Flipside Crypto - The Bounty Brief #7

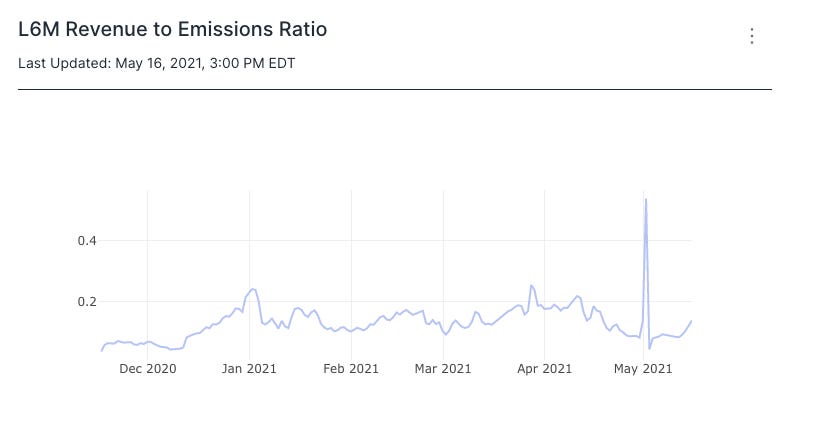

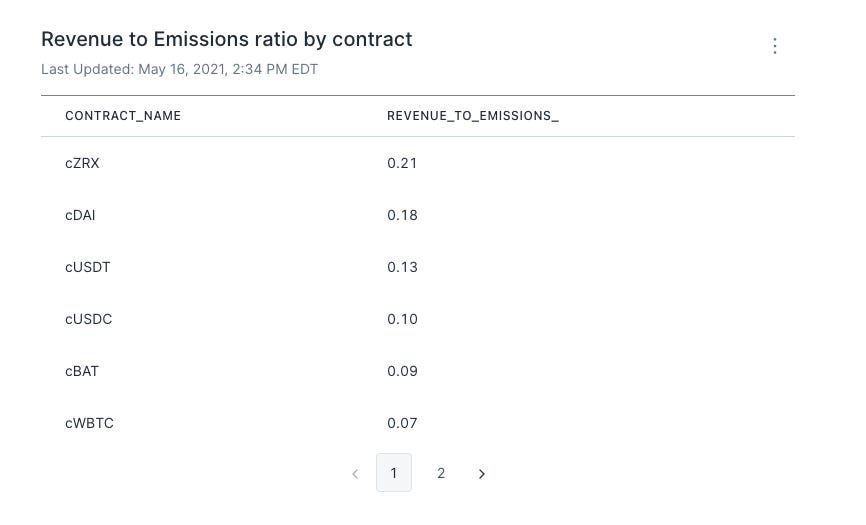

Hello there, Bounty Hunters 💸 We know it’s been a rough week for many of you, filled with bear markets, falling prices, and dwindling bags. That’s why your friends at Flipside Crypto are here to help you make money, even in a bear market, with a fresh slate of new bounties for you to claim and complete. This week, we’ve got the latest round of bounties from Compound, new bounties on Uniswap as well as the best of the available analytics bounties from around the web. So, if you haven’t already, sign up for an account on Velocity, claim a bounty, and find profit in the bear market. And don’t forget — you can also enter the Uniswap Grants Dashboard competition to earn up to $5,000 for your bounties. Submissions to Uniswap are due by 12 midnight on May 31, so make sure you get your dashboards in! Learn more about the Uniswap Grants program here, and get help/feedback from our team in Discord! Now, onto the bounties for this week. Uniswap 🦄Top Liquidity Providers 💧 Bounty: Up to 9.47 UNI Description: Explore the behavior of the top liquidity providers since V3 launch. For top liquidity providers, analyze correlation between daily price change and daily LP actions. (Do LPs move quickly to adjust their position when price changes?) Characterize the typical price spans of top provider's positions - does this vary by pool and/or fee tier? How much are top liquidity providers spending in fees? Token Swap Analysis 🪙 Bounty: Up to 9.47 UNI Description: Provide a dashboard and/or analysis of the top tokens being exchanged on Uniswap. Which tokens are swapped most frequently for which other tokens? (ex. USDT is swapped most often for USDC and then WETH, +). Define "top tokens" both in swap counts and swap volumes (USD). Provide analyses for V2 & V3 together, and separately. Whale Activity 🐋 Bounty: Up to 9.47 UNI Description: How did UNI whales react to the bear market? Choose 3 metrics that best illustrate their behavior. Include how you defined "whales" in your answer. See all Uniswap Bounties🦄 Bounty: Up to 9.47 UNI Description: Answer one of these top analytics questions from the community and receive up to 9.47 UNI as a reward. 📈 CompoundThe Top DeFi Lending Platforms Dashboard 🏆 Bounty: Up to 0.5 COMP Description: What are the top competitors to Compound in the DeFi ecosystem? Create a dashboard comparing Compound to Aave, Maker, and any other notable DeFi lending protocols (InstaDApp, Liquity). Use the major leading insights (TVL, volume, users) and anything else that would be insightful in analysis. Price Dip Impact 📉 Bounty: Up to 0.5 COMP Description: What was the impact on Compound of the dip in prices across all of crypto on Wednesday? Suggested data points: Change in liquidity in Compound - how was compound impacted compared to other defi protocols? Number of liquidations and volume of liquidations? Average gas price to transact? APY Spread Bounty: Up to 0.5 COMP 📊 Description: What is the APY for stablecoins vs. ETH vs. other tokens used as collateral assets for borrowers? Has that changed over time? If you were building a portfolio that managed risk vs. yield, what would be your recommended investment in each? See all Compound Bounties💰 Bounty: Up to 0.5 COMP Description: Answer one of these top analytics questions from the community and receive up to 0.5 COMP as a reward. 🕸️ IoTeXReview And Improve IoTeX Docs 📄 Bounty: 15505.86 IOTX Description: We would like you to go through our documentation website at https://docs.iotex.io from a User/developer perspective and provide a report pointing out errors, inconsistencies, typos, dead links. Also go through the examples and tutorials and try them reporting what is not working, errors, outdated content etc.. Port UMA Protocol On IoTeX 🌀 Bounty: 77529.30 IOTX Description: Port and deploy UMA protocol (Universal Market Access) on IoTeX to allow any dApp on IoTeX to use UMA to build synthetic financial products. 