Flipside Crypto - The Bounty Brief #8

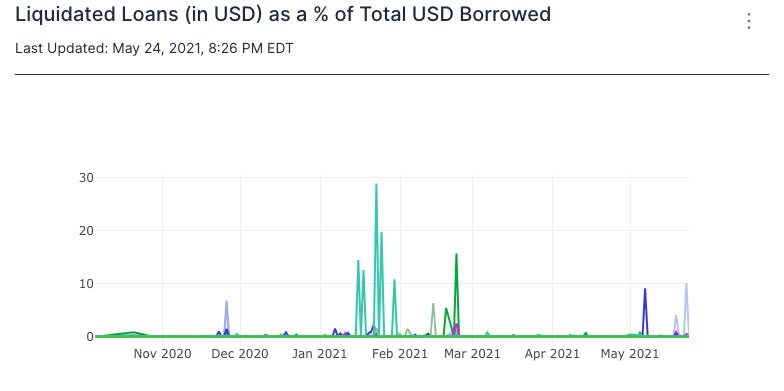

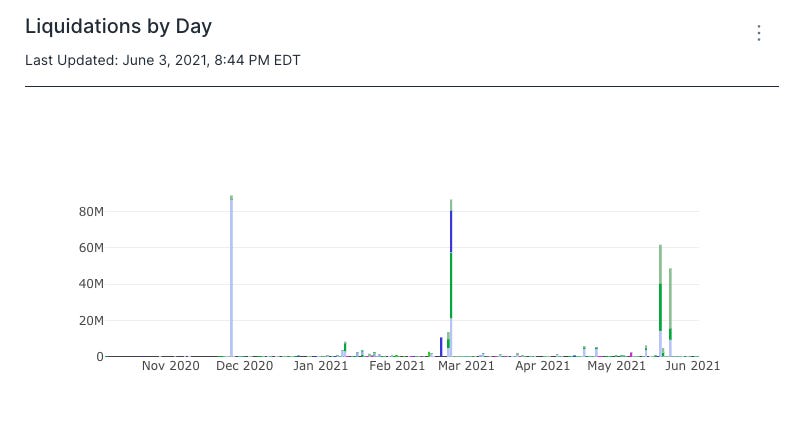

Hello there, Bounty Hunters 👯 Are you a part of our community on Discord? If not, you should be. Onto this week’s bounties, including some from Uniswap, Compound, and more. Uniswap 🦄[Easy] Active Liquidity 💧 Bounty: Up to 9.47 UNI Description: Find the 5 largest liquidity pools in Uniswap V3. What percentage of positions and what percentage of virtual liquidity (liquidity_adjusted) are currently out of range? When this occurs which is the approach most taken: updating the range or waiting it out. [Hard] Concentrated Liquidity 💦 Bounty: Up to 9.47 UNI Description: In terms of concentrating liquidity in specific ranges. Look at the top five liquidity pools. What are the reward rates associated with concentrating liquidity in larger ranges that have more providers? What are the reward rates associated with concentrating liquidity in smaller ranges in areas where there are not as many providers? Compare these rates and visualize this comparison. [Hard] Capital efficiency ⛑ Bounty: Up to 9.47 UNI Description: Find the 5 largest liquidity pools in Uniswap V3. How does the capital efficiency (efficiency of capital increased is by getting more out of the same amount of money) compare to the same pools in V2? What range incorporates at least 75% of the liquidity in the pool? See all Uniswap Bounties🦄 Bounty: Up to 9.47 UNI Description: Answer one of these top analytics questions from the community and receive up to 9.47 UNI as a reward. 📈 Compound[Easy] How does price volatility affect the borrow APY? 📈 Bounty: Up to 0.5 COMP Description: Show how sharp price changes have affected the borrow APY in the past. To answer this question, please include a clean definition of volatility and specific tokens for comparison. [HARD] What are the risks associated with pool liquidity falling too low? 📉 Bounty: Up to 0.5 COMP Description: What are the risks associated with pool liquidity falling too low? How often has this occurred in the past 6 months? When is this most likely to occur? [HARD] What happened to leveraged borrows with the crashes a few weeks ago? 💥 Bounty: Up to 0.5 COMP 📊 Description: Show how sharp price changes have affected the borrow APY in the past. To answer this question, please include a clean definition of volatility and specific tokens for comparison. See all Compound Bounties💰 Bounty: Up to 0.5 COMP Description: Answer one of these top analytics questions from the community and receive up to 0.5 COMP as a reward. 🌐 TurqEnable Users to Post 📌 Bounty: 80.04 USD Description: Viewable Figma here with frontend. Need the intake to have the following 5 steps: Issue Headline Issue Description/details Legislation Needed Location of Concern Funding or Sharing on Twitter. 