China Just Made A Significant Geopolitical Mistake

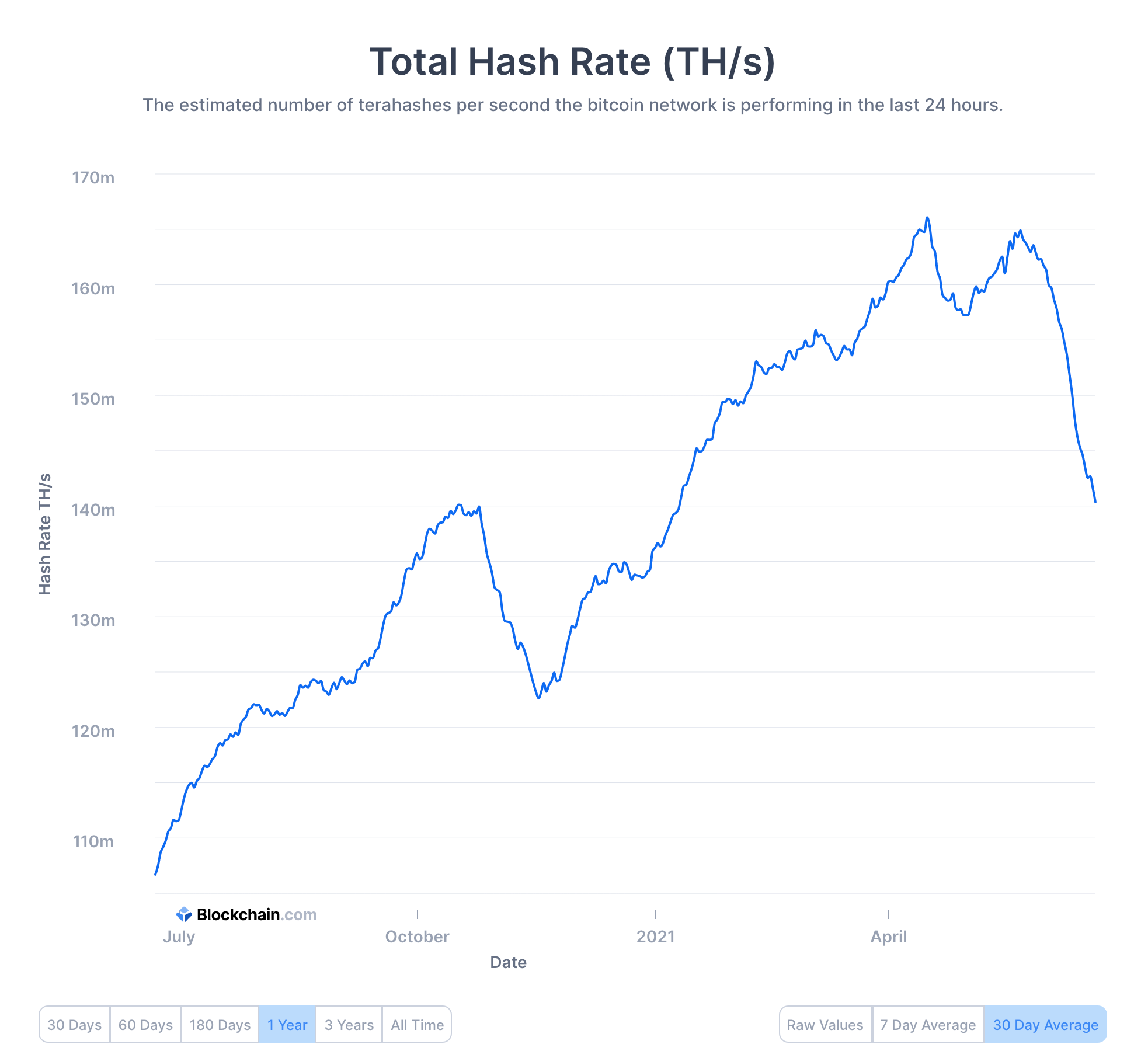

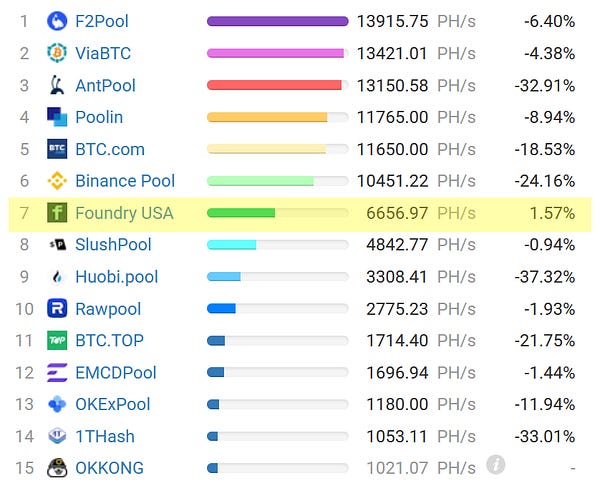

This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 185,000 other investors today. To investors, Majority of geopolitical mistakes in history have been related to violent combat. They either occur in the high tension period leading up to the conflict or they occur during the actual conflict with another nation state. This is a story as old as time. Every once in awhile a mistake is made on the global stage that doesn’t involve violent combat though. These situations almost always rely on a nation state impairing themselves in some way, instead of there being some sort of harm done to another nation. You can think of this as a self-inflicted wound. One historical example of these self-inflicted wounds is internet access in North Korea. According to Wikipedia, “Internet access is available in North Korea, but is only permitted with special authorization. It is primarily used for government purposes, and also by foreigners. The country has some broadband infrastructure, including fiber optic links between major institutions. Online services for most individuals and institutions are provided through a free domestic-only network known as Kwangmyong, with access to the global Internet limited to a much smaller group.” The country’s leadership essentially made the decision that the internet would only be used by the government and ruling family. The every day citizens and business owners are not allowed to access the open internet without special permission. However, they are allowed to use an intranet that mimics the value proposition of the internet, yet has none of the freedoms or true value that an open system provides. It doesn’t take a rocket scientist to see that the decision from North Korea has been a big mistake. They chose to pursue authoritarian control of the country and population over economic prosperity. While this likely has been a key decision to consolidating power, it has spelled disaster for the citizens of the country. China is in the process of repeating this mistake. The superpower of the East has had an interesting relationship with bitcoin over time. The government has essentially banned the digital currency and any related activities for years. That ban only applies to the average citizen or entrepreneur though. If you are a government official, or if you’re able to secure special permission, the bitcoin network was available for your legal use. This is almost an exact replica of the North Korea internet strategy — keep the empowering technology for the elites or their friends. But China has recently doubled down on their anti-bitcoin stance. They are enforcing the ban in a much more aggressive manner in the last few weeks. This has led to upwards of 90% of all bitcoin miners in the country being shut down. These miners have two choices — patiently wait to see if the regulators will allow them to resume operations later or pick up and leave the region to begin re-building their business elsewhere. As you would expect, many of the Chinese miners have decided to leave China. This decision means that they operationally have to shut down their mining equipment, pack it up, ship it to a new location, set it up again, and then commence mining activities. We can see this happening in real time as the total mining hash rate appears to have fallen off a cliff recently. The beauty of bitcoin is that a drop in hash rate like this will be quickly corrected by the mining difficulty adjustment that occurs approximately every two weeks. For those who are unaware of how this works, the simplest explanation is that mining bitcoin will become easier for those still on the network (this makes the remaining miners more profitable until the miners who left are able to return to their mining activities). There are a few ramifications that I think are worth calling out here. First, this move by China is a significant blow to the bitcoin critics. The anti-bitcoin argument historically revolved around China’s market share of mining or the ability for the country to control/manipulate the network. As we are watching miners move out of the country, this argument is losing most of its teeth. China doesn’t control bitcoin and never has. Also, the free market of economic incentives will always lead bitcoin miners to seek the lowest cost power, specifically in regions where there is the greatest political and regulatory stability. Next, the United States is a massive winner in this situation. Take for example the exclusive gain in hash rate for the largest American bitcoin mining pool, Foundry USA. While China is losing market share in bitcoin mining, the United States is gaining market share. It won’t necessarily be one-for-one because some Chinese miners will not come to the US, but it is hard to argue any country is going to benefit more from this than the United States. This is why I started the letter with references to geopolitical mistakes. China has chosen a path that will become a more obvious self-inflicted wound, while simultaneously handing a large, non-violent victory to a Western superpower. It is hard to see in the moment. It may not be obvious for years. But this is what we are watching occur in real-time. Historians will write that China had a majority of hash rate within their geographic borders, yet they made decisions that pushed that hash rate into more democratic and capitalistic societies. Just as North Korea chose to embrace the internet only for the elites, China is making a similar mistake here. As if that wasn’t bad enough, China’s plan for a nation state digital currency is similar to North Korea’s internal “internet.” As we have discussed over and over again, open systems beat closed systems. The Chinese approach of banning an open monetary network in pursuit of a tightly controlled monetary system is unlikely to be seen as an advantageous strategic move for their citizens. But just like North Korea, this decision will be helpful in continuing to consolidate power and ensure the longevity of the dictatorship. The United States is choosing to embrace the open monetary system though. We must continue to encourage our political and regulatory leadership teams to become the global leader in this open monetary network. Whether we embrace it or not, the bitcoin network will be adopted by countries around the world. Just as it didn’t matter if North Korea or others leveraged the internet, because other countries decided to plug into the open information system, it won’t matter what one individual country does with bitcoin. There will still be more countries waiting to plug into the open monetary system. This is the beauty of bitcoin. It doesn’t care about geopolitics. It doesn’t care about monetary policy. It doesn’t care about sentiment. The bitcoin network simply continues to produce block after block after block of transactions. The network just doing what it was designed to do — providing a decentralized payment system that can be used by anyone in the world with an internet connection. China just made one of the greatest geopolitical mistakes in recent memory. The United States is the greatest beneficiary of the situation. Americans should be celebrating, and capitalizing on, this gift that we were just given. In a game of chess, you don’t always need to win. Sometimes, you just need to wait for your opponent to make a mistake. Hope each of you has a great start to your week. Talk to you tomorrow. -Pomp SPONSORED: AppSumo is all about helping businesses grow and empowering entrepreneurs. As a thank you to their amazing community they’re hosting their first-ever Sumo Day! A 72-hour event where they’re making it rain amazing products, discounts, surprises, and giveaways 🔥 Get all the Sumo Day updates sent straight to your inbox by clicking here to sign up! Sign up: http://social.appsumo.com/pomp THE RUNDOWN:Venture Capital Makes a Record $17 Billion Bet on Crypto World: For a sense of just how big everything crypto has become, you can, of course, just take a look at coin and token prices. And then you can check again five minutes later to see if the space’s notorious volatility has markedly changed the first observation. But for a more stable measure of the industry’s growth, consider this: venture capital funds have already poured $17 billion this year into companies that operate in the space, according to data provider PitchBook. That’s by far the most in any single year and nearly equal to the total amount raised in all previous years combined. Read more. BlackRock Wants a Blockchain Strategy for Aladdin, Its Investments Engine: BlackRock, the world’s largest asset manager with almost $9 trillion in assets under management, is seeking to develop a blockchain strategy for its flagship portfolio management system, Aladdin, according to a job posting. The director-level hire will “evaluate different blockchain protocols/platforms to explore solution alternatives.” Public and private chains are on the table, a source familiar with the posting said. Read more. US Government to Auction Off Seized Litecoin Alongside Bitcoin: The U.S. General Services Administration, an agency that sells surplus assets held by the federal government from office furniture to houses and tractors, said it will auction off bitcoin and litecoin with a combined market value of $377,000. The bidding in the latest auction starts Friday at 5 p.m. ET and runs through Monday at 5 p.m., according to a press release. Eleven lots of cryptocurrency are on the block, including 8.93 bitcoins and 150.2 litecoins. According to a document on the GSA’s auction website, the litecoins were seized from a taxpayer for nonpayment of internal revenue taxes. Read more. Galaxy Digital Will Provide Liquidity for Goldman Sachs’ Bitcoin Futures Trades: Billionaire crypto financier Mike Novogratz’s Galaxy Digital has agreed to provide liquidity to Goldman Sachs for the bank’s bitcoin futures trades. Under growing demand from institutional clients, in March Goldman Sachs reopened its crypto trading desk after a three-year hiatus. The desk is part of the bank’s U.S. Global Markets division. Read more. Security Audit Firm Raises $5.3M From Funds Investing in Polkadot, Cardano Blockchains: Blockchain security auditor Runtime Verification has raised $5.3 million from a handful of prominent backers. Led by IOSG Ventures, the funding round included investment from Polkadot-focused Hypersphere Ventures, Cardano's cFund, the Tezos Foundation, Elrond Research and Algorand accelerator Borderless Capital. Read more. LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE Dave Rubin is a political commentator, YouTube personality, and talk show host. He is the creator and host of The Rubin Report, a political talk show on YouTube and the network BlazeTV. Dave is also the founder of Locals, a new subscription service built for creators. In this conversation, Dave and I discuss:

I really enjoyed this conversation with Dave. Hopefully you enjoy it too.  LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE Podcast SponsorsThese companies make the podcast possible, so go check them out and thank them for their support!

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re on the free list for The Pomp Letter. For the full experience, become a paying subscriber. |

Older messages

The Market Manipulators Are Laughing As They Ruin The World

Monday, June 14, 2021

Listen now (8 min) | This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 185000 other

The Re-Accumulation Phase Is Almost Over

Friday, June 11, 2021

Listen now (4 min) | To investors, Will Clemente breaks down this week's bitcoin situation using on-chain metrics to separate the signal from the noise. You can follow Will on Twitter or sign up

Special Message From Pomp 🙏🏼

Thursday, June 3, 2021

Hey! What a wild, volatile ride bitcoin bull markets are. Thanks for being a free subscriber to The Pomp Letter. Hopefully this has helped you understand what is currently transpiring across assets and

Is the Sell-Off Over Or Will There Be More Pain?

Friday, May 28, 2021

Listen now (5 min) | This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 180000 other

There Are No Gods Among Us

Monday, May 17, 2021

Listen now (8 min) | This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 175000 other

You Might Also Like

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these

HubSpot, OpenAI, Canva, Google Cloud and hundreds more: Who will you see at SaaStr?

Tuesday, March 11, 2025

See who's speaking at SaaStr Annual and book a discounted ticket To view this email as a web page, click here Prices Go Up July 31st — SaaStr Annual 2023 is the SaaS event of the year! saastr