Hey, hey. We hate to break it to you, but the holidays will be here before you know it. Though 2021 is projected to be another record-breaking year, holiday gifting is being haunted by fulfillment and shipping concerns across the industry. Are you prepared?

On October 14 at 11:30am ET, Retail Brew will sit down with Rina Hurst, Shipt’s chief business officer, and Courtney Carlson, Walmart’s SVP of category marketing, for a conversation guaranteed to fill you with cheer (and successful strategies in these unprecedented times). Click here to sign up.*

In today’s edition:

- Consumers get blunt

- TikTok Shopping is here

- Starting on a Highnote

—Glenda Toma, Julia Gray, Jeena Sharma

|

|

|

Unsplash

As we’ve been reporting on all things cannabis this month, we found ourselves curious about some big questions: Are people embracing it as shoppers, particularly as legalization efforts ramp up? And if so, how—and what—are they buying?

To find out, Retail Brew teamed up with Harris Poll, which ran a nationally representative survey of 2,097 adults over the weekend. Turns out, cannabis is hit or miss.

We match: First, some perspective. Two-thirds of respondents (66%) believe that recreational cannabis should be federally legalized.

- That number jumped up to 79% and 76% for millennials and Gen X, respectively, while less than half (48%) of Boomers were in favor.

- The support for legalizing medical cannabis, though, was a slam dunk, at 84%. (The lowest level of backing came from Gen Z, at 77%.)

Disjointed

Here’s where things start to split.

Only 40% of those surveyed said they’ve ever bought a cannabis product, and just a third had ever visited a dispensary for recreational reasons, with the overwhelming majority doing so for the first time prior to the pandemic (81%). Still, 31% said they’ve upped their recreational use throughout Covid.

- A quarter are purchasing recreational products several times a week.

-

Legal cannabis sales in the US were a record $17.5 billion in 2020, per a BDSA report in May.

The good news, for cannabis stores at least, is that that’s where most people (54%) are doing their shopping. (Thirty-seven percent still know “a guy” that gets them their goods.) And even if other avenues, like online marketplaces, open up to cannabis products, half of respondents would still prefer to buy from a dispensary.

Side note: Foot traffic data from Placer.ai, provided to Retail Brew, found that visits to Curaleaf’s shops surged more than 100% from 2019 to 2021 each month (except in August, when they increased 92%). MedMen’s stores also saw a bump, with monthly visits up an average 39.5% over the same time frame.

- “An increasingly friendly regulatory environment alongside a greater focus on health and wellness will likely position these brands to thrive in the near and longer term,” Ethan Chernofsky, VP of marketing at Placer.ai, said via email.

Also working in cannabis’s favor is that of the shoppers who’ve splurged on recreational cannabis, more than a third (34%) expect to shell out $200+ on products over the next year—including 39% of Gen Zers.

- The most popular recreational products are flowers and gummies (64%), followed by edibles/drinks (60%).

But, but, but: For all the opportunities out there, it will be tough to change minds that are already made up. Among those who have never purchased a cannabis product, only 29% are more open to buying or trying it as more states move to legalize. Thirty-four percent straight up said “never.”—GT

|

|

|

TikTok

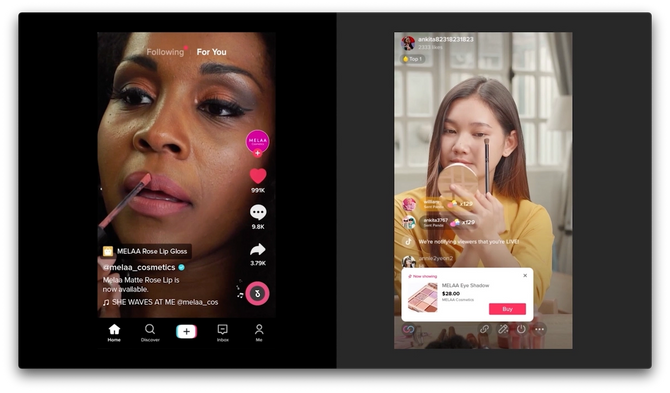

TikTok’s opportunity in the burgeoning social-commerce space was served on a silver platter: #TikTokMadeMeBuyIt, which has 5.4 billion views on the platform. And yesterday, the company announced further plans to capitalize on the engagement with TikTok Shopping.

