The eCoinomics Team - October 2021, #3

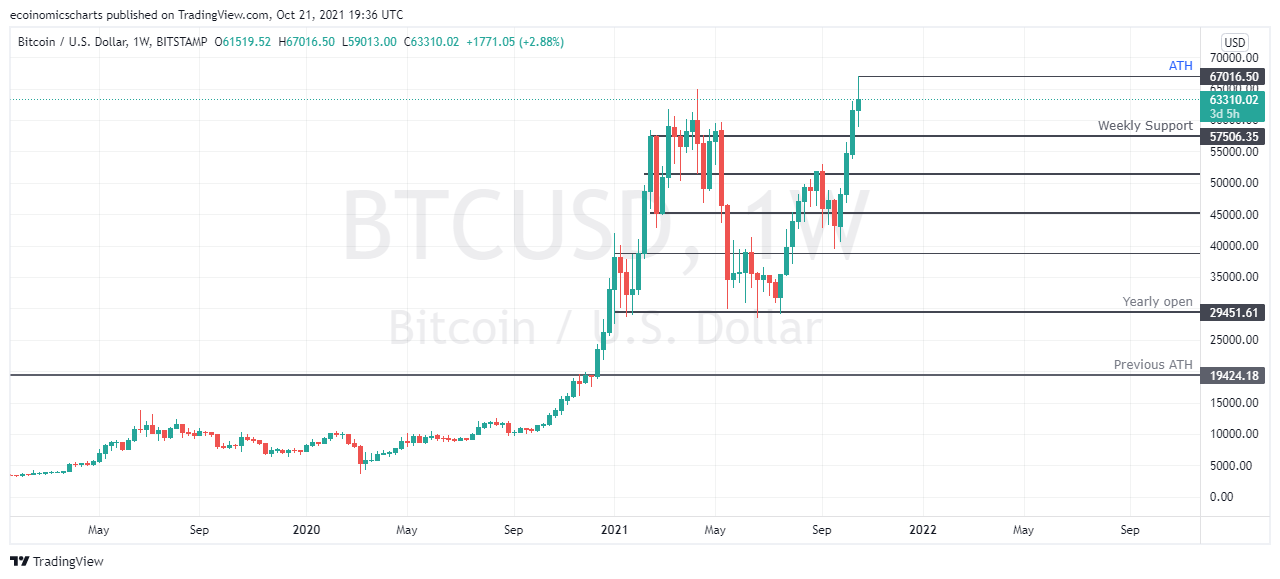

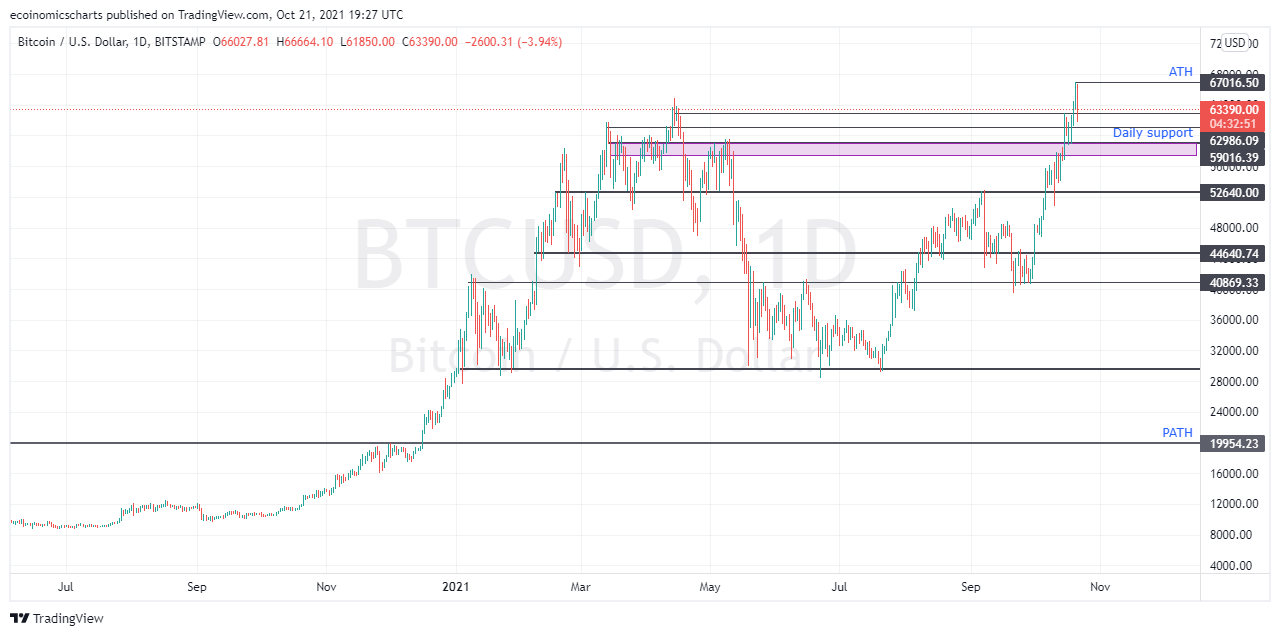

October 2021, #3This week we discuss the Bitcoin and Ethereum price action, part 3 of our trading system series, why alts are losing momentum to Bitcoin and spotlight Binance coin (BNB) and Polkadot (DOT)This Week. 1. Bitcoin ATH. Ethereum/Bitcoin price analysis. 2. Getting your trading system right (Final) 3. First BTC *futures* ETF goes LIVE. 3. Zoom-In: Harmony (ONE) and Shiba Inu (SHIB) Dear reader, Thank you for subscribing to eCoinomics. We appreciate your readership and hope you are here with us for many more issues. When we thought about writing a weekly newsletter, we weren’t thinking about an audience. It was more about reminding ourselves to stay the course and not act against our sober minds once money was on the line. It’s a reminder not to FOMO or be afraid to take a trade because we fear price might dump past what would have been a good entry. So in a way, that’s exactly what you get by reading eCoinomics. We discuss macro technical and fundamental analysis away from low time frame noise that helps build a long-term trading mentality. You also get news and we discuss the projects we are looking at for the week in the Zoom-In section. These are essentially letters to ourselves and we hope you can gain some useful insights every time you read them. You may contact us for any reason at ecoinomicsweekly@gmail.com. We host a twitter spaces session called #CryptoRoundUpAfrica with some of our best buds on Twitter every Thursday at 10 PM WAT. Follow us @avogroovy, @oloye__ If you missed any of the Twitter live sessions, check out the podcast at https://linktr.ee/cryptoroundupafrica The eCoinomics team. All-Time High.First, we’d like to say congratulations. To all of us. We deserve this. More importantly, we made this happen. Shoutout to our Bitcoin family. You guys. Despite the fud, the uncertainty, fear of losing it all, everyone that doubted us. Those who said we were hodling magic internet money. Here we are! Bitcoin made a new ALL-TIME HIGH! Our magic internet money is now worth 1.18 trillion dollars. The people have voted with their pockets. The people’s money reached a new peak. That’s amazing. I personally wasn’t feeling up to it this week, writing this newsletter. Been busy with life. But I am here to celebrate with you. So this is getting written on a Thursday night, at 9 PM WAT. Our news and Zoom-In section was written by my co-author on Tuesday. So, you get it. Hear, hear. Bitcoin made a new all-time high at $67000. The minor pullback we expected is happening right now as funding rates were getting very hot (no thanks to the 100x degens.) We expect $57000 to hold on a weekly if we were to nuke some more. A daily pullback to $60000 is more likely. As long as we don’t nuke past this, we expect a continuation upwards to the 1.27 fib extension line at $73000 . These are the levels we are looking at for this week. TLDR: $57000-$60000 as