The Two Cap Tables of Crypto Companies: What They Are and How They Relate to Each Other

Tomasz TunguzVenture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. The Two Cap Tables of Crypto Companies: What They Are and How They Relate to Each Other

Crypto companies that launch a token maintain two capitalization tables: equity and token cap tables. They are distinct but related.

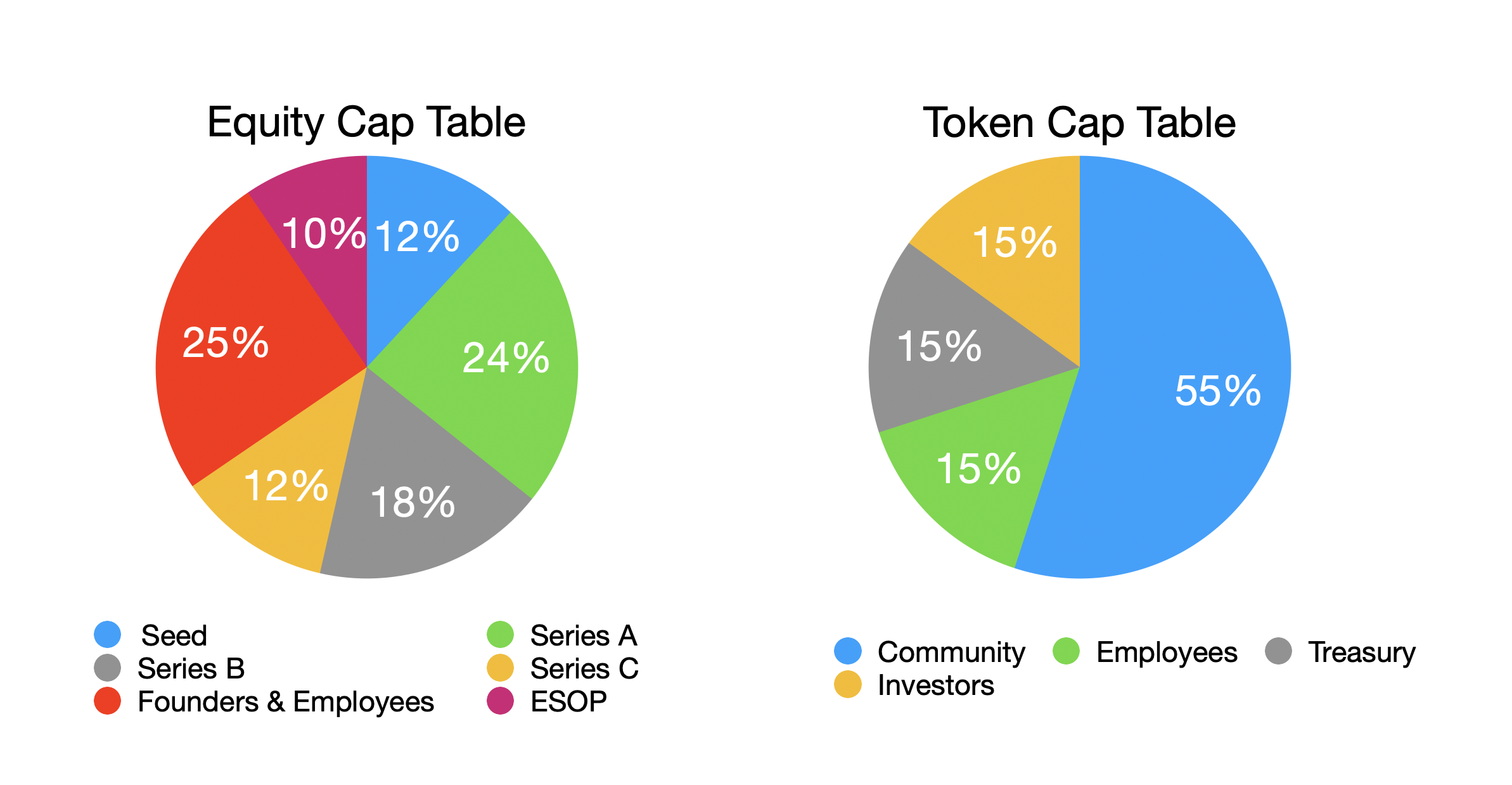

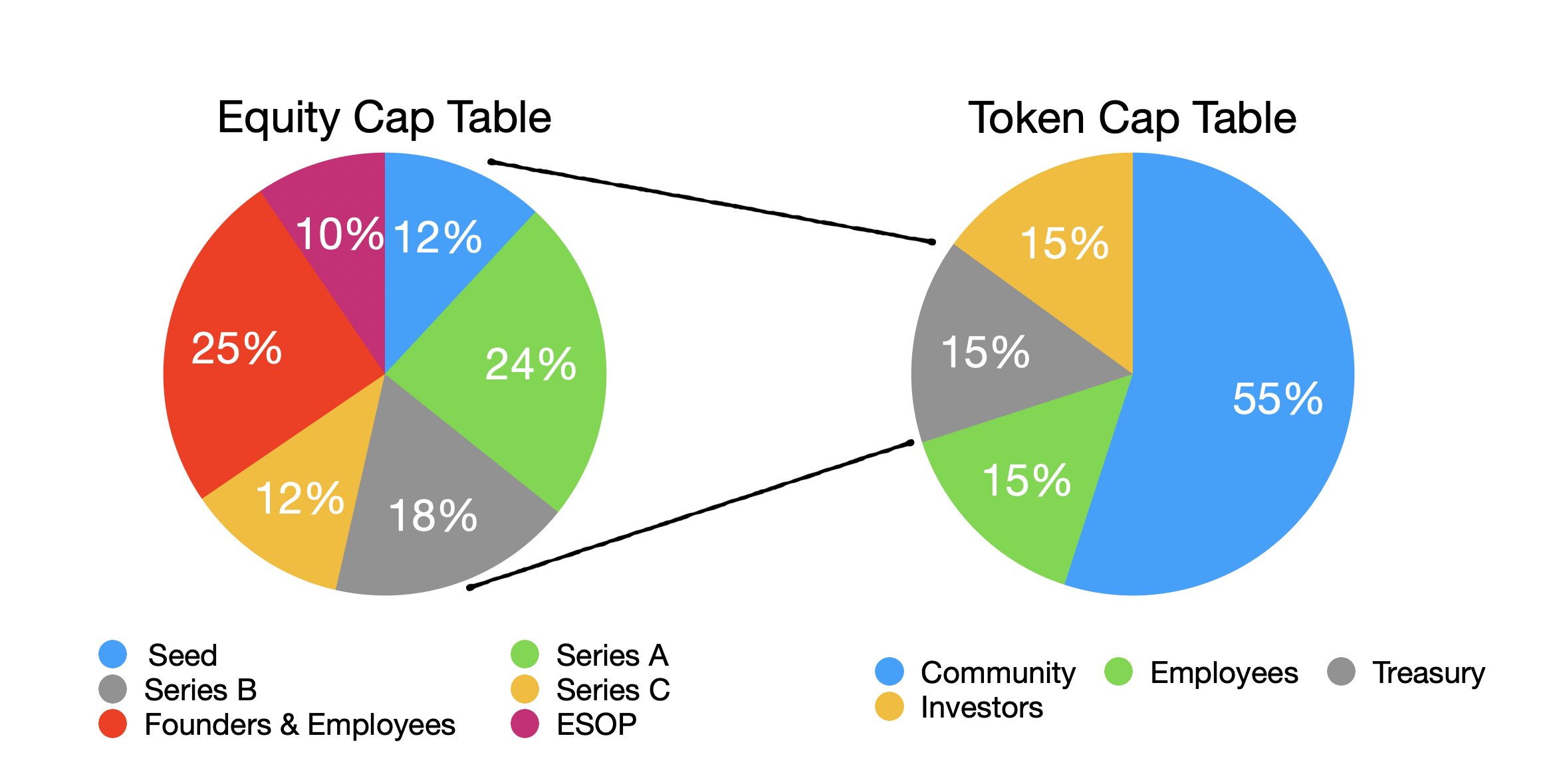

Let’s look at a hypothetical crypto company’s cap tables. On the left, the cap table shows a company that has raised a Seed, A, B, and C rounds. In addition, there are allocations for the founders & employees, plus the Employee Stock Option Pool (ESOP) for new employee grants and retention grants. On the right is the token capitalization table. 55% of tokens is reserved for the community. This figure has evolved quite a bit in the last five years but let’s peg it at 55% for now. That leaves 15% for employees and founders, 15% for the treasury, and 15% for investors. These aren’t universal numbers because the “standard” terms are still coalescing in the market. Two things should jump out looking at the diagram. First, the community allocation dominates the token cap table. The community tokens incentivize network participants (validators/stakers) to jumpstart network effects. Second, crypto cap tables contain a new element not found in classic equity cap tables: the treasury. The treasury belongs to the foundation or corporate entity responsible for ongoing support of the project. The treasury captures tokens from the foundation’s efforts to participate in the community: running validators or stakers. Also, if the crypto company sells software/services to other crypto companies and receives payment in tokens, the token revenue generated from that relationship resides in the treasury.

