26 Oct: Betsson chafes at regulatory questions

26 Oct: Betsson chafes at regulatory questionsBetsson Q3, Monarch Casino Resort Q3, Caesars Entertainment analyst pick, gaming sector earnings preview, ad-tracking impact +MoreHello and welcome to today’s newsletter. Today the news is dominated by Betsson which the day before its Q3 results saw its board announce a change of mind over the future of the once - and now once more - CEO Pontus Lindwall. Speaking of crowns, Monarch Casino Resort also release record results overnight while a Royal Commission in Victoria, Australia has found that the “dishonest, unethical and exploitative” Crown Resorts should be given one last chance to “clean up its act.” If you were forwarded this newsletter and would like to subscribe, click here: Betsson Q3The top line

Scandi Succession: What to make of Betsson’s u-turn over the future of CEO Pontus Lindwall? The sense of boardroom confusion certainly does the company no favors. The evident difference of opinion has already seen previous chairman Patrick Svensk depart in saying he had disappointed the company’s “major owners”. More bizarre, a #bringbackpontus campaign launched by an igaming events company crowed on social media yesterday about Lindwall getting “overwhelming support” from the industry. Reverse ferret: New chairman Johan Lundberg says now is not the time to change leadership due to “future priorities” such as mitigation of the “unexpected Dutch decision” and the US entry. It’s an open question as to how much the “Dutch decision” - i.e. a regulatory process that was five years (and the rest) in the making - can be unexpected. Going back: What is true is that complying with the demands from the Dutch regulator to halt operations will cost the company ~SEK300m in EBIT a year. The company claims a licensing decision will come in the summer of 2022 but when asked about future profitability, Lindwall said the company would “work towards profitability but not from day one”. Hostages to fortune: On what was a fractious call with the analysts, Lindwall defended the company’s performance in western Europe and the Nordic region as well as its situation in Turkey where it acts as the B2B provider to Realm Entertainment.

No-loss leader: Where Betsson did see growth was in central and eastern Europe and the rest of the world. Breaking down its South American Q3 revenues, it saw 75% YoY growth to SEK 249m. On the US, Lindwall said the launch in Colorado in Q122 was designed as a showcase for Betsson’s B2B offering. “We don’t plan a huge launch campaign,” he added. Monarch Casino Resort Q3The top line

Table top: The removal of betting limits in Colorado in May21 and the addition of baccarat helped push Monarch’s Denver area casinos to all-time revenues and profits with the Black Hawk property in particular benefitting from having 25% more casino space. The Reno operation, Atlantis, also performed well despite being affected by air quality issues caused by the Californian wildfires. Grease is the word: Truist suggested the read-across for regional gaming operators was clearly positive, particularly the continuing “elevated” margins. On the earnings call, management suggested the results had been driven by word-of-mouth rather than any big marketing push (being held in reserve for the official grand opening next year). Macquarie analysts noted the company was looking for a “new direction to grow the business” now that the Black Hawk renovation was complete. Caesars Entertainment analyst pickDotted line: Caesars Entertainment got a vote of confidence from analysts at Wells Fargo which has made the shares a ‘signature pick’. The team suggest Caesars is well-placed to benefit from the Las Vegas recovery and has “all the pieces in place” to become a leading operator in sports-betting and igaming. We’ll have no trebuchets here: Listing where Caesars is strong in terms of brand, media partnerships, differentiated omni-channel experiences, Caesars Rewards, access to capital, a fully integrated tech stack and market access via 16-plus states and Canada, the Wells Fargo team say Caesars has a “sizeable moat”. Gaming analyst previewWeak beats: The sector’s fundamentals remained strong in Q3 but expectations are for “solid” results and the forecast beats will be weaker than in the second quarter, according to analysts at Truist. They suggested the balance to look out for on the earnings calls will be between the “consistently strong” consumer behavior, improved destination flows and continued margin strength on the one hand and rising inflation, gas prices, labor and supply chain issues, the cost of online and tougher comps on the other. Apple’s ‘Do not track’ impactIdentity crisis: Online gaming stocks were caught up in a general tech sell-off late last week on concerns that Apple’s Identifier for Advertisers changes (the ‘do not track’ option) will impact news sign-ups. The issue was highlighted by Snap which said in its Q321 earnings statement it had been caught off guard by how disruptive the impact would be. Advertising efforts “were essentially rendered blind,” Snap CEO Evan Spiegel said. Impact zone: With targeted advertising via mobile devices now trickier than before, analysts at Credit Suisse suggest there will be two lines of impact. First free-to-play; if operators now have a harder time monetizing a user base through advertising, it will be harder to acquire new users in the first place. The second problem is whether advertising will have the granularity needed to find highly motivated users, which could lead to lower conversion rates. This “should” result in lower advertising rates for the time being.