support, $73000 as resistance. ETH.BTCEthereum also showed strength v Bitcoin even as Bitcoin made a new ATH. On its USD pair, Ethereum also touched its own All-time high although it help as resistance. Its BTC pair is what we have followed for a while on eCoinomics. We believe it is a better signal for alts season. This week, ETH reclaimed its 0.064 support multi-timeframe level from a low of 0.059 BTC at the peak of Bitcoin dominance to make a weekly high of 0.066 BTC. There’s not much by the way of resistance until 0.07 BTC. We expect ETH to continue upwards especially if Bitcoin holds the current range. Below the current price, we expect 0.060 BTC to hold as support. Remember what we said about alts. Think of them as leveraged Bitcoin. Bitcoin goes up 10%, they go 30%, it goes up 20%, they do 50%, same for when it nukes. (Obviously, the numbers are not accurate, just a representation.) Anyway, Alts season coming soon. Watch out. 2. Getting your trading system right (Final)……contd 4. Dips are normal. Nothing goes vertical forever.You should learn how to make money whether the market is going up or down. Follow the path of least resistance. Dips will happen. Your trading system must factor this in. Being in a risk position that follows trends is the only way to catch the bulk of a bullish or bearish trend. While a choppy market may result in short term losses, it’s the price to pay for catching parabolic moves and big nukes. This is why the concept of R: R is very important for traders and must be a part of your trading system. Loses happen. We don’t want to win 100% of our trades, that’s impossible. We want to win more than we lose. Even the best traders usually hover around a 60% win rate. The goal is to make money over time. The crypto market is not a get rich quick scheme. Stick to your system and accumulate wealth using a long term mentality. 3. Bitcoin futures* ETF go LIVEwritten Tuesday… The first Bitcoin futures* exchange-traded fund (ETF) go live as ProShares (BITO) started trading on the floor of the New York Stock Exchange (NYSE) Tuesday morning. The Securities and Exchange Commission (SEC) did not give formal approval or block the trading of Proshare ETF since its listing. The deadline for approval or disproval by the SEC expired on Monday and the administrative silence means trading can commence since the SEC didn’t formally object. ProShare ETF only allows for BTC futures trades only which tracks BTC futures price directly. This news has led to more upside volatility witnessed in the Bitcoin price action within the week as Bitcoin is trading just below the all-time high price (At the time of writing) as traders look to front-run the announcement. Now traders wait for further actions such as listing or announcements of the other ETF applications by Valkyrie and Invesco due this week which will track the spot market price of Bitcoin Trading of BTC ETF will bring a new set of investors into the crypto market and also allow institutional investors to get exposure to digital assets. 4. Zoom-In: Harmony (ONE) and SHIBA INU (SHIB)written Tuesday… This week the entire crypto market has been sideways and choppy just like last week. Nothing noteworthy has changed except Bitcoin back at the ATH area. It is difficult to predict which tokens have upside potential, but here are the ones we are looking at. ONE has so far maintained its high time frame bullish structure during the recent run-up to make a new ATH last week $0.265. It has successfully retested old ATH and it is holding up very well. As it continues to consolidate in the former ATH area $0.237, an ascending movement into price discovery is imminent as there is renewed interest in the ecosystem as traders have witnessed the rise of similar ecosystems like Fantom (FTM) and Avalanche (AVAX) in recent time. If the price is rejected at the top, $0.21 and $0.18 are good areas of support to bid for a bullish continuation. SHIB is back! Retail investors particularly like this “Doge killer” and dog meme knock off probably because of its mass appeal and ridiculously cheap price per token. Robinhood announced that they will be listing SHIB in their trading app as a petition to list SHIB crossed over 250k signature - the people get what they want to trade-. Price is sitting at $0.00002777 ON low time frame support and significant overhead resistance is at $0.00003000 which has to be broken to see a sustained move back to the previous ATH price. With the incoming Robinhood app listing, SHIB is expected to see an uptick in trading volume. If price dumps, there is support at $0.00002440 which bulls have to defend in order to see a continuation or risk a free fall. It is important to note that the altcoin market is still mostly dependent on what bitcoin does and the overall state of the market. If bitcoin remains relatively stable then we expect the spotlighted coins to perform well. The contents herein are for educational, informational and entertainment purposes only. It should not be considered financial or investment advice. We are not financial advisers and have no experience in the field. Please talk to trained finance professional before making any investment decisions. If you liked this post from eCoinomics Newsletter, why not share it? |

Older messages

October 2021, #2

Thursday, October 14, 2021

This week we discuss the Bitcoin and Ethereum price action, part 3 of our trading system series, why alts are losing momentum to Bitcoin and spotlight Binance coin (BNB) and Polkadot (DOT)

September 2021, #5

Thursday, October 7, 2021

We discuss price action and expectations for Bitcoin and Ethereum, part 1 of trading systems, how the China FUD is different this time, and Zoom-In on Axie Infinity (AXS) and Fantom (FTM)

October 2021, #1

Thursday, October 7, 2021

This week we discuss the Bitcoin rally, Ethereum price action, part 2 of trading systems, E-naira postponement and Zoom-In on FTX Token (FTT) and Curve DAO Token (CRV)

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