DeFi Rate - This Week in DeFi - October 15

This Week in DeFi - October 15This week, Sushiswap goes mobile with Celo, Morningstar Ventures invests $15m in Elrond, and pNetwork and Alchemix gear up for V2s

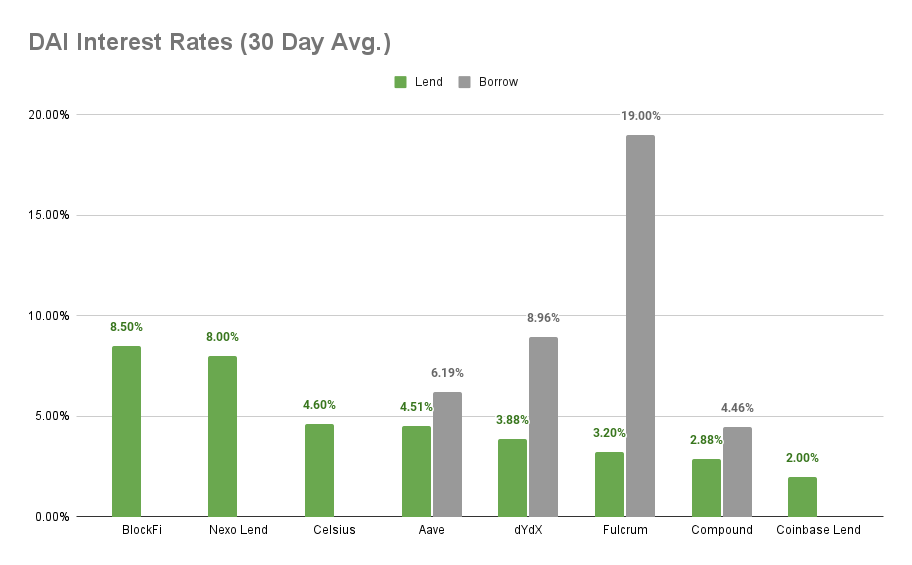

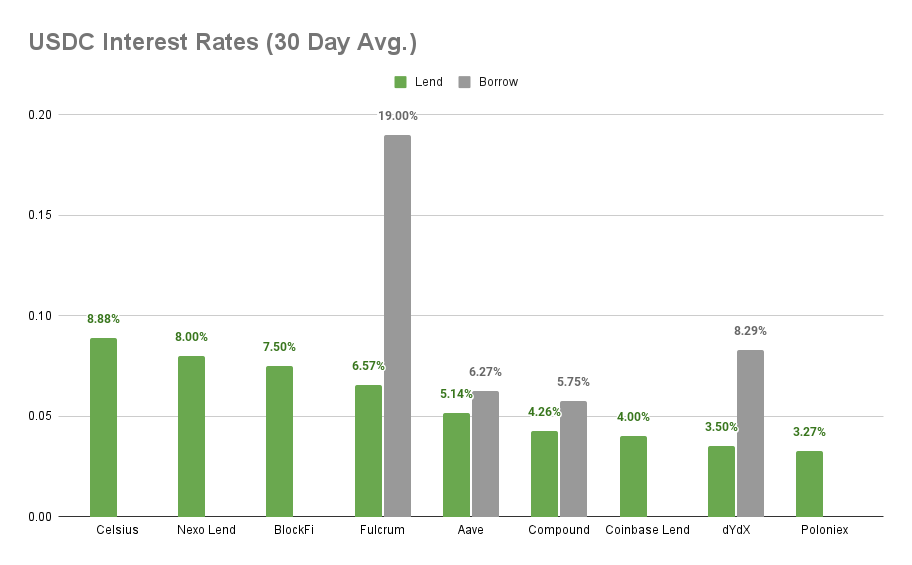

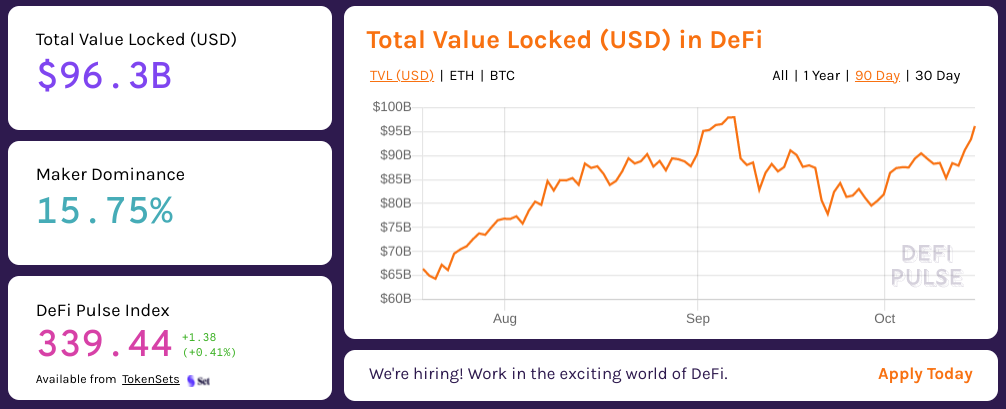

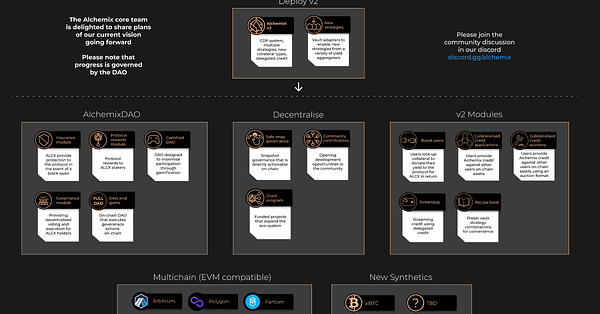

To the DeFi community, This week, Sushiswap and Celo announced a partnership to bring $12.6 million in liquidity mining rewards to Celo’s mobile-first user base, with rewards going live at 4pm ET on October 14. The partnership also launches with support from Optics, an L2 token bridge that will now allow users to bridge from Polygon to Celo without needing to route through Ethereum (while offering withdrawal capabilities to Ethereum as well).   Dubai-based Morningstar Ventures announced a $15 million investment in Elrond, to provide support to founders and builders working within the Elrond ecosystem. Funds will also be used to set up an Elrond Incubator based in Dubai, with an eye towards growing Elrond use in the UAE and the rest of the Middle East.   pNetwork presented plans for V2, enabling enhanced cross-chain and cross-L2 transfers of both assets and data messages, employing a unified infrastructure layer to route between chains as opposed to the current one-lane pToken bridges between individual chains. Postman will do the same but with smart contract data, allowing assets like NFTs and oracle data to more easily be transferred throughout the crypto ecosystem.   And LP-collateral loan primitive Alchemix released a roadmap for the future, including the announcement that V2 code is nearly complete and will go for audits on November 1. Plans also include increased decentralization and launching a DAO, a grant program, multichain support, and a slew of other improvements to bring the protocol into the DeFi 2.0 epoch.   With institutional interest firmly entrenched, DeFi has become an industry in its own right in a remarkably short time. Now some of you may have heard the rumblings about ‘DeFi 2.0’, distinct and different from the Compounds and Curves of the world, but still a piece of the broader project to democratize financial access and improve financial wellbeing around the world. Opinions on DeFi 2.0 are still being formulated and consolidated, but here are a few initial thoughts. DeFi 2.0 protocols are largely reliant on the building blocks laid down during the initial DeFi wave - decentralized exchanges, overcollateralized lending protocols, and the wrapped tokens and bridges that allow value to more or less freely float through the ecosystem. DeFi 2.0 increasingly seems to be capturing those protocols that use these foundational components in ways not seen before in the traditional financial system, or anywhere else. Increasingly robust algorithmic and incentives-based stablecoins are beginning to find real uptake and traction while avoiding implosion, while time-based lending protocol lockups and staking schemes try to find the balance between ‘too difficult to understand’ and ‘too good to pass up’. Finally DeFi 2.0 represents a truly multichain experience, where demand (even in this nascent industry) can only realistically be met by offering services on multiple blockchains or L2 solutions. As with many things in crypto, there’s more to believe in and a more sturdy foundation, but the number of potential winning projects to keep track of has grown exponentially - in this world the factors to consider change, but picking good investments rarely gets easier. Nobody can keep track of it all, and I’ve missed more winners than I care to admit. But keep your head in the game and do your research, and it will be hard not to come out at least a bit better off. Thanks to our partner: Nexo – Unlock the power of your crypto with up to 12% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: BlockFi at 8.50% APY, Nexo Lend at 8% APY Cheapest Loans: Compound at 4.46% APY, Aave at 6.19% APY MakerDAO Updates DAI Savings Rate: 0.00% Base Fee: 0.00% ETH Stability Fee: 2.00% USDC Stability Fee: 0.00% WBTC Stability Fee: 2.00% USDCHighest Yields: Celsius at 8.88% APY, Nexo Lend at 8.00% APY Cheapest Loans: Compound at 5.75% APY, Aave at 6.27% APY Top StoriesPoly Network is live on ArbitrumCurve Launches on Harmony BlockchainShell Protocol Jumps into ‘Concentrated Liquidity’ Just Like Uniswap and CurveSaffron Finance Joins the Neo N3 Early Adoption ProgramStat BoxTotal Value Locked: $96.3B (up 3.63% since last week) DeFi Market Cap: $135.76B (up 3.18%) DEX Weekly Volume: $15.62B (down -3.99%) Total DeFi Users: 3,543,720 (up 1.58%) Bonus Reads[Chainalysis Insights] – DeFi Drives Growth in World’s Second-biggest Cryptocurrency Market But Ransomware Is Cause For Concern [Owen Fernau – The Defiant] – DeFi 2.0 Wave of New Projects Test Liquidity Mining Alternatives [Frogmonkee – Bankless] – The next big unlock for DAOs [Anthony Sassano – The Daily Gwei] – Innovate or Die - The Daily Gwei #355 If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week in DeFi - October 1

Sunday, October 10, 2021

This week, Fireblocks wants in on Aave Arc, Polygon users overtake Ethereum, R3 is building for DeFi, and SocGen bank wants DAI for bonds

This Week in DeFi - October 8

Sunday, October 10, 2021

This week Fei launches V2, DominantFi comes to Polygon, Visor Finance colab with Perp Protocol, and Stripes gets $8.5m for interest rate swaps

You Might Also Like

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡ incentive → click → sale

Saturday, March 8, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: World Network Launches Chat Feature, Zora Set to Introduce Its Native Token, and Trump Ann…

Saturday, March 8, 2025

Sam Altman's blockchain project, World Network, has launched World Chat, a “mini-app” integrated into the World App wallet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Treasury Secretary Scott Bessent hints at future US Bitcoin reserve acquisition plans

Friday, March 7, 2025

Federal government considers expanding Bitcoin holdings without taxpayer funds; official discussions underway in Washington. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

NFT & Gaming - 🦁 Loaded Lions’s LION went live and was the top gainer on CoinGecko; Trump-owned company DTTM Oper…

Friday, March 7, 2025

Loaded Lions's LION token went live on the Cronos and Solana. Trump-owned company filed a trademark for a metaverse and NFT marketplace. Hamster Kombat introduced a Layer-2 blockchain on TON ͏ ͏ ͏

WuBlockchain Weekly: Trump Officially Signs Executive Order for U.S. National Bitcoin Reserve, White House Hosts C…

Friday, March 7, 2025

David Sacks, the “Crypto Tsar” and the White House's AI and Crypto Affairs Chief in the United States, tweeted that Trump has signed an executive order to establish a strategic Bitcoin reserve. ͏ ͏

Cardano’s Charles Hoskinson reacts to White House crypto summit snub

Thursday, March 6, 2025

Hoskinson focuses on legislative progress, unfazed by his absence from Trump's crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