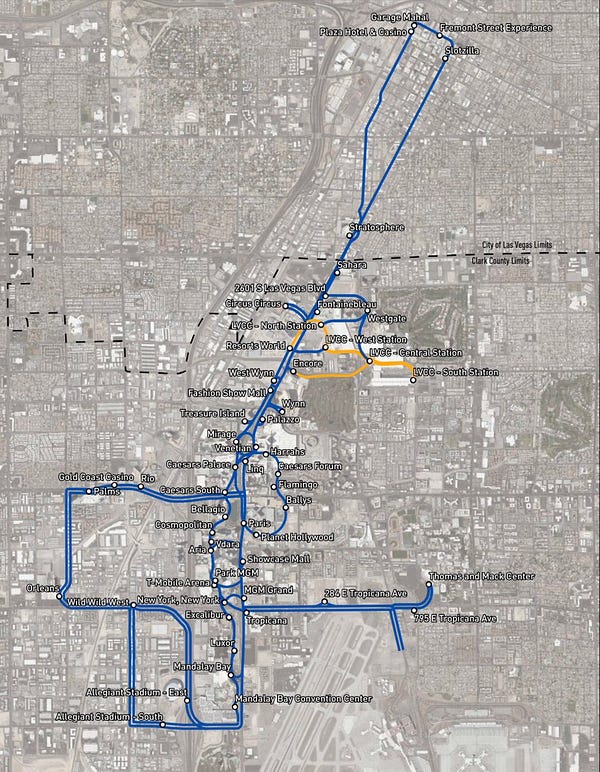

Connecticut dataTri-state traffic: The new sports-betting market in Connecticut has been boosted by punters crossing state lines, according to GeoComply. The company said that since the market for mobile sports-betting and icasino had opened on October 19, it has seen 12m bets with a large concentration (38%) in the southwest corridor close to neighboring New York. Just passing through: Pointing out that Connecticut had quickly established itself as the ninth biggest state by sports and gaming traffic yet with a relatively small population of ~3.5m. GeoComply said this was likely due to an unspecified contribution from New York residents. “We’ve learned from the New Jersey experience that New Yorkers are clearly motivated to travel locally,” Chad Kornett, VP for global government relations, said. NewslinesLouisiana purchase: FanDuel (initially with fantasy sports) and Caesars have joined DraftKings in saying they have received approval from the Louisiana regulator to launch mobile sports-betting when the state opens up on Nov 1. Caesars said it is already signing-up customers Winners not welcome: The French igaming regulator ANJ has scolded the country's online sportsbooks for refusing to accept bets from winning players. ANJ said consumer complaints around the issue had risen considerably and now made up 17% of all complaints. ANJ reminded operators they had to prove a “legitimate motive” for refusing wagers and not being able to do so could lead to sanctions. Board games: Staying with Caesars, the company has appointed Sandra Douglass Morgan, formerly the first black woman chair of the Nevada Gaming Control Board, to its board. “Sandra is rooted in the gaming industry in a way few others could be,” said Gary Carano, Caesars Entertainment executive chairman. Seat of the pants: OTT subscription streaming service Fanseat has agreed a deal with Sportradar for the right to broadcast six European basketball leagues, including the ACB’s Liga Endesa and the Copa del Rey, in Denmark, France and the UK. Raise you: Accel has more than doubled its debt load after increasing its senior secured credit facility to $900m from $438m and agreeing a new five-year term. The company said the increase would provide it with “greater financial flexibility and liquidity”. Smart move: Affiliate company Natural Intelligence, which works in part within the gaming sector, has announced its first-ever fundraise in a move that values the company at over $1bn. The Israeli-based company will raise over $100m. According to Israeli press reports, the company disclosed that it will achieve revenues in 2021 of between $450-475m. Tarnished Crown: The Victorian Royal Commission report into Crown Resorts’ activities at its Melbourne property recommended the casino license could be kept despite finding the company engaged in “illegal, dishonest, unethical and exploitative” conduct. The company has been warned to “clean up its act”. Betting partnershipsBally’s Corporation has signed up with the Nashville Predators as an official sports-betting partner and the official free-to-play partner. The partnership, Bally’s first in the NHL, runs through to 2025. Bet365 and the San Antonio Spurs have launched a free-to-play offering ahead of the new NBA season called ‘Call My Shot’. Betway has signed up with the Philadelphia 76ers, the company’s seventh NBA sports-betting partnership. What we’re readingDecisions, decisions: Will Scientific Games go the private equity route with its lottery business after all? The new ad-normal: the sports-betting ad deluge dissected. Stonk: Trump the meme stock. When the Game stops: The SEC gets to grip with meme stock fervor. Burning the Benjamins: Scott Galloway on losing other people’s money. On socialBeing boring: Elon Musk’s Vegas Loop gets the go ahead.     Same-game: Calendar

