Tomasz Tunguz - The 100x ARR Multiple

Tomasz TunguzVenture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. The 100x ARR Multiple

The 100x ARR multiple might be the fundraising meme of 2021. Before, most investors used forward ARR multiples to value companies, but recently, the 100x multiple seems to be a benchmark for SaaS companies raising rounds. Where did this figure originate? How does it compare to the public markets' valuation of companies?

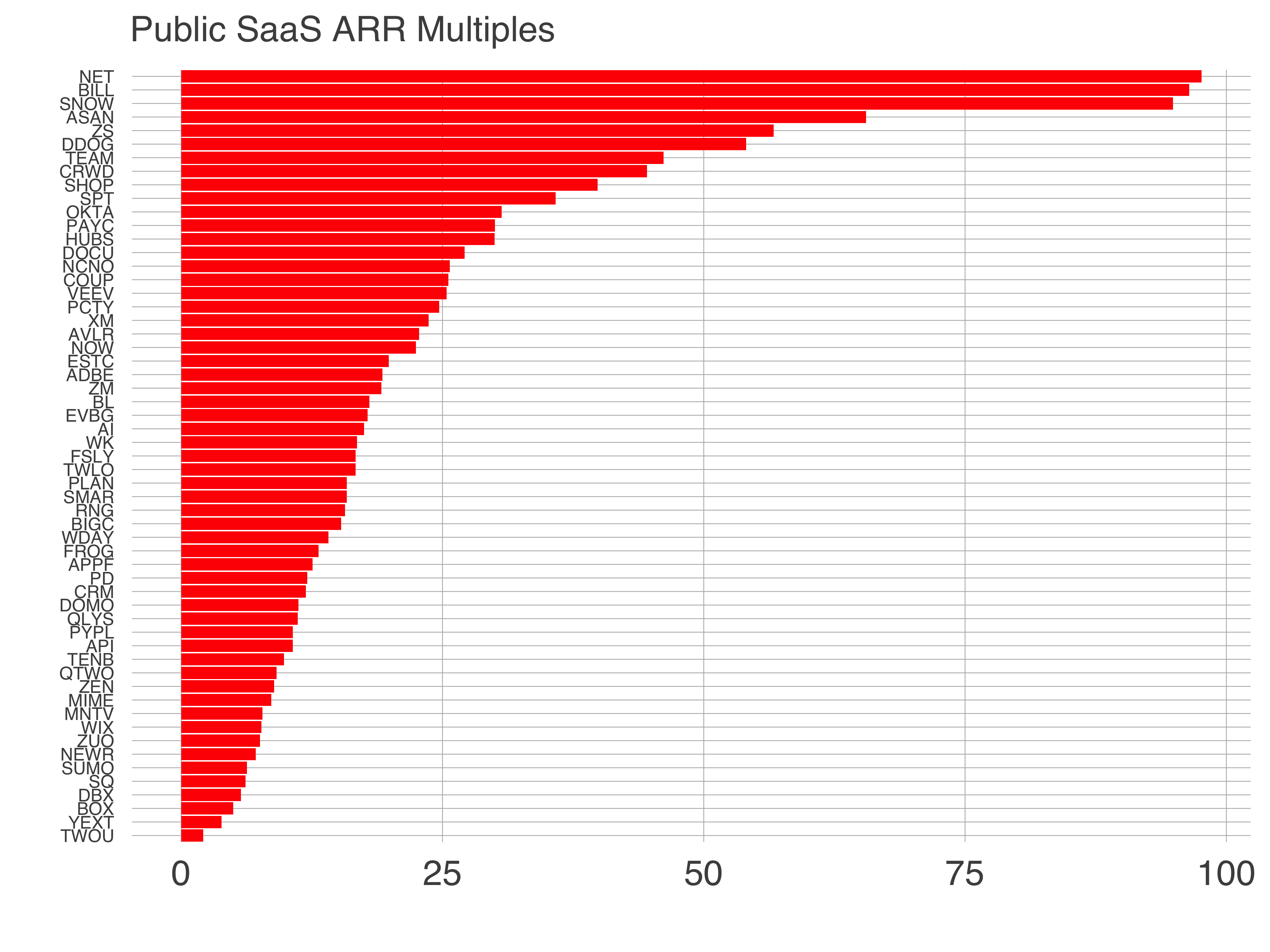

Let’s look at the data. Here are the estimated ARR multiples for public SaaS companies. I estimated ARR as the annualized revenue of the most recent fiscal quarter. The distribution of enterprise value to ARR multiples parallels those of EV/NTM revenue in a few ways. First, the range is similar: 2 to about 100. Second, the correlation between the two metrics and revenue growth is identical at about 36%. Third, there’s a power law shape to both data sets. I don’t know if the market has decided to afford highly sought after ARR multiples by looking at this data. But the data suggests a company commanding 100x ARR is supported by the market, if the startup is in the top 5% of businesses.

Of course, these multiples are for public companies; anyone can buy shares. The private market has a pattern of paying premiums to public figures because access is the scarcest commodity in startupland. The question before most investors today is: how much of a premium to pay? It depends and the premium implies the number of years of perfect execution the investor credits the startup team. The greater the premium, the greater the future forward expectation of performance. Is it warranted? We’ll know in the fullness of time. Not every company will be as successful as those who top the list in the charts above and achieve billions in revenue growing 70% or more annually. I wonder if it’s the right metric long term. Unlike the forward ARR valuation method, this technique doesn’t normalize for forward growth which means there’s information lost in the figure. Regardless, the 100x ARR multiple seems to be a benchmark in the industry today. It has some foundation in the public markets, but assumes quite a bit of forward execution. |

Older messages

Hex - The Best Product for the Technical Analyst

Wednesday, October 20, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Hex - The Best Product for the Technical Analyst

Using the Reversal Mental Model to Invest Better

Tuesday, October 19, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Using the Reversal Mental Model to Invest Better

Spot.ai - The Future of Video Intelligence

Friday, October 15, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Spot.ai - The Future of Video Intelligence co-

