was perviously the CTO and chief cryptographer at Ripple.

“As digital assets continue to grow and mature as an asset class, institutional investors need trusted custody and trading solutions on par with their requirements for investing in traditional securities. Our partnership with PolySign is another example of how we, at Cowen, position ourselves to better serve our clients by identifying disruptive trends that we believe will impact investment markets for years to come," Says Solomon. The news brings yet another institutional gateway and security option to service more investors looking to enter the cryptocurrency space.

|

|

Decentral Capital is a registered FinTrack business that provides secure access and diversified exposure to the digital currency asset class. |

|

Your Cryptocurrency Investment Partner

The best place to invest, track and use cryptocurrencies

for the long term investor

|

|

|

Bitcoin Makes 1st Test of Bull Market Support Since August 2020 |

Last week was a painful one for Bitcoin HODLers. Following two weeks of positive price action, Bitcoin clocked a 25% drop last week on the back of a Tweet from Elon, and the potential implication of ESG investors losing faith in Bitcoin. This sell-off was also likely exacerbated by the excessive amount of leverage in the space and the cascading margin calls that resulted from it. However, it is important to note that swings of this magnitude are not uncommon in the cryptocurrency industry. It is worth noting that our last bull-run in 2016-2017 saw a total of eight +30% pullbacks in the price of Bitcoin. At this time, this bull run has only seen two.

This pullback also marked a decisive break to the downside, out of the ascending megaphone pattern we have been following since the beginning of 2021. At the time of writing the Bitcoin price has even dropped below the Bull Market Support band, indicating the potential for a trend reversal. With all that said, we have still not broken the critical horizontal line of support at $43K if we make a decisive weekly break below that support line, there would likely be further downside to follow.

|

Altcoins Fair Well Amidst Bitcoin Pullback |

Despite the 25% pullback in Bitcoin last week, the broader altcoin market posted yet another positive week in market dominance. That now puts this rally at 9 straight weeks! This is to be expected when Bitcoin is trapped in a trading range. When Bitcoin is not in price discovery, liquidity filters into coins with higher potential profitability. At the time of writing, altcoin dominance sits at 58% topping out just shy of 60% market cap. The all-time high for altcoin dominance remains at 64%, however, it will be a significant test to break above 60%, a level we have not seen since May of 2018.

As we said last week, the alt market has been running hot for over 2 months now, and with the latest pullback in Bitcoin price, a V-shaped recovery in Bitcoin may pose a threat to alt-coin dominance as liquidity shifts back into Bitcoin to capitalize on low prices.

|

|

Vitalik Buterin Donates Over 1B in SHIBA (SHIB) Proceeds to Fight COVID in India |

|

|

|

RedFOX Labs is is a tech-forward venture builder delivering companies & platforms that are secure, scalable, and innovative, bringing the world into a new era of technology and prosperity. They're building an inclusive future that empowers people around the world as we move to new digital frontiers. RedFox labs were founded in 2018 with the intent to be Southeast Asia's first blockchain venture builder and to help with the mass adoption of blockchain and other emerging technologies.

RFOX has seen a 75% decline in its price vs Ethereum since the end of March. It has been consolidating in a descending wedge and is nearing the end of the pattern. If RFOX is able to break out of this pattern, we feel there is potential for a large bounce as it tries to recover some of its recent losses.

|

|

|

|

Algorand builds technology that accelerates the convergence between decentralized and traditional finance by enabling the simple creation of next generation financial products, protocols and exchange of value.

Algorand is still miles away from its all time high vs Bitcoin, but has been seeing bullish momentum over the past few months. With an exceptional team, comprehensive research and technically sound code, we feel like Algorand is a diamond in the rough that has not yet seen its time in the sun. As development on the platform continues, if they are able to attract developers and build a high quality dapp ecosystem, there may be plenty of upside for this project in the weeks and months to come.

|

|

|

|

The largest bitcoin event in history, is taking place June 4-5th in Miami. Bitcoin 2021 will feature an iconic lineup of the best and brightest minds in Bitcoin, including Michael Saylor, senator Cynthia Lummis, Jack Dorsey, Tony Hawk and Nick Szabo. World renowned investors and fund managers like Tim Draper, Olaf Carlson-Wee, and Mike Novogratz. C-level and founders of some of the most innovative companies in the crypto space will also be in attendance, such as Solana's Sam Bankman-Fried, Brian Brooks the CEO of Binance US, and Cameron and Tyler Winklevoss. Additionally, authors and podcast hosts such as Jeff Booth, Peter McCormick, Allan Stevo, and Charlie Shrem. If you're able to make it to Miami, then Bitcoin 2021 is a must.

|

|

The Largest Bitcoin Event in History

Date: June 4-5

🌐 Miami, FL

💲 $900 paid in BTC

|

|

We've covered NFTs a lot over the past few months, and for good reason. One of the hottest topics in blockchain and cryptocurrency goes beyond the collectibility and price soaring auctions. NFT Summit is a FREE virtual event that covers all aspects of the Non-Fungible landscape. Speakers include some of the top protocols, digital artists, investors and companies leading in NFT innovation.

|

|

NFT SUMMIT

Date: June 1-2

🌐 Virtual

💲 FREE

|

|

|

|

Want to Sponsor the Newsletter? |

|

We at CryptoWeekly are not Financial Advisors. None of the content or opinions expressed in this newsletter should be considered financial advice. We highly recommend that you do your own research before investing in any project within or outside the cryptocurrency space. |

|

|

|

|

|

|