Flipside Crypto - The Bounty Brief #16

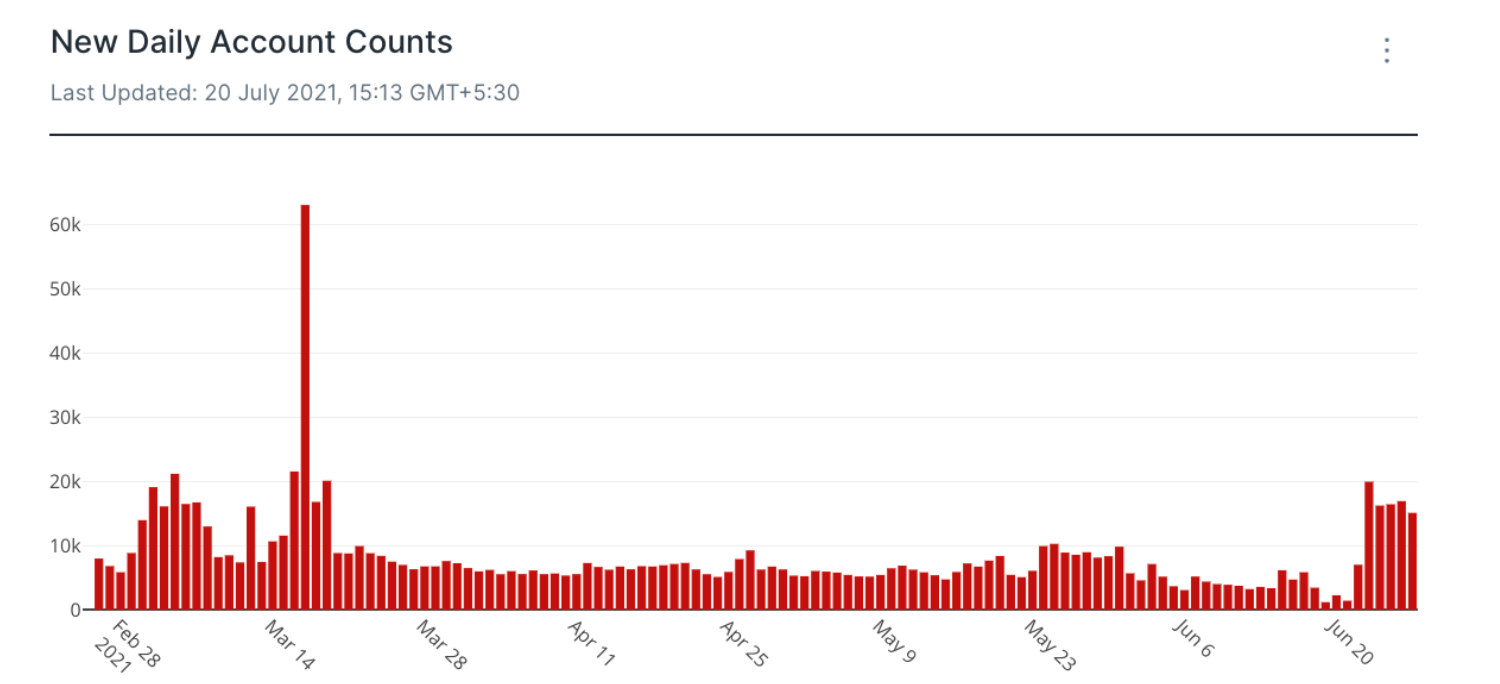

Hey there analytics experts, The waiting — or should we say yearning — is over. Yearn bounties have arrived at Flipside Crypto. Check out our scavenger hunt here to get started. We’ve got some brand new Yearn bounties below, along with more Terra and Uniswap bounties, plus the best from around the web. Need help solving them? Join our community to get all your questions answered. 🌀 YearnFree Square Question 🔲 Bounty: Up to 1,000 USDC Description: Provide any interesting insights on Yearn. The top 5 dashboards will earn 1,000 USDC. These will be judged by a council that includes other community members and the Flipside team! Comparing Yearn Vault Strategies 🏦 Bounty: Up to 750 USDC Description: Select two of the available strategies; define and visualize the returns each has generated over the past 30 and 90 days; and compare their performance. Provide at least one paragraph to explain why one performed better than the other. Returns on the ‘Generic Leverage Compound Farm’ strategy 🚜 Bounty: Up to 750 USDC Description: The USDC yVault has a ‘Generic Leverage Compound Farm’ strategy that earns a return by supplying liquidity to Compound, using flash loans for additional leverage. What return in Comp has it earned over the past 30 days and how much in flash loans has it used to earn this? View all Yearn Bounties🌀 Bounty: Up to 1,000 USDC Description: Answer one of these top analytics questions from the community and receive up to 1,000 USDC as a reward. Terra 🌎[Easy] LUNA Price Volatility 📊 Bounty: Up to 38.25 LUNA Description: What has the daily volatility (standard deviation of price day over day) of LUNA price been over the past 2 weeks? How does that compare to the volatility of ETH over the past 2 weeks? What are events and/or factors potentially impacting these? [Easy] Anchor Deposits 💰 Bounty: Up to 38.25 LUNA Description: How have deposits on Anchor changed in the past 2 weeks? Why do you think this is? [Easy] Anchor Collateral Ratio ⚓ Bounty: Up to 38.25 LUNA Description: What has happened to Anchor's collateralization ratio over the past two weeks? What impact has this had on user behavior on Anchor? Pick at least 2 metrics to quantify the impact. (ie. TVL, 24hr volume) [Hard] UST Collateralization 🪙 Bounty: Up to 76.50 LUNA Description: To what degree has UST been fully collateralized over the past two weeks? Has it been under collateralized at any points? How long did it stay like that on average? [Hard] Mirror & Anchor TVL 📈 Bounty: Up to 76.50 LUNA Description: How have the TVLs on Mirror and Anchor changed over the past two weeks? Are there any correlations that you can see? What might be some reasons for these relationships? View all Terra Bounties 🌎 Bounty: Up to 76.50 LUNA Description: Answer one of these top analytics questions from the community and receive up to 76.50 LUNA as a reward. 🦄 Uniswap[New Users Only] LP Fees 💧 Bounty: Up to 12.10 UNI Description: Summarize the fees collected by LPs over time. Do we notice any trends? Tip: Use uniswapv3.position_collected_fees [New Users Only] Swap Volume Comparison 🔀 Bounty: Up to 12.10 UNI Description: Compare the swap volume for V2 vs V3 over time. How has that changed? Tip: Use ethereum.dex_swaps [Easy] Uniswap Weekly Volume Breakdown 📅 Bounty: Up to 12.10 UNI Description: For the past 10 weeks, what has been the week over week change in total volume for Uniswap in total? What has been the week over week change in total volume for each of the top 5 pools by volume (ranking determined by most recent week?) [Super Hard] Impermanent Loss Dashboard 📊 Bounty: Up to 36.55 UNI Description: Calculate the IL vs HODL of the top 10 most active LPs on the top 10 pools. View all Uniswap Bounties 🦄 Bounty: Up to 36.55 UNI Description: Answer one of these top analytics questions from the community and receive up to 27.83 UNI as a reward. 