The treasury’s ownership is typically dictated by the equity cap table and distributed pro-rata across the equity cap table. In this case, founders and employees own 25% of the equity cap table. Ergo, they would own 25% x 15% = 3.75% of the treasury. Those are straightforward observations from the diagram. However, there’s an additional question: how does the investor ownership in the equity cap table map to the investor ownership in the token cap table? Most deals are bespoke. Investor token ownership rights may take the form of a warrant in which equity investors have the right, but not the obligation, to purchase tokens at a discounted price to market in an early round. Some structures discount the investors' allocation by a negotiated percentage: e.g., 66% warrant coverage per equity dollar invested. Lock-ups and holding periods also vary quite a bit. They span a few months to several years. Classic startup investing documents cohered around standards sometime in the late 2000s. The NVCA model documents and the YC standard SAFE documents. Crypto companies are still iterating and testing the key business terms of community and investor rights. Once those have settled, we may see standard crypto term sheets. But we’re not there yet. |

Older messages

Passive Investing in Venture Capital and the Parallels to Public Equities

Friday, October 8, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Passive Investing in Venture Capital and the

Redpoint Office Hours with Claire Hughes Johnson, former COO at Stripe

Thursday, October 7, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Redpoint Office Hours with Claire Hughes Johnson,

Why You Should Repeat Yourself, A Lot

Tuesday, October 5, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Why You Should Repeat Yourself, A Lot If you'

Crypto Companies Insider Ownership is Approaching that of Classic Startups

Monday, October 4, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Crypto Companies Insider Ownership is Approaching

Height - The Project Management Tool for the Modern Worker

Wednesday, September 29, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Height - The Project Management Tool for the Modern

You Might Also Like

This dead simple web app generates $100K/year

Sunday, March 9, 2025

