Is The Trump Administration Crashing The Market On Purpose?

To investors, The big question in financial markets over the last two weeks has been “is Donald Trump intentionally trying to tank the US stock market?” This would have been an absurd question before the inauguration. The general thought process was President Trump is a businessman and investor. He measures the health of the US economy through the stock market performance, so you can expect the stock market to go up if Trump becomes President. I know this was the consensus because I believed it too. There was no obvious reason why Trump would allow the US stock market to drop, let alone take actions to crash the market himself. But that is exactly what is happening now. Here is President Trump talking over the weekend about his plan to get interest rates and energy down: Kris Patel and Amit Is Investing highlight how this plan works:

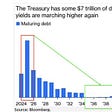

Now this is not the easy way to get interest rates down. The easy way was to have the Federal Reserve cut interest rates at the start of the year, but that didn’t happen. In fact, many of you may remember that Trump kept telling Jerome Powell to cut interest rates last year. Powell was public in his defiance of Trump’s request, so now Trump and Scott Bessent are taking matters into their own hands. They are crashing asset prices in an attempt to force Jerome Powell to cut interest rates. We will see who blinks first. Don’t believe me? Here is Trump explicitly saying you can’t watch the stock market right now: So the entire administration has their eyes on the 10-year Treasury yield. But even without Powell stepping up to the plate and slashing interest rates, we have already seen the 10-year drop from 4.8% in January to 4.25% this weekend. That is a good start. We are going to need much more movement on interest rates though if we want to have a profound impact on our refinancing costs. Lower interest rates don’t merely affect the US government though. The drop in interest rates since the start of the year have helped drop mortgage rates as well. Kris Patel points out “as interest rates decline, more buyers will emerge, but so will many sellers. We need the housing market to thaw.” Housing is not the only game in town that benefits from lower interest rates. Perplexity, my favorite AI search engine, explains:

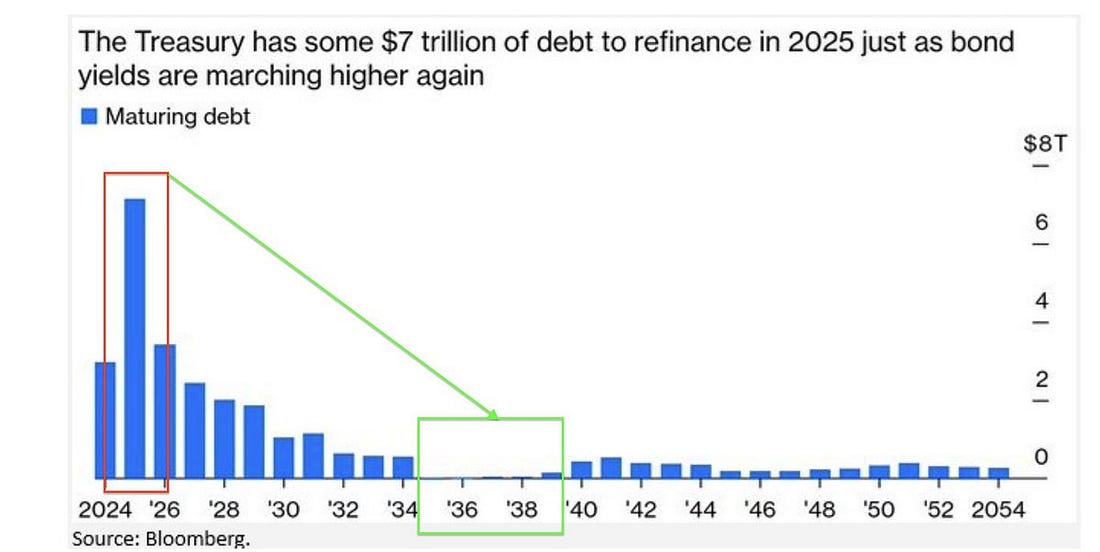

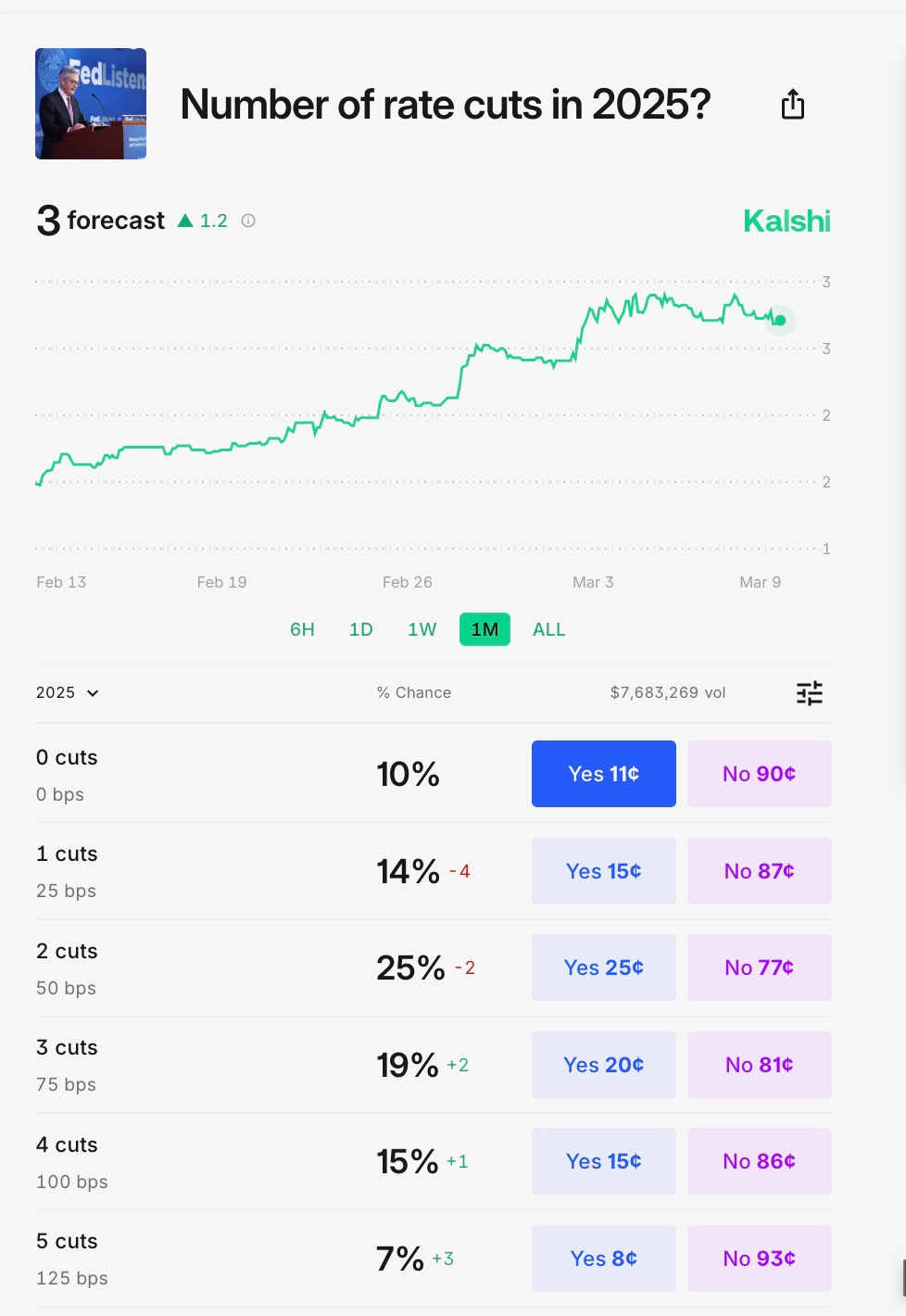

So how many interest rate cuts can we expect in 2025? Prediction market Kalshi says the market has increased its expected number of rate cuts. It now gives >75% odds of two or more cuts this year. Kalshi is also showing a 38% chance of a recession this year. So is Donald Trump, Scott Bessent, Howard Lutnick and the current administration trying to pull down asset prices? Absolutely. They claim to be focused on Main Street over Wall Street. The big goal is to get interest rates down, which will lead to more economic activity thanks to the access to cheap capital. This is not your grandfather’s economy. And this is not your grandfather’s economic policy. No wonder there is so much controversy over the strategy — people hate new things, especially when they are bold bets coming from one side of the political aisle. But if we end up with lower interest rates and can somehow avoid a recession, then we will all have to tip our cap to the current leadership team. I don’t envy their position. Something new has to be done since we can’t continue on the path we are on. Let’s all hope this plan works. Millions of Americans are depending on it. Have a great start to your week. I’ll talk to everyone tomorrow. - Anthony Pompliano Founder & CEO, Professional Capital Management Why Bitcoin Crashed After Trump Strategic Reserve News Jordi Visser is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos. In this conversation we talk about what is going on with tariffs, how it’s impacting the economy, how to think about the bitcoin strategic reserve, and what investors are currently thinking about. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

We Finally Have A Strategic Bitcoin Reserve

Friday, March 7, 2025

Listen now (4 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Maybe We Are Getting A Bitcoin-Only Strategic Reserve After All

Wednesday, March 5, 2025

Listen now (3 mins) | Today's letter is brought to you by Osprey Funds! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Age of Economic Chaos

Tuesday, March 4, 2025

Listen now (7 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What I Think About The Crypto Strategic Reserve

Monday, March 3, 2025

Listen now (8 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin industry insiders aren’t worried about the price correction

Friday, February 28, 2025

Today's letter features a guest post from Phil Rosen, the co-founder of Opening Bell Daily, an independent financial media company. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

The Silver Influencer 🩶

Monday, March 10, 2025

Work with Gen X and Boomer influencers.

Elon lost the fight to Open AI

Monday, March 10, 2025

but did he really lose?..... PLUS: Authors sued Meta!

TikTok updates, video editing hacks, avoiding AI hallucinations, and more

Monday, March 10, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... presented by social-media-marketing-world-logo Mondays can feel overwhelming, Reader, but don't worry... we've got your

How Amazon Lures Chinese Factories Away From Temu [Roundup]

Monday, March 10, 2025

Need funding for your Canadian Amazon business? Not sure if you should use a Canadian corporation or US LLC to form your company? We'll cover these questions and more in our Start and Grow Your FBA

Dry powder piles up for mature funds

Monday, March 10, 2025

Defense tech VC deals balloon; data dive on VC's emerging opportunities; France's positive quarter, but sluggish year Read online | Don't want to receive these emails? Manage your

Digiday wants to hear from you

Monday, March 10, 2025

As a loyal reader, your feedback is vital as we continue to evolve our products and coverage. We're reaching out to see if you'd answer a few questions to help make your experience with Digiday

Advertisers are calling for full URL-level campaign reporting, and DSPs are responding in different ways

Monday, March 10, 2025

The Trade Desk quells talk of full URL-level campaign reporting (similar to Amazon), but there are nuances. March 10, 2025 PRESENTED BY Advertisers are calling for full URL-level campaign reporting,

The 90-10 Rule: Why Great Leaders Don’t Need Universal Approval

Monday, March 10, 2025

Leaders who focus too much on making everyone happy may inadvertently stifle the very innovation and progress that constructive dissatisfaction can inspire.

Athletes Are Making Their Own Chip Deals 🥔💰

Monday, March 10, 2025

Athletes turning snacks into serious cash 🚀🥔