In today's Finshots we talk about the Evergrande crisis and see why analysts across the board seem to think that this could spell doom for China

The Story

China has been trying to walk a tightrope. Property prices have risen considerably in the past 15–20 years and it has made housing unaffordable for millions of people — something that isn’t very palatable to the Communist Party of China (CPC).

But the thing is — This has largely been their own doing. For years now, the Chinese government has facilitated easy financing options for the likes of Evergrande —one of China’s largest real estate group. These companies in turn have relied on cheap debt to lap up land parcels across the country. With a fixed land stock, this incredible buying spree has created an artificial scarcity of sorts. The scarcity thus precipitated, has indirectly pushed land prices higher. And the increase in land prices has fed into the boom in property prices.

So naturally, if you were trying to address the problem you’d have to revisit the root cause — the property developers and their remarkable appetite for debt. And earlier this year the CPC outlined a three-red line policy to deter real estate companies from binging on credit.

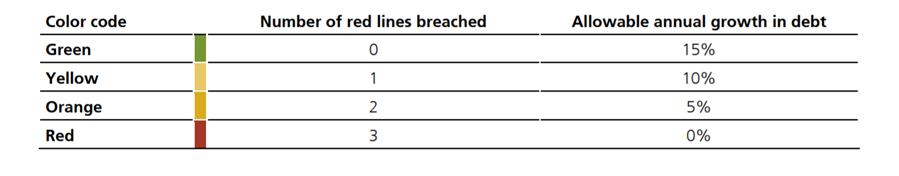

The state cherry-picked a list of companies (thought to be systemically important) and forced an audit. Through the audit, they wanted to know if these companies were breaching a list of three debt-related indicators — something Chinese authorities put together after taking into account the state of the industry. It involves things like net gearing ratio and Liability to asset ratio — rather complicated things. So we won’t dabble with the precise definitions. Instead, know that each breach meant you got a strike against you. In fact, here’s a handy chart from a UBS report explaining the implications.

If you breached a red line, you’d have to slow down on taking new debt. If you breached all three red lines, you’d have to stop taking debt altogether.

And that’s what happened with Evergrande.

Evergrande has been so indebted that they now have liabilities to the tune of $300 billion. They can’t borrow anymore and the funding taps have all but closed. Now some people have likened this to the infamous Lehman moment — when the US investment bank crumbled under its debt burden and precipitated a global financial crisis (back in 2008). Even others have brushed aside these fears as being exaggerated. But the truth is that it’s more complicated than you think.

A total collapse of the Evergrande group won’t bode well for anyone. There are suppliers waiting for payments. There are banks hoping to see their loans repaid. And there are homebuyers praying that their unfinished home sees the light of day. If Evergrande were to go bankrupt, the implications of this won’t just be limited to the real estate group — It will spread far and wide. It will also send shockwaves across the entire industry as one in five of China’s biggest real estate developers have also breached similar limits. Real estate prices could come crashing down as developers try to get rid of unsold homes.

More importantly, it could be problematic to the Chinese people. Nearly 70% of Chinese household wealth is tied up in real estate and a sudden downturn in prices could mean erosion of wealth — the kind that's never been seen before. So by all accounts, this is problematic, not just for big developers but also for the population at large.

However, there’s also growing belief that the Communist Party will engineer a “soft landing.” They have the resources and the political willpower to mitigate a catastrophe and maybe that’s precisely what they’ll do. Also bear in mind, unlike the US, the Chinese influence doesn’t extend as far. A real estate crisis in China will most certainly impact some nations and may even affect India, but it’s unlikely to be as damaging as the 2008 financial crisis.

So yeah, hopefully this explains why everyone’s talking about Evergrande and if you liked the article don’t forget to share it on WhatsApp, Twitter and LinkedIn.

Until next time..