The Economic Data Can't Possibly Be Accurate. Here Is Proof.

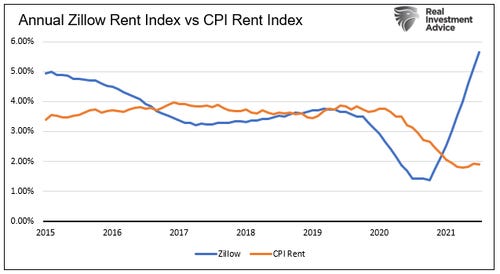

To investors, I hope each of you had a great weekend. At the end of last week, I saw a chart that really confused me. It showed the difference between the CPI Rent Index and the Zillow Rent Index. These numbers show that Zillow is estimating rents are increasing about 5.5% to 6% annually right now. The CPI Rent Index is showing just under 2% rent growth. The confusing part of this was that the two metrics, which are supposed to be measuring the exact same thing, are apparently coming in at such different numbers. The Zillow Rent Index is almost 300% higher than the CPI Rent Index. But they weren’t the only ones. The Apartment Guide rent report published on August 31, 2021 also showed numbers significantly higher than the CPI Rent Index. The lowest rental increase for the national average was more than 2x the CPI Rent Index number. How could this be? Well, I started to dig deeper into the data and what I found was honestly shocking. It all starts with the data sets that are being used by the various reports. First, the CPI Rent Index uses the following definition for rent in the CPI:

So how exactly do they do select which units and/or tenants or landlords to survey? The government uses the 1990 Census data obviously. No, seriously. I had to read this about 50 times before I actually believed it. Here is the exact explanation:

Ok, that seems crazy but maybe we are just overreacting. How many units are included in the national rent index? Must be millions, right? Nope. It is only 32,000 total units. Here is the explanation:

This is starting to look absolutely ridiculous. But it is about to get even better. If you’re going to report a monthly change in the national rent average, you’re obviously going to survey the units on a monthly basis, right? Nope. The government only surveys the units every 6 months.

Now the government does their best to account for the lack of monthly surveying…by increasing rents by one dollar (lol). I wish that I was making this up. But here is the information directly from the BLS’ fact sheet.

Alright, in case you weren’t paying attention, here is what we have making up the CPI Rent Index — Approximately 32,000 units across the US that were selected based on the 1990 census data and are each surveyed only twice a year. Sounds like a disaster. Now what about the Zillow Rent Index? Here is how they describe their methodology:

Zillow then describes how they don’t take a small sample size of homes within a region, but rather they use every home or unit.

So the government is using 32,000 units that they survey every 6 months and Zillow is using 100 million units that they evaluate every month. You can determine which of these two methodologies you believe are more likely to be accurate :) This exercise was only done for the rent index, but you can replicate it for pretty much every single CPI number that is presented. The data is bad. The methodology is antiquated. The government is living in the past and refuses to use modern technologies and platforms to capture more accurate data. It is impossible to make good decisions when you are using bad data. Everything from your understanding of the problems to your belief in the intended outcomes is skewed. This is a very real problem that is provable today. The Federal Reserve, Treasury, and various politicians are making monetary and fiscal policy decisions on data that is telling them CPI inflation is 5.3%, core inflation is 4%, and the annual change of the rent index is sub 2%. Alternative data sources, which use more robust methodologies and are based on larger data sets, have these numbers at 50% to 300% higher depending on the metric. Maybe the alternative data sets are accurate. Or maybe they are overestimating to some degree. But what is clear here is that the CPI Rent Index can’t possibly produce an accurate monthly number if they aren’t even surveying the housing units on a monthly basis. Therein lies the problem. Bad data gets you bad decisions. And bad decisions have severe consequences when you are dealing with monetary and fiscal decisions that end up making the rich richer and the poor poorer. Someone stop the madness. Make it all make sense. Because right now none of this adds up. Hope each of you has a great start to your week. I’ll talk to everyone tomorrow. -Pomp SPONSORED: Polymarket is the world’s leading information markets platform where you can trade on a variety of markets – politics, current events, and more – all on the blockchain. Take, for example, this market on whether the floor price of CryptoPunks will

TRY IT HERE: Click here to get started. THE RUNDOWN:US Regulators Looking to Get a Handle on Stablecoins, NY Times Says: Saying the rush to bring stablecoins under regulatory control might be “the most important conversation in Washington financial circles this year,” the New York Times published an explainer article on the type of cryptocurrency and laid out what the author (and perhaps her sources) sees as the top options at regulators’ disposal. Read more. Biden Administration Plans Cryptocurrency Sanctions to Combat Ransomware: The U.S. government plans to issue guidance and impose sanctions in an ongoing effort to tamp down on ransomware attacks. The Wall Street Journal reported Friday that the Joe Biden administration is planning an array of actions to mitigate ransomware attacks, with a focus on payments. The Treasury Department will announce these actions next week, CoinDesk confirmed. Read more. Bakkt to Go Public Next Month After SEC Okays SPAC Plans: Bakkt Holdings and VPC Impact Acquisition Holdings have received approval from the Securities and Exchange Commission to complete their merger and push forward with plans to operate as a single publicly traded entity, the companies said in an announcement Friday. VIH shareholders will meet on Oct. 14 to approve the merger, the companies said. Cryptocurrency exchange Bakkt, which is majority-owned by Intercontinental Exchange, has been planning to go public via the merger with VIH, a special purpose acquisition company. Read more. Christie’s to Sell Some of the Earliest NFTs – And Only for ETH: Christie’s is listing a set of 31 Curio Cards and several other prominent non-fungible token (NFT) projects in a live auction on Oct. 1, furthering its foray into digital art sales. The 254-year-old auction house made history in March when it auctioned a Beeple NFT for $69 million. Christie’s Asia branch is now taking bids for several rare CryptoPunks and Bored Ape NFTs as recent buyer appetite for NFTs approaches manic levels. Read more. LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE Kyle Samani is a Co-Founder and Managing Partner at Multicoin Capital, a thesis-driven investment firm with a global footprint that invests exclusively in the crypto ecosystem. Multicoin Capital manages several billion in assets across hedge funds and venture funds. In this conversation, we discuss Bitcoin, Ethereum, Solana, crypto investment thesis, and how Kyle sees the future unfolding in crypto. LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE Podcast SponsorsThese companies make the podcast possible, so go check them out and thank them for their support!

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re on the free list for The Pomp Letter. For the full experience, become a paying subscriber. |

Older messages

I made a mistake. NFTs are going to be much bigger than I anticipated.

Friday, September 10, 2021

Listen now (6 min) | To investors, The NFT industry has exploded in popularity this year. There was more than $2.5 billion in sales volume during the first half of 2021 and it has only accelerated

Prediction Markets and The Beauty of Crowds

Thursday, September 2, 2021

To investors, Below is a write-up from Sebastian Deri and the team at Polymarket, the largest blockchain-based information markets platform. They explain what information markets are and how they can

Lightning Network Overview

Friday, August 27, 2021

Listen now (4 min) | To investors, Below is a guest post overview of the Lightning Network from Mitch Klee. You can follow him on Twitter by clicking here. Lightning network has been on track to change

Monetary Maximalism & Technology Competition

Monday, August 23, 2021

Listen now (6 min) | To investors, I am often asked about my opinion on bitcoin and the crypto industry. While it is easy to articulate the answers to specific questions, I've recently found it

Lightning Network vs Western Union

Friday, August 20, 2021

Listen now (4 min) | To investors, Western Union is one of those businesses that the average American has heard of, but doesn't pay attention to on a daily basis. The approximately $9 billion

You Might Also Like

How Amazon Lures Chinese Factories Away From Temu [Roundup]

Monday, March 10, 2025

Need funding for your Canadian Amazon business? Not sure if you should use a Canadian corporation or US LLC to form your company? We'll cover these questions and more in our Start and Grow Your FBA

Is The Trump Administration Crashing The Market On Purpose?

Monday, March 10, 2025

Listen now (4 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Dry powder piles up for mature funds

Monday, March 10, 2025

Defense tech VC deals balloon; data dive on VC's emerging opportunities; France's positive quarter, but sluggish year Read online | Don't want to receive these emails? Manage your

Digiday wants to hear from you

Monday, March 10, 2025

As a loyal reader, your feedback is vital as we continue to evolve our products and coverage. We're reaching out to see if you'd answer a few questions to help make your experience with Digiday

Advertisers are calling for full URL-level campaign reporting, and DSPs are responding in different ways

Monday, March 10, 2025

The Trade Desk quells talk of full URL-level campaign reporting (similar to Amazon), but there are nuances. March 10, 2025 PRESENTED BY Advertisers are calling for full URL-level campaign reporting,

The 90-10 Rule: Why Great Leaders Don’t Need Universal Approval

Monday, March 10, 2025

Leaders who focus too much on making everyone happy may inadvertently stifle the very innovation and progress that constructive dissatisfaction can inspire.

Athletes Are Making Their Own Chip Deals 🥔💰

Monday, March 10, 2025

Athletes turning snacks into serious cash 🚀🥔

🔔Opening Bell Daily: Investor jitters grow

Monday, March 10, 2025

Traders keep selling stocks and US indexes are lagging the rest of the world.

A shellacking

Monday, March 10, 2025

Gaming share prices crater on US consumer fears ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

10x more leads (powerful)

Monday, March 10, 2025

Launching a product? I'm helping startups build better products and reach product-market fit. To do that, we've built ProductMix and you should use it: https://rockethub.com/deal/productmix