This is Horrifying + Your Next $15k A Month w/ Vending?

This is Horrifying + Your Next $15k A Month w/ Vending?Boring businesses win again + What keeps me up at night right now.Back at it again, this week we’re literally...dispensing cash. Welcome, 802+ of you new Contrarian Thinkers! If you like CT, the biggest thing you can do? Share with a bud (or 12). Our mission today should you choose to accept it…

#1 What if the Music Stops?I can't believe I'm saying this... I'm actually concerned we may default on our national debt. Yes, we, these United States. I think there is a very rational (not saying right, but rational) argument. Buckle up, MFers… 1st: Mother RussiaRussia is unwinding its $40Billion portfolio of USD in favor of the Yuan, Euro, and purchasing gold for the first time in history. (Could be pandering prior to Putin vs Biden meeting but they look to be taking action). 2nd: ConspiraciesAs I said in this provocative thread where I got called a Q’Anon (always fun), I said wouldn’t it be wild if bitcoin was actually created by China to disrupt the USD as the international currency of choice. Although tongue in check, it’s worth a read... 3rd: CoincidencesInteresting to note that China and Russia had publicly debated creating a supernational currency until ultimately dropping the idea in 2009. What is special about 2009? Oh I dunno, it’s the year Bitcoin was put into the world. Ain’t that a fun little coinkey-dink. Here’s the most compelling argument for a situation I hope never happens.

The US Defaulting On It’s DebtFirst, if you take a walk through history, anytime a country has gone to 130% debt / GDP it has been a metaphorical point of no return.Meaning NEARLY EVERY SINGLE TIME, the country has defaulted. Storytime: Over the past 200 years

This is when economists scream, “What about Japan!” Japan is the only country in 200 years that hasn’t defaulted with this debt to GDP ratio. BUT, Japan is a blue footy boobie. Ahem, it’s like super rare. It is a nation with a:

Compared to the US, we are a nation with:

In Summary:Over 200 years, 98% of countries with our debt to GDP ratio in history have defaulted on their debt…

That’s all the sunshine I have for you today. I hope I’m wrong. But it’s better to be prepared for the worst instead of an ignorant ostrich. So with that context…. #2 Let’s Bash Some PoliticiansHow to tell who is a terrible politician? Anyone talking about who is not getting enough money from the government and should be getting more. No matter the righteousness of the issue at hand. Our country is under attack, from within. Picture: A group of “doctors” surrounding a big formerly healthy human who is hooked up to a series of IV’s all siphoning out his blood to give to others. One IV would be fine. Even two. But this poor guy has 20: subsidies, student loan payoffs, reparations, free healthcare, open borders, infrastructure, it’s both sides of the aisle. As his once pink face becomes pale, and his heart slows, the white coats are arguing over where to stick in the next needle. “Neck!” “Hand!” “In between the toes!” They shriek. They don’t want him to recover, they want every last drip to feed the beast of their reelection campaigns. Their short-term greed, creating a long-term execution. #3 UNSEXY: Is Your Portfolio Ready for a Recession?How’s this for a business model?

Wait, is that too simple? It’s not tokenized? Located on the cloud? Backed by Andreessen Horowitz. LAME. Ok, except, it works. In a world obsessed with the next hot thing, the newest lux gadget, God Damn digitized cats… I’ve been obsessing about something else. What happens when the world comes back to reality? At least for a minute or two as happens in economic pullbacks or recessions. I woke up and realized a ridiculous amount of my net worth is focused on the future and things that go boom during bull markets. But what about busts? #4 He Makes $10k A Month w/ Robots Dispensing Candy?Mini Grocery Stores: The Vending Machine PlayFace in palm, a Memorial Day weekend road trip landed me at a Tennessee rest stop for a potty break. But it wasn’t the restroom that was the main attraction. One building labeled ‘vending’ had a line out the door. Inside the Cheetos were $1.50… and I spent $10 in 30 seconds without talking to a human. Got me thinking… What’s the deal with vending machines? And should I own some? Enter... Quinn J Miller, the Willy Wonka of the robotic machines game, who we found on the Twittersphere. Q makes upwards of $10k/month operating vending machines, and has only been in the game a little over 10 months. Fast stats: Currently Quinn has….