🔏 HOPRWhich Days Of The Week Are Most Effective For HOPR? 📅 Bounty: 300 HOPR Description: From our early analysis and observations of a short period, we have learned that HOPR's marketing (Twitter), community (Telegram) and trading activities (Uniswap) are active on Wednesdays and Fridays. We would like to analyze better the most active day of the week across platforms and channels (Twitter, Telegram, Uniswap) in a quantitative fashion. 🦡 Badger FinanceDeFi Yield Farming Strategy Review For Badger MStable BTC Vault 🔒 Bounty: 300 BADGER Description: We are seeking 3 independent reviews for this vault. We ask that these are completed no later than EOD on June 2nd. If you are a highly skilled solidity developer with relevant experience and are interested in building with Badger, we hope you will consider completing this bounty. We’d also ask that you include a recent version of your CV with your submission. 🪙 BitgesellPull Request bounty hunt 🏹 Bounty: 100 USDT Description: To get more people involved and provide motivation, we are announcing Bitgesell Pull Request bounty hunt! The rules are simple: You can create any reasonable pull request that may contain any modifications, including, but not limited to: Refactoring and simplification; Test fixes (1 test group/file fixed by single PR counts!); Cleanup of features that are no longer used (e.g. non-segwit transactions); Documentation and comments (but if no code changes then some reasonable amount of changes should be done to count); Bug fixes. #️⃣ Hashtag ProtocolTurn Footer Into Reusable Component For Entire Platform Bounty: 1564 DAI Description: Our (marketing website, demo dapp, documentation site) all run as separate apps written in Vue.js. The footer in each looks the same, however, editing the footer involves editing the footer component in all three apps. Not fun. We would like a way to have all three apps reuse a single footer component. The solution should be a re-usable npm component or GitHub package that can be used in each of the three web properties. 🏆Bounty Submission of the Week 🏆Submitted by @shenron_eth Welcome back to our Bounty Submission of the Week! In case you’ve already forgotten after last week’s debut, in each issue of the Bounty Brief, we’ll feature one of the best submissions as voted by our community on Discord. In this edition, we’re excited to feature a look at Compound Revenue and Emissions from @shenron_eth. According to @shenron_eth, Compound has generated $0.1305 in revenue per dollar issued on their own token over the past six months. That ratio has remained mostly stable over time, outside of a notable spike in early May caused by a sharp decline in emissions and a rise in the value of $COMP. @shenron_eth also notes, however, that we see different contracts provide varying returns when looking at the breakdown of this ratio by any market. When comparing stablecoins, for instance, DAI provides $0.18 of revenue per dollar of $COMP issued, higher than both USDT ($0.13) and USDC ($0.10). @shenron_eth had tons of great findings we couldn’t fit into this newsletter, so make sure you check out their submission to see all of the dynamic data they presented, and get your submissions in to be considered for future editions of the Bounty Brief. Good luck with your bounties this week🤞🍀 Make sure you join our community on Discord to keep up with all things bounties and get answers to any questions you have about solving our queries: Sharing is caring! Make sure you subscribe and share the Bounty Brief with a friend that wants to get involved in the space: If you liked this post from The Bounty Brief , why not share it? |