“There was a lot of behavior already happening on TikTok to show that this is the place for the new generation of commerce,” Ray Cao, managing director and global head of product strategy and operations at TikTok, told Retail Brew.

-

According to an Adweek–Morning Consult survey in May, 15% of all adults and 36% of Gen Z respondents make purchases based on what they saw on TikTok.

Here, here: Building off pilots with retailers like Levi’s and Walmart last year and a new partnership with Shopify announced last month, TikTok Shopping was in the works for 18 months. The new tools let brands add product links, personalized and targeted ads, and—a big one—live shopping. With that, TikTok is tapping into the platform’s bread and butter: product reviews, unboxings, and hauls.

“What’s the best advertising vehicle ever created? Word of mouth. So the live shopping experience is the digitized version of that,” Cao said. “We’re accelerating the funnel...allowing people to shop right away.”

- TikTok Shopping will also include landing pages for companies’ promo content and a marketplace that facilitates brand-creator partnerships.

Zoom out: As the company pushes toward shopping, it’ll have to compete with new social commerce apps like Flip. But with 1 billion monthly users (and 1 billion potential customers for brands on the platform), TikTok might have a leg up.—JG

|

|

|

|

The holidays are so close you can almost hear the sound of sleigh bells cutting through a silent night...and a voice in your head whispering, “Is that holiday campaign ready yet?”

No, you’re not going crazy—pinning down the perfect holiday campaign is top of mind for every retail marketer. So how do you sleigh the busiest shopping period of the year?

Start by reading Lexer’s 2021 Retail Holiday Guide—it’s got nine customer data-powered strategies you can unwrap and start playing with right out of the box, including:

- Gifting campaigns

- Product recommendations and gift guides

- Post-purchase surveys

Not all customers are created equal, which is why 80% of revenue comes from 20% of your customers. Build a campaign strategy to ensure you reach your best customers in time for the holiday surge.

See why top brands like Beautycounter, Igloo, Supergoop!, and Sur La Table look to Lexer to improve customer experiences and drive sales. Download the guide here.

|

|

|

Highnote

What makes online shopping easier? Faster checkouts? Payment flexibility? (Or maybe just a bigger paycheck.)

While buy now, pay later options and co-branded cards are commonplace for big retailers, it’s been slow-going for small and medium-sized enterprises (SMEs).

A new startup wants to help speed things up.

Highnote emerged out of stealth this week with $54 million in funding; Oak HC/FT led the Series A round, after co-leading a seed round with Costanoa Ventures.

- Other investors include Bill Ready, president of commerce and payments at Google (and former COO of PayPal).

Check it out: Highnote’s pitch is that its platform “levels the playing field” for smaller merchants, according to cofounder John Macllwaine.

“These [businesses] are trying to rebuild their brand, sell products, and differentiate themselves, but are not necessarily experts in banking and regulatory and payments,” he told Retail Brew. “It’s really about providing those capabilities in an open, modern platform so that they can move really fast and get on with growing a business.”

- Highnote noted it cuts the timeline to launch a card to weeks, versus the typical four to eight months.

- The startup, which is both the card issuer and processor, said it “shares in the revenue of the card programs...set up.”

The big picture: As the pandemic pushed consumers online, SMEs need to meet shoppers where they are. A Salesforce survey found that 71% of the small and medium-sized businesses it polled said their customers now expect them to offer digital transactions.—JS

|

|

-

Warby Parker is going public today via a direct listing.

-

Target said its holiday deals will start October 10, and, in a first for the retailer, shoppers can ask for a price match on products bought at Target if they’re later discounted.

-

Gorillas, the instant-grocery-delivery startup, has halted its US expansion.

-

Lego reported strong first-half earnings, with digital sales increasing 50%.

-

US consumer confidence dropped to its lowest level since February.

