From Brain Eating Mold, To Crypto Proving Assets > Income

Ah Contrarians, we got a good month for you. This is the free newsletter, premium click here for our monthly playbooks and FB community. 😳 What Do You Have if You LOSE YOUR HEALTH?A lesson on: Decentralization of wealth + health + Assets > Income Have you heard of my bud Mike Dillard? Well… He is a reigning name in the world of the internet. He has built multiple 6, 7, 8 figure businesses. He’s going to blush when I call him a genius but I think it’s true, his mind just spins differently. Which is why I always ping him on everything from how to scale an e-commerce business, to a mastermind, to a podcast, to media business, and beyond. But Mike has a cautionary tale. He was at the height of his game. His businesses were doing multiple millions in revenue, his podcast had hundreds of thousands in downloads and then he started slowly but increasingly not feeling very well. He shuffled from doctor to doctor trying to figure out where his energy, his mental capacity, his vigor had gone. No one could tell him what had happened? No one could figure out how this guy with formerly limitless energy now was struggling through workouts. In his words:

After dozens of blood and DNA tests, months of providers prodding, he figured out that toxic mold had gotten into his brain. Essentially according to Mike what that means is:

Long story short, his brain was being eaten alive by mold. Horrifying. And oddly, not that rare. In fact, 25% of the population has a genetic predisposition to suffer from toxic mold and 70% of homes are estimated to have some sort of mold. *Looks around the new house I just overpaid for in Austin like… That said, it got me thinking… Mike couldn’t really work for YEARS. If Mike had had a normal job that came with a trading time for money mentality he would have been screwed. Then I started thinking, well how many humans at some point get incapacitated from work?

Ok, those are scary numbers.Then pair that with our abysmal savings rate and you’ll really have a jolly good time.

Yet, when I met with Mike - despite not being able to work for months if not years he was crushing it. I not so appropriately asked…What’s the secret bud?His answer? Assets. Namely cryptocurrency. He’s made multiple 7 figures from investing in bitcoin and alt coins, again and again. While I AM FAR from an expert in the space I’ll tell you what Mike taught me and give you some questions to contemplate after all: As the saying goes, “what got us all here, may not get you there.” My Progression on Crypto:

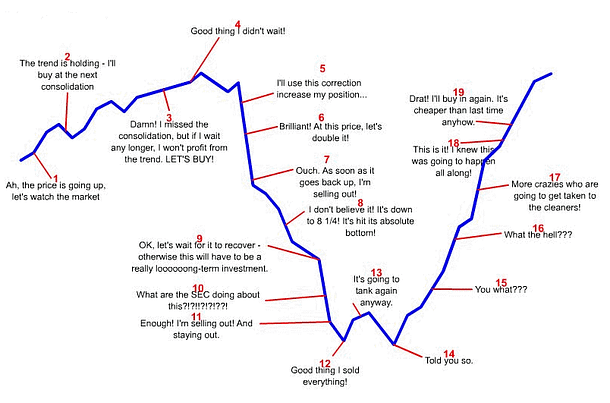

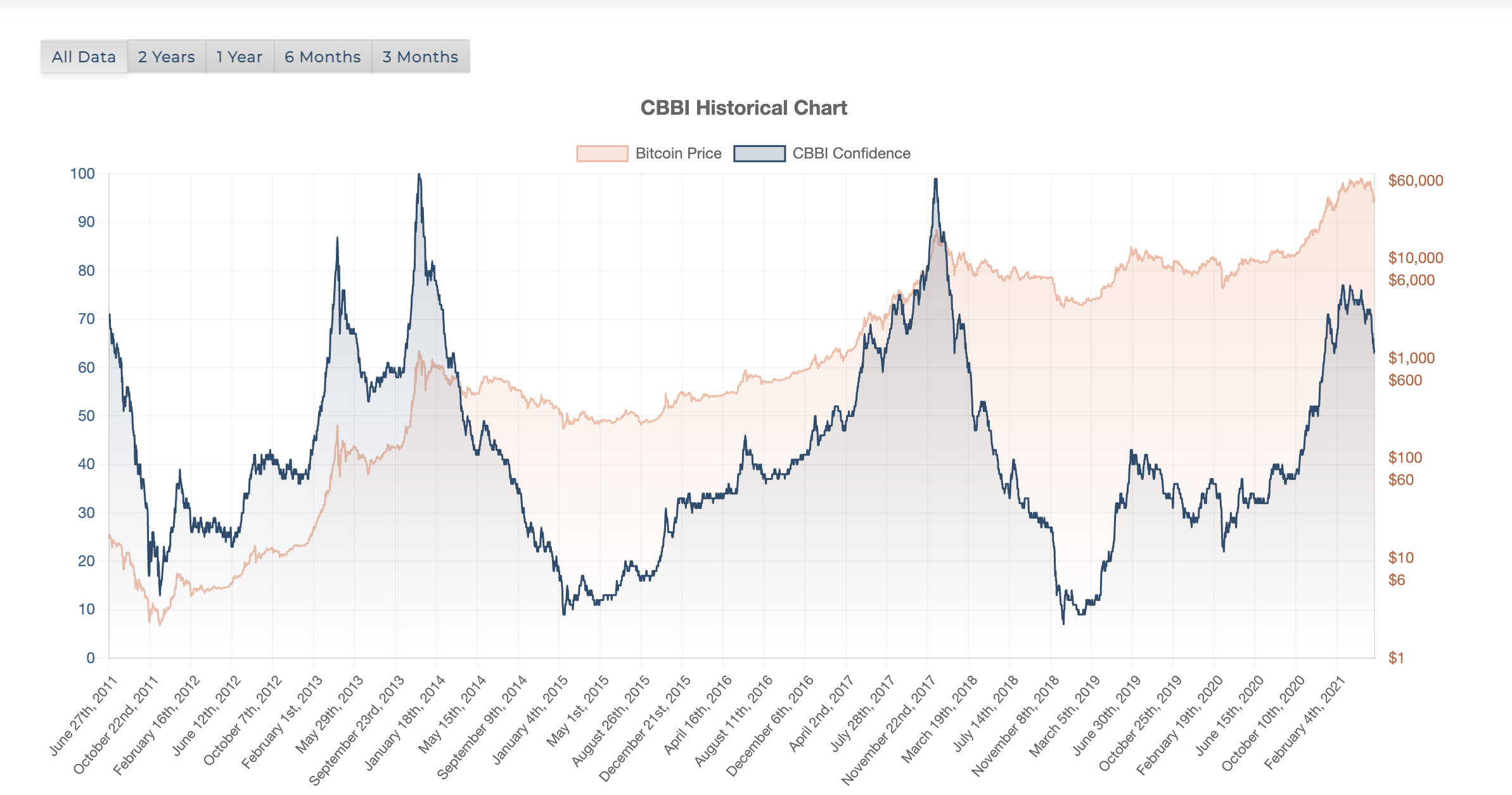

Thennnnn I wrote a whole article about how this ship was gonna burn soon. #sorrynotsorry I LOVE the long term trend, I hate speculation it always burns the little guy. But this week since this baby halved and everyone from not so Teflon Elon to Munger ain’t got no bitcoin hunger hates the BTC, it’s the perfect time to talk about it. Lessons from the Rational Non-Euphoric Dillard:In summary: First, you dabble in Bitcoin on Coinbase, then you go to Gemini, then you learn about Staking, then you get into second-tier coins, then you figure out wallets, then you go down a deep dark rabbit hole. Five thoughts on the old BTC, ya you know me. 1 - The average investor who lost money in this BTC cycle?Those who held $10-100k. Aka retail investors. Aka me, you, Chad, Nance. Those who get emotional, typically lose. Mike’s recommendation… if you’re a beginner, weight your portfolio on 100 % bitcoin. Slightly more advanced? 50% Bitcoin, 50% Ethereum. Leave altcoins for money to play with. And never invest in sh*t like Dodge… it’s only funny and memey when you’re up. 2 - The hardest thing is to know when to sell, and actually selling.It’s really all just a guess. But an interesting rule of thumb from Mike, is to follow the indicators of Colin Talks: https://colintalkscrypto.com/cbbi/. When 3-4 of these confidence indicators hit 70-90%, it’s likely Bitcoin is at a peak. Start thinking about your plan for exit and re-entering at a downturn. 3 - Security should be one of your TOP concerns.Keeping your assets safe, not a given. Mike himself was actually the victim of an exchange scam back during its first bull run spike. He lost 100’s of thousands in assets when the exchange shut down and ran away with his crypto (worth millions today). No bueno. The TLDR - get it off the retail exchanges if you’re holding for long term AND you’re not going to trade it.

