The Signal - MPL is king

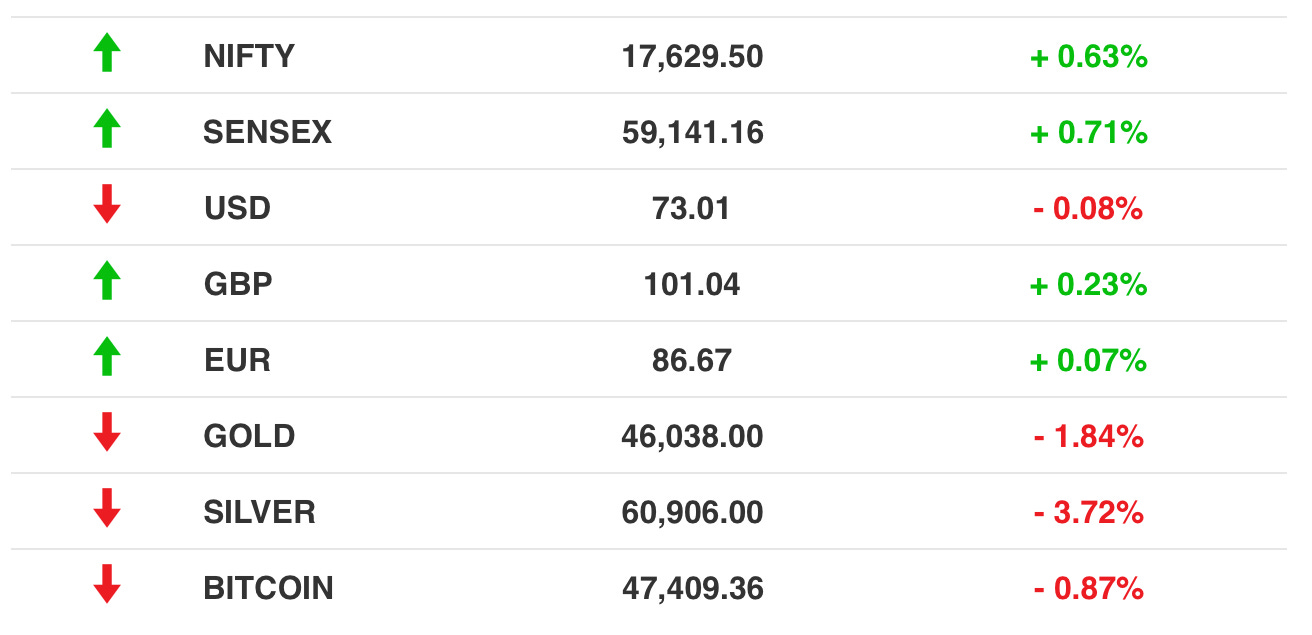

MPL is kingAlso in today’s edition: A world without passwords, Banking on bad assets, Big Tech weaponised acquisitionsGood morning! The US Soccer Federation declared that it would be paying its men’s and women’s teams the same pay and contracts. Earlier this year, the Irish Football Association, too, had decided that it too would offer its footballers the same pay. Better late than never. The Market SignalStocks: Powered by Reliance Industries, ITC, and ICICI Bank stocks, the BSE Sensex and the NSE Nifty closed at new peaks. Vodafone Idea stock zoomed 25% after it got a government lifeline. Most bank stocks rallied as the government announced the setting up of a bank to take over bad loans. Forgot Password? It’s OkMicrosoft is ditching password logins for all its services. Instead, it is going to let users choose to access their accounts using its Microsoft Authenticator app, Windows Hello, a physical security key, and SMS or emailed codes. Why? Human-generated passwords are fairly easy to hack into. Every second, 579 password attacks occur, adding up to 18 billion a year. Passwordless logins are not new. Microsoft itself has done it before and many other companies like Google and Apple are also trying it out. The future: Two-factor authentication makes for a secure internet experience. However, using SMS or emailed codes alone with vanilla passwords can still be problematic as they can be hacked into via SIM-swapping or mirroring. Authenticator apps, on the other hand, generate codes on the app itself and not the SIM card. Biometrics are even safer since it’s difficult to steal someone’s fingerprint. That is until someone finds a hack to copy biometric inputs. Bad Bank Is ComingFor many years, the government used taxpayers’ money to recapitalise banks plagued by poor risk management that created a mountain of bad debts. It is finally setting up a National Asset Reconstruction Company (NARCL) that will take over non-performing assets of banks worth about ₹2 lakh crore. What’s the deal? Banks will sell their bad loans—₹90,000 crore initially— to NARCL for 15% cash up front and the rest in government-backed, tradable securities. The Cabinet has set aside ₹30,600 crore for this. The guarantee will stay for five years by when expectedly the asset will be is sold. So, what? Rising bad loans have crimped banks’ lending capacity. Dodgy assets forced banks to keep 60% of their operating profits as provisions in the second quarter of FY22, leaving them with little money to improve their core business. Banks would have more leeway to bolster post-pandemic economic recovery by lending to credit-starved small businesses that contribute 30% of India’s GDP and account for nearly half of the country’s exports. What Puts MPL On The Unicorn Podium?MPL joined the growing list of unicorns of 2021. Reports suggest 27 so far. The gaming company is now valued at $2.3 billion and is the second of its kind to enter this club. To be fair, The Signal has stopped counting now. Maybe some smart folks out there need to create a new barometer for measuring tech startups. Dragons, it seems, could be the new one. Roll the dice: But there’s something unusual about MPL, which helps it stand apart. It has 85 million users, mostly on Android. Ok? So what? Well, Google Play Store doesn’t host MPL’s app. It has to be sideloaded. The app can be, however, found on Apple’s and Samsung’s stores. Phoren dreams: Earlier this year, MPL went overseas with a move into the US, which almost guarantees it higher revenue.

Just Another Crypto DayTo plug a hole in its product array and catch up with global rivals, the US’s largest cryptocurrency exchange, Coinbase, wants to start futures and options on its platform. Derivatives could help boost trading volumes which on September 14 was around $5.5 billion. To compare, on the world’s biggest exchange, Binance, Bitcoin futures alone were over $17 billion in the 24-hour period. The highly-regulated Coinbase offers investors an alternative to more liberal, and hence risky, exchanges. Popularity breeds fraud: A US court has sent Stefan He Qin, founder of cryptocurrency hedge funds Virgil Sigma and VQR Multistrategy Fund, to prison for embezzling $54 million in investor money. India potential: Andreessen Horowitz is said to have opened talks to make its first India investment, in crypto investment platform CoinSwitch Kuber which was earlier valued at $500 million after a $25 million investment from Tiger Global. Presidential mess-up: Protests have broken out in El Salvador which adopted Bitcoin as legal tender last week. The protestors, who set fire to a Bitcoin ATM, believe President Nayib Bukele’s move was aimed at consolidating power. FTC Vows No More Secret DealsBig Tech was using acquisitions as a weapon to kill competition, the Lina Khan-led US Federal Trade Commission (FTC) now believes. While the FTC was busy examining billion-dollar acquisitions, five big technology companies made 819 small deals that slipped under the radar between 2010 and 2019, a study by the commission revealed. Why? Under the Hart-Scott-Rodino Act, companies are only required to report transactions exceeding $92 million. Big technology companies rampantly exploited that loophole to nip competition in the bud by purchasing patents, hiring talented employees from other organizations, and acquiring small firms that could have grown to be threats. Getting stricter: The FTC plans to identify and plug loopholes found by the HSR study, making it harder for companies to sidestep the regulatory lens. What Else Made The Signal?Down the ladder: Tencent, the last Chinese company in the list of the world’s top 10 companies by market value, has dropped out of the coveted ranking. A harsh regulatory crackdown by China has eroded trillions of dollars in market valuation of its companies. Buying spree: Byju’s has made another purchase, its ninth this year to be precise. This time, it has bought children’s coding site Tynker for $200 million to expand its US footprint. Mostly jabbed: China is ahead of the West when it comes to vaccination. It has given the Covid-19 jab to over 1 billion people, ~70% of its population, as of September 15. Tip jar: In the second-largest ever payout till date, the Securities and Exchange Commission in the US paid a whistleblower $110 million under its whistleblower program for a sanctionable tip. Caller listing: Truecaller wants to list on Nasdaq Stockholm in its home country Sweden for $116 million. This could value the company at $3 billion. Painted green: Australian graphic design platform Canva has raised $200 million, led by Franklin Templeton, Sequoia Capital Global Equities, and Greenoaks Capital among others. It is now the world’s fifth-most valuable private startup. Betting big: Brand-building company Mensa Brands has got $10 million from Tiger Global, now putting its valuation between $250-$260 million. FWIWThat’s not bacon: In an internet vandalism attempt, a British plant-based meat company called This replaced the images of bacon on Wikipedia’s page with pictures of its own products. Twice. Trained missiles: North Korea is getting creative with its missile launches. It tested new ballistic missiles from a train. Flipping over: CBS series The Activist, starring Usher, Julianne Hough, and Priyanka Chopra Jonas will switch over from being a competitive show to a documentary that will showcase the work activists put in. Filming is set to begin from scratch. Write to us here for feedback on The Signal. If you liked this post from The Signal, why not share it? |

Older messages

Toxic Insta hides the fact

Thursday, September 16, 2021

Also in today's edition: Vi gets a breather, Glassdoor buys Fishbowl, App Annie broke a vow

Biden's gift to Indians

Wednesday, September 15, 2021

Also in today's edition: Apple launches new toys, Litecoin wrecks dreams, Chinese idol can't be hot

Shades of ads

Tuesday, September 14, 2021

Also in today's edition: The box office is back, Flipkart expects a bumper year, Parle sits down for breakfast

Epic fight ends in a draw, sort of

Monday, September 13, 2021

Also in today's edition: ISRO to help fire private rockets, Mark picks up the privacy banner, Ford concedes defeat in India

India cannot afford a stock market crash

Saturday, September 11, 2021

A shock would pulse through the economy all the way to the grassroots

You Might Also Like

🪴Sculpting vs Pottery

Wednesday, November 27, 2024

I wrote a mini essay!

Tornado Cash Sanctions Lifted in Major Privacy Victory for Crypto

Wednesday, November 27, 2024

Plus Thanksgiving Flashback Raises Questions About Bitcoin's Next Move

Tips for Talking to AI

Wednesday, November 27, 2024

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's Pie in the Face Day, Reader! Which would you choose: banana cream or

This super simple product is generating an insane $850k per month [Trending Products]

Wednesday, November 27, 2024

Do you have an SEO plan in place to capitalize on all these product searches? Find out how 180 Marketing can help you grow your search revenue (eCommerce sites only). Trending Products on Amazon This

A Marketer Who Is Thankful

Wednesday, November 27, 2024

Tomorrow is Thanksgiving in the United States. It's been a tough couple of weeks, but I am thankful for some things. Marketing Junto | News & Commentary About Digital Marketing Marketing Junto

Change your newsletter... Change your life?

Wednesday, November 27, 2024

A meta newsletter about newsletters: On returning to Substack and launching a second newsletter, and how it's all part of something bigger. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

This type of content is 50x more likely to rank organically

Wednesday, November 27, 2024

You may have noticed that Google is showing a lot more videos on its search results pages. 62% of all Google searches now include video carousels, according to Ubersuggest... and videos are up to 50x

AI's VC arms race heats up

Wednesday, November 27, 2024

Can EU regulation spur crypto VC deals?; UK dealmaking shifts down a gear; fintech Yubi seeks $200M Read online | Don't want to receive these emails? Manage your subscription. Log in The Daily

The Gratitude Shift: From 'Grateful For' to 'Grateful In'

Wednesday, November 27, 2024

For many of us, 2024 has been a year of extremes. The highs have felt exhilarating, and the lows have been profoundly difficult.

Short Video 101

Wednesday, November 27, 2024

It's as easy as 1, 2, 3.