Contact us

If you liked this post from Wagers.com Earnings+More, why not share it? |

Older messages

22 Oct: Weekend Edition no.19

Friday, October 22, 2021

iGamingNEXT review, Eilers & Krejcik app analysis, Macquarie Las Vegas survey analysis, US regional gaming analyst view, startup shoutouts +More

21 Oct: LVS: desperately seeking visibility

Thursday, October 21, 2021

Las Vegas Sands Q3, Penn National and IGT analyst updates +More

20 Oct: Catena Media’s European writedowns

Wednesday, October 20, 2021

Catena Media Q3 update, DraftKings/Entain bid extension reactions, Nigel Eccles/BetDEX news +More

19 Sep: Germany and Netherlands dog 888

Tuesday, October 19, 2021

888 Q3 update, Bet-at-home profit warning, New Jersey hits £1bn +More

18 Oct: Aristocrat buys Playtech for £2.7bn

Monday, October 18, 2021

Aristocrat buys Playtech, GAN investor presentation, Gambling.com Group +More

You Might Also Like

🎯 Stop Planning Your Goals Like An Amateur

Monday, December 23, 2024

Here's how to actually crush 2025 while everyone else is nursing their hangover... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🌁#81: Key AI Concepts to Follow in 2025

Monday, December 23, 2024

Plus – we become Hugging Face's residents 🤗

The best countries to manufacture your product [Roundup]

Monday, December 23, 2024

Here's your chance to win our best-selling "How to Find a Product to Sell on Amazon" course for FREE by answering our Amazon Software Poll. Hey Reader, Want to start sourcing from places

This "Boring" Website Makes $35k/month + A Special Deal

Monday, December 23, 2024

I'm always fascinated by different types of websites and how they make money. I recently ran across a website on such a boring subject, it got me thinking...maybe boring is a great way to make

How brands leverage commerce media for seasonal success in 2025

Monday, December 23, 2024

How diversifying ad placements reveals untapped revenue opportunities

Holiday Special: Lifetime Access for Less Than $1/Day

Monday, December 23, 2024

Make 2024 Your Year – Special Holiday Deal ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Create a LinkedIn funnel from personal posts

Monday, December 23, 2024

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Pfeffernuesse Day, Reader! Who wants a delicious and spicy

New SEO strategies for 2025

Monday, December 23, 2024

60% of Google searches result in no clicks. Zero. With AI integration, that number could become even higher. I'll show you how to adjust your strategy so you can capitalize on these shifts in our

Can We Mine Bitcoin In Space With Solar Panels?

Monday, December 23, 2024

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI keeps its grip on early-stage deals

Monday, December 23, 2024

Playground Ventures pares flagship fund size again; ecommerce startups ring up a funding surge; is 2025 the year of the industrials revival? Read online | Don't want to receive these emails? Manage