Where to Put Your 💲 If It All Falls Apart?

Where to Put Your $ If it All Falls Apart?Safe Havens: For Money & Freedom If you want to be one, join the crew here. This month...we're talking Taxes and How To Keep More of What You Make.Share This Post The world can seem scary right now. We've all felt it. The twisting winds of change. The echoing worry that the world as we know it may not stay. The concern that it may not be enough to put our heads to the proverbial grindstone. We may need to look up from the ladder climbing, or from the inside of our business, or up from the wealth we are accumulating, or the debt we are trying to erase. We may need to do more. That is daunting. It is hard ENOUGH to achieve financial freedom, to just be healthy, to find a small spot of happiness. But sometimes, even though it is hard enough, it is not enough. What if the reason meme stocks are at all-time highs, social has exploded, is because we are looking to escape truths we feel now more than ever. They say that humans used to be able to sense storms coming, as animals do, but we seem to have lost it. Our senses are muddled by one too many dancing teen TikTok videos (guilty). There's a shadow hanging. The party rages underneath unaware or uncaring of the storm to come. "Maybe it'll just pass," we think. I can tell you one thing, whether it comes or not, we are trying like hell to ignore it. Because what do you do against the clouds of today? They are a twisty mercurial thing, the enemies are hard to see, let alone stop. A virus of the body and perhaps, of ideas. I sat with my man last night discussing what we see happening in the world around us. We asked ourselves these questions:

I started Contrarian Thinking to free your minds and your bank's accounts, and... to free mine. With the knowledge that financial freedom can lead to personal freedom and philosophical freedom. Your ability to think without constraint. But I see much happening that scares me, these words have an echo, don't they? “A not-too-distant explosion shakes the house, the windows rattle in their sockets, and in the next room the class of 1964 wakes up and lets out a yell or two. Each time this happens I find myself thinking, "Is it possible that human beings can continue with this lunacy very much longer?" You know the answer, of course.” - George Orwell “In seven days God had created the Earth. In a single day mankind had turned it upside down.” - Kristina McMorris They are words that come from WWII. We are not at war with the world today, although we are abandoning an embassy in a far-off land. We are not having bombs dropped on us, although the bombs of tomorrow may be nodes broken, tech exploded, circuits breached. We are not mandating youth be sent to trenches, although we are mandating a good many things for all against will and process. So if what Warren Buffett says is true, "Rule Number One: Never Lose Money. Rule Number Two: Never Forget Rule Number One," then we should prepare for the storm to come. Without being alarmist, here's how I am doing so... BUT REMEMBER, there is ALWAYS opportunity. In every market, in every day and age, there are winners. So despite that pit we feel in our stomachs know this, you are exactly where you are supposed to be. You reading this newsletter is no accident my friend. You being one of the few who do, the doers, will matter in the days, months and years to come. I see you, and I'm here to help find the guides for you, and for me. Today in 10 minutes < We're Going to Dive into:

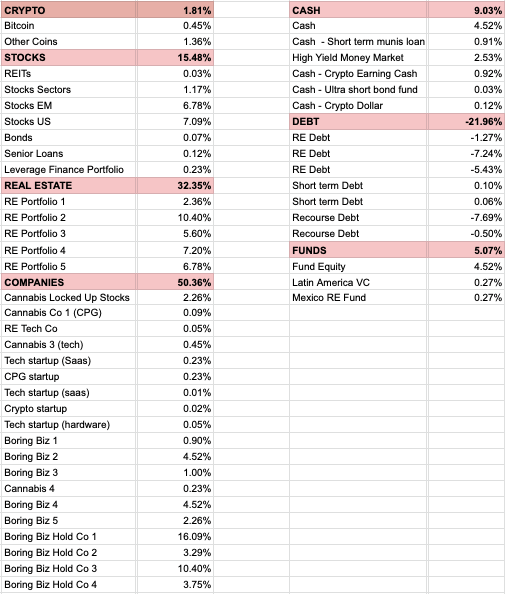

Hills to Stand or Die OnI am a believer that to measure an independent mind is not to measure only what you think, but HOW you think. For that reason, I typically don't share my hard stances or opinions but post questions and my self-titled rants. Because after all, no one, including me, has all the answers. But finding those squirrely solutions starts with asking the right questions. Here is what I will say today, ideas about freedom for you to ponder, and a hill I'll die on. 1) Every time we give power to a central authority, we must never expect it back. The Patriot Act (an emergency act) just expired in 2020. When was it enacted, 2001. That's 19 years. Every time a government stops you from action without your consent, imagine it lasts for 19 years first. Then ask yourself if you are still willing to give up that right. 2) A society of consent is better than a society of group mandate. Have you ever been in a job where you thought... "gosh, I bet my boss, boss's boss, or maybe the board would be better at making the decisions about my daily role?" Probably not. Because you should be the decision-maker of your own life. More people should ask for consent, not demand compliance. Remember that in the days to come. Try to allow empathy for those who differ completely in their opinions, and help ALLOW them the right to live their life and for you to live yours. 3) If you have a billion dollars and allocate badly, you will be poor. Same for our country. https://twitter.com/balajis/status/1425195836124778498?s=20 What Do I Do With My Money If the Worst Arises?Unlike the government. I have repercussions if I allocate poorly. I will go bankrupt. My investors will come after me. My affinity for overpriced coffees and anything with truffle oil in it will become unsustainable. So how about I open up the kimono? This is my actual portfolio broken down by percentages and types. No hiding.

Adding & SubtractingOverall pretty boring and has relatively low leverage. But perhaps this is the part that is intriguing... Now you can see if these moves were right or wrong in the long term. 1) Movements - Where am I increasing?

2) Where am I decreasing?

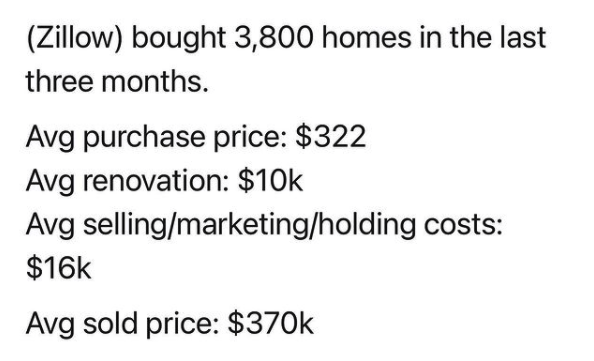

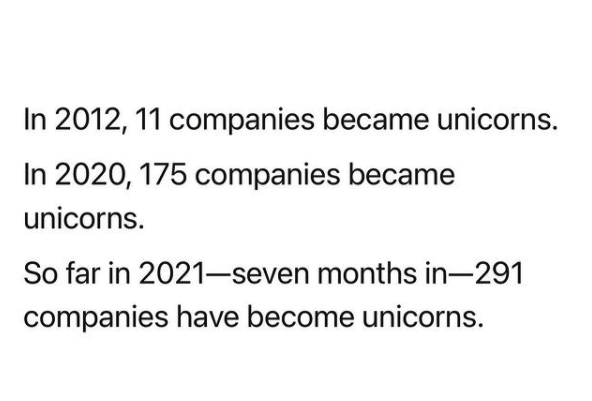

So what do you do? Open up your accounts, and instead of playing individual stocks or allocating blindly start thinking about the world in trends. Where are the winds pushing and where can you trim or add to follow? Most Interesting/Common Questions on Money TodayI read almost every DM that crosses my social or email. Let's just say you Contrarians are clever, you Twitter and Tik Tok crew are crazed animals, and Instagram, well you're pretty. :) Let's boil down some of the questions amidst the noise. Inflation: Bubbles Bubbles Everywhere, but Yet Do We Still Buy?"If we’re betting on continued inflation, then wouldn’t it make sense to me to leverage debt to acquire assets even if they are a bit overvalued? I’m locked into that low interest rate, so with tax savings, cash flow, and long-term equity combined with the lower value of my future dollars, I’m getting paid to have debt in an inflationary environment. What am I not understanding?" Short answer: Yes. Long answer: carefully. Buying slightly expensive assets, with low-interest rates, where cash flow covers your payment and debt allows you to combat inflation is smart. The catch, make sure the debt is long-term, at a set rate, and you can afford to continue to pay in the event of a big downside. For example, I invest in real estate still. But VERY VERY judiciously. Why? The market is at all-time highs just about everywhere. Low rates, loose monetary policy, and many players concerned about inflation have led to a bubble. Yes, real estate is in a bubble. So if you buy, diversify with an eye to the margin. If you can barely break even on a property, now is probably not the time. I have a slew of people who love to tell me how many "doors" they have in real estate. My response back to them: keep your doors and tell me your PROFIT. How to Play it: I like buying at auction, mobile home parks, RV parks, airbnb's in 'freedom states' or vacation cities. Don't play a 20th-century game in a 21st-century world."I don't know where to put my money, aren't I better off getting really good at one thing? Focusing on one area?" In the past, you could get very very good at one thing, and continue to double down on it to get rich. Even working for another. Today, you do not need to and should not wait for another's permission (aka employment) to grow your wealth. The movement today is for more and more of us to become investors, and owners of assets AS WELL AS employed or employers. After all, what are you more interested to hear from others, where they work? Or what assets, investments, coins, etc they are in? So start today pick an asset class or two, begin learning and allocating:

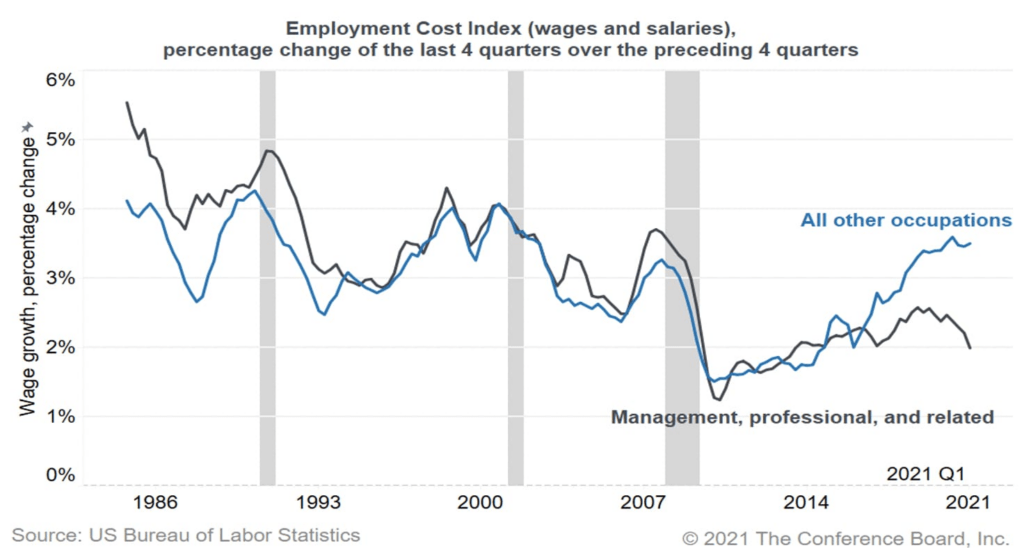

Crypto: Is It the Answer?"Will the crypto regulations in the infrastructure bill affect us as crypto investors or just the companies that are building the projects?" I love the core tenants of crypto; I believe in the idea of sovereignty through technology. However, hope is a terrible investing strategy. The bigger issue with crypto overall is what will the government do? Power is a heady drug and addiction is instant. My prediction; the US will be one of the worst domiciles for crypto holders. Why? Because we can be. El Salvador accepted crypto as legal currency for their nation with open arms, why? No one wants currency from El Salvador. They had no power. The US is not a small central American country. Until we have it no longer the nation will cling to every vestige of it and it's right to tax your dollars. Wage Inflation Is Already Here"My employee cost has jumped 30%. And that is what I'm seeing nationwide. I work with over 1.3B in auto repair services. I feel blue-collar is being hit harder than white-collar office jobs." Yes, it is, blue-collar wage inflation is real. We see it across all our businesses, so be prepared for blue-collar service costs to go up. This is how inflation starts to spread. It's beginning. It's here.