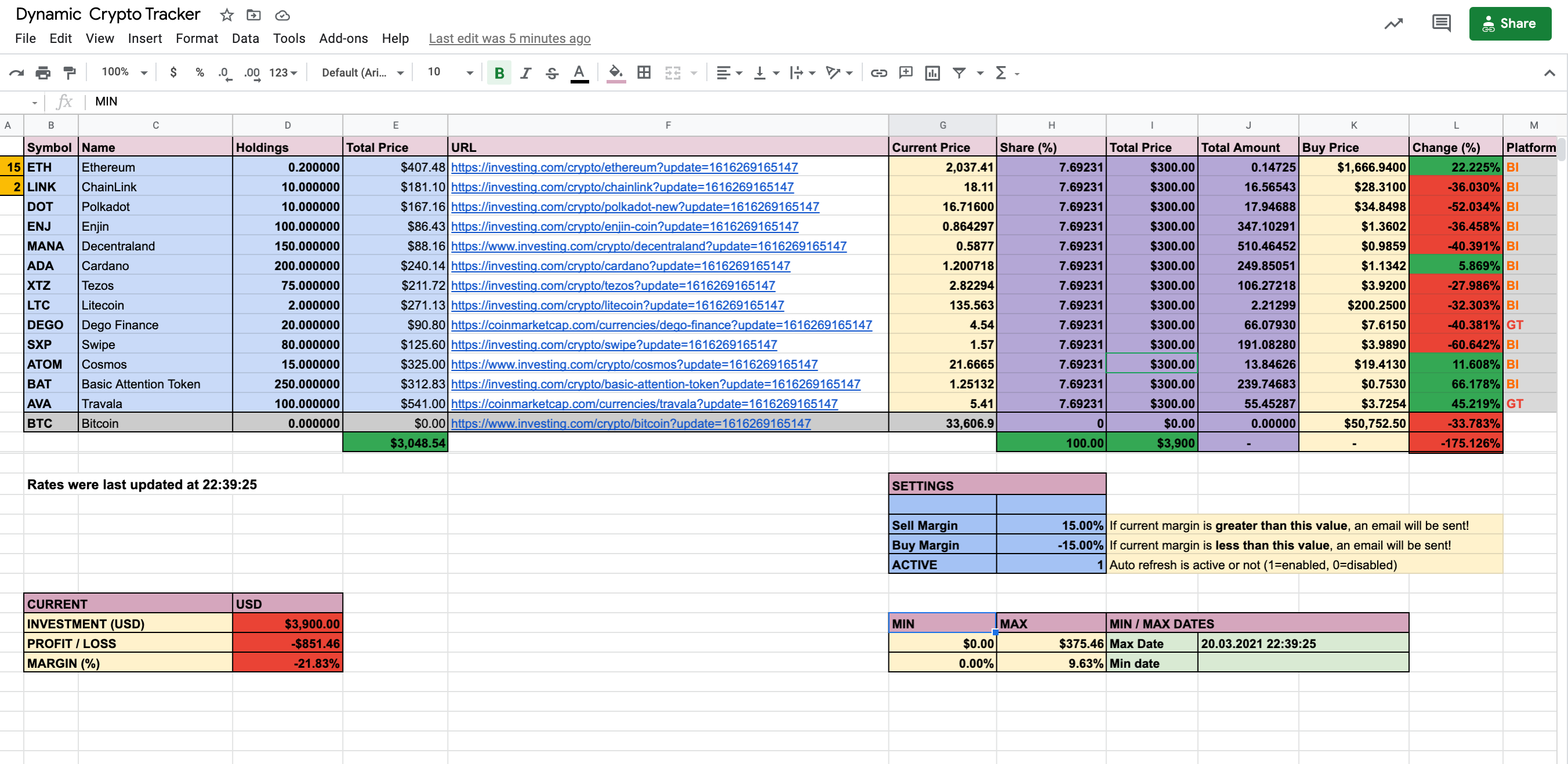

We broke down his intense security plan in its entirety in the Contrarian Cashflow Playbook this month. He also dropped a gift for the Cashflow community if you were interested in learning more from his crypto course. 4 - Own your tracking.You can track cost basis on apps etc but most have flaws. We like to track it in private spreadsheets with dynamic pricing included, here’s our spreadsheet below. Because money runs away from those who don’t track it. And are you even an investor if you don’t have red and green excel graphs glaring at you? 5 - What is Old Is New Again, Except It’s NotI see a lot of charts like this in bitcoin. In fact, POMP wrote an article with this doozy of a sentence, “Due to the open-source transparent nature of the Bitcoin blockchain, investors can analyze the capital flows of the market in ways that are not possible in traditional financial markets.” In English - I see the future, thanks. Here’s the thing, this type of charting is not magic, it’s called Point and Figure (P&F). And sorry kiddos, while BTC may be new, Charting is over 100 years old. It’s even older than the BTC haters Buffett and Munger. It’s so old they used to draw the charts... with pencils. So basically take everything we’re talking about with a giant grain of salt. Knowledge is power, but only as powerful as your ability to question it. _____ Long story short. Whether it’s crypto, real estate, businesses, etc, make sure you optimize for assets, not just income. Income requires your time. Assets don’t. So we like big ass-ets. Question everything… Codie DO YOU WANT FINANCIAL FREEDOM? That’s our goal too. We’ve helped now over 100+ people on their path to divorcing their time from money. Come along with us, join CT Premium. A monthly deep-dive, play by play, guide book to cashflowing unconventionally, paired with a community for AMA’s and accountability on your path to profits. If you liked this post from Contrarian Thinking, why not share it? |

Older messages

Can You Say...ROI?

Saturday, May 29, 2021

Let's celebrate how YOU turned $1000 into $6010 in 18 Days Hey Contrarian - Before taking some time to celebrate a reader's win, I wanted to say THANK YOU for the tens of thousands of you who