The Two Cap Tables of Crypto Companies: What They Are and How They Relate to Each Other

Monday, October 11, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. The Two Cap Tables of Crypto Companies: What They

Passive Investing in Venture Capital and the Parallels to Public Equities

Friday, October 8, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Passive Investing in Venture Capital and the

You Might Also Like

This dead simple web app generates $100K/year

Sunday, March 9, 2025

Starter Story Sunday Breakfast ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Building Lovable: $10M ARR in 60 days with 15 people | Anton Osika (CEO and co-founder)

Sunday, March 9, 2025

Listen now (70 mins) | The AI startup that's Europe's fastest-growing company ever ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👻 The AI sourcing secret that's haunting your competitors.

Sunday, March 9, 2025

Uncover the mysterious ways AI is transforming product sourcing and why it's giving some brands an otherworldly edge. Hey Friend , Sourcing products used to be a slow, manual process—searching

🗞 What's New: Why AI can't replace my $1k/mo human assistant

Saturday, March 8, 2025

Also: 25+ AI agent opportunities ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #436

Saturday, March 8, 2025

Debating the future of SaaS + what many VCs are thinking... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🎯 Fix your fulfillment, fix your profits

Saturday, March 8, 2025

The answer to higher profits is not always selling more. This is how smart businesses do it… Hey Friend , Most ecommerce founders focus on selling more to increase profits. But what if I told you that

Create a social media strategy in 7 (straightforward) steps

Friday, March 7, 2025

Plus, the latest from the blog and social media ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

10words: Top picks from this week

Friday, March 7, 2025

Today's projects: Wallpaperee • Chatbox • DesignLit • PH Deck • ChatPro AI • Opencord.AI • NexaAI • GReminders • Springs • crimalin • SuperCarousels • TitleSprint 10words Discover new apps and

Experiment Report: Trying New Things — The Bootstrapped Founder 380

Friday, March 7, 2025

When I talked to Anne-Laure Le Cunff earlier this week, we get into experiments and how to run them effectively. Here's what I've been doing. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📍Why global trade tariffs might actually boost your ecommerce profits

Friday, March 7, 2025

The best ecommerce brands are now using these trade shifts to their advantage Hey Friend , If you think global tariffs and rising costs are bad for your ecommerce business, think again. Yes, some

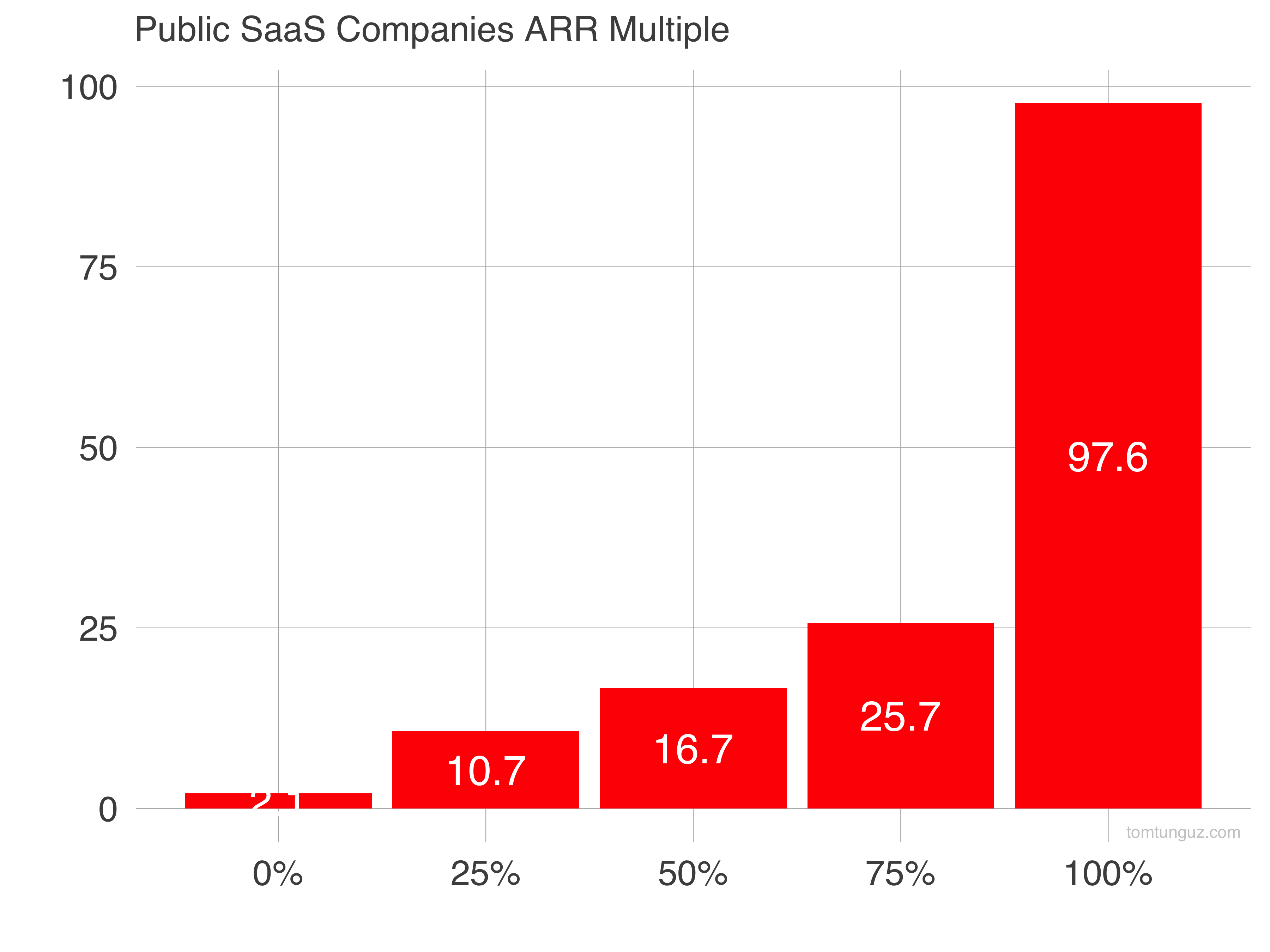

The quartile distribution of multiples tells a different story. The 75th percentile multiple is 26x ARR and the median is 17x.

The quartile distribution of multiples tells a different story. The 75th percentile multiple is 26x ARR and the median is 17x.