🎶 HarmonyExpose All Configuration Variables And Values 🔍 Bounty: 4883.14 ONE Description: We need to expose all configuration variables and values to the log file and RPC interface. An option/flag in the configuration to print all configuration variables and their values in the log file, as a way to debug the configuration changes. Also, a new RPC interface to expose all configuration variables and values. PPF Module Extension ↔️ Bounty: 29298.84 ONE Description: Extend the harmony node's Pprof service with some advanced developer options. 🦸 SovrythonData-Science-Advanced-Analytics-And-Simulations 🧮 Bounty: $7,500 in SOV Description: We are having loads of data and not enough people to read it! We are in need of advanced analytics on our trading data, simulations of the effect of smart contract settings (e.g. parametrization of the EMA for the v1 pool oracles), and ways to observe the effect of our marketing campaigns. Data-Science-Oracles 🔮 Bounty: $7,500 in SOV Description: Almost every action on Sovryn requires a price oracle. While we are transitioning our core protocol to using only internal oracles maintained by our AMM converters, we still have a need for external price feeds (or other data oracles) for new features and products. You can submit your solutions to both our Covalent and API3 partner bounties and this one. Data-Science-API 🧪 Bounty: $7,500 in SOV Description: The easier it is for third parties to connect to Sovryn, the better. Currently, the only API is the smart contract ABI. It would be great to see an easy-to-use API for querying our contract data. You can submit your solutions to both our Covalent and API3 partner bounties and this one. 🏆Bounty Submission of the Week 🏆Submitted by CrypGOAT on Discord Welcome back to our Bounty Submission of the Week! According to CrypGOAT on Discord, there have been several major liquidation events in recent history on the Compound platform. First was the liquidation of 6.8% DAI, among other liquidations, in November of last year, caused by DAI coming off its peg and reaching highs of as much as $1.30. That was followed by several UNI liquidations in the early part of this year, including 15% of WBTC borrowed was liquidated on February 22, coinciding with a big slide in Bitcoin prices. As we can see in the chart below, the more recent waves of liquidations have likely been triggered by broader bear markets as well. But, as CrypGOAT points out, it’s important to remember that the scales of borrowing markets can be vastly different. And, as a result, large percentage liquidations in small markets can lead to lower absolute value, as seen below. CrypGOAT had tons of great findings we couldn’t fit into this newsletter, so make sure you check out their submission to see all of the dynamic data they presented, and get your submissions in to be considered for future editions of the Bounty Brief. 🌟 ICYMI 🌟

Good luck with your bounties this week🤞🍀 Make sure you join our community on Discord to keep up with all things bounties and get answers to any questions you have about solving our queries: Sharing is caring! Make sure you subscribe and share the Bounty Brief with a friend that wants to get involved in the space: If you liked this post from The Bounty Brief , why not share it? |