Starter Story Sunday Breakfast ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Building Lovable: $10M ARR in 60 days with 15 people | Anton Osika (CEO and co-founder)

Sunday, March 9, 2025

Listen now (70 mins) | The AI startup that's Europe's fastest-growing company ever ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👻 The AI sourcing secret that's haunting your competitors.

Sunday, March 9, 2025

Uncover the mysterious ways AI is transforming product sourcing and why it's giving some brands an otherworldly edge. Hey Friend , Sourcing products used to be a slow, manual process—searching

🗞 What's New: Why AI can't replace my $1k/mo human assistant

Saturday, March 8, 2025

Also: 25+ AI agent opportunities ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #436

Saturday, March 8, 2025

Debating the future of SaaS + what many VCs are thinking... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🎯 Fix your fulfillment, fix your profits

Saturday, March 8, 2025

The answer to higher profits is not always selling more. This is how smart businesses do it… Hey Friend , Most ecommerce founders focus on selling more to increase profits. But what if I told you that

Create a social media strategy in 7 (straightforward) steps

Friday, March 7, 2025

Plus, the latest from the blog and social media ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

10words: Top picks from this week

Friday, March 7, 2025

Today's projects: Wallpaperee • Chatbox • DesignLit • PH Deck • ChatPro AI • Opencord.AI • NexaAI • GReminders • Springs • crimalin • SuperCarousels • TitleSprint 10words Discover new apps and

Experiment Report: Trying New Things — The Bootstrapped Founder 380

Friday, March 7, 2025

When I talked to Anne-Laure Le Cunff earlier this week, we get into experiments and how to run them effectively. Here's what I've been doing. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📍Why global trade tariffs might actually boost your ecommerce profits

Friday, March 7, 2025

The best ecommerce brands are now using these trade shifts to their advantage Hey Friend , If you think global tariffs and rising costs are bad for your ecommerce business, think again. Yes, some