Cash is King or Cash is Trash?"Six months ago, the conversation was "Cash is trash" get your hands on hard assets. Now I'm hearing "stash more cash" -which is it?" This my friends this is what we call a 'false dichotomy'. Two things are true right now: every dollar is worth less each day with inflation AND there will be no better time to have access to cash than going forward. Thus how do you create more cash on hand while having more hedges? The answer: smart, low-cost debt with cash flowing profitable endeavors. IE, buying businesses. So our mission? Have access to money to deploy without losing it through the slow steady bleed of inflation. A NOTE:Do you know why I don't only niche down and talk about one thing? Why do I talk about many types of investments? It's a stupid move to do if you want to grow online. They love putting people in a singular box, "the RE guy," the "small biz" lady. But boxes will not protect you from a storm. The world will punish those who play a 20th-century game in a 21st-century world. DECENTRALIZING + DIVERSIFYING. That is the key. Question everything & protect your ass-ets, Codie & the Contrarian Team “This is the lesson: never give in, never give in, never, never, never, never—in nothing, great or small, large or petty—never give in except to convictions of honor and good sense. Never yield to force; never yield to the apparently overwhelming might of the enemy.” — Churchill If this post helped you, or even made you start to think differently, share with a friend to be enlightened too. Do You Want to Build a Newsletter? Cashflow Monthly?I was getting so many questions about the details behind the Contrarian Thinking newsletter, how we grew to 100k subs, spun out multiple revenue streams, and made it a 7 figure business. At the same time, our buds at AppSumo approached us and asked us to experiment making a course. So we did. How To Build Your Own 7 Figure Newsletter Course was born.8 modules, 10+ lessons, 5+ exclusive videos and interviews, editable templates and financial models...and all the steps and tools you need to replicate that with your own newsletter. Eventually, we're going to have this for $597, but for a short time while it's listed on AppSumo, it's only $139. If you want to grow your bank account, audience, and influence, this will give you the tools.

|

Older messages

Victimhood: This Email 📧 May Trigger You...

Thursday, August 5, 2021

View This Email in Your Browser Victimhood: This Email May Trigger You... Controversial ideas on being the victor… and raising money no matter who you are. Well HELLO! And welcome back to

Psychedelics 🍄 Investing & How I Missed a $2.4B Company?

Thursday, July 29, 2021

Psychedelics Investing & How I Missed a $2.4B Company? How to play the multi-voweled medicine game: psilocybin, ketamine, ayahuasca etc. Welcome to the almost 2000 Contrarians who joined last

The Warren Buffet of Cashflow Buys Trailer Parks?

Thursday, July 22, 2021

The nitty gritty on mobile home parks making millions, with Justin Donald The Warren Buffet of Cashflow Buys Trailer Parks? Welcome to you 2243+ newly minted Contrarians. This is the free newsletter,

Your own 7 Figure Media Business?

Tuesday, July 13, 2021

And a breakdown of the 21st century creator economy View in your browser Want to Create a Media Income Stream? Well hey there crew Do you want to create another income stream? This one a 7 figure

Your own 7 Figure Media Business?

Saturday, July 10, 2021

And a breakdown of the 21st century creator economy View in your browser Want to Create a Media Income Stream? Well hey there crew Do you want to create another income stream? This one a 7 figure

You Might Also Like

The Biocomputer That Blurs Biology, Tech, and The Matrix - AI of the week

Monday, March 10, 2025

Cortical Labs introduced CL1, a biocomputer merging neurons and tech; AI advancements included autonomous agents, AI-powered phones, healthcare assistants, and humanoid robots; plus, Derek Sivers

• World Book Day Promo for Authors • Email Newsletter + Facebook Group Posts

Monday, March 10, 2025

Book promo on 4/23/25 for World Book Day Join ContentMo's World Book Day Promotion #WorldBookDay is April 23rd each year. ContentMo is running a special promo on 4/23/25 for World Book Day

If you're meeting with someone this week...

Sunday, March 9, 2025

Plus, how the LinkedIn algorithm works and how to get your first 100 newsletter subscribers. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

$30,000 Youth4Climate grant, USAID support festival pro bono resources, Interns at Fund for Peace

Sunday, March 9, 2025

The Bloom Issue #205, March 9 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Food for Agile Thought #483: Leadership Blindspots, Tyranny of Incrementalism, Who Does Strategy?

Sunday, March 9, 2025

Also: Product Teams 4 Success; Rank vs. Prio; Haier Self-Management ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Authors • Spring Into Reading Book Promo • Email Newsletter + FB Group Posts & More

Sunday, March 9, 2025

Promo is Now Open for a Limited Time MARCH 2025 Reading Promotion for Books Join ContentMo's

Why you’re always busy but never productive

Saturday, March 8, 2025

Do you schedule time to think? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

• 30-Day Book Promo Package • Insta • FB Groups • Email Newsletter • Pins

Saturday, March 8, 2025

Newsletter & social media ads for books. Enable Images to See This "ContentMo is at the top of my promotions list because I always see a spike in sales when I run one of their promotions. The

Get More Sales and Repeat Buyers.

Friday, March 7, 2025

Conversion Optimization for Ecommerce Growth Playbook. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Tell a Friend About Now I Know?

Friday, March 7, 2025

Help my spread my love of sharing by... uh, also sharing.