Older messages

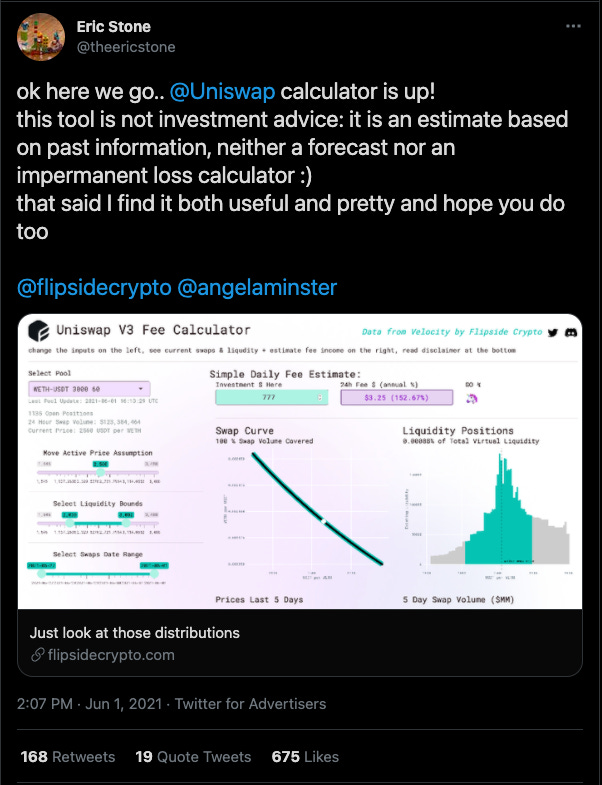

Uniswap V3 Fee Calculator

Tuesday, June 1, 2021

See how much you could earn by providing liquidity to Uniswap V3 with Flipside Crypto's Uniswap V3 Fee Calculator.

Only A Few Days Left To Enter The Uniswap Grants Bounty Competition

Friday, May 28, 2021

Submissions for the Uniswap Grants Bounty Competition are due by midnight on May 31. Don't miss your chance to win up to $5000!

The Bounty Brief #7

Thursday, May 27, 2021

Make money, even in a bear market

All About Flash Loans

Thursday, May 27, 2021

Flash loans — they're making big waves, can result in big profits, and are often associated with hacks and exploits. So what are flash loans, exactly?

The God of Thunder Arrives: Learn All About THORChain

Wednesday, May 26, 2021

On April 13, the long-awaited God of Thunder finally made its arrival. Now, it's time to learn more about THORChain and its RUNE token.

You Might Also Like

The Cross-Currents Shaping Crypto Markets

Tuesday, March 18, 2025

Exploring the macro and crypto forces driving current market dynamics ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

WuBlockchain Talks with BitMart Founder Sheldon: From Bicoin in College to 7 Years of Entrepreneurship and US Regu…

Tuesday, March 18, 2025

Sheldon, founder of BitMart, first encountered Bitcoin as a college sophomore in 2013 after reading about an ASIC mining breakthrough. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

In-depth Analysis of the $1.5 Billion Theft Incident at Bybit: Identifying Security Blind Spots in Multi-signature…

Tuesday, March 18, 2025

This discussion started with the $1.5 billion theft incident of Bybit, mainly exploring the security vulnerabilities of multi-signature wallets (like Safe) and their solutions. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Michael Saylor says US needs Bitcoin to continue as military superpower aligning with SoftWar theory

Tuesday, March 18, 2025

Viewing Bitcoin through a military lens, Saylor champions its role in national cybersecurity and global strategic dominance. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: Donald Trump Creates U.S. Bitcoin Reserve

Tuesday, March 18, 2025

March 10th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Donald Trump Creates US Bitcoin Reserve Diddy Shows 'Kindness' To Sam Bankman-Fried Robinhood Conducts $1M Crypto Trivia

The Rise of TIMEFUN: An In-Depth Analysis of Celebrity Time Tokens

Tuesday, March 18, 2025

Recently, Binance founder CZ shared his idea of time-based tokens, where KOLs tokenize their time. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Ethereum's Pectra upgrade successfully deployed on the Sepolia testnet; Pump.fun saw a sig…

Tuesday, March 18, 2025

Ethereum's Pectra upgrade deployed on the Sepolia testnet; Pump.fun saw a significant drop in token launches; World Network's messaging app introduced intra-network fund transfers. ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Ethereum's Pectra upgrade successfully deployed on the Sepolia testnet; Pump.fun saw a sig…

Tuesday, March 18, 2025

Ethereum's Pectra upgrade deployed on the Sepolia testnet; Pump.fun saw a significant drop in token launches; World Network's messaging app introduced intra-network fund transfers. ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump cabinet’s Bitcoin investments raise ethics alarms in pro-crypto era

Tuesday, March 18, 2025

Cabinet members' Bitcoin holdings spark debate over ethics and influence in Trump's pro-crypto governance approach. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

WuBlockchain Weekly: Rumors Circulate About Trump Family Investing in Binance US, UAE Royal Family Invests in Bina…

Tuesday, March 18, 2025

According to the Wall Street Journal, representatives of President Trump's family have held negotiations regarding an investment in the US subsidiary of cryptocurrency exchange Binance. ͏ ͏ ͏ ͏ ͏ ͏