Older messages

All About Flash Loans

Thursday, May 27, 2021

Flash loans — they're making big waves, can result in big profits, and are often associated with hacks and exploits. So what are flash loans, exactly?

The God of Thunder Arrives: Learn All About THORChain

Wednesday, May 26, 2021

On April 13, the long-awaited God of Thunder finally made its arrival. Now, it's time to learn more about THORChain and its RUNE token.

The Bounty Brief #6 💸

Thursday, May 20, 2021

Compound and Uniswap bounties galore 🦄 📈 💸💸💸

Uniswap V3 Dashboard Debrief #3: Swap Stats 🦄 🔄

Wednesday, May 19, 2021

Flipside Crypto takes a closer look at Uniswap V3 swap volume with the help of our labeled, on-chain data.

Uniswap Dashboard Debrief #2: Help us build a bigger, better dashboard — and get paid 💸 💰

Tuesday, May 18, 2021

Join us as we work to build the biggest, baddest, and all-around best Uniswap V3 dashboard available!

You Might Also Like

The Cross-Currents Shaping Crypto Markets

Tuesday, March 18, 2025

Exploring the macro and crypto forces driving current market dynamics ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

WuBlockchain Talks with BitMart Founder Sheldon: From Bicoin in College to 7 Years of Entrepreneurship and US Regu…

Tuesday, March 18, 2025

Sheldon, founder of BitMart, first encountered Bitcoin as a college sophomore in 2013 after reading about an ASIC mining breakthrough. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

In-depth Analysis of the $1.5 Billion Theft Incident at Bybit: Identifying Security Blind Spots in Multi-signature…

Tuesday, March 18, 2025

This discussion started with the $1.5 billion theft incident of Bybit, mainly exploring the security vulnerabilities of multi-signature wallets (like Safe) and their solutions. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Michael Saylor says US needs Bitcoin to continue as military superpower aligning with SoftWar theory

Tuesday, March 18, 2025

Viewing Bitcoin through a military lens, Saylor champions its role in national cybersecurity and global strategic dominance. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: Donald Trump Creates U.S. Bitcoin Reserve

Tuesday, March 18, 2025

March 10th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Donald Trump Creates US Bitcoin Reserve Diddy Shows 'Kindness' To Sam Bankman-Fried Robinhood Conducts $1M Crypto Trivia

The Rise of TIMEFUN: An In-Depth Analysis of Celebrity Time Tokens

Tuesday, March 18, 2025

Recently, Binance founder CZ shared his idea of time-based tokens, where KOLs tokenize their time. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Ethereum's Pectra upgrade successfully deployed on the Sepolia testnet; Pump.fun saw a sig…

Tuesday, March 18, 2025

Ethereum's Pectra upgrade deployed on the Sepolia testnet; Pump.fun saw a significant drop in token launches; World Network's messaging app introduced intra-network fund transfers. ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Ethereum's Pectra upgrade successfully deployed on the Sepolia testnet; Pump.fun saw a sig…

Tuesday, March 18, 2025

Ethereum's Pectra upgrade deployed on the Sepolia testnet; Pump.fun saw a significant drop in token launches; World Network's messaging app introduced intra-network fund transfers. ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump cabinet’s Bitcoin investments raise ethics alarms in pro-crypto era

Tuesday, March 18, 2025

Cabinet members' Bitcoin holdings spark debate over ethics and influence in Trump's pro-crypto governance approach. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

WuBlockchain Weekly: Rumors Circulate About Trump Family Investing in Binance US, UAE Royal Family Invests in Bina…

Tuesday, March 18, 2025

According to the Wall Street Journal, representatives of President Trump's family have held negotiations regarding an investment in the US subsidiary of cryptocurrency exchange Binance. ͏ ͏ ͏ ͏ ͏ ͏