-

Cotton prices hit a roughly 10-year high, which could drive up the cost of jeans and more.

|

|

Today’s top retail reads.

Building up: “The plus community is viewed as a monolith too often, and that’s what we’re really trying to break down here, is that it is a full spectrum of people, just as it is in straight sizes.”—The cofounders of The Power of Plus on their goals for the platform. (The Cut)

Street cred: Emerging designers are making their mark on New York’s Orchard St. in the Lower East Side. (Business of Fashion)

Pack it in: Companies like Heineken see an opportunity in nonalcoholic beer. The challenge is how to market it. (Marketing Brew)

Tune in: What do major brands including Big Face, Bombas, Lounge Underwear, and Mented Cosmetics think about the future of commerce? Find out at Shopify’s Commerce+ livestream event on October 13. Register for free today.*

*This is sponsored advertising content.

|

|

|

Francis Scialabba

On Wednesdays, we wear pink spotlight Retail Brew’s readers. Want to be featured in an upcoming edition? Click here to introduce yourself.

Anjarae Hamilton joined Faire, the wholesale marketplace, as its head of apparel in January—and amid the pandemic, which she said has led retailers to adopt omnichannel and other online tools in ways they hadn’t before. Her earlier experience at Bain & Company, DoorDash, and Square sharpened her skills as an operator working across product, support, engineering, strategy, and sales teams. Here, she tells us more.

How would you describe your job to someone who doesn’t work in retail? I help ensure emerging and established apparel brands can grow their businesses by appearing in local retail shops around the world.

One thing we can’t guess about your job from your LinkedIn profile: I’ve worked with many of my peers at Faire for over 10 years.

What’s your favorite project you’ve worked on? Our first online apparel trade show, Faire Fashion Week. Pulling off a weeklong event required incredible cross-functional collaboration. It was motivating to witness the energy of everyone involved.

Name your must-follow retail account: My husband and I are expecting our first child, so my current favorite is spearmintbaby.

One emerging retail trend you are most excited about this year: Social selling. It’s not something I’ve personally tried yet, but it’s seen incredible growth and benefitted many of our customers, so I’m intrigued to see how it evolves globally.

|

|

|

Francis Scialabba

While we can’t help you pick out the perfect gifts for your friends and family this holiday season, we can offer some guidance around e-commerce trends and fulfillment strategies.

On Thursday, October 14 at 11:30am ET, Shipt’s Rina Hurst and Walmart’s Courtney Carlson will join Retail Brew’s The Checkout for a chat about the 2021 holiday season e-commerce shopping craze. Click here to sign up.*

*This event is brought to you by Square.

|

|

Catch up on the Retail Brew stories you may have missed.

|

|

|

Enjoying the newsletter? Share it with your network to take advantage of our rewards program.

When you reach 3 referrals, you'll be invited to Monthly Exclusive Events with our co-founder Alex and the biggest names in business.

Hit the button below to learn more and access your rewards hub.

Click to ShareOr copy & paste your referral link to others:

morningbrew.com/retail/r/?kid=303a04a9

|

|

Tune in: What do major brands including Big Face, Bombas, Lounge Underwear, and Mented Cosmetics think about the future of commerce? Find out at Shopify's Commerce+ livestream event on October 13. Register for free today.*

*This is sponsored advertising content

|

|

|

Written by

Glenda Toma, Julia Gray, Jeena Sharma, and Katishi Maake

Was this email forwarded to you? Sign up

here.

WANT MORE BREW?

Industry news, with a sense of humor →

-

HR Brew: analysis of the employee-employer relationship

Tips for smarter living →

Podcasts →

Business Casual

and

Founder's Journal

Podcasts →

Business Casual

and

Founder's Journal

Accelerate Your Career →

-

MB/A: virtual 8-week program designed to broaden your skill set

|

ADVERTISE

//

CAREERS

//

SHOP

//

FAQ

Update your email preferences or unsubscribe

here.

View our privacy policy

here.

Copyright ©

2021

Morning Brew. All rights reserved.

22 W 19th St, 8th Floor, New York, NY 10011

|

|