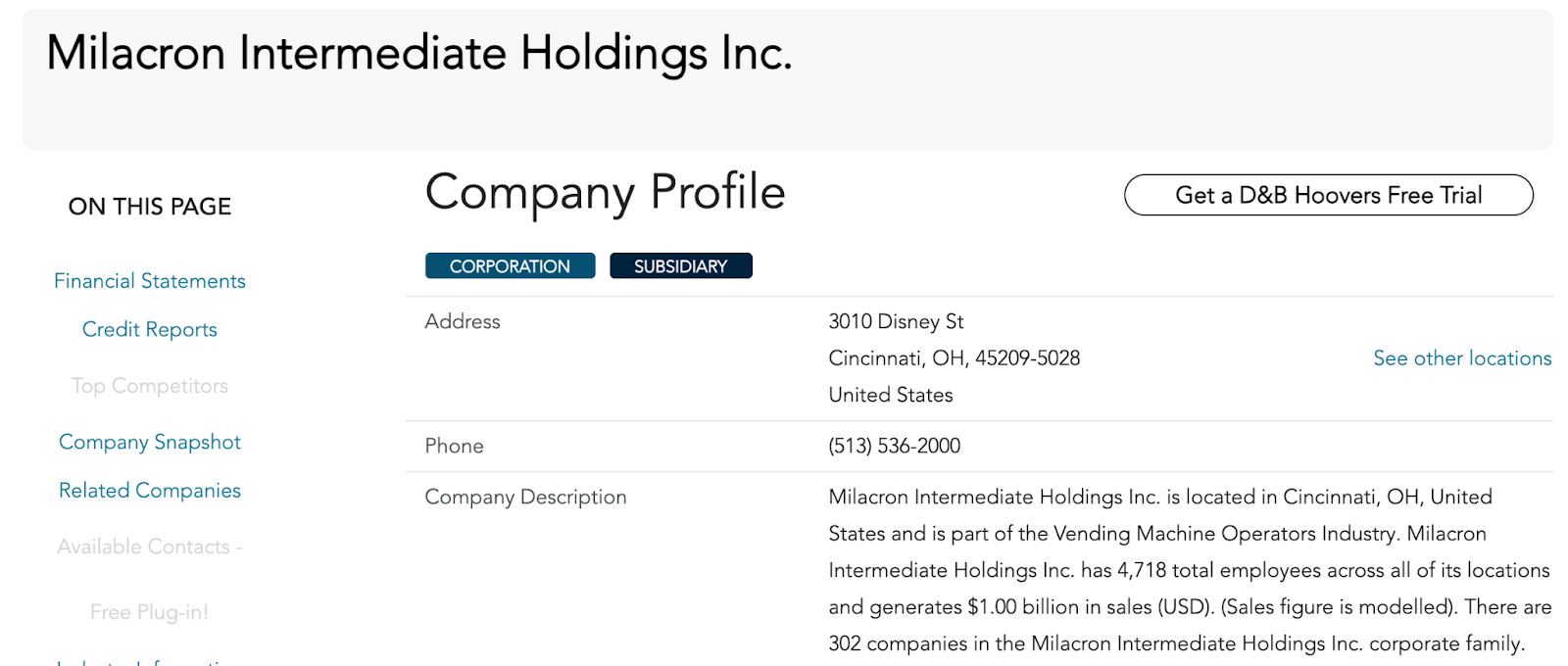

Quinn started the business after a chat with one of his mentors who sold his grouping of 100’s of vending machines to a private equity firms for a nice big fact 8 figure check. Quinn was like, “So you find a spot, negotiate w/ the building owner, buy a machine for $500-3k, fill it with a couple $100 worth of product, throw it on an app and it breaks even 30-60 days later? Mentor goes: “Yup.” Quinn: “Hmmm, and if I rinse and repeat I can sell my portfolio to PE? LFG.” BIG PICTURE: Dispensing CashFirst, it turns out vending is big business. It’s a $30.3 billion market, expected to grow at a CAGR of 9.4%. Quite a few companies make billions in the space (always a good sign)… For instance, Milacron is a large name in the space and was actually acquired for $2Billion even with a pretty hefty debt on its balance sheet. Framework: Market + Cashflow + Built in AcquirersQuinn’s 6 Step Process

The Highlights:#1 LocationQuinn starts with lower-income apartment complexes, motels, and hotels, calls them up, and gets their location for his vending machine...in exchange for him doing ALL of the work. Your location needs to have a centralized access point and be highly visible for foot traffic. The more people = more sales. The ideal location is to place your machine right next to the elevators which is called a BLD location (breakfast, lunch & dinner). How do I get the spot? Pick a niche and vet some locations. Just like you would real estate, except a new kind. He attributes his volume of locations to his stellar sales skills. Call them up and talk to the low man on the totem pole first to get all the info you need. Next, pitch the decision-maker with a presentation on how vending machines as a value add to any office or location but are expensive and difficult to manage one off making them not profitable enough to run yourself. Vending Hotspots:

Or these 55 other locales: #2 The C’s: Card Readers, Costco & Cool TechAn easy one to start, is to add a Credit Card reader for innovation as you can keep track of purchases in real-time on your computer. Note to self...payments stop coming in, the machine is probs broken. To keep it stupid simple he buys from Costco in bulk and upcharges anywhere from 50-65%. His most popular items with the highest margin? Coca-Cola. #3 But, How Much Time Do I Need to Commit?No such thing as a free lunch. While it’s not a 4 hour work week without an operator, it is a 20 hour work week. 7 hours pre-packing

#4 Takes Money to Make $Quinn bought his first machine for $500 on Craigslist. But these bad boys can go for anywhere from $300-$3k. Since they’re your largest cost, getting a deal on them can substantially change your COC. Cost Breakdown:For the best producing machine he has it’ll do $1000+ a month with $250-400 in COGS. Not too shabby. BUY DON’T BUILDHere’s where I differ from Quinn. I like letting other people do the hard work. I’d rather buy one for 2-3x profit and start with a business that cashflows $10-20k a month rather than build it. Fun fact: the industry was down double digits in 2020 due to Covid-19. So now might be an interesting time to BUY up some old vending machine locations because the total sales are probably down YOY but will IMHO rebound. Link to a bunch: here. CONS:

To combat that I might think about: exploring healthy vending options with higher costs and bigger average purchase price like these here. Or ya know, these guys are dispensing weed while college students go straight naughty with a Sex&Go vending machine. TLDR: Just Give Me A Quickie:

Basically boring wins again.Want more resources? MFM Podcast Hit on this Subject. And we covered it here first :) → Here’s to less debt, more cash flow, and politicians with brains.Stay boring my friends, Codie + Nikki If you liked this post from Contrarian Thinking, why not share it? |

Older messages

Make Free Money On Your Crypto?

Tuesday, June 8, 2021

An insider look into this month's Cryptocurrency Playbook Hi crew, We wrote a playbook on our topic discussion with Mike Dillard on...Staking and Earning Cryptocurrency, something he's made

I Turned 📧 into a 7 Figure Biz: 5 Step Process

Thursday, June 3, 2021

What might surprise you? A bunch of billionaire investors are doing the same thing. Here's how you can too.

From Brain Eating Mold, to Cryptro Proving Assets > Income

Wednesday, June 2, 2021

Decentralization of wealth + health + Assets > Income From Brain Eating Mold, To Crypto Proving Assets > Income Decentralization of wealth + health + Assets > Income Ah Contrarians, we got a

What if Money Does Grow on Trees?

Saturday, May 29, 2021

Million Dollar Trees & 5 Figures a Month from Selling Plants...

Shaq: $400M from Carwashes & Franchises?

Saturday, May 29, 2021

Sexy Celebs, Boring Businesses = The How to game

You Might Also Like

🧙♂️ The EXACT Job Titles To Target (Based On Brand Size)

Monday, March 10, 2025

Please stop DMing brands ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Why American Christianity has stopped declining

Monday, March 10, 2025

Hi all, Please have a wonderful week. Trevor The man who wants to know everything (article) Fantastic profile on Tyler Cowen. Part of me feels like he's missing out on some of the joys of life, but

The Biocomputer That Blurs Biology, Tech, and The Matrix - AI of the week

Monday, March 10, 2025

Cortical Labs introduced CL1, a biocomputer merging neurons and tech; AI advancements included autonomous agents, AI-powered phones, healthcare assistants, and humanoid robots; plus, Derek Sivers

• World Book Day Promo for Authors • Email Newsletter + Facebook Group Posts

Monday, March 10, 2025

Book promo on 4/23/25 for World Book Day Join ContentMo's World Book Day Promotion #WorldBookDay is April 23rd each year. ContentMo is running a special promo on 4/23/25 for World Book Day

If you're meeting with someone this week...

Sunday, March 9, 2025

Plus, how the LinkedIn algorithm works and how to get your first 100 newsletter subscribers. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

$30,000 Youth4Climate grant, USAID support festival pro bono resources, Interns at Fund for Peace

Sunday, March 9, 2025

The Bloom Issue #205, March 9 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Food for Agile Thought #483: Leadership Blindspots, Tyranny of Incrementalism, Who Does Strategy?

Sunday, March 9, 2025

Also: Product Teams 4 Success; Rank vs. Prio; Haier Self-Management ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Authors • Spring Into Reading Book Promo • Email Newsletter + FB Group Posts & More

Sunday, March 9, 2025

Promo is Now Open for a Limited Time MARCH 2025 Reading Promotion for Books Join ContentMo's

Why you’re always busy but never productive

Saturday, March 8, 2025

Do you schedule time to think? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

• 30-Day Book Promo Package • Insta • FB Groups • Email Newsletter • Pins

Saturday, March 8, 2025

Newsletter & social media ads for books. Enable Images to See This "ContentMo is at the top of my promotions list because I always see a spike in sales when I run one of their promotions. The