You Might Also Like

You Can't Trust Email Open Rates.

Monday, March 10, 2025

Here's Why, and What to Measure Instead. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Phone Company That Hung Up On Its Customers (1)

Monday, March 10, 2025

I kind of don't blame them.

🧙♂️ The EXACT Job Titles To Target (Based On Brand Size)

Monday, March 10, 2025

Please stop DMing brands ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Why American Christianity has stopped declining

Monday, March 10, 2025

Hi all, Please have a wonderful week. Trevor The man who wants to know everything (article) Fantastic profile on Tyler Cowen. Part of me feels like he's missing out on some of the joys of life, but

The Biocomputer That Blurs Biology, Tech, and The Matrix - AI of the week

Monday, March 10, 2025

Cortical Labs introduced CL1, a biocomputer merging neurons and tech; AI advancements included autonomous agents, AI-powered phones, healthcare assistants, and humanoid robots; plus, Derek Sivers

• World Book Day Promo for Authors • Email Newsletter + Facebook Group Posts

Monday, March 10, 2025

Book promo on 4/23/25 for World Book Day Join ContentMo's World Book Day Promotion #WorldBookDay is April 23rd each year. ContentMo is running a special promo on 4/23/25 for World Book Day

If you're meeting with someone this week...

Sunday, March 9, 2025

Plus, how the LinkedIn algorithm works and how to get your first 100 newsletter subscribers. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

$30,000 Youth4Climate grant, USAID support festival pro bono resources, Interns at Fund for Peace

Sunday, March 9, 2025

The Bloom Issue #205, March 9 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Food for Agile Thought #483: Leadership Blindspots, Tyranny of Incrementalism, Who Does Strategy?

Sunday, March 9, 2025

Also: Product Teams 4 Success; Rank vs. Prio; Haier Self-Management ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Authors • Spring Into Reading Book Promo • Email Newsletter + FB Group Posts & More

Sunday, March 9, 2025

Promo is Now Open for a Limited Time MARCH 2025 Reading Promotion for Books Join ContentMo's