Net Interest - Next Steps for Net Interest

Welcome back to Net Interest, my newsletter on financial sector themes. I hope you had a good summer; I spent time in the Scottish Highlands walking hills and sampling whiskies. It gave me time to ponder the next steps for Net Interest, and I’ve decided to introduce a paid tier. Read on and I’ll explain... About a year ago, I wrote a piece on the equity research industry. It was a big industry once, but it’s been in decline. This year, asset managers will spend around $13.7 billion on traditional investment research globally, down from the $17 billion or so they spent in 2015. The era of the rock star equity research analyst passed a long time ago, yet revenues continue to fall. The reasons for the decline in the industry lie in its economics. It isn’t that demand for research product is waning; the amount of money active in seeking out investment returns around the world only goes up and the leverage such money can extract from a good piece of research is immense. Rather, the value chain that supported the traditional model is being rebuilt. One catalyst for this was regulation. At the beginning of 2018, a new regulation – MiFID II – took effect in Europe. Among other things, it forced asset managers to cover the cost of research themselves rather than pass it on to their clients inside trading fees. Unsurprisingly, this led to a reassessment of the value they place on research; it’s easy to try the lobster when someone else is paying. Many independent research-led brokers were hit hard. One of them was Redburn, a London-based firm with 200 employees. Revenues are down 25% from their pre-MiFID II peak and in its recently filed accounts for 2020, the company complains that “the aggregate equity research market wallet…remains under pressure… [I]t is proving challenging for the core business to generate meaningful growth in this market, given the market size headwinds.” Yet while equity research providers gnash their teeth at the unbundling of research from trading, another unbundling has been taking place within equity research itself. Just as in related sectors like media, equity research offers a range of services which are increasingly being picked off by specialist providers. It’s this unbundling that explains the continued decline in investment research revenue. Services include:

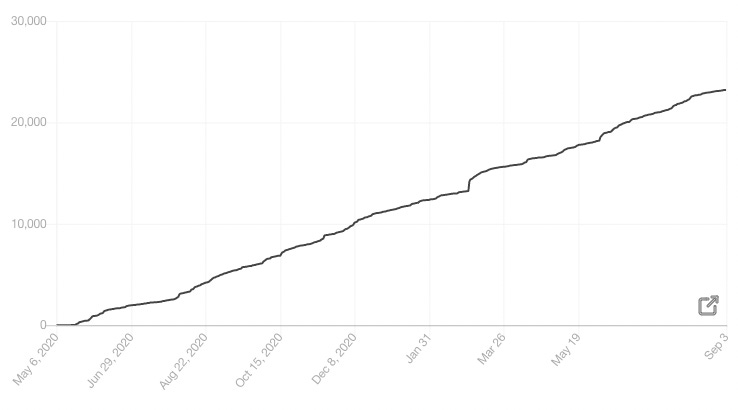

Take access to company management. Equity research providers used to host grand conferences, taking over entire hotels to intermediate meetings between investors and corporate executives. As an investor I would routinely fly to New York or Florida to meet with CEOs in airless hotel rooms, paying Goldman Sachs or Credit Suisse for the privilege. Now, a lot of that can be done online at lower cost. Earlier this year, OpenExchange, a provider of virtual event solutions, raised $23 million in series D funding to fuel its growth. The company managed 4,000 meetings in 2019 but that jumped to over 100,000 in 2020 and 84,000 in the first half of 2021. Or take access to experts. Firms focussed on introducing investors to industry experts have been around for a while; indeed some of them became embroiled in an insider trading probe in 2010. But they’ve been showing strong growth recently, earning over $3 billion of revenues in 2020, with investment managers comprising some of their best customers. Gerson Lehrman Group (GLG) is the market leader [disclosure: I’m one of their experts] – they earned over $600 million in revenue last year – but lots of new entrants have come to the market, including Tegus, which retains a library of transcripted calls. The leading provider in China, Capvision, recently filed to go public in Hong Kong; it’s grown its revenues by 29% per annum over the past two years and now does close to $100 million in sales. Across the whole spectrum of jobs to be done in equity research, new entrants are pecking away. Canalyst raised $20 million of series B funding in 2019 to do earnings models. Companies like Procensus offer a platform for institutional investors to share opinions and forecasts directly. Traditional data providers like Bloomberg are pushing up into research to secure positioning in their core market. And although not a startup, the Financial Times did more to bring Wirecard management to account than most research analysts. One analyst highlighted the conflicts that can arise from bundling when she told a German parliamentary inquiry: “It is an analyst’s job to sell ideas. Wirecard was one of my strongest recommendations.” Finally, there’s industry knowledge. Traditionally this was sold at a very high price to a small number of clients. Redburn, for example, has no more than a thousand clients. But the low cost of internet distribution opens up a much larger potential market at a lower price point. A pioneer here is Ben Thompson, who offers tech industry knowledge and strategic insight via his Stratechery newsletter. He is estimated to have between 25,000 and 30,000 customers. His ideas have even been repackaged by traditional equity research houses and passed off as their own:  Alex Persson @PerssonAC @benthompson Credit Suisse blatantly copying your work and not providing credit where credit is due. https://t.co/Wnplsl3gEzAll of which brings me to Net Interest. When I launched Net Interest in May 2020, I never really grasped the power of the internet. I had spent over 20 years in public markets, first in equity research and then as a partner of one of Europe’s premier hedge fund firms, analysing and investing in financial services firms throughout. At peak, my team and I managed $4 billion of assets in the sector, which we deployed, long and short, around the world. Although I’ve given up managing other people’s money, I maintain a keen interest, particularly in fintech, and thought it would be fun to write down what I was thinking about each week. Over 60 issues later, we are at more than 23,000 subscribers. Readers include CEOs and CFOs of some of the biggest financial institutions in the world, founders of some of the most exciting startups, and investors at some of the highest performing funds across venture and public markets. The email open rate is around 45%, which I’m told is quite good, and top posts are read by up to 50,000 people. The content isn’t equity research in the fully bundled sense. I don’t make stock calls nor do I publish earnings models. In addition, I write a lot about private companies whose securities don’t trade. But the industry knowledge is there, built on 25 years of experience. In fact, as an investor, I often observed a gap in the market for historical, contextual research – simple explanations for why an industry came to be and the longer term dynamics at play. Net Interest is my contribution to filling that gap in the financial services sector. From today, I’m adding a paid tier. The weekly long form piece will remain free, but paid subscribers will have access to three supplementary features:

I’m excited by what Net Interest has accomplished over the past year and I’m ready to take it to the next level. I’m emboldened by some of the great endorsements I’ve received from some very demanding readers:

In addition, plenty more executives, founders, hedge fund managers and venture capitalists have written to say how much they enjoy Net Interest. One reader tweeted: “Very insightful, thought provoking, informative and his experience shows up in every one of his posts. @MarcRuby is part historian, part finance professor & 100% awesome.” That’s nice, but where’s the value for me?Net Interest provides three services to help operators and investors navigate the evolving financial services sector: Frameworks. For beginners to the financial services sector and experienced professionals alike, Net Interest provides a series of frameworks to help analyse what’s going on. As well as looking at ways to think about traditional banking, we’ve explored the economics of fund management, how investment banking works and the shifting power dynamics between Wall Street brokers and global exchange groups. Teardowns. S-1 teardowns are great. I’ve contributed to a couple (Coinbase, Affirm) and I’ve written up a few here too (eToro, Wise) but pre S-1 primers of private companies on the path to going public are a step ahead of the crowd. Net Interest has published several: on Ant Group of China and on Paytm of India months before either filed their prospectuses; and on Revolut and Klarna which have yet to file. Calls. OK, I don’t make stock calls; I prefer to leave the last mile up to you. But I can get you close. On the long side, I’ve written up Square, Tinkoff and Irish banks. The stand out is Tinkoff, up 120% since publishing at the beginning of the year. It doesn’t always go as planned of course. I wrote up Galaxy Digital Holdings, the Goldman Sachs of crypto, in April, and its stock hasn’t recovered since. On the short side, the standout is Greensill. Steve Clapham and I laid out all the red flags nine months before the company’s collapse. Our piece was even highlighted at a UK Parliamentary hearing into the matter. As a private company, there’s not much most readers could have done with our analysis on the investing side. But we hope that some of the VCs out there took note when Greensill tried to raise fresh capital later in the year. More actionable may have been Evergrande, which we discussed in July; it’s down a lot since then. Again, though, it’s not all one way traffic. I was pretty sceptical of Robinhood’s prospects at IPO and that stock is up almost 20% since. What will it cost?The subscription price is $250 per year, or $25 per month. In addition, I am opening up just 25 slots for institutional members. These members will receive a more personalised service, where I will be available for quarterly one-on-one calls. The price for an institutional membership is $5,000 per year. Compared to the tens of thousands of dollars that asset managers pay for bundled equity research, either of these subscription plans represents a very good offer. My pitch to you is that if this newsletter can help you make one better decision each year, it’ll pay for itself. And if it doesn’t, you can cancel anytime. When will this change happen?The first subscriber-only post will go out next week, 10 September. There’s plenty in store for the months ahead. Coming soon is a write-up of M-Pesa, the original ‘digital wallet’ born in Africa. There’s a piece on the art market in the pipeline and also something on Chinese banks as well as continued explorations in decentralised finance. If you’ve gained any valuable insights from what you’ve read in Net Interest so far, I hope you’ll join me on the next leg of the journey and sign up as a paid subscriber. We won’t be breaking the equity research model, but if it’s financial industry knowledge you’re after, in an accessible format, then Net Interest is the place for you. In the meantime, whether you’re celebrating Labor Day, Jewish New Year or a birthday (I am!) have a great week ahead, Marc You’re on the free list for Net Interest. For the full experience, become a paying subscriber. |

Older messages

After Afterpay

Friday, August 6, 2021

Plus: Big Tech Doing Finance, European Banks, Blackstone

Blackstone's Moment

Friday, July 30, 2021

Plus: Archegos, US Payments, Monzo, Finally

Ever Grande

Friday, July 23, 2021

Plus: Simply not Fintechery, Circle, Equity Research, Finally

Litigation Finance

Friday, July 23, 2021

Plus: Stress Tests, Revolut, Tink/Visa

The Long Slow Short

Friday, July 23, 2021

Plus: Robinhood/Distressed Investing, Banker Hours, Compound Treasury

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