🟥 AgoricSmart Liquidation Module For Agoric Treasury 🧠 Bounty: Up to 9595.20 USD Description: This bounty asks you to provide a new liquidation strategy for loans of RUN provided by the Agoric Treasury. The context section below gives background detail on the current approach and our goals. Build a liquidation contract that can be used by the Agoric Treasury’s vault manager contract instead of the current liquidation contract (see References section). This strategy should use market data available to it to manage liquidations. It is the job of the bounty applicant to propose a coherent liquidation strategy 🪙 Gitcoin ETHCC Hackathon 2021Personality Tokenization for ERC 725 🧍 Bounty: 5976.30 USD Description: Thank you for your interest in building projects for the ETHCC hackathon 2021 in Paris. The Curio Team invites you to participate in the development of a personality tokenization system on Ethereum using the ERC 725 standard. Personal tokenization implies a Reputation Token associated with a specific user's wallet in any decentralized application, for example, on an exchange or marketplace. This will allow you to carry out secure transactions on the marketplace and increase trust among users of the platform using this mechanism. 🦡 Badger FinanceRevamp Sett.Vision Into The Portfolio View 💰 Bounty: 680.59 BADGER Description: BadgerDAO is a fair-launched DeFi DAO, that provides asset management services focused on bitcoin, and with a mission to extend the use of Bitcoin in DeFi. Our core product is a group of vaults, or as we call them, Setts(the name of a badger home). Long ago we had a dashboard called sett.vision which provided users detailed information about our vaults, and their holdings and earnings. It is no longer functional as we have not kept up with adapting it to protocol changes, but you can see it here: https://sett.vision. Over the last month, we have come up with a concept to rebuild this and integrate it into a new portfolio function in our main dapp.. We have already worked with a UX designer to come up with a Figma, now we just need it built. 🤵 iExecChest X-Ray Covid Classifier Using Blockchain & IExec Confidential Computing 🩺 Bounty: 1524.00 RLC Description: Application for analyzing chest X-ray images to classify whether the lungs are healthy, with pneumonia or COVID. The classification is achieved using a trained neural network algorithm. The application uses confidential computing on the images (confidential patient data) so that only the requester of the computation (the doctor) will be able to see the results, even if the computation is made on a distributed network. 🏆Bounty Submission of the Week 🏆Welcome back to our Bounty Submission of the Week! In this week’s edition, we’re giving our Terra bounties some love in the form of a submission from @shreyashpatodia, who examined the number of new addresses joining Terra each day. As we can see below, the number of new users has spiked in recent weeks, with more than 10,000 new users on each of the last few days in June. This is an increase over the 5,000 to 8,000 accounts that typically join each day. It’s also the most since an even more significant peak during LUNA’s ATH and the launch of Anchor. @shreyashpatodia had more insights to offer, so be sure to check out the submission here. Good luck with your bounties this week🤞🍀 Make sure you join our community on Discord to keep up with all things bounties and get answers to any questions you have about solving our queries: Sharing is caring! Make sure you subscribe and share the Bounty Brief with a friend that wants to get involved in the space: If you liked this post from The Bounty Brief , why not share it? |

Older messages

Flipside Roundup July 30

Friday, July 30, 2021

Solve Yearn bounties and see the best submissions from this week!

Flipside Roundup

Friday, July 23, 2021

Best data analytics from this week and how to get started with Uniswap bounties

The Bounty Brief #15

Friday, July 23, 2021

A storm is coming...⛈️⚡🌩️

The Bounty Brief #14

Friday, July 16, 2021

Gunslingers, Bounty Hunters, Explorers, and Greenhorns, oh my!

The Bounty Brief #13

Saturday, July 10, 2021

Lights. Camera. Bounties. 🎬 🪙

You Might Also Like

Texas doubles down on crypto with new $250 million Bitcoin reserve bill

Tuesday, March 11, 2025

Texas' second crypto bill seeks to enhance state and local government participation in digital asset investments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How-ey Can Get Out of Here

Tuesday, March 11, 2025

How On-Chain Data Can Clarify the Regulation of Cryptoassets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

February CEX Data Report: Significant Decline in Trading Volume Across Major CEXs - Spot Down 21%, Derivatives Dow…

Tuesday, March 11, 2025

In February 2025, the spot trading volume of major CEXs decreased by 21% compared to January. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

El Salvador defies IMF, continues Bitcoin purchases amid market downtrend

Monday, March 10, 2025

El Salvador's Bitcoin holdings grow to $504 million, challenging IMF directives amid sharp price declines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🖊️ Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO …

Monday, March 10, 2025

Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO for a Cronos Strategic Reserve; Texas's Senate passed bitcoin reserve bill SB-21 ͏ ͏ ͏

Vitalik TAKO AMA: ETH Positioning, Sequencer Centralization, L1 vs L2, Governance, and Success Metrics

Monday, March 10, 2025

On the evening of February 19th at 12 PM UTC and lasting until 12 PM UTC on February 20th, Vitalik Buterin, the founder of Ethereum, was invited to participate in a flash text interview on Tako (a

Donald Trump Creates U.S. Bitcoin Reserve

Monday, March 10, 2025

March 10th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Donald Trump Creates US Bitcoin Reserve Diddy Shows 'Kindness' To Sam Bankman-Fried Robinhood Conducts $1M Crypto Trivia

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