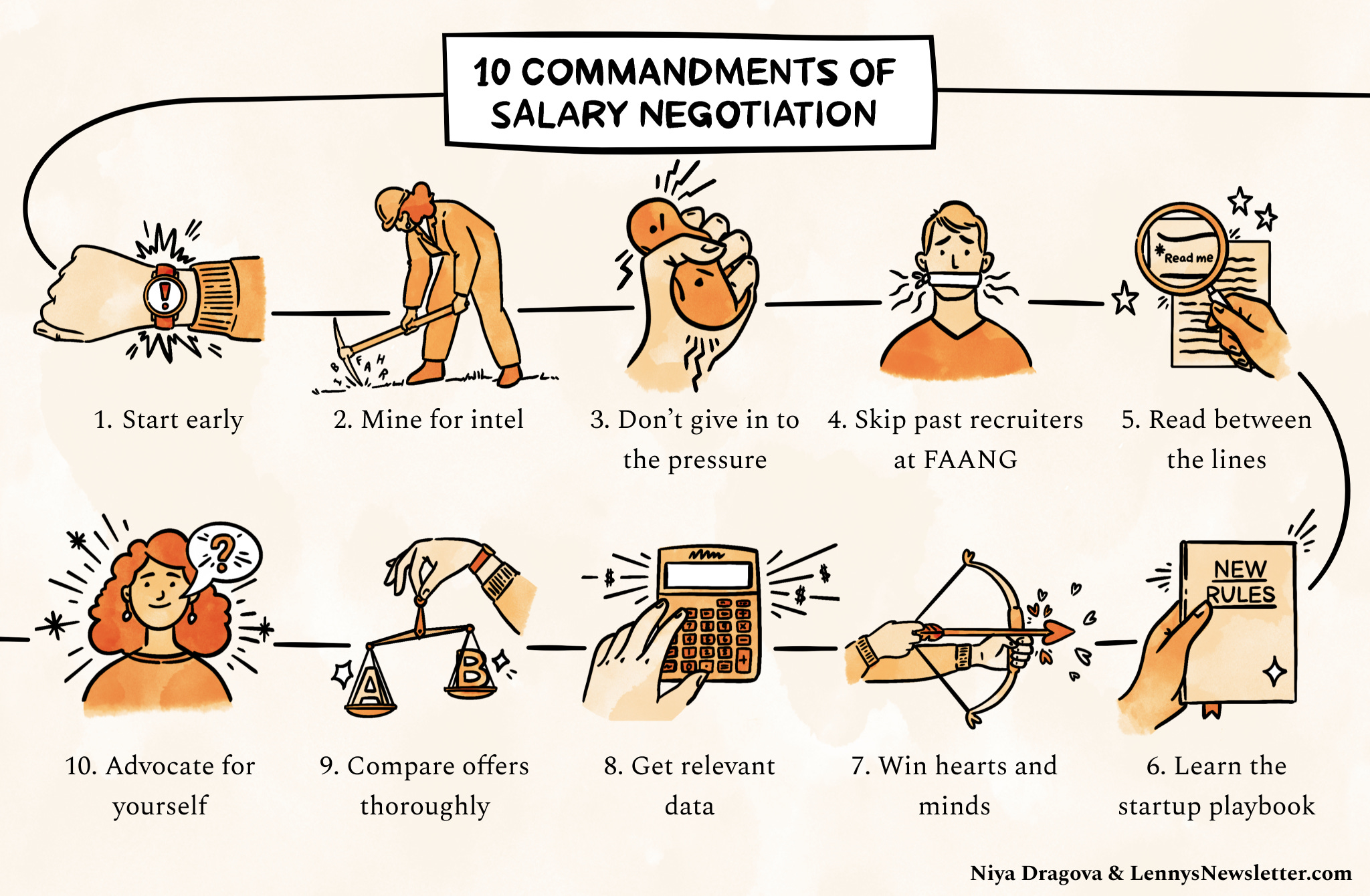

The 10 commandments of salary negotiation

👋 Hey, Lenny here! Welcome to a ✨ bonus edition ✨ of my weekly newsletter. Each week I humbly tackle reader questions about product, growth, working with humans, and anything else that’s stressing you out about work. On to this week’s post…

If you think you’re bad at negotiating, I’m even worse, I promise you. Why can’t you just tell me how much it’ll be, and then we can move on? Why do we need to play this game?? Jeez louise. Well, the reason we have to play this game is because, like it or not, everyone else is playing it. And you’re probably losing — on salary, equity, and promotions. The good news is that because the other side is playing, they expect you to play along (especially at larger companies). So it rarely creates hard feelings when you negotiate. But you have to know how. And that’s where today’s post comes in. Since I’m so bad at this, I pulled in Niya Dragova, co-founder of Candor, to answer your question and to share her hard-earned negotiating wisdom with us. Niya has single-handedly helped hundreds of people negotiate their compensation at all of the top tech companies and, as you’ll see below, has incredible insights into the process. I can honestly say this is the most useful post I’ve ever come across on the topic, and I’m really excited to share it with you all. Enjoy! You can find Niya on LinkedIn and Twitter, you can learn more about Candor here, and don’t miss Niya’s insightful weekly newsletter that highlights hiring trends across the largest tech companies. The 10 commandments of salary negotiationby Niya Dragova The largest salary increase I’ve helped get was for a female FAANG executive: I helped her get $5.4M more on her offer. Through the process, it struck me that even though she was a senior leader everyone admired (you’d 100% know of her if I told you her name), she had very little knowledge of how to negotiate. Don’t get me wrong — she knew how to ask and be assertive, but she was much less comfortable “playing the game.” And she’s not alone. Regardless of how senior or junior you are, most tech folks struggle with negotiation. Partially this is because compensation is set up to be intentionally misleading. Partially it’s because sticking up for yourself is nerve-racking AF. Here are the 10 commandments to negotiation I wish everyone knew: 1. Negotiation starts earlier than you thinkEvery recruiter worth their salt will ask about your salary expectations when you first start interviewing. Do not — I repeat, do not — give them a number. What to do instead: Ask for the range they’re budgeted for the role. How to say it: “Can you tell me the salary band for this level? Happy to let you know if it’s within my range, and we can discuss specific numbers later when I’ve met the team.” Bonus points: If you’re junior/mid, time all your interviews so you get offers around the same time. If you’re senior, get some press before you start meeting folks. 2. Mine for intel during interviewsGo into the interview ready not just to answer questions but to ask some of your own. You will use this as ammunition to negotiate later. Here are a few examples of what you should ask:

3. Don’t give in to the pressureOnce you’ve been offered the role, the recruiter’s job shifts from evaluating you to closing you. Most experienced recruiters will ask you again to put up a number for your salary. Clever recruiters may even tell you that they “will go to bat for you.” Yeah, no thanks. What recruiters say: “If you give me your number, I will make it happen for you.” What they mean: “I’ll get you something lower, but kinda close to what you asked for.” 4. At FAANG, your recruiter may have no say at allAt FAANG-size companies (i.e. over 5K employees), compensation is heavily formulaic. In fact, there is often a separate team — the “compensation committee” — who sets your salary. They take into account your background, interview performance, and level. They give the recruiter a number to go with. The recruiter then gives you the number, and every time you negotiate they have to go back to that committee to ask for a re-evaluation. What do clever recruiters do? They get your number up-front to save some legwork. Unfortunately, this may hurt your chances of getting more on your offer later. It also deprives you of some valuable data — where you fall in the level/salary band. If you get caught in this loop, quickly turn the tables: most companies will consider “new information,” like another offer, to reopen a negotiation. Don’t forget, an offer to stay from your existing company also counts! 5. Read between the linesYour initial offer speaks volumes, if you know how to interpret the data. Here are a few scenarios you should consider: Let’s say you’re applying for an L6 role at a big company. Initial offer comes in low: The team may have felt that you have a lot of “room for growth.” In this case, my advice is to dig deeper and ask the interviewer to share feedback from folks who met you to fix any misconceptions before you ever negotiate. Telling someone you want more money because you’re “the greatest PM ever” while the team felt you were “meh” is not going to fly. Middle of the road: You got “the number” (the medium opening number that’s basically a template recruiters use). It’s the most common opening offer — companies do this to reduce risk of lawsuits. Over 80% of people get it. It likely means you don’t have a strong advocate on the interview loop. Do not negotiate until you match with a team and you have a manager batting for you. Initial offer comes in top-of-band: There was likely a discussion about giving you a higher level. Many times in this case, you can push for an “out-of-band” offer — essentially getting paid for an L7 while you’re an L6. 6. At a startup, the playbook is differentYou may be dealing with the founder directly. It’s very likely there is no range for the role, as smaller companies have much less access to salary data. The goal at the initial offer conversation is to understand three things:

That last one can be tricky because you need data the recruiter may be reluctant to give — the option strike price, preferred price, number of outstanding shares — and you need to understand how options work. At last, get ready to ask:

And get ready to not get a straight answer until you’ve asked five times (yes, this is normal). TL;DR: Ask the questions an investor would ask because, *news flash*, you are now an investor — but instead of cash, you’re staking your time and earning trajectory on the company’s success. You can meet with the investors too; it’s 100% OK to ask for that when the company is early-stage. Lastly, 2021 has been a weird year for startup compensation, so much of the data from previous years is unreliable. Remote work, abundant access to capital, and greater trust in international talent have skewed things quite a bit. Still, I find the Holloway Guide ranges to be a good starting point. 7. Your job is to win hearts and mindsIt can be tempting to think you need to negotiate now that you have data. Nope, not yet. The next step, instead, is to upsell your worth before you come back with any kind of counteroffer. This is especially important if you’re going for a senior role. What to do next: Ask for follow-up meetings with decision makers. If you’re a Director or higher, you can usually ask to meet with any VP and possibly C-level execs. VPs can often meet with the CEO and even board members. Take your time; this is important if you want your salary to reflect your value. If everyone wants you, you’ll be calling the shots later. How to run these effectively: Come prepared with three things, tailored to who you’re meeting:

8. OK, now get some good dataDid you know that women make only 47 cents in equity for every dollar a man makes? A HUGE reason for that is that many women don’t fully evaluate their offer before negotiating. Let’s change that. Particularly if you are a woman, ask yourself these questions:

9. Comparing offersNot all offers are made equal — in fact, they are intentionally confusing. At Google, you may get a front-loaded vesting schedule on your stock; at Amazon, sizable cash bonuses the first two years. It seems obvious that you should look at the comp, but that’s not everything:

TL;DR: Getting paid more up-front doesn’t always mean you’ll make the most overall. Plan carefully. 10. Time to make an askIt can be awkward to ask for more money, but trust me, everyone expects you to do it. On top of that, it doesn’t help that so much of the advice out there is conflicting. Let’s set the record straight:

MYTH: You absolutely do not need multiple offers. Just being able to say you’re speaking to other companies is sufficient — you can quote the expected salaries for other roles if needed.

MYTH: Nope, nope, nope (even though Google in particular loves to ask for them). You signed an NDA before every interview, so you can always use that as a reason.

MYTH: Negotiating via email = MAJOR CRINGE and definitely a worse outcome. I know there are folks selling fill-in-the-blank templates out there. My advice if you want a meaningful/large increase is to have the conversation over the phone.

MYTH: Nothing boils a recruiter’s blood more than “It says X on Glassdoor.” Compensation is an exact science — have arguments prepared that are specific to your situation.

MYTH: You already got interviewed and everyone’s read your resume. That’s how you got your initial offer; now you need to build additional arguments. Use the information you collected during the interview about what challenges the team is facing — maybe that increases the scope of the role? Discuss why leaving your current role will be hard — are you critical to your current team? In other words: instead of asking for money, make them give you more money by bringing in obstacles the recruiter needs to overcome to close you.

MYTH: LOL, let me know how that goes for you. My guess is you’ll get a mediocre increase worded as a “final offer.” If you want big moves, I’m talking $100K+ more, you need to collaborate with your recruiter, not make them an enemy. As a final word of wisdom: Start with negotiating your overall compensation, not individual components. For example, ask for “500K” and then the next round ask “Can I have X more equity?” Then, when you’ve exhausted all other avenues, ask for a signing bonus. If you still need more help, you can always read our guide. Now that you’ve got all these RSUs in your compensation…If your new RSUs are more than 10% of your liquid net worth, you should make a plan to diversify ASAP. Holding a concentrated position can translate into greater portfolio volatility, which has been shown to reduce compounded growth rates and future wealth. At Candor we help you automate RSU diversification by converting your stock weekly, even during blackout periods. You can find us here. Thanks, Niya! Till next week, and have a fulfilling and productive week 🙏 🔥 Featured job opportunities

Browse more open roles, or add your own, at Lenny’s Job Board. How would you rate this week's newsletter? 🤔Legend • Great • Good • OK • Meh If you’re finding this newsletter valuable, consider sharing it with friends, or subscribing if you haven’t already. Sincerely, Lenny 👋 You’re on the free list for Lenny's Newsletter. For the full experience, become a paying subscriber. |

Older messages

How to use behavioral science to boost your conversion rates

Friday, September 17, 2021

Guest post by Kristen Berman, co-founder of Irrational Labs

Demand driving supply: The little-understood growth loop behind a surprising number of iconic billion-dollar compa…

Tuesday, September 14, 2021

Guest post by Brian Rothenberg, Partner at Defy.vc, former VP of Growth at Eventbrite, and two-time founder

The Best of Lenny’s Newsletter

Tuesday, August 17, 2021

My all-time best posts, past and future

Why now?

Wednesday, July 21, 2021

Why it matters for startups to have a strong "why now"—and also why it doesn't

Kickstarting supply in a labor marketplace

Tuesday, July 13, 2021

Growth lessons from over a dozen of today's fastest-growing labor marketplaces

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