The World Is So Crazy That Grocery Stores Are Speculating Like Hedge Funds Now

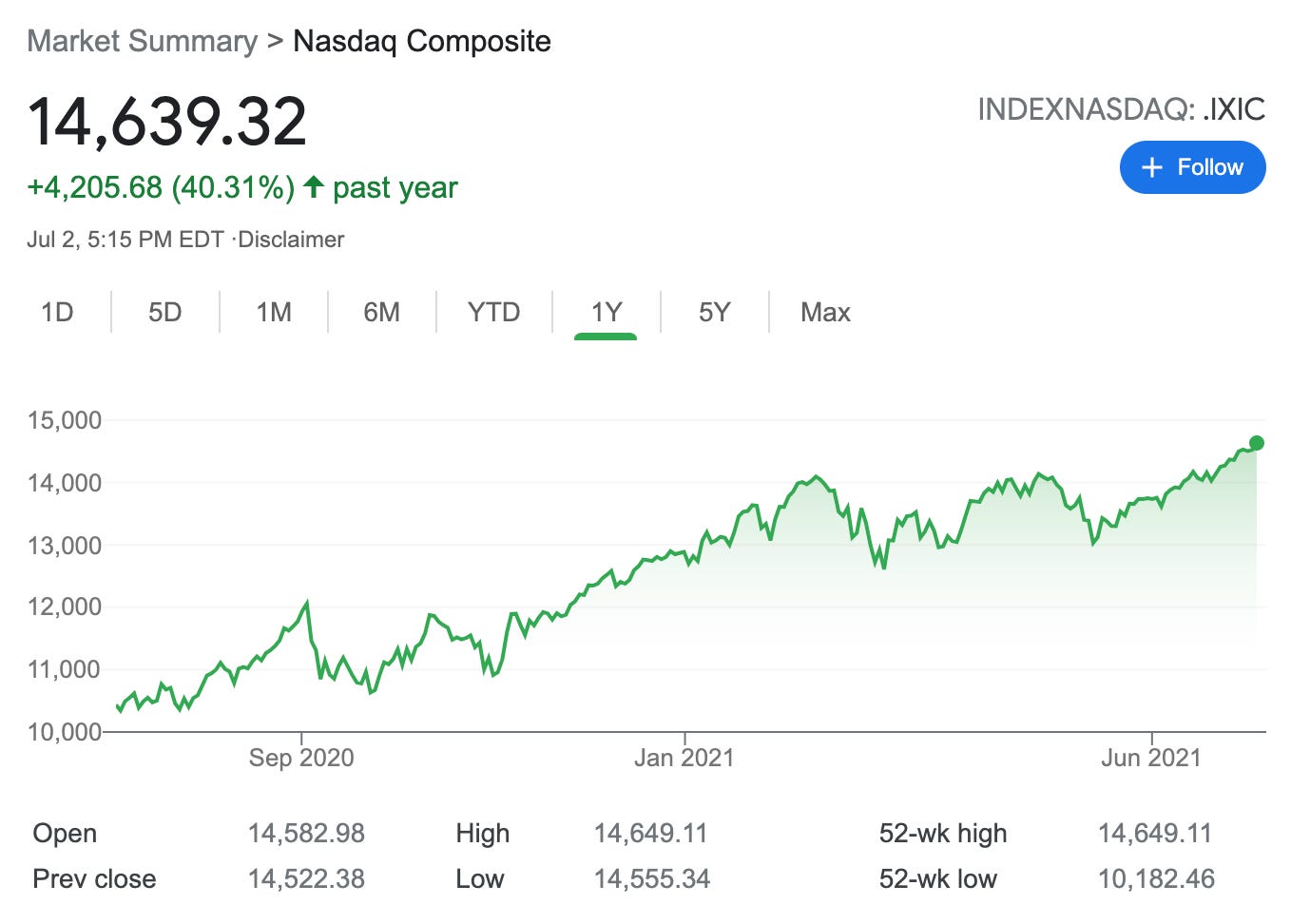

This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 185,000 other investors today. To investors, Something very unique is happening in the public markets. The S&P 500 has hit a new all-time high every day for the last 7 days. The Nasdaq also sits at an all-time high as well. Look at this chart — everything is up and to the right. The bull market rages on. This is all happening while millions of Americans are still experiencing pandemic-related issues. It seems like the complex beast known as the economy has broken all preconceived notions of how it is supposed to work. Gasoline prices have increased $1 from a year ago, which brings the national average to $3.13 currently. The prices of commodities have increased so rapidly that home builders are throwing their hands up and refusing to participate in the market until they can better forecast their cost structures (read this epic thread for context). This is not a problem specific to the United States though. The Washington Post had a great article highlighting the exploding food prices around the world. In the piece, Adam Taylor writes:

So what about the United States? Surely we couldn’t be experiencing the same thing in the most developed nation in the world, right? Wrong. Take this opening from Jaewon Kang’s article in the Wall Street Journal this morning:

There is a level of insanity at the moment that is hard to comprehend. Grocery stores are acting like hedge funds through their speculation on future food prices. Think about that for a second. The current economy is so out of whack that the grocery stores are speculating. Speaking of speculation, Robinhood revealed quite a bit of information in their S-1 filing. Here are a few statistics that stood out to me:

This is an incredibly large business, but there are some nasty sides to it too. For example, Tanay Jaipuria correctly identified one issue:

Given the research around less trading historically equating to higher long-term returns, this level of activity is a big negative for the user base’s economic outlook. But that isn’t even the worst part. Check out this insanity:

These statistics scream SPECULATION! to me. Speculation isn’t necessarily a bad thing on its own, but when you add in the context of the broader financial markets and economic calamities, the current situation is alarming to say the least. But as I mentioned at the top of this letter, the S&P 500 and Nasdaq continue to hit all-time highs. That means the wealthiest people in our society continue to get richer and richer, while things like rising food costs continue to eat away at the financial well-being of the economy’s most vulnerable. Rather than spend time complaining about the situation, my suggestion to every person is to get educated about how the economy works and position yourself to benefit from the macro economic forces. You, nor I, will be able to change the current situation. There is literally rumors of $6 trillion infrastructure bills being floated inside the current administration, so we actually may see things get even more crazy over time. Education is the great equalizer in uncertain times. While it can be fun to speculate, remember the most common investment strategy of the world’s greatest investors: Buy good assets at discounted prices. That is it. Easy to understand, hard to execute. Hope each of you has a great start to your day. I’ll talk to everyone tomorrow. BONUS: We are running our 5th cohort for the Bitcoin and Crypto Training Course starting tomorrow, Tuesday July 13th. Graduates have already been hired at Coinbase, BlockFi, Gemini, Kraken, and many other great companies. Want to increase chances of being hired? Apply here: https://pompscryptocourse.com -Pomp 🚨 SPONSORED: With the markets swinging wildly this year, the need for diversification has never been more apparent. Vinovest gives investors access to investment grade wines, an asset class that had only been available to the ultra wealthy until now. Vinovest uses an algorithm to select and manage your portfolio, delivering clients 17.8% average returns in 2020. For an investment opportunity uncorrelated to the stock market that has outpaced the S&P 500 over the last twenty years, check out Vinovest to invest today. They are giving Pomp Letter subscribers an exclusive offer to receive a $50 bonus credit if you open and fund an account before August 1, 2021. Click here to get started. THE RUNDOWN:Coinbase to Woo India Recruits With $1,000 in Crypto: Coinbase is looking to hire “hundreds” of recruits for its new hub in India, and is offering an incentive of $1,000 in crypto. The aim is for recruits to "leverage this offering to learn about crypto," Pankaj Gupta, VP of engineering and site lead in India, said a blog post Friday. The exchange is looking to tap the country's "world class community" of engineers, tech builders and entrepreneurs, Gupta wrote. Read more. Fed’s Powell May Have Met With Coinbase CEO in May: U.S. Federal Reserve Chairman Jerome Powell was scheduled to meet with Coinbase CEO Brian Armstrong on May 11, according to an entry on the central bank’s calendar. It was unknown what the subject of the planned half hour meeting was or that it even took place. Former Speaker of the House Paul Ryan was also to have been in attendance. Read more. UK Bank Barclays Blocks Payments to Binance: U.K. bank Barclays said Monday it is blocking customers from using their debit and credit cards to make payments to crypto exchange Binance. "With effect from today, Barclays intends to stop credit and debit card payments to Binance," Barclays said in an email to CoinDesk. "This action does not impact on the ability for customers to withdraw funds from Binance." Read more. Revolut in Talks With SoftBank for Investment at $30B+ Valuation: U.K.-based digital bank Revolut is in “detailed talks” with SoftBank about a fundraising round that could value the firm between $30 billion and $40 billion, according to a Sky News report. Revolut and its advisers have asked investors at SoftBank's Vision Fund 2 to submit proposals for an investment of between $750 million to $1 billion with a deal expected to be “some weeks” away. Read more. Digital-Asset Investment Funds See Net Inflows of $63M: Digital-asset investment funds attracted net capital inflows in the week to Friday after four consecutive weeks of redemptions, as bitcoin, the crypto-market leader, consolidated its quick recovery from sub-$30,000 levels. Data tracked by the U.S.-based CoinShares show crypto funds registered a net inflow of $63 million last week, of which nearly 62%, or $39 million, went into bitcoin-dedicated funds. Read more. LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE Patrick Stanley is the founder and CEO of CityCoins, a new product that allows you to support your favorite cities while earning yield in Bitcoin. In this conversation, Patrick and I discuss:

I really enjoyed this conversation with Patrick. Hopefully you enjoy it too.  LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE Podcast SponsorsThese companies make the podcast possible, so go check them out and thank them for their support!

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re on the free list for The Pomp Letter. For the full experience, become a paying subscriber. |

Older messages

How China's Crackdown Is Impacting On-Chain Metrics

Friday, July 2, 2021

Listen now (6 min) | To investors, Will Clemente breaks down this week's bitcoin situation using on-chain metrics to separate the signal from the noise. You can follow Will on Twitter or sign up

Strong Hands Are Aggressively Accumulating Bitcoin

Friday, June 25, 2021

Listen now (6 min) | To investors, Will Clemente breaks down this week's bitcoin situation using on-chain metrics to separate the signal from the noise. You can follow Will on Twitter or sign up

China Just Made A Significant Geopolitical Mistake

Monday, June 21, 2021

Listen now (5 min) | This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 185000 other

The Market Manipulators Are Laughing As They Ruin The World

Monday, June 14, 2021

Listen now (8 min) | This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 185000 other

The Re-Accumulation Phase Is Almost Over

Friday, June 11, 2021

Listen now (4 min) | To investors, Will Clemente breaks down this week's bitcoin situation using on-chain metrics to separate the signal from the noise. You can follow Will on Twitter or